Cracks & Red Flags: October 30 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON

Here’s the link to tonight’s YouTube video, check it out if you have a few minutes!

FOMC showed relatively little overall volatility, which is not always the case looking back over time.

Despite indices not displaying abnormally wide ranges, the VIX did not deflate following the event risk represented by the FOMC announcement or press conference, raising red flags pertaining to the broader indices, in my view. Many times, the erasing of doubt brought about by major announcements where people might have been hedging in advance of the announcement leads to volatility unwinding, but not this time, with the VIX having already been crushed from 25 down to the 16-area.

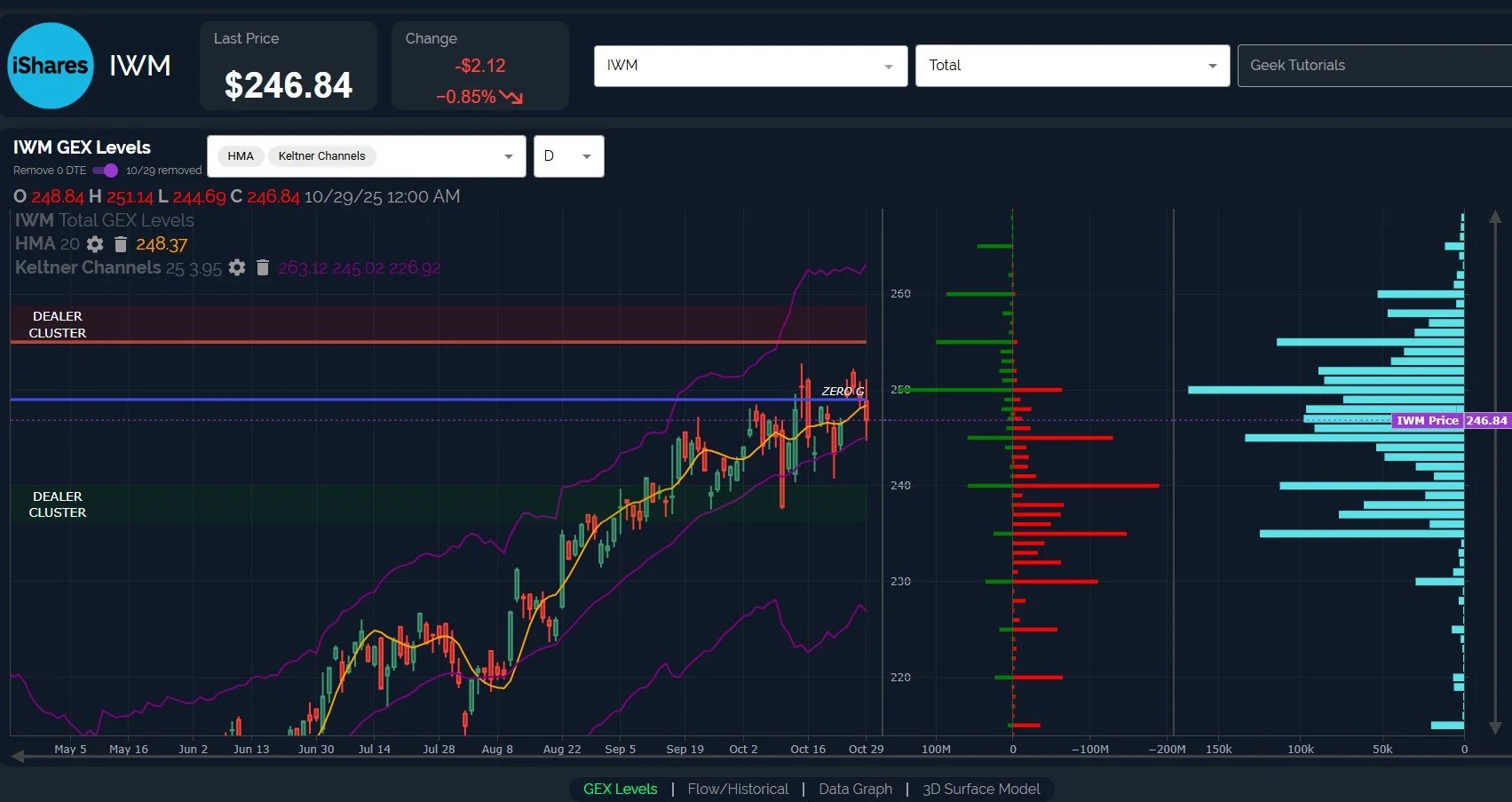

Another potential warning today was IWM closing below the Hull Moving Average by a wide enough margin to raise the odds of follow through to lower targets.

GEX also dipped further into negative territory on a net basis. IWM 240 appears to be a solid target in the event of continued downside, though our initial bias (when considering various quantitative factors) is to be a buyer at the lower Dealer Cluster zone around 240 in anticipation of further upside before the year ends.

Looking more closely at the VIX, we see a 3rd day of green, and the daily Hull has now declined to a point where the VIX is crossing back over the Hull to the upside. Given the thick cluster of negative GEX strikes between 15-18, a test of the largest negative cluster at 18 would not be surprising, and it’s possible that surpassing 18 could see 20-25 (again) very quickly.

While I may sound bearish to some, I am pointing out what might be a good dip buy, in my view. Looking back at the recent VIX rally to 25, the market wasn’t really down that much in the grand scheme of things..Market bulls will want to see various indicators and sentiment factors display a heavy contrarian bearish bias when the next modest drop occurs, potentially signaling that the modest drop allowed enough of a reset to fuel a move toward higher targets, which we’ll look at momentarily.

In other words, if the “crowd” gets too bearish too quickly, we may perversely see more solid footing for a final push higher before the year ends.

While IWM had a solid close below the Hull, QQQ and SPX still have their heads in the clouds (or in the sand, to use an ostrich analogy), floating above a variety of gaps and remaining stretched above the Hull. This is hardly sustainable based on history, but even a decline toward 620 or 600 isn’t necessarily bearish in and of itself. We will want to re-evaluate other factors in conjunction with GEX at the time that we see a decline unfold.

Ultimately, we see GEX at 640 and 650 that has recently grown, and 650 now matches the upper Keltner channel, giving confluence with other indicators. Dip first, or straight to target?

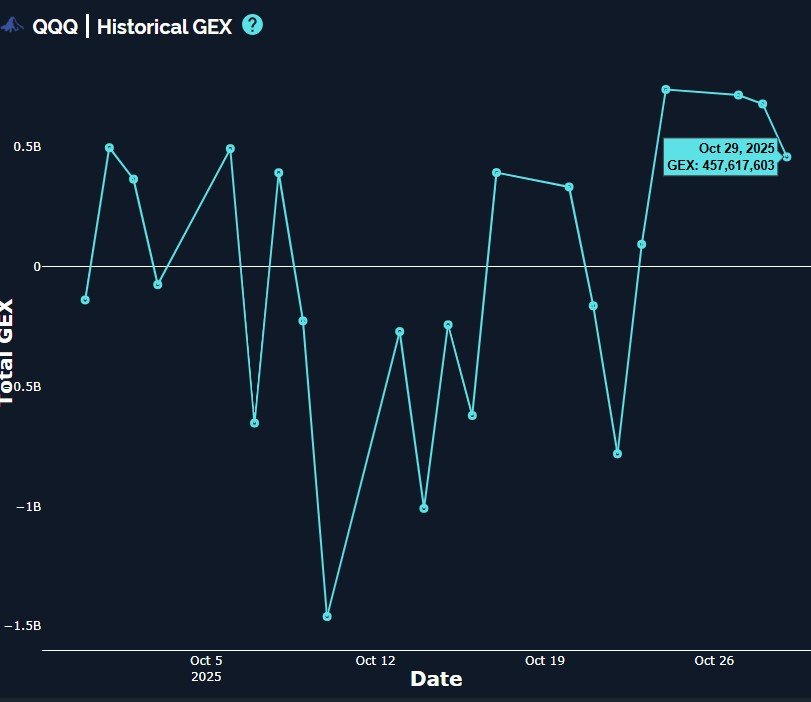

QQQ saw GEX decline for a 3rd day in a row, though today was the first meaningful drop. With the larger indices, high GEX readings can often accompany short-term tops, at least within 2-3 days of the top.

SPX painted a higher high today, but closed unchanged relative to the previous day’s close.

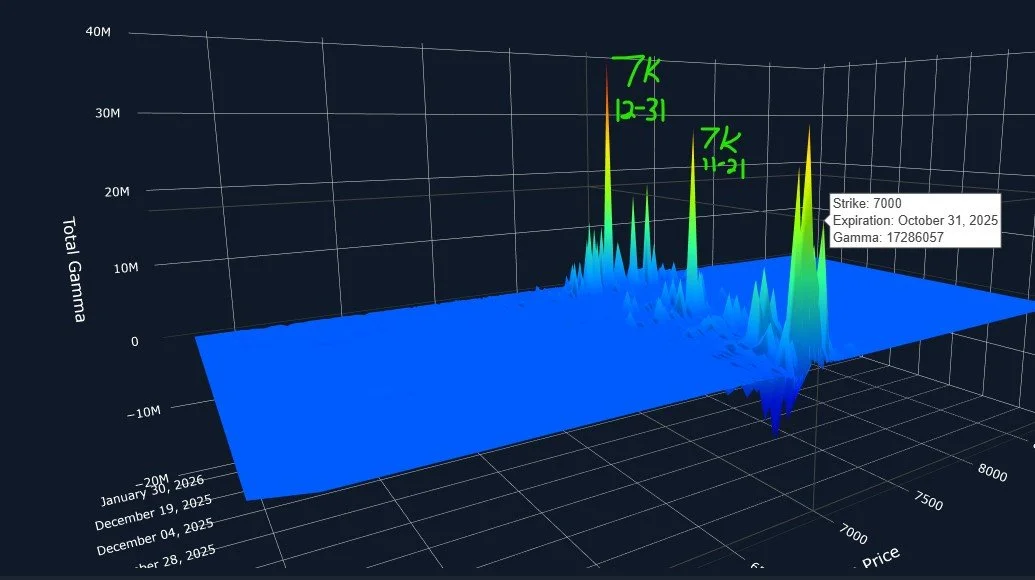

7000 remains a very prominent GEX concentration, though SPX needs to hold above 6900 to make that last 1.5% more likely. We said the same thing about the 6700 level, and once that resistance became support, the next levels methodically became magnets.

Bulls will want to see 6825 held for immediate continuation higher, otherwise we may see the previously mentioned scenario play out: A decline now that sets up a push toward 7000 as we approach December.

After reaching absurdly positive GEX readings over the last 2 days, we finally saw a huge drop in SPX net GEX, plunging from 3.7B to a still bullish 1.08B.

The change is noteworthy, though another day or two in the negative direction will catch my attention further, since today’s drop in GEX was arguably correcting an excess from the last two days.

As much as I don’t believe the market fundamentally deserves to go higher at this point (or even well before today), the GEX picture has kept me properly focused for the most part, and GEX is still telling me that SPX has intentions of reaching 7000. We saw a distant GEX target of 7000 at 12/31 shift to now reflect meaningful GEX at both October 31 and November 21, giving us a broad range of time to reach that area.

Given the momentum higher, and the extreme nature of the upside gaps, I suspect we’ll have our answer soon regarding a pullback and then targeting 7000, or an immediate tag of 7000 and then a consolidation that could last until year end (we do have a recent year as an example of a weak final month).

We will take a look at what tomorrow’s 0 DTE picture tells us once the cash session starts, so join us in Discord and we’ll take a look at the 0 DTE picture for real-time clues as we progress into Thursday. Thanks for joining us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.