Blow-Off Top Into FOMC? October 29 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON

Here’s the link to tonight’s YouTube video, check it out if you have a few minutes!

The rocket launch gap-ups continue, challenging traditional thought surrounding the space-time continuum. You would think we just dropped 20%, but no, actually we just rallied somewhere around 50%. I guess bulls are just realizing they haven’t been bullish enough.

All kidding aside, the current uninterrupted move higher (right into FOMC? Sure, let’s play it safe!) looks awfully like a blow-off, complete with absolutely terrible breadth and divergences galore. That’s right, the only thing up more than the market today was the VIX. Oh, but Powell will take care of that tomorrow, right?

Small caps are also underperforming, though I think it’s reasonable to assign fair probability that IWM can play catch up over the next couple of days if the market continues higher.

SPX is incredibly close to the year-end target of 7000 that we’ve noted (thanks to GEX data) for at least a month now. The hastened early approach introduces the possibility of a 2024 repeat, to some extent: Tagging the highs early, then fading into year-end. We could also see an immediate drop and then a rally into year-end, if a drop materializes immediately. Key point: Tomorrow has potential to be pivotal, given the extreme move we’re currently seeing.

SPX is at the upper Dealer Cluster zone, though the upper Keltner gives room to 6981, within a stone’s throw (or as I like to say, an NVDA chips throw) away from 7000 at that point.

The stretch above the Hull is extreme, so mean reversion is very likely here.

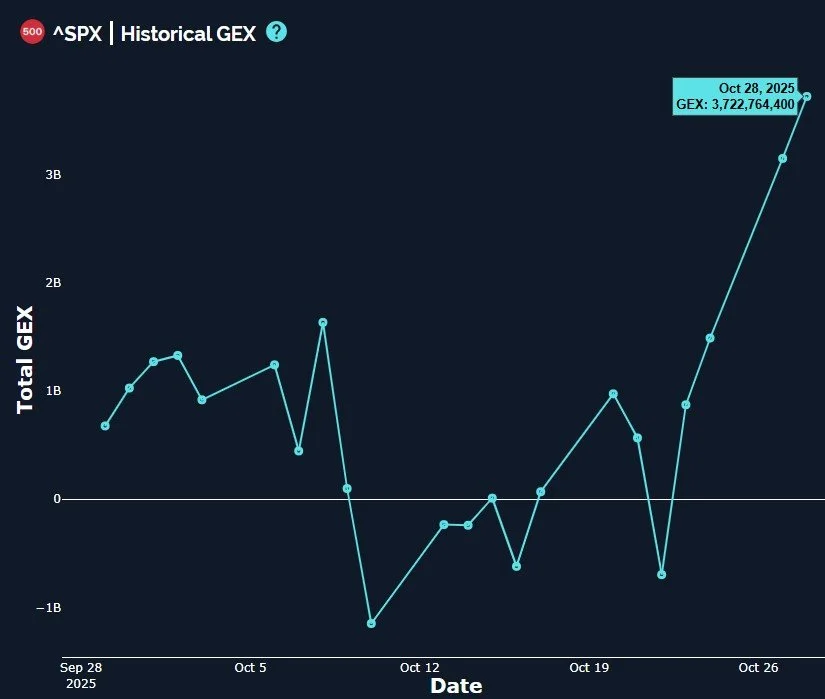

Just when you thought SPX extreme positive GEX couldn’t get more extreme, GEX at the close today jumped another 600 million, reaching a level I can’t remember seeing in the last 2-3 years.

Extreme positive GEX can be a contrarian signal, and we see divergent negative moves from other indices, so I view the sharp increase as a potential negative at this point.

QQQ shows a similar parabolic, one-sided blow-off, with GEX overhead at 635 and 640. The upper Keltner matches fairly well with 640.

The upper Keltner channel has been a good reversal guide in the past, so while the channel is pointing sharply higher, the GEX+Keltners at 640 increase the probability of some sort of reversal at that point or lower.

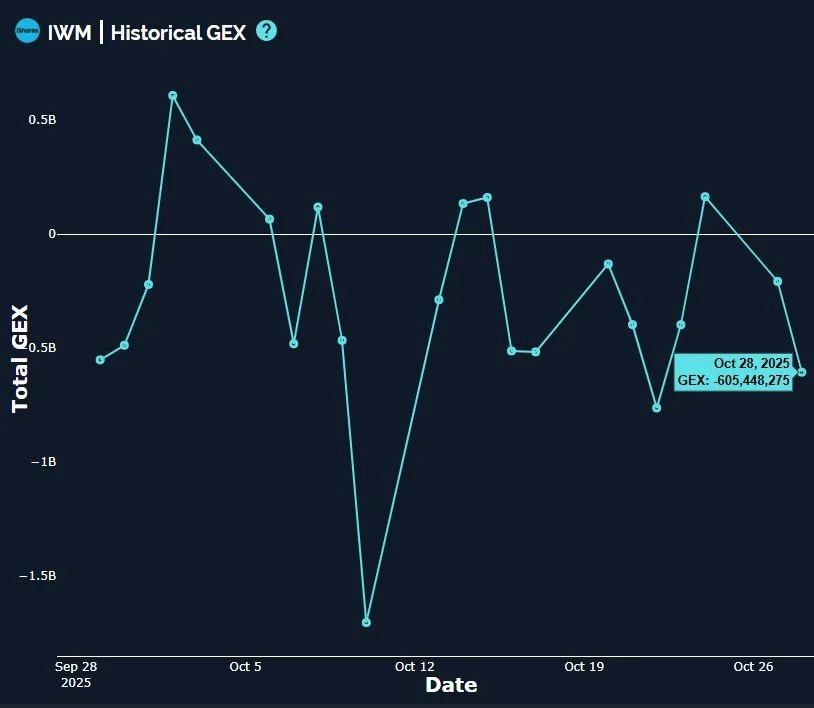

IWM has been marginally red for a couple of days, underperforming the blow-off indices dramatically.

It’s important to note that IWM still held the rising Hull Moving Average today, so recapturing 250 could bring about a nice “catch-up” rally (as opposed to a Ketchup rally, where you were short too early and saw your puts turn very red) with IWM potentially reaching 255 or even the upper Keltner at 260.

More alarming than the price dropping slightly is IWM GEX moving sharply lower again, though a contrarian case exists to say that participants are getting too bearish too quickly for IWM.

If IWM continues dropping, there’s an increasing chance that IWM “drags” down the other indices with it, though even if IWM rallies to 260, the overbought conditions and one-sided GEX picture for SPX imply odds of a reversal still increase from that point.

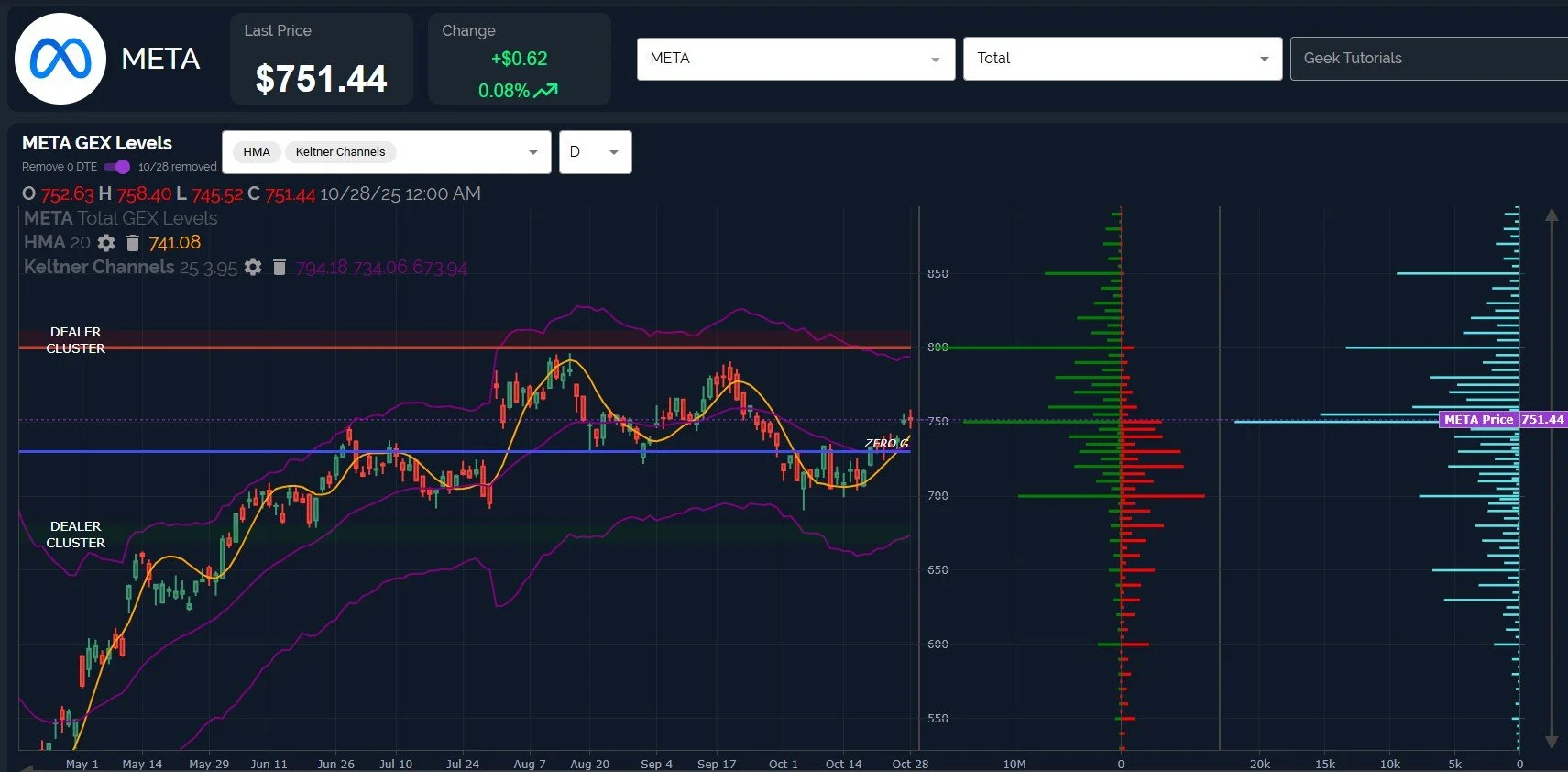

Lastly, even with indices approaching potentially precarious highs, we still see opportunity on individual bases. META is one of the major tech names that has resumed an uptrend, but it seems to be holding the 750 area, and big GEX at 800 is possibly waiting to be tagged.

We will post our GEX observations in Discord tomorow so you get to see what we’re watching!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.