Concluding Q3 Earnings: October 31 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout! ENDING SOON!

Here’s the link to tonight’s YouTube video, check it out if you have a few minutes!

IWM weakness over the last couple of days appears to be catching up with the blow-off crowd, with SPX and QQQ dropping today. Many recent gap downs have resulted in strong buying, but today’s action ended up with indices closing at or near lows.

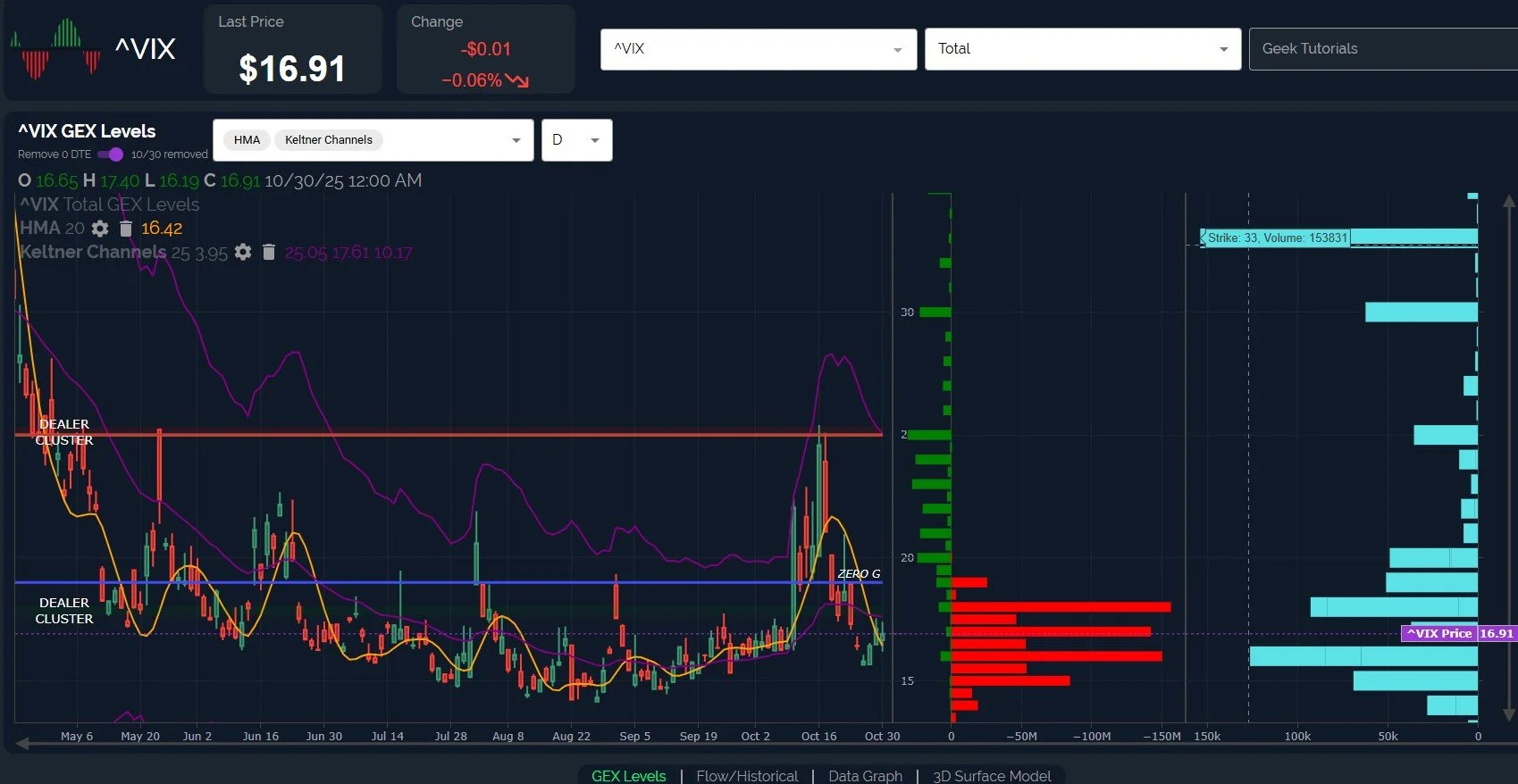

The VIX has now closed at or above the daily Hull Moving Average for the 2nd day, leaving two primary possibilities: A continued spike toward 18, with a breach of 18 potentially leading to 20-25 again, or a rejection and retest of the 15-area before another spike.

The 4-hour chart shows a close above the Hull, yet rejection at the middle Keltner channel, so we don’t have a definitive next move.

Even then, the odds seem to favor a bounce in the VIX toward 19.5 before a potential rejection and resumption of the market rally (toward 7000?).

As I write this, we see AMZN positive after hours, and AAPL positive, so perhaps we make a Friday high and then a pullback next week. The VIX may bottom just below 15 if the downside for volatility continues.

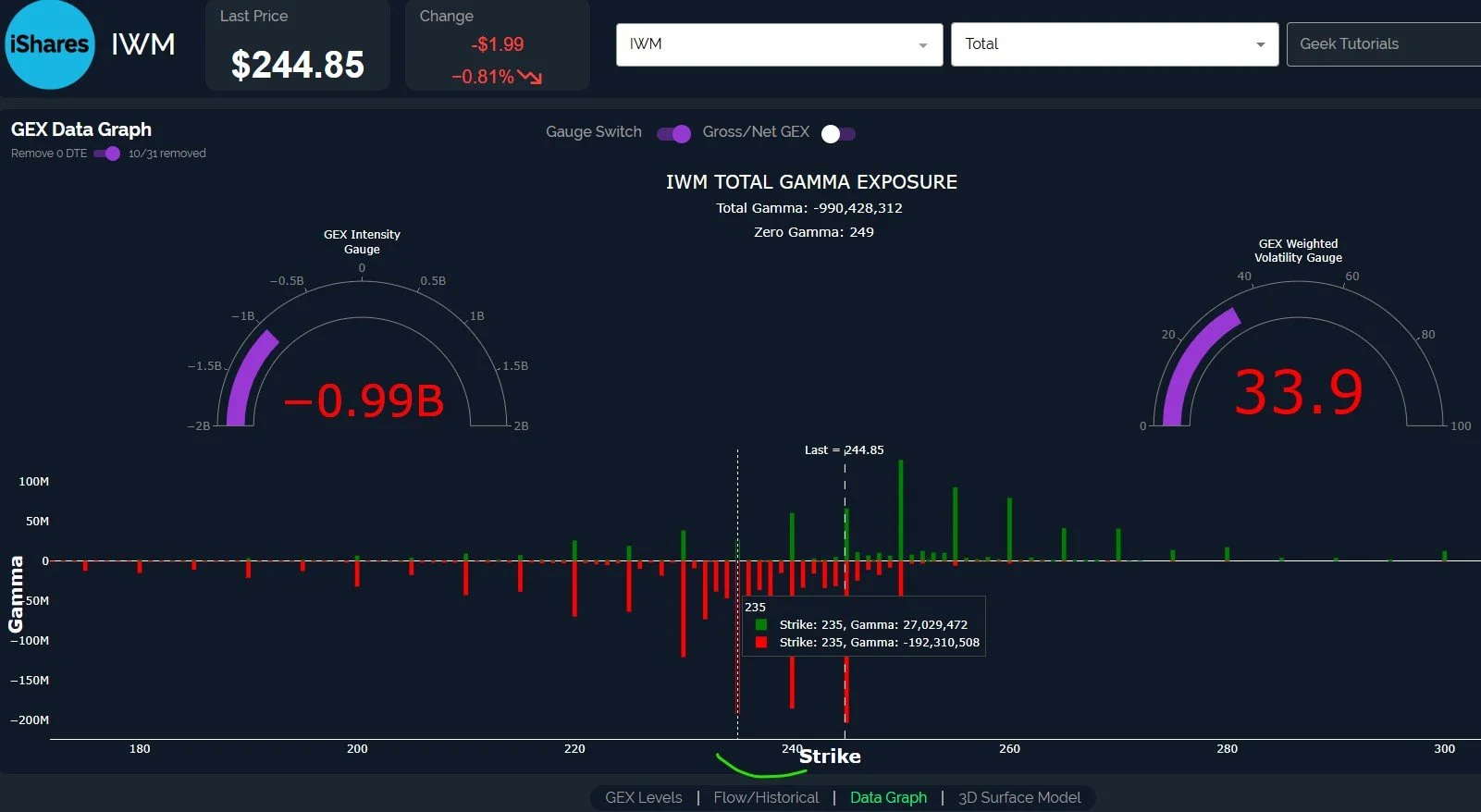

IWM closed well below the Hull, though just below the meaningful 245 GEX cluster, also leaning bearish but leaving open the possibility of a 250 retest and potentially higher.

250 is now significant resistance, though a continued drop toward 235 might be a great buying opportunity.

IWM’s net GEX continues declining each day, reaching a deeply negative -1B.

If we see IWM move closer toward the lower GEX extreme, we may see other indices bottoming as well. We will watch for the GEX Intensity Gauge to reach a lower limit and then look at where SPX and QQQ are.

To expand upon that point, IWM breaking 240 may lead to 230-235, though we currently see very little GEX below these strikes, so they currently appear to be good areas for a potential long.

SPX technically closed below the Hull, as did QQQ, opening the possibility of a trip toward 6700. The close was unconvincing, closing barely below the line. A rebound tomorrow may finally tag 7000, or close to it at 6900, whereas a decline will likely target 6800, then 6700.

QQQ still shows meaningful GEX at 650, also matching well with the upper Keltner Channel.

As of now, QQQ needs to retake the big cluster at 630 to have a shot at the upper 550-560 zones.

QQQ dipped back into negative GEX territory, which can be helpful when it reaches an extreme. For now, we are within a neutral zone, so the market can really go either way here. Join us in Discord tomorrow morning for the latest observations and insights!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.