Forwarned Decline Activated: Opportunity Knocks! November 5 Stock Market Preview

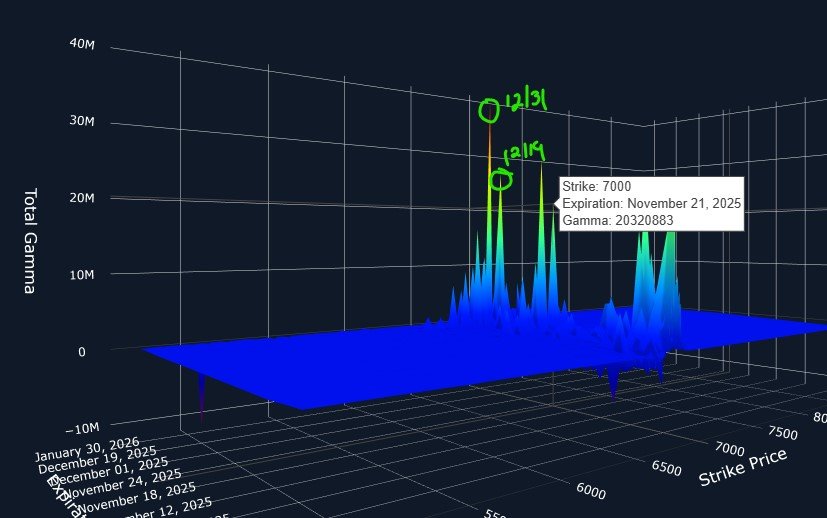

November 5 Stock Market Preview: Our warning yesterday of an increased risk of a pullback was vindicated today with a weak day for markets. With SPX 7000 still potentially looming as a target for 12/31, in contrast with a bullish VIX picture (bullish for volatility), what might come next?

Increasing Risk Of A Pullback? November 4 Stock Market Preview

November 4 Stock Market Preview: Boring day for the indices, though the VIX almost reached 19 and then retested 17 on the downside, holding as of now. With IWM holding below the downward leaning Hull, and SPX 7000 GEX shifting yet again- away from near-term dates- can we finally get a deeper pullback?

SPX 7000 Now Or Later? November 3 Stock Market Preview

November 3 Stock Market Preview: SPX, QQQ, and IWM all show bearish signals, and the VIX showing some bullish signals, we may be at a spot where a bounce can happen. Will we see a bounce materialize, or is this the beginning of a larger pullback?

Concluding Q3 Earnings: October 31 Stock Market Preview

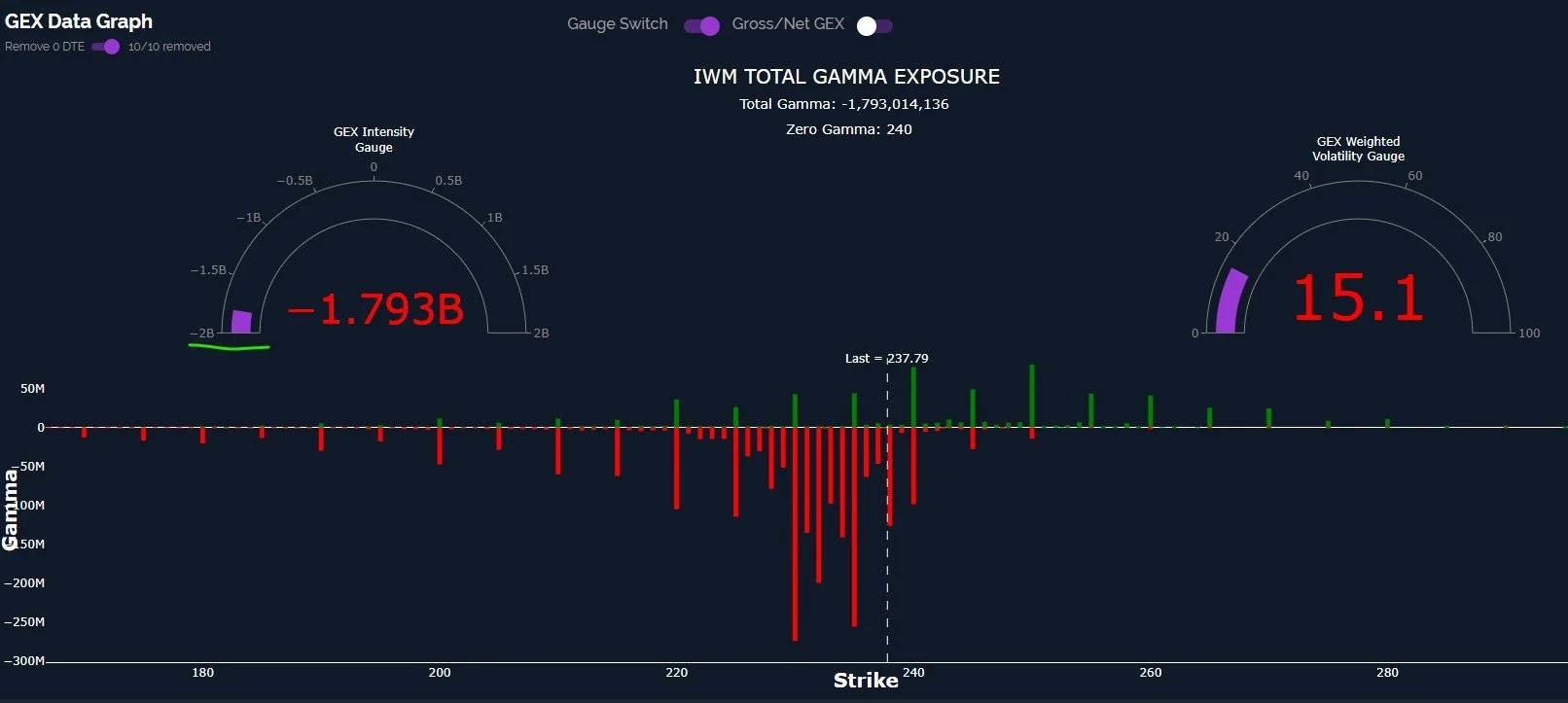

October 31 Stock Market Preview: Indices saw bearish follow through today, with IWM leading the pack.What likely comes next?

Cracks & Red Flags: October 30 Stock Market Preview

October 30 Stock Market Preview: QQQ held onto a positive bias all day, but the other generals are falling all around, with SPX and IWM both struggling during the afternoon of FOMC day. IWM closed below key technical support and GEX declined across the board for major indices. The VIX is also on the brink of breaching key resistance to the upside. If a pullback materializes, what might it look like? Let’s review a few parameters to watch in coming days.

Blow-Off Top Into FOMC? October 29 Stock Market Preview

October 29 Stock Market Preview: The “B” word comes to mind looking at SPX and QQQ( “Blow-off”), but IWM seems to be sitting out from the party. With FOMC tomorrow, we could see volatility in both directions. Let’s take a look at the current GEX picture heading into Wednesday’s Fed announcement.

Extreme Positive GEX, Negative Divergences: October 28 Stock Market Preview

October 28 Stock Market Preview: Divergences are starting to widen, with SPX and QQQ making new all-time highs while IWM made a lower high. We also see GEX divergences. What comes next?

Bulls Are Winning, But TIme For A Breather: October 27 Stock Market Preview

October 26 Stock Market Preview: Friday saw a bullish breach of key technical and key GEX levels, and the VIX quickly plunged into the 16s. A statistically bearish week ultimately failed for the bears, though we did see weakness for part of the week. Let’s take a look at the bullish shift as well as recognizing that we’re likely close to a reversal zone given that the VIX is already back to almost 16.

Decision Time Is Here: October 24 Stock Market Preview

October 24 Stock Market Preview: The VIX needs to bounce now as it’s about to lose both the Hull and the 9-SMA on the weekly. Fortunately for the VIX, we see indices in their upper Dealer Cluster zones, and IWM still basically where we started yesterday. What comes next as CPI is reported in the morning?

Rolling Over? October 23 Stock Market Preview

October 23 Stock Market Preview: Last night’s newsletter highlighting the increasing odds of a pullback was validated today, with a sharp intraday drop timed with a trade war headline regarding tariffs. While SPX and QQQ saw neat rebounds from the daily Hull, we have a few red flags that warrant addressing as we approach the end of the week.

Increasing Odds Of A Pullback: How Deep? October 22 Stock Market Preview

October 22 Stock Market Preview: The VIX retested the important weekly Hull Moving Average today, holding the area so far. Indices were largely unchanged, consolidating after Monday’s gains. What comes next?

Whipsaw And A Fork-In-The-Road: October 21 Stock Market Preview

October 21 Stock Market Preview: The big VVIX crush we highlighted over the weekend led to more upside Monday, with indices showing strong performances Monday. We now see volatility approaching a point where it might stage a comeback, but will we see lower highs for the VIX and a continuation higher for indices, or a shift in trend lower?

Bears Already Giving Up? October 20 Stock Market Preview

October 20 Stock Market Preview: Friday’s VIX and VVIX crush gives an encouraging sign to bulls, as well as QQQ and SPX’s close just above a potentially key technical indicator, the Hull Moving Average. However, IWM seems to be firmly in bearish territory, and the Hull+9SMA crossover happening on the VIX weekly chart gives cause for concern. We’re left with an uncertain picture, but let’s take a closer look.

Preparing For What Comes Next: October 17 Stock Market Preview

October 16 Stock Market Preview: IWM finally (and properly) tagged 250 today, in fact, surpassing 250 for the intraday high of almost 253. IWM left a huge indecision candle that is quite some distance above the Hull Moving Average, likely increasing the chances of dropping back below 250. Will we see a decline to 230-240 now? SPX and QQQ both surpassed and then failed to hold their own respective Hulls, with the VIX holding above 20 as VVIX climbed. From the looks of it at this moment, we may not be out of the woods just yet.

VIX Holding Above 20, Indices Meeting Resistance: October 16 Stock Market Preview

October 16 Stock Market Preview: IWM finally (and properly) tagged 250 today, in fact, surpassing 250 for the intraday high of almost 253. IWM left a huge indecision candle that is quite some distance above the Hull Moving Average, likely increasing the chances of dropping back below 250. Will we see a decline to 230-240 now? SPX and QQQ both surpassed and then failed to hold their own respective Hulls, with the VIX holding above 20 as VVIX climbed. From the looks of it at this moment, we may not be out of the woods just yet.

Volatility Still Expanding? October 15 Stock Market Preview

October 15 Stock Market Preview: IWM nearly touched 250 today, essentially (though not precisely) fulfilling the 250 target we mentioned only yesterday. Given the harsh rejection at the end of the day, and the VIX maintaining over 20, we may be done with this leg of the rebound, aiming for an OpEx low. We can’t be certain though, because SPX and QQQ may still rebound further to test their own Hull Moving Averages, implying potential for IWM to temporarily reach even further beyond 250. What levels will we watch tomorrow?

Bouncing Quickly Into A Decision Point: October 14 Stock Market Preview

October 14 Stock Market Preview: Today’s rebound rally took indices almost to initial resistance points, mirroring prior months where we saw quick pullbacks followed by a resumed uptrend. We do have several differences this time that we need to discuss, as well as IWM possibly giving us an early sign tomorrow regarding participants’ intent to continue upward or perhaps retest lows again.

Initial SPX DOwnside Objective Reached: October 12 Stock Market Preview

October 13 Stock Market Preview: Despite conflicting bullish data on a very short-term basis last week, key bearish data points shared took priority as Friday saw the biggest intraday decline since April. We saw the predicted VIX spike fulfilled and our 6500-6600 pullback range tagged Friday. With IWM and QQQ GEX Intensity Gauges signalling near-extreme negative GEX readings, will we see a bounce coming up, and how much of a bounce?

IWM On Mission 250: October 10 Stock Market Preview

October 10 Stock Market Preview: While indices were down today, the VIX closed below the key Hull Moving Average again. IWM closed below the Hull as well, but IWM made a higher low and higher high relative to yesterday. Perhaps the most concerning development was a sharp drop in SPX net GEX to new lows since September 25. While that low also marked a low for indices, we can’t say the same this time around.

6800 Within Sight: October 9 Stock Market Preview

October 9 Stock Market Preview: One of the two scenarios laid out in yesterday’s newsletter appears to be in play: SPX reaching 6800 while the VIX continues stair stepping toward a larger spike. IWM failed to make a higher high today, with QQQ seeing the greatest action. Will IWM play catchup? Can the VIX drop further without invalidating the setup for a spike higher?