VIX Holding Above 20, Indices Meeting Resistance: October 16 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout!

Here’s the link to tonight’s YouTube video, which covers SPX, IWM, the VIX, GLD, RDDT, and more, so check it out!

Let’s start the newsletter addressing IWM, which properly tagged 250 today, almost reaching 253 before fading back down to the magnet at 250. The resulting daily candle reflects possible indecision and a battle by buyers and sellers in this current zone.

3 observations:

1) Positive GEX at 255 and 260 hasn’t grown substantially in recent days, but those clusters are large enough to consider as possibilities if IWM can hold above 250.

2) IWM’s price is stretched relatively far above the Hull Moving Average. You can see the last several times we stretched too far below or above that line, we saw consolidation or a sharp retracement back to the line. Given that the Hull is now almost sideways instead of steeply rising, consolidation sideways seems to be a lower probability, implying that the risk to the downside might be greater this time.

3) Volume is still relatively high at lower strikes, with GEX at 230-240 still remaining as potential targets to the downside. With GEX right along the zero line (slightly positive), we could see a big move in either direction in the short run.

The VIX started out considerably lower, but the intraday reversal saw a nearly perfect rebound off of the daily Hull at 19.39, allowing the VIX to close above the big GEX clusters at 20.

Despite the rebound, the VIX did print a lower high and a lower low, but the general idea is that we’re seeing a consolidation before the next move, whether we see the VIX lose 18-19 and head back to 15, or if we head toward the highest daily volume strike at 25, which has considerable positive GEX as well.

VVIX was positive today, postponing the VVIX deflation bulls would like to see to signal that the rising phase of the VIX might not be over for this round.

SPX closed just below the declining Hull, maintaining the downtrend and failing to close above the big GEX zone at 6700.

We’re currently watching Friday’s low as an important area that might signal more consolidation sideways versus more downside.

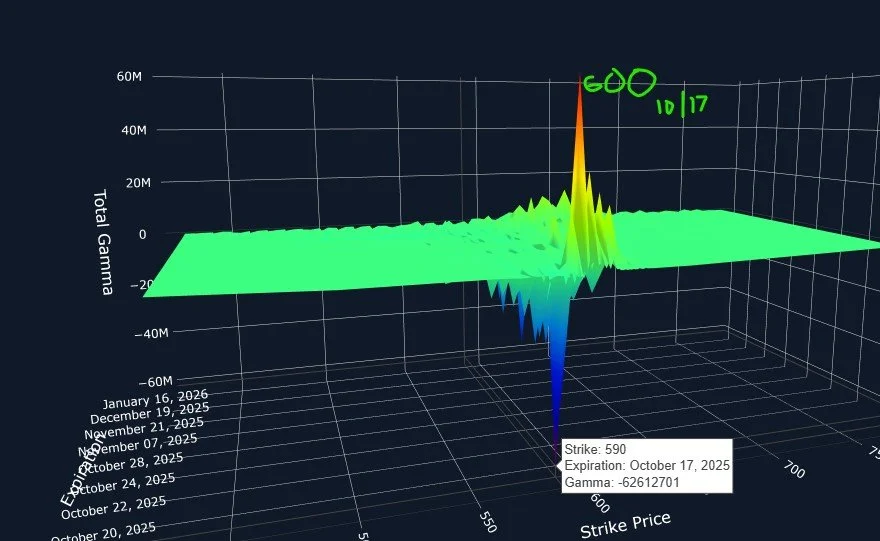

QQQ also closed below the Hull, though QQQ is still above the big GEX area at 600. 590 is an important zone to watch for QQQ if we see any further attempts to the downside in coming days.

To further illustrate this point, our 3D GEX graph shows 590 to be the largest GEX cluster expiring Friday, even larger than 600 for OpEx (additional clusters at 600 are spread across other expirations).

We’ll keep an eye on action this Thursday, since it seems interesting that 590 is larger than 600 for Friday, despite 600 being the larger overall GEX cluster. Will we retest that area again?

We have IWM outperforming the other indices, which is positive, yet IWM is at a point where we may see retracement, with QQQ and SPX right on the Hull but leaning slightly toward the bearish side. The VIX maintains the possible pathway to 25. Uncertainties remain as we approach OpEx Friday (and PPI tomorrow morning), so we’ll continue looking for clues across the board using the 0 DTE picture as our guide after the open.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.