Preparing For What Comes Next: October 17 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter coude FALL2025 at checkout!

Here’s the link to tonight’s YouTube video, where we cover today’s reversal to the downside as well as what we see coming next with SPX and IWM, also looking at AMZN, GOOGL, and AMD, so check it out!

I don’t always enjoy seeing the market drop, but I always enjoy seeing GEX continue to work, and the VIX indeed tagged the 25 strike that we identified as a likely target as long as the VIX held above 20.

25 is the lowest edge of the upper Dealer Cluster zone, but it’s also the largest GEX cluster, so we could very well see a reversal lower on the VIX at any moment. We have a few reasons to be skeptical that the spike is over, but it’s good to be aware that the upside targets are being fulfilled.

30 and 35 remain realistic upside targets if the VIX can hold above 25, but keep in mind that holding above 25 becomes key, we can’t assume that we automatically reach 30.

A loss of the 20-strike might quickly open the door to 18, but we are in a positive GEX environment with the VIX and thus our bias is toward continuation higher until a reversal signal appears, tactical considerations in mind (a loss of 20 negating that, for instance).

VVIX is perhaps the most concerning indication for volatility bears, with VVIX closing essentially at highs, signaling that participants might not yet expect volatility to subside. I drew crude green underlines below each time the market bottomed over the summer, and you can see VVIX almost always saw a red candle due to an intraday reversal at the same time SPX was putting in a short-term low, and we’ haven’t seen that yet.

We have one exception highlighted on the chart below, so maybe this could be the 2nd exception, but we like to base decisions on the odds as opposed to counting on a repeat of an exception.

IWM fulfilled our prior day warning about the distance above the Hull, dropping significantly and early to lead the way lower.

While initial rejection from 250 was to be expected, note that we are right at the 250 GEX consolidation area, with both positive and negative GEX showing large quantity.

IWM closed 1 point below the Hull, a technically bearish sign, though not significantly, and any further drop to 230-240 is likely a good buy, given the current GEX structure.

QQQ closed below the big GEX cluster at 600 by a penny, certainly not convincing of further downside.

The closing price of 599.99 is still below the Hull at 602.42, so we do maintain a short signal here, though I would suggest a move toward the big GEX cluster at 590 (also mentioned yesterday) might be a great buying opportunity for a reversal next week. We don’t know what will happen, but we want to share what we’ll be watching, at least.

SPX closed well below the Hull, roughly 35 points below, so SPX seems to also suggest greater odds toward more downside.

The late day bounce off of 6600 wasn’t surprising, given the GEX at that area, but we’ve had multiple tests of that line, a sign of weakness and greater odds that 6600 is broken.

Net GEX moved more negatively across the board, and 6500 remains a potential target if SPX continues lower than 6600 tomorrow/Monday.

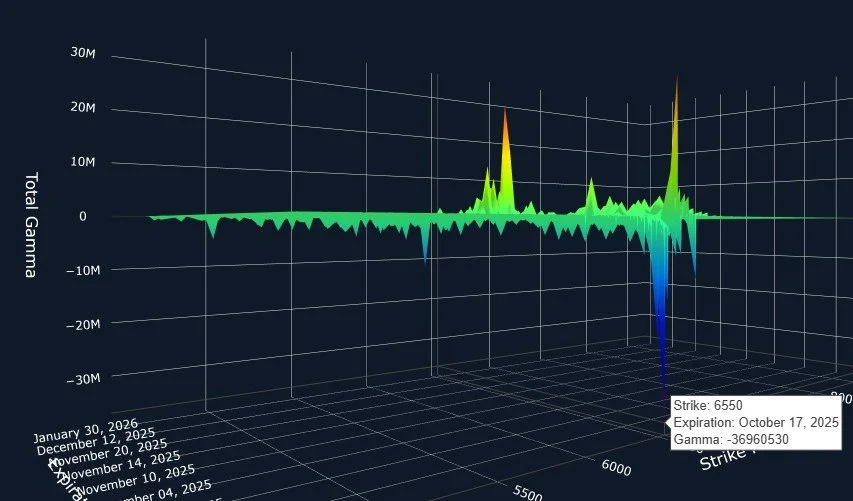

Interestingly, a quick look at SPX’s 3D graph reveals 6550 as the largest GEX cluster tomorrow, with 6650 the 2nd largest. Could we see both areas tagged? We sure can, especially if an opening gap puts us close enough to one target or the other, thus allowing all day to reverse toward the other target.

Without getting too speculative on a micro timeframe, conceptually accept that this is possible, but we will clear our memory as we review tomorrow’s opening GEX picture to consider what is present at that time.

We’ve shared a bit more than usual this week, and we will continue to tomorrow, so we hope you’ll join us in Discord for our intraday updates!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.