Volatility Still Expanding? October 15 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout!

Tonight’s YouTube video adds context to where indices closed today while also addressing a variety of tickers including NVDA and MDLZ, so check it out if you have a few extra minutes!

Cutting right to the chase (or to the bone for whoever shorted the VIX at 15), the VIX printed a higher low and higher high today, closing at almost 21. Indices gapped down in a big way, though rebounding from the early part of the day.

OpEx market bulls will want to see the VIX close below 20 to indicate greater odds of reaching the 15-18 area in the next couple of days.

The risk to a market rebound scenario includes the continued higher volume and increasing GEX at higher strikes, primarily up to the 35 strike, but even as high as 47.5.

With monthly VIX options expiring a week from tomorrow, we may see a whipsaw with volatility in coming trading sessions, so stay on your toes!

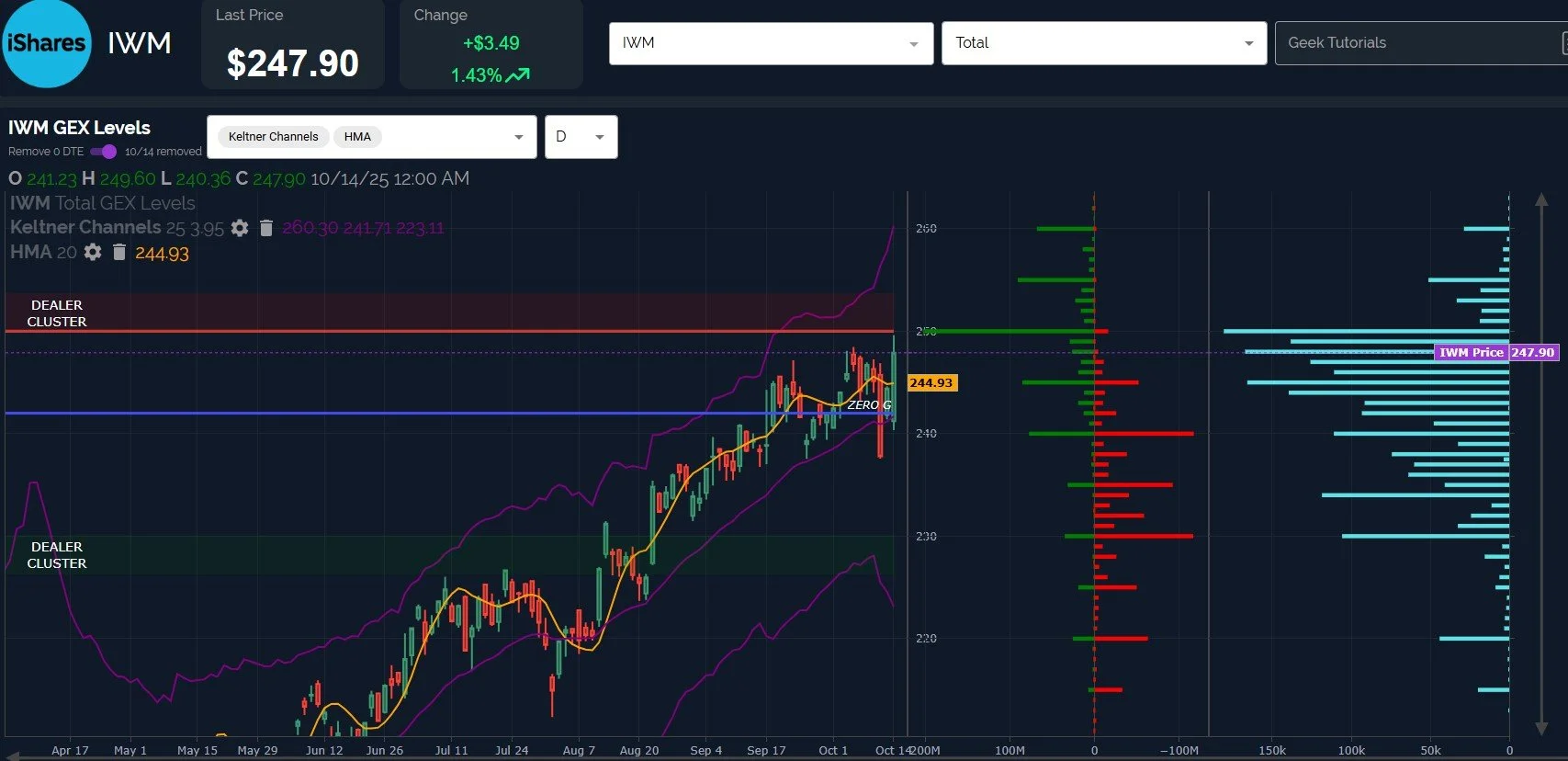

As we mentioned in last night’s newsletter, when we still saw relative calm across the futures market, IWM had the “cleanest” bullish setup. It’s always nice to see a potentially high odds scenario fulfilled quickly, and that’s what IWM did today, nearly reaching our 250 target, as advertised by the GEX picture.

IWM continues frustrating obsessive-compulsive perfectionists everywhere, failing to reach the exact 250-mark, but getting close enough that we consider it tagged. We are still left with a current picture that is uncertain, with possible rejection at this level, or a continued rally toward 255. The air certainly starts to thin out around 255, so barring a big shift in GEX, we are still within the general zone where a reversal may occur.

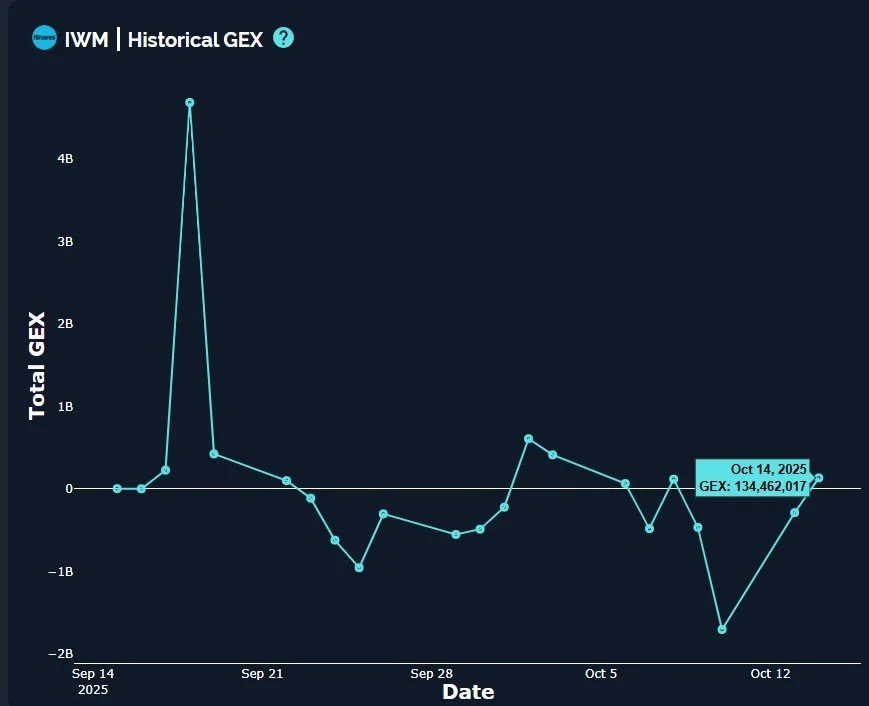

On the positive side, IWM did barely close in positive GEX territory, though keep in mind IWM primary showed negative net GEX the entire time from April into June, a fairly strong rally time.

In addition to the potential contrarian correlation between IWM GEX and performance, we really haven’t seen dramatic shifts in GEX since the drop in mid-September, with Friday representing the deepest negative reading we’ve seen in some time. Currently still in “neutral” territory as far as we’re concerned, we currently derive more value from our analysis of GEX at individual strikes for IWM than any conclusions from the net GEX picture.

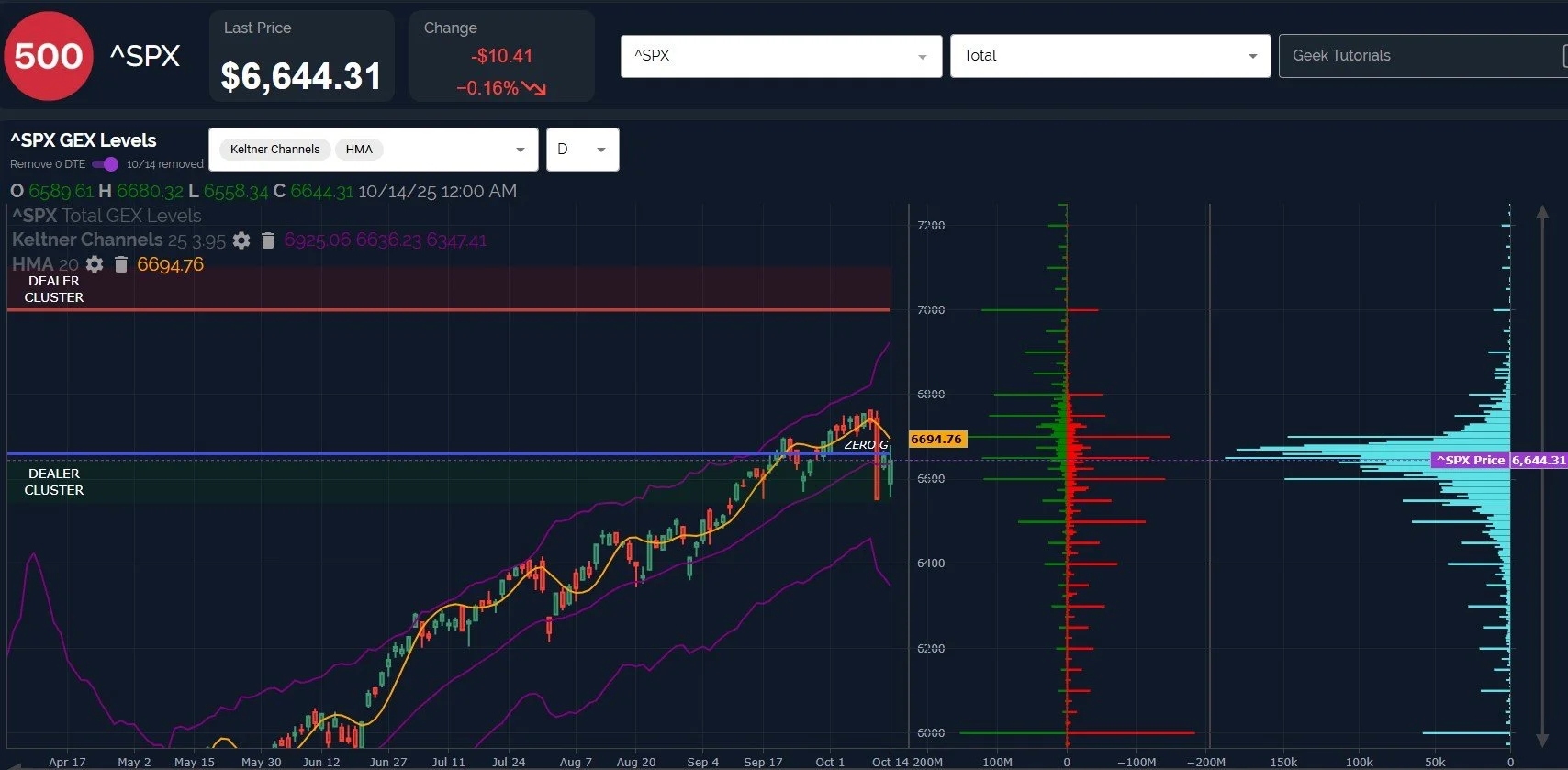

SPX still hasn’t tested the Hull Moving Average since Friday’s gap down. The pattern is clearly different already compared to the last 4 small pullbacks, which should raise some eyebrows, so we need to be mindful that we may or may not see further upside toward that 6700-area prior to the decline concluding, if it’s still ongoing.

I hate making statements that lack actionable information, but our approach this week has been to trade each day based on what the 0 DTE picture tells us each morning, and sometimes that’s the best approach. If we close above 6700, we may see further upside toward 6800, but otherwise, the trend is still lower, according to the Hull.

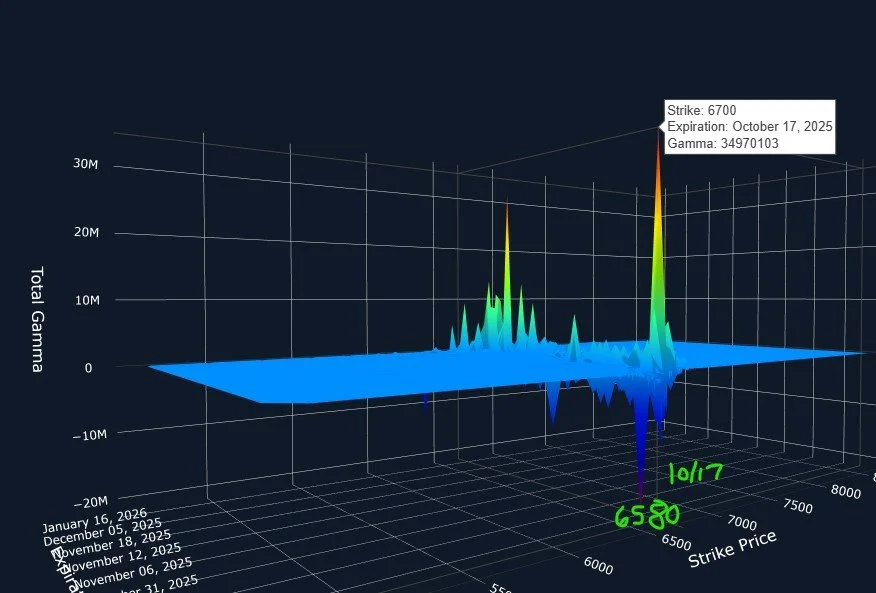

Taking a brief look at our 3D graph, which shows individual GEX clusters at each expiration, we see the largest clusters expiring Friday are a positive cluster at 6700 and a negative cluster at 6580. Based strictly on this information, it would seem the greater risk in terms of magnitude is to the downside, though 6700 currently shows higher odds of being reached, at least initially.

QQQ has actually been the weakest performing index since Friday, failing to get close to the 605 Hull. We also see more GEX at 580 and 590, with volume also tilted lower.

Is QQQ giving a contrarian signal, with retail traders becoming too bearish at the bottom? We can’t say strictly based on this data, but similar to SPX, until QQQ overcomes the declining Hull (with clear upside GEX targets), the trend remains down, with a break of 590 opening the door to 580.

While SPX and IWM saw net GEX remain flat or increase, QQQ saw a sizable push back down in net GEX.

With SPX and IWM looking at least somewhat hopeful for bulls (more so IWM), yet QQQ and the VIX looking ready to continue breaking things, we’re waiting for a combination of signals to give us greater conviction before making huge changes to our hedges or exposure.

As usual, we’ll share our updates throughout the day for our members in Discord, including at least some updates in our free channel as well, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.