Bouncing Quickly Into A Decision Point: October 14 Stock Market Preview

NEW PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code FALL2025 at checkout!

Tonight’s YouTube video takes a look at the post-mortem carnage of Friday’s bull grill (all steaks served rare), but we also packed it with some quick GEX insights on CRWD, GLD, GOOG, and PLTR, so check it out if you have a few minutes!

Most of the fun had between Friday’s wipeout and Monday’s retracement of roughly half of the loss was in the overnight futures market, with futures traders pumping indices and the VIX losing roughly half of Friday’s spike, in contrast.

With this week marking OpEx week, and monthly VIX options expiring a week from Wednesday, we still have a potentially treacherous path ahead, with a whipsaw in both directions possible, or perhaps a surprising move toward upside or downside extremes.

Looking more closely at the VIX, we see over 368,000 contracts traded at the 35 strike, certainly an eye-catching amount of activity, though our immediate focus is on the potential for a continued spike higher toward the upper Dealer Cluster zone at 25.

With current momentum being lower for the VIX, a reversal back up appears to be very important around the 18 area, matching the big negative GEX cluster at 18 as well as the rising Hull Moving Average. Below the cluster at 18, we may see yet another visit to the 15 area, making Friday’s drop just another brief step back along a pathway to new highs.

We do want to observe one big difference between Friday’s drop and the last several smaller dips we experienced: Most of those smaller setbacks involved sizable gap downs, with SPX then climbing back to new highs. Friday’s relatively large reversal was intraday as opposed to a big gap down. Will it matter? Does it mean anything? We’ll let you know after the market makes a decision regarding the next move (sorry, not very funny).

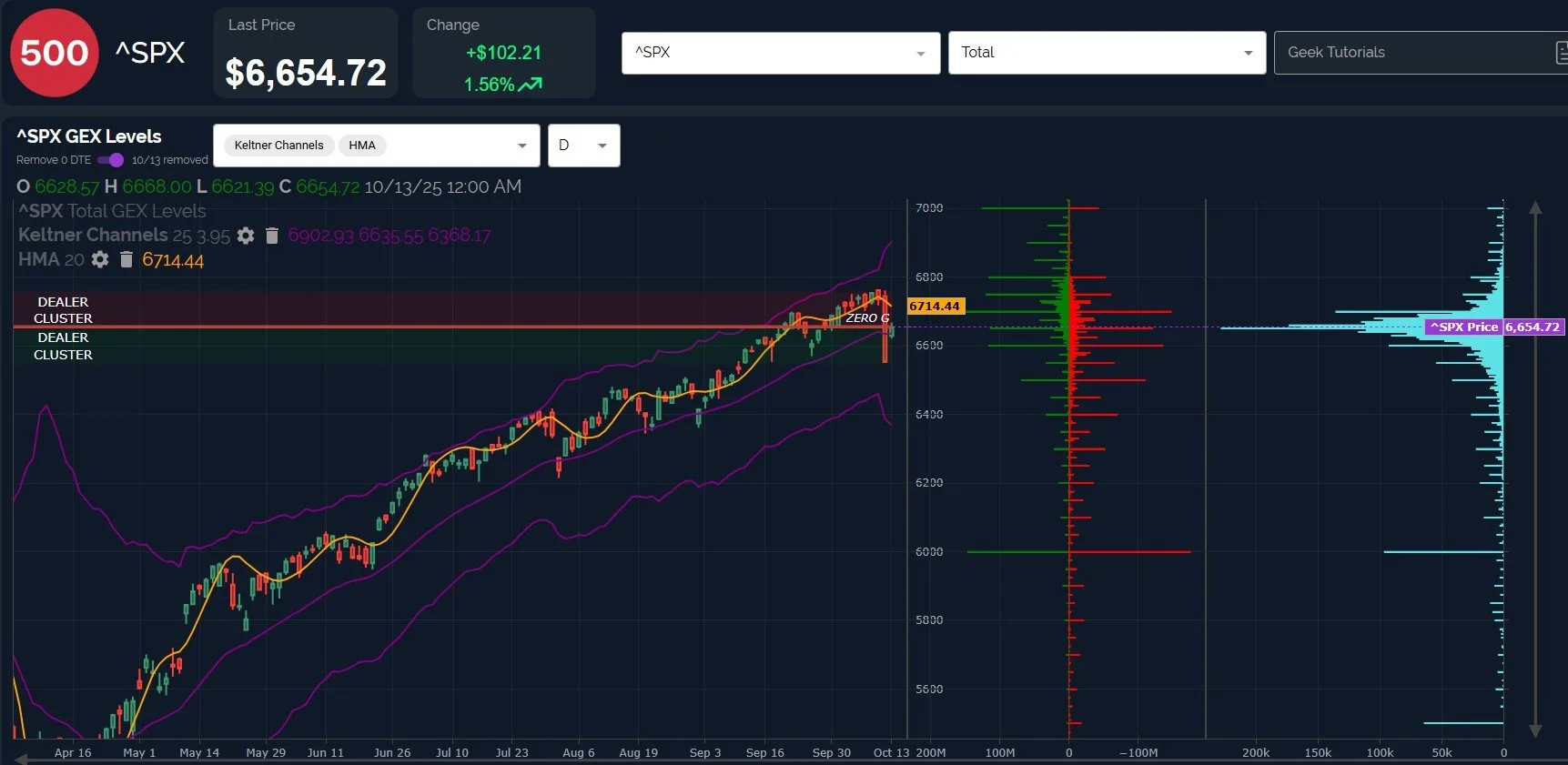

Regardless of whether the drop is over or not, it would seem only proper to have SPX at least attempt to overcome the now declining Hull at 6714.44. 6700 is a huge GEX zone on the positive and negative side, so a breach above 6700 that holds likely means we continue higher, while rejection potentially implies a retest of Friday’s lows or even lower.

If participants aren’t interested in what is proper, we could drop and retest 6600 without testing 6700, and ultimately, we may still tag the 6500 level. Key levels will likely be tested in coming days that will make the next pathway more clear.

QQQ closed above the key 600 GEX area, with 606.73 and possibly then the positive GEX cluster at 610 looming overhead.

It’s important to note that all indices still closed with negative GEX today, though SPX did drift slightly into positive territory during the after hours session (we track and make available to members both GEX at the close and GEX into part of the after hours session).

As for QQQ, this point brings me to the 590 strike, which is still the largest net GEX cluster on the map currently, making it a potential magnet with fairly good odds of being tagged again.

Last but not least, IWM closed almost right at the Hull, a mere .43 away. We may end up with an advanced preview from IWM regarding the markets next direction that we can then extrapolate to SPX and QQQ, which have a little more to go to reach the same indicator (the Hull).

We believed IWM could have reached 250 last Friday, which obviously didn’t happen, yet GEX at 250 remains, with Friday representing the largest expiry.

IWM appears to have the “cleanest” bullish setup in my opinion, though we have to remember cleanest is a relative word, we’re still digging through the dirty laundry.

We mentioned the big GEX cluster at 250 expiring Friday, which we can show you using our 3D graph below.

We also want to note a variety of smaller negative clusters ranging from 230-238 that add up to more GEX than what we see at 250, all expiring Friday, so at least as of this moment, IWM actually hasn’t yet shown us its hand completely. The current negative GEX read on a net basis (though improved) adds to an unclear picture.

Tonight’s newsletter raises more questions than answers, but hey, it’s Monday, and at least we shared some levels we’ll be watching. We anticipate actionable data in the next day or two, and we’ll be sure to share those updates. Thanks for joining us here as well as in Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.