6800 Within Sight: October 9 Stock Market Preview

We discuss SPX, QQQ, IWM, MRVL, and more in tonight’s YouTube video, so check it out if you have a few minutes.

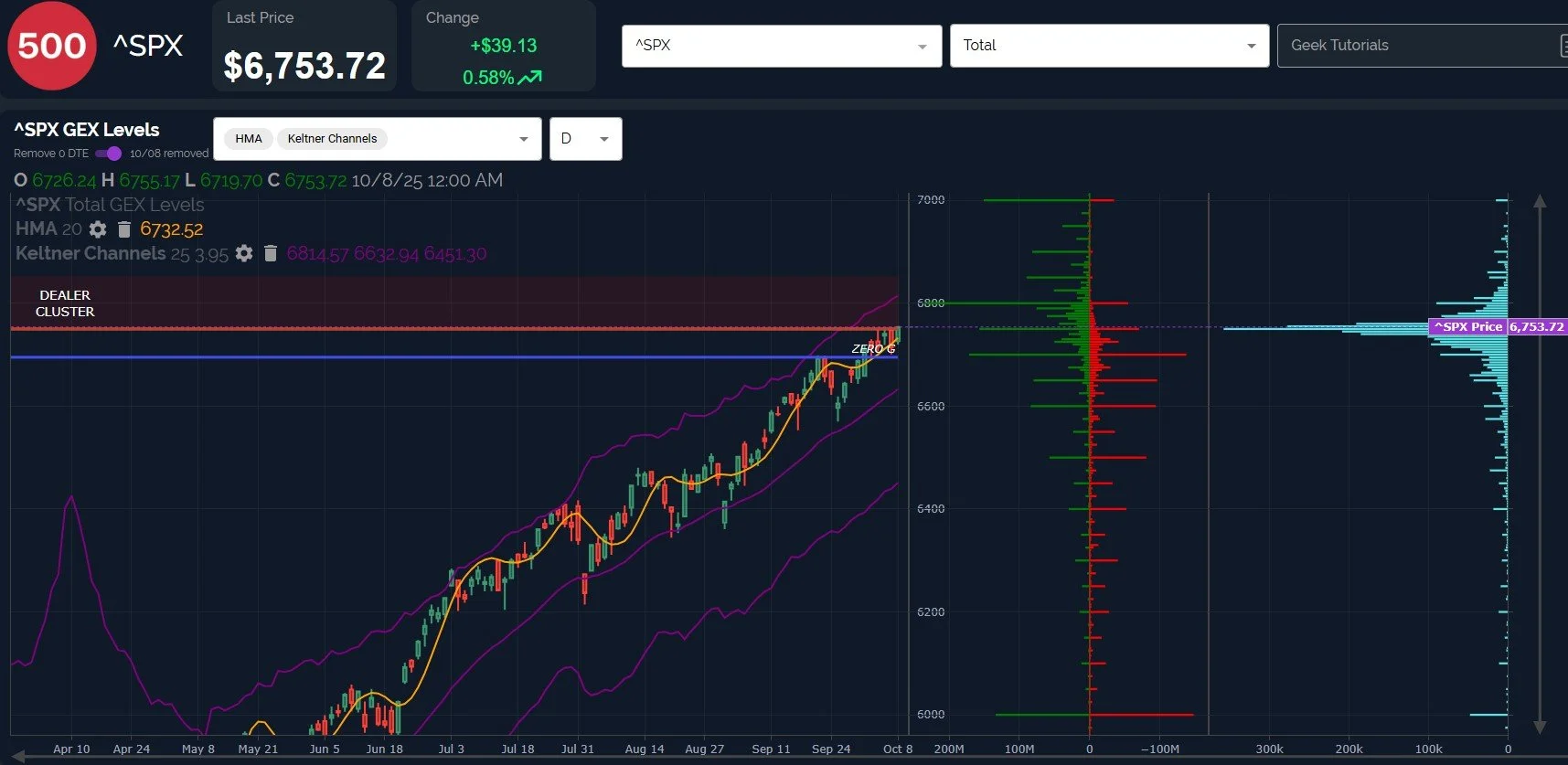

Our suspicion regarding yesterday’s narrow close below the Hull Moving Average yesterday appears to have been warranted, with the proximity to the line being close enough that SPX pushed higher yet again today.

The previously identified positive GEX cluster at 6800 continues to be a strong potential magnet, and we still think anywhere between today’s closing price and 6800 (perhaps even an overshoot toward 6830-40) will likely mark a reversal area.

The red Dealer Cluster zone indicates just that- a zone where dealer behavior may turn to selling. 6800 still lines up fairly closely with the upper Keltner channel, and we still have the VIX maintaining its uptrend.

Tactically, breaching 6732 to the downside might be an entry for a ride to 6700, where the next test may be. In the face of such strong upside momentum, I personally prefer to wait for similar signals instead of picking the exact top.

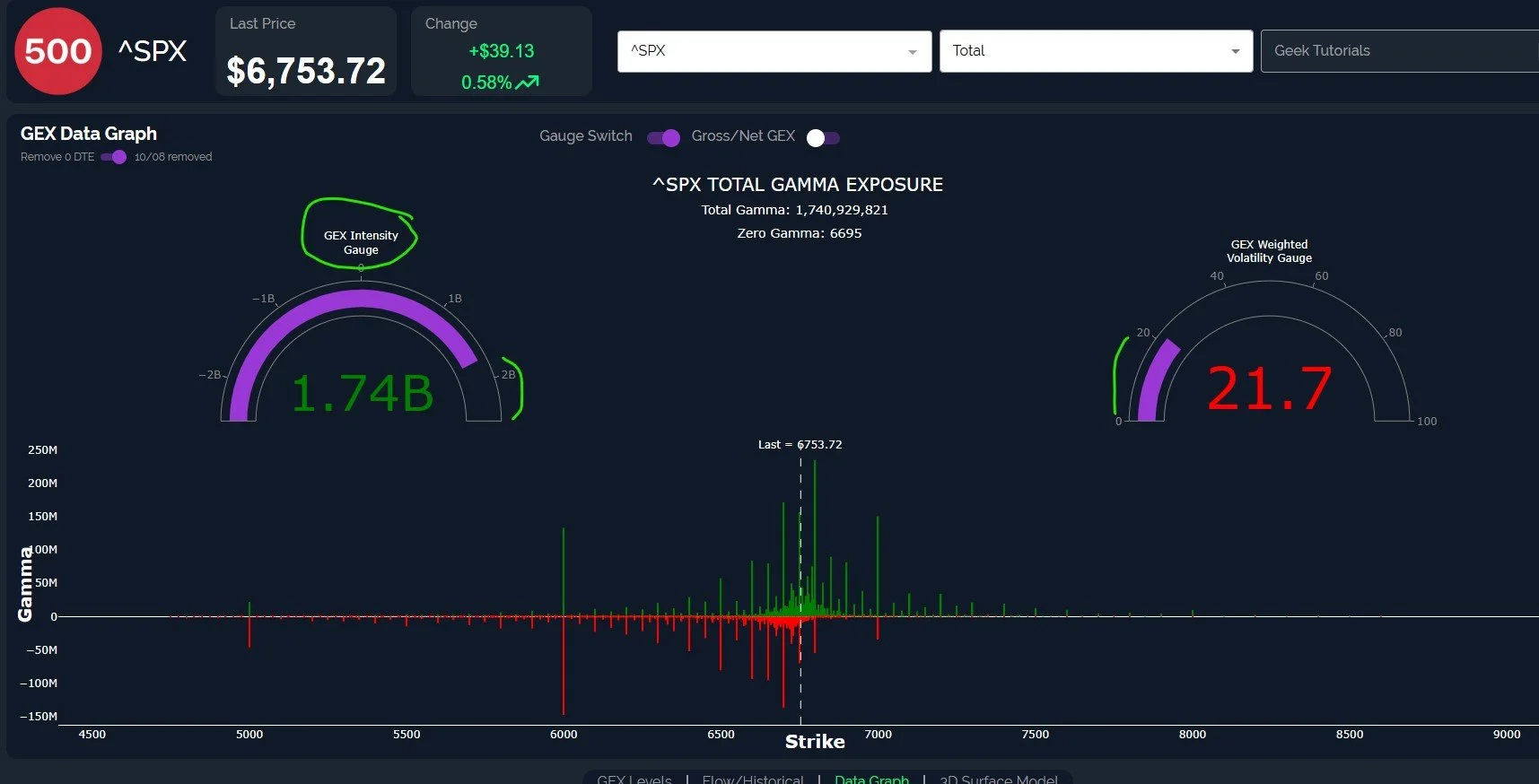

SPX is nearing an extreme reading on the GEX Intensity Gauge, which has served as a good contrarian indicator at times in the past, with pullbacks ensuing shortly after extreme readings. SPX still has some room to go to reach an extreme, and GEX-weighted volatility may drop further. Perhaps coinciding with a tag or exceeding 6800?

6700 continues to be the important line-in-the-sand we mentioned yesterday, so bears might be wise to be tactical in managing any attempts to short by recognizing that we may see a battle at 6700 as long as substantial positive and negative GEX reside at that level.

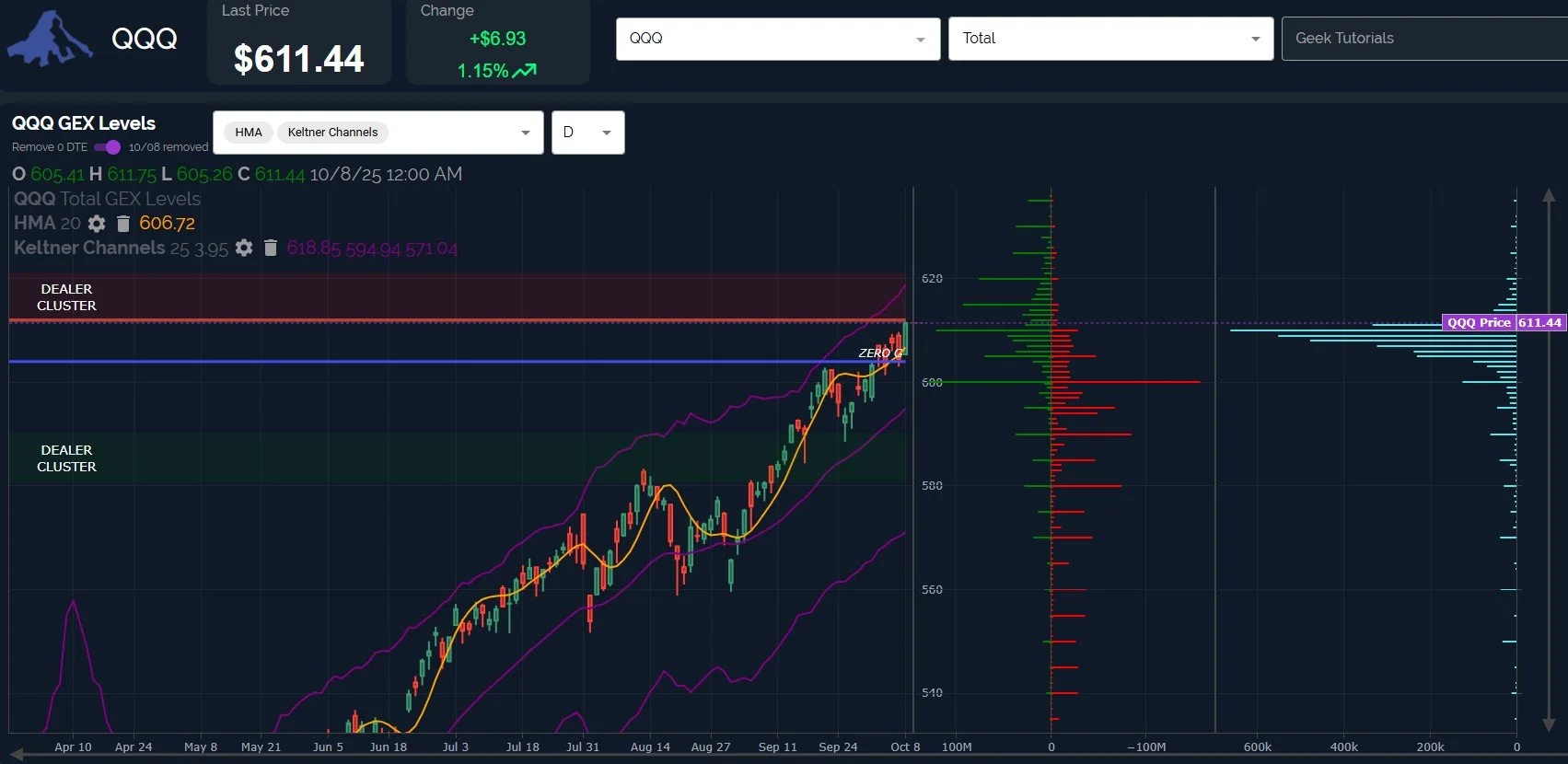

QQQ exceeded the big 610 GEX cluster after two days of falling just short of the mark, bringing the next levels at 615 and 620 into focus.

The Keltner channels continue rising, now almost matching 620 for the upper channel.

We continue watching 600 as the big potential bull/bear line based on GEX, with large positive and negative clusters present.

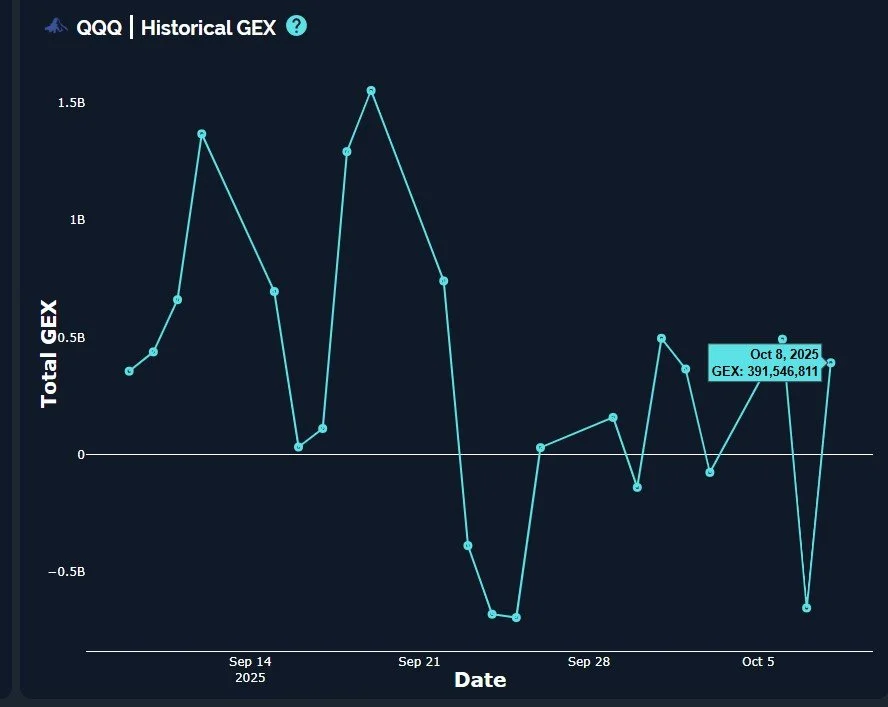

Along with the positive action today in QQQ, we see net GEX improved enough to get QQQ back over the zero line, though overall we’re still stuck in a neutral zone.

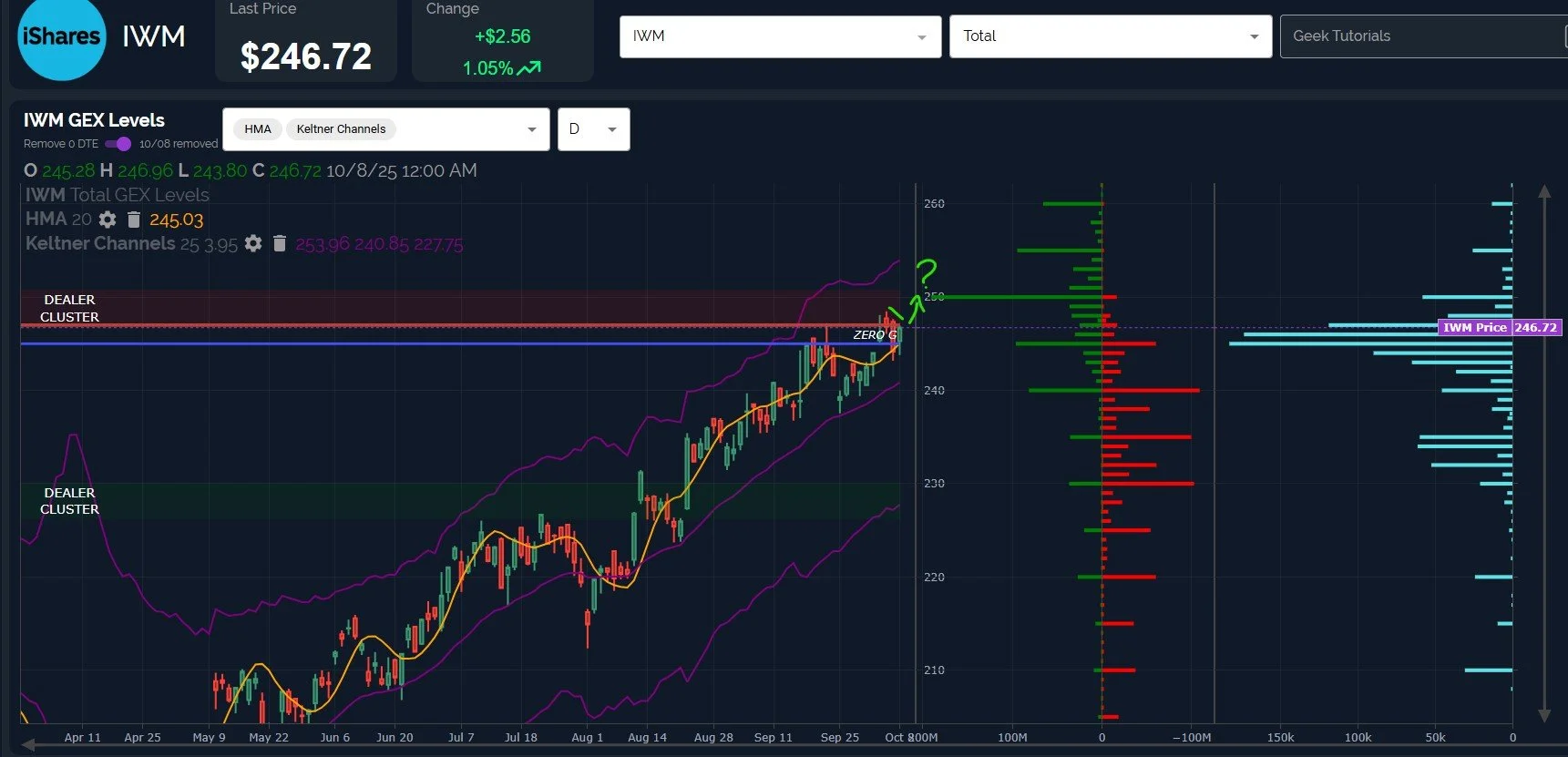

IWM saw some negative divergence today, making a lower high for the 3rd day in a row.

With the big positive GEX cluster still waiting at 250, and attempts toward 250 stopping shy at the 248 area, it seems reasonable to expect that 250 may finally be tagged in the next day or two.

240 seems to be an important bull/bear line based on GEX.

A breach of 250 to the upside may even tag 255, though 250 is significant enough to expect that going straight through that area without interruption is fairly unlikely at this time.

IWM technically crossed back into positive GEX territory, though barely.

The rising pattern on the VIX since mid-September remains one of the more compelling reasons why a pullback may happen soon, as discussed yesterday. Even today’s nearly 1-point drop in the VIX still maintains the general pattern of higher lows, and we still saw the VIX close pretty close to the Hull. Volume continues to be elevated at higher strikes and we see positive GEX stretching up to the 30 strike.

A drop to 16 would still maintain the rising pattern, and you can see virtually no GEX or option volume is present below the 15 strike in any meaningful amount, thus presenting low odds of a sustained breach to the downside for the VIX.

Opinion- the best thing for bulls desiring a solid finish to the year with potential for upside into the new year would be a pullback right now (in the next few days, or perhaps alongside Q3 earnings reports). The higher we go without more than a 3%-4% pullback, the more of an outlier event this rally becomes. The S&P is up over 14.8% YTD, and that’s with a 21% decline in between, meaning the latest rally since April has been 39.5% to the day from low to high, a 6-month timeframe. Annualizing 80% a year? “Sustainable” is not a word that comes to mind…But we will trade what is in front of us, with asymmetric positions and hedges carrying our portfolio through the unexpected.

The Geeks are overall bullish, so we view any upcoming pullback as a buying opportunity, and we will continue to update our Discord community throughout the day as we see new information on the GEX front. Thanks for reading and thanks for joining us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.