On The Brink: October 8 Stock Market Preview

In addition to taking a look at what today’s close means for broader indices, we also look at CRWD, the VIX, and NBIS in tonight’s YouTube video, so check it out if you have a few minutes.

Will SPX be able to make it to 6800? Before we dive into SPX, let’s spend a little more time than usual looking at the VIX, because it seems to be flashing red lights at us as indices play games around the seemingly never-ending rising trendline.

Starting with a TradingView chart going back to early Summer 2024, I underlined periods of time where the VIX trended higher for several consecutive days without spiking. All such trends ended with either a very large spike or (in one case) a smaller gap up spike before reversing. Most other times are comprised of periods of down trending VIX levels with intermittent smaller spikes, such as what we’ve seen the entire time from April until roughly mid-September. Count this statistic as one vote in favor of a VIX explosion.

VIX 4-hour chart maintains the volatility uptrend, with the VIX regaining the key Hull Moving Average, and the Keltners allow room up to 18, not too far from today’s 17.23 close.

The VIX daily chart shows negative GEX up to 19, then GEX flips positive above 20, with my own observation that GEX has grown in recent days at the 22-25 strikes.

Also note that seeing so much negative GEX spread across such a wide range of strikes (from 15-19) is a bit unusual, we typically see negative GEX more concentrated on a couple of potentially lower targets, like 14-15 that we saw for a period of time this Summer. An invitation for pain as participants have to cover shorts?

We’ve noted volume up to the 50 strike recently, but I think a more probable outcome in the short run is a spike toward 20-25, though we have to be aware of the first point made in the newsletter about previous uptrending VIX patterns. It could get ugly.

If we do see a huge VIX spike, this would almost certainly change the likely market trajectory into year-end, so we can’t assign good odds toward such an event until we see what happens with the next pullback, and whether or not it becomes something bigger.

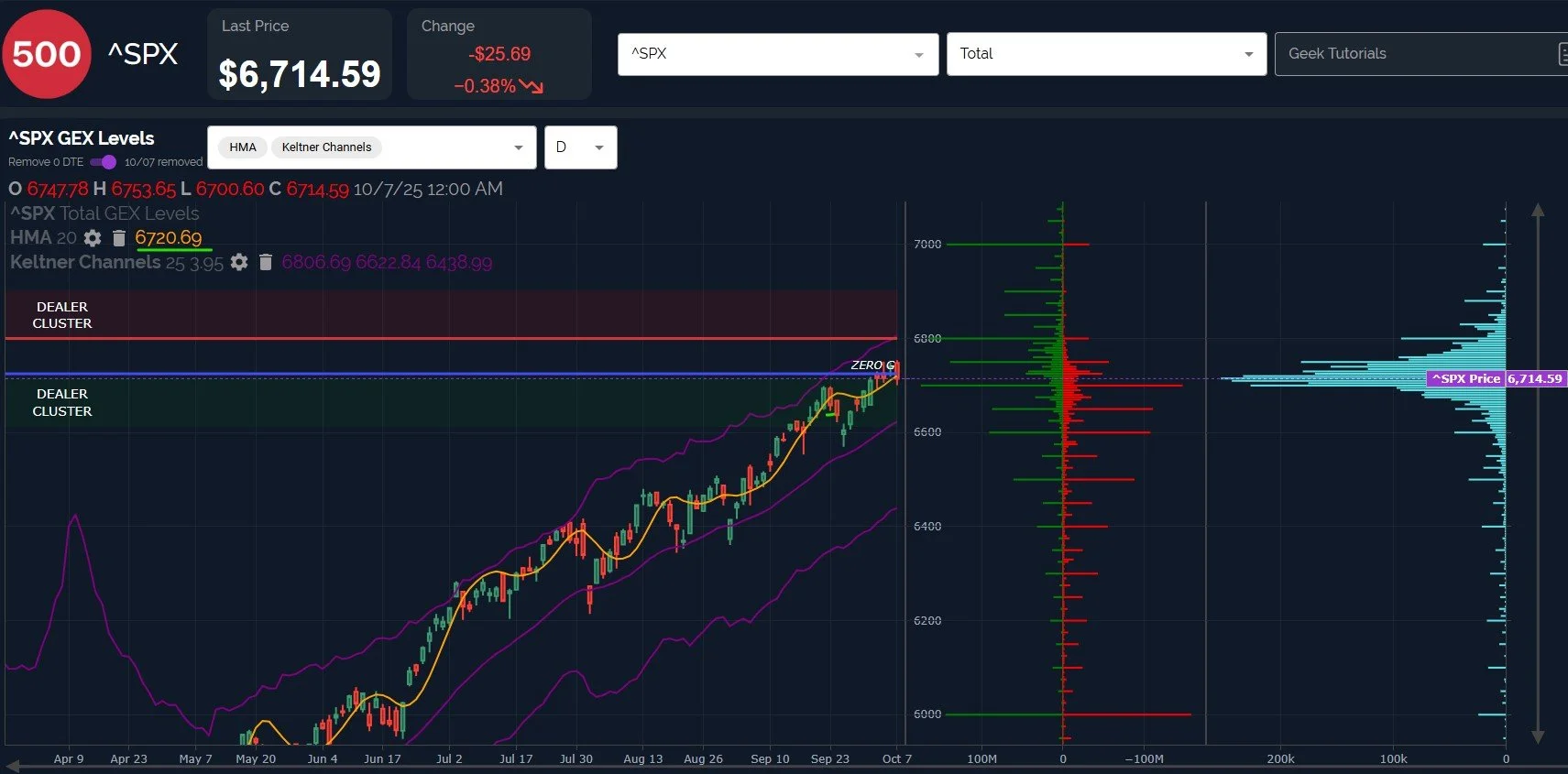

Indices give a less convincing setup at this exact moment, with SPX closing a hair below the Hull, with noteworthy GEX still awaiting us at 6800. 6700 becomes an all-important level, with a gap below potentially signaling a faster trip down to 6500-6600.

It’s entirely possible that the market rebounds from today’s weakness and makes the 1.5% or less trip to 6800 while the VIX continues preparing for a larger spike.

I would also not be surprised by the market making a decision in one direction or another overnight, with a gap into the cash session.

SPX saw net GEX drop a lot, but GEX is still positive overall at over 400M (a neutral reading from our perspective).

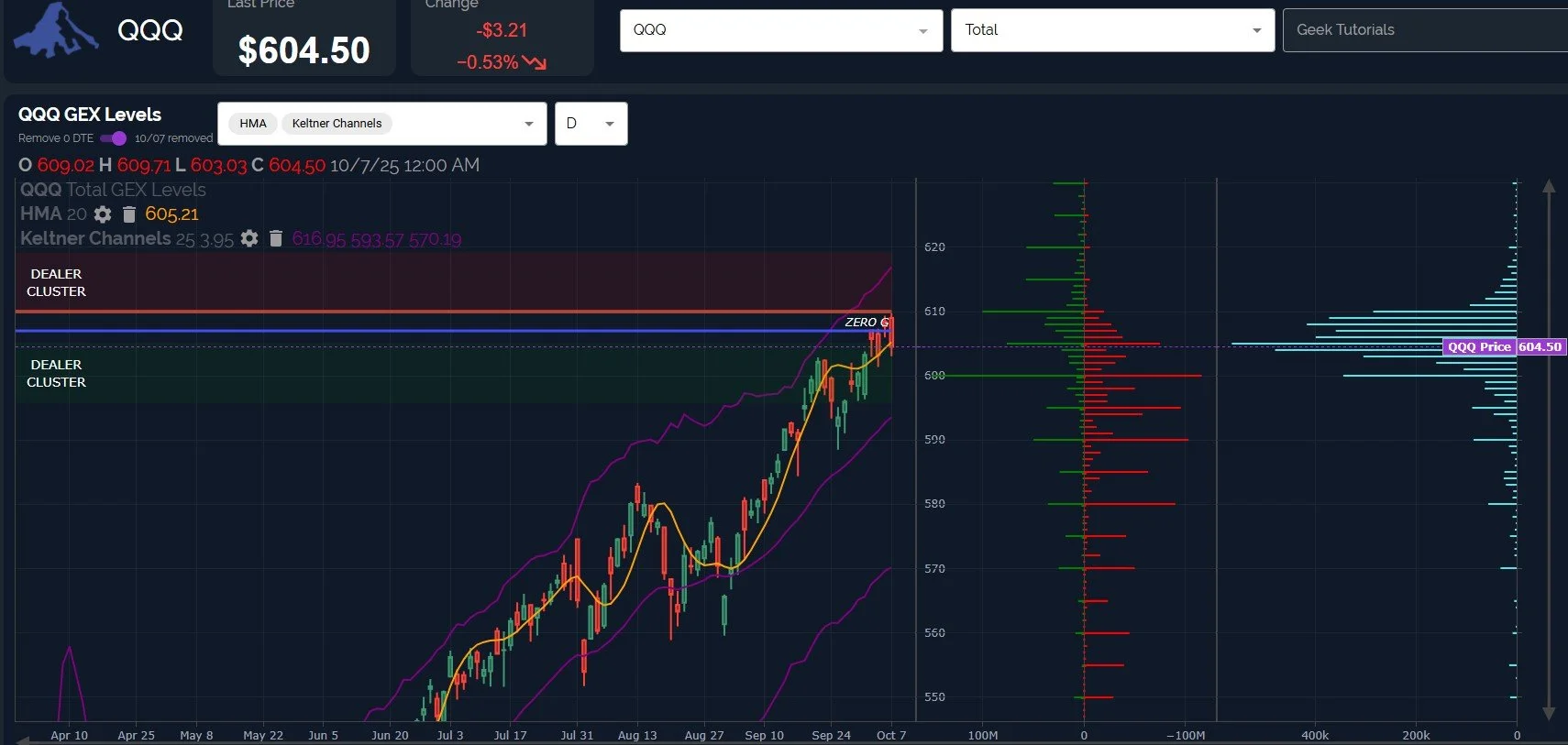

Similar story for QQQ: A close just below the Hull, we still have substantial positive GEX at 610, though QQQ did approach 610 within pennies today, so it’s yet to be seen whether or not another attempt is made prior to more downside.

600 becomes an important line of delineation. Negative GEX at 580 and 590 is significant and may represent initial downside targets once a “real” pullback unfolds. 580 will soon mark the lower Keltner channel on the daily chart, making for nice confluence of GEX+chart indicators at 580.

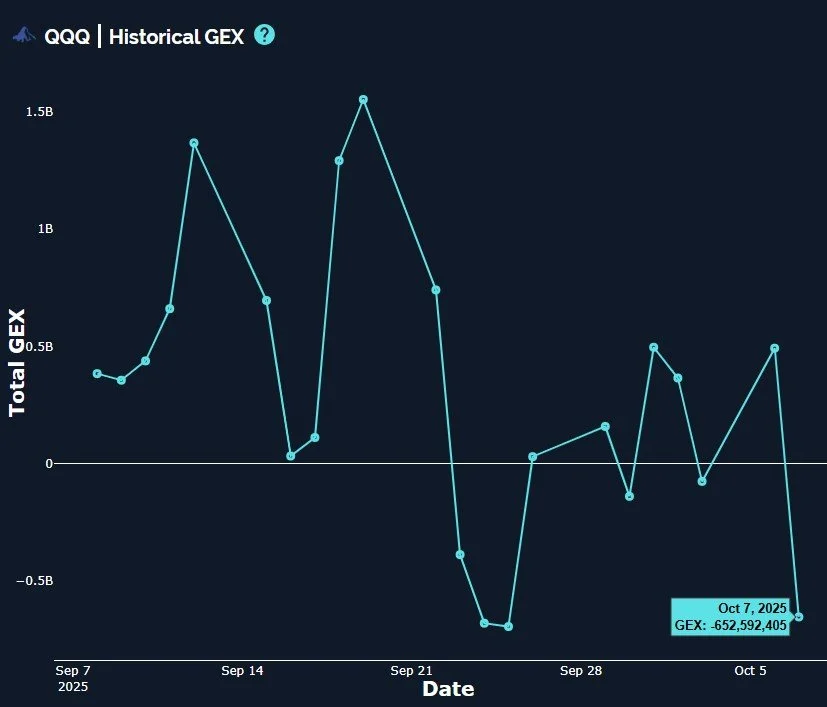

One difference between QQQ and SPX is QQQ showing a steeper drop in net GEX into negative territory.

It’s worth noting that the last time QQQ GEX was at this approximate level, we marked a bottom, though a true shift lower would likely also see a drop to this area, with deeper negative GEX readings to follow.

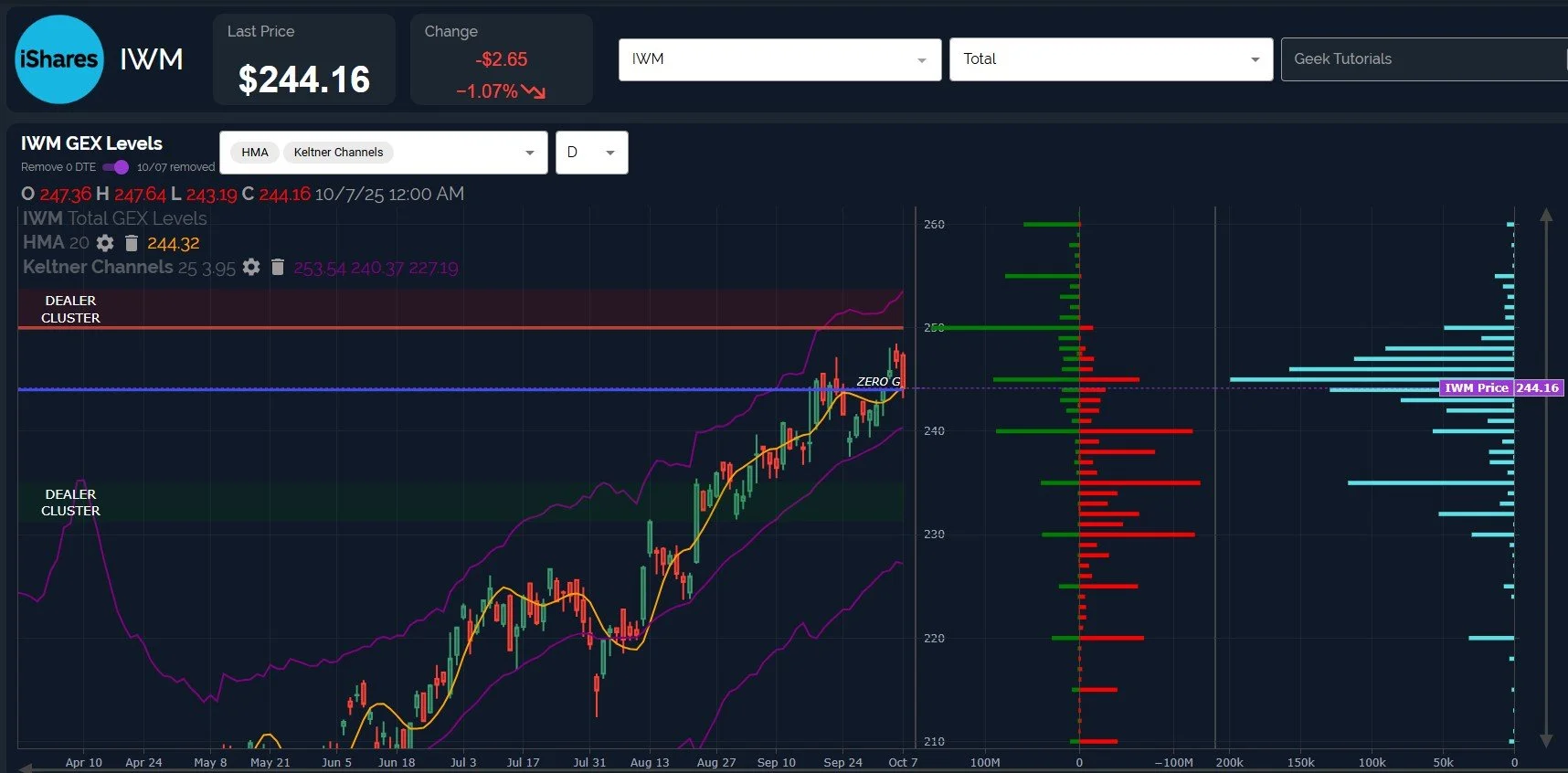

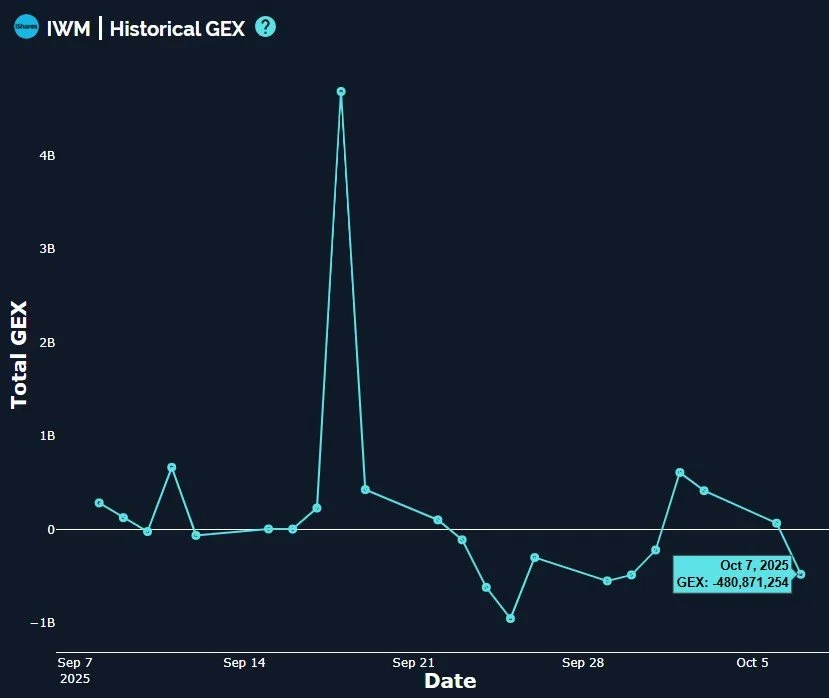

IWM also closed just below the Hull after making a lower high today.

GEX still remains at 250, and the Keltners are rising, so the burden is still upon the bears to prove that time is up for bulls (for now).

Upside appears to be relatively capped at 250 for now, and bears need below 240 to target 230. Volume was once again elevated at 235 today.

IWM saw a move into negative GEX territory today, similar to QQQ. Not exactly what a feverishly bullish cheerleader would want to see, and this is 3 days in a row of negative movement for IWM GEX.

We’re open to anything by tomorrow’s cash session open, but ultimately, the VIX is going to need to really make a strong downside move to justify indices continuing higher in a sustainable way, otherwise we can expect an upcoming VIX spike that may be larger than the last several spikes we’ve seen.

We will post our intraday observations in Discord, so join us if you haven’t already!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.