IWM On Mission 250: October 10 Stock Market Preview

Tonight’s YouTube video addresses SPX and IWM, but we also cover TTD, AMZN, and EBAY, so give it a quick view if any of those pique your interest. Or simply if you’re bored, or perhaps you like to fall asleep to the soothing sound of GEX analysis.

The bottom line today is that everything is slightly below the Hull Moving Average: SPX, QQQ, IWM, and even the VIX. Someone has a sense of humor, I guess. None of those breaches appear convincing by any means, and SPX is still holding above the key 6700 level.

Let’s turn to the VIX before coming back to SPX later: The VIX printed a higher high and a higher low compared to yesterday, but closed below the Hull, potentially signaling downside toward the 16 or 15.5 area. The VIX hasn’t strayed too far from the Hull going back 2 weeks, and neither have the indices.

Volume and GEX both continue to suggest that the VIX is unlikely to drop below 15 in any meaningful way, and the pattern of a generally rising VIX has typically ended with some sort of spike higher.

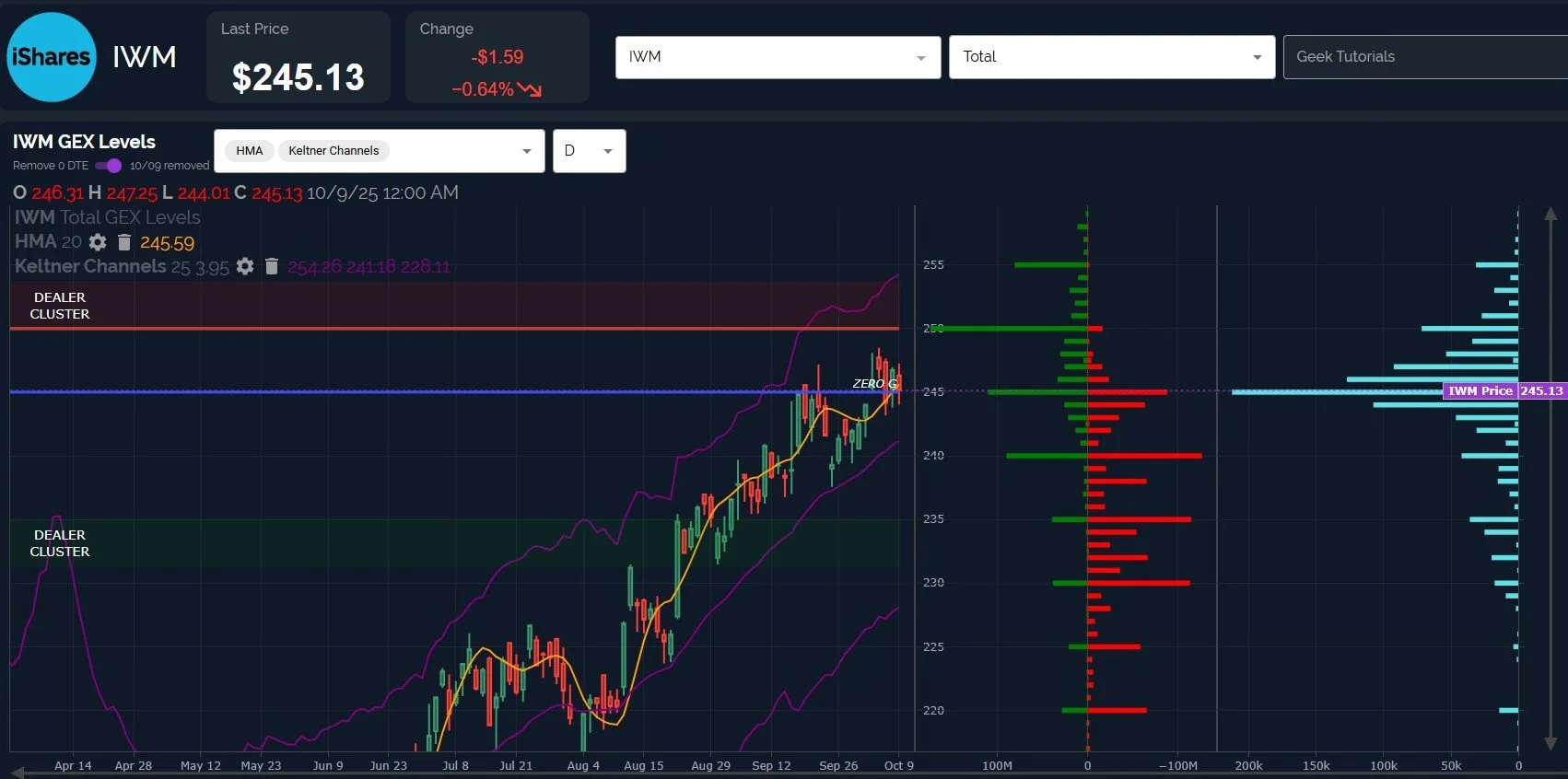

IWM also printed a higher high and a higher low compared to yesterday, generally continuing the multi-day compression into a triangle. This is likely to break, and despite today’s close .36 below the Hull, I think IWM has good odds of reaching 250 on the basis of holding the large GEX area at 245.

We certainly can’t get short-term bearish until IWM breaches and holds below 245. We will likely have a 0 DTE picture available to us giving further clarity when and if that happens.

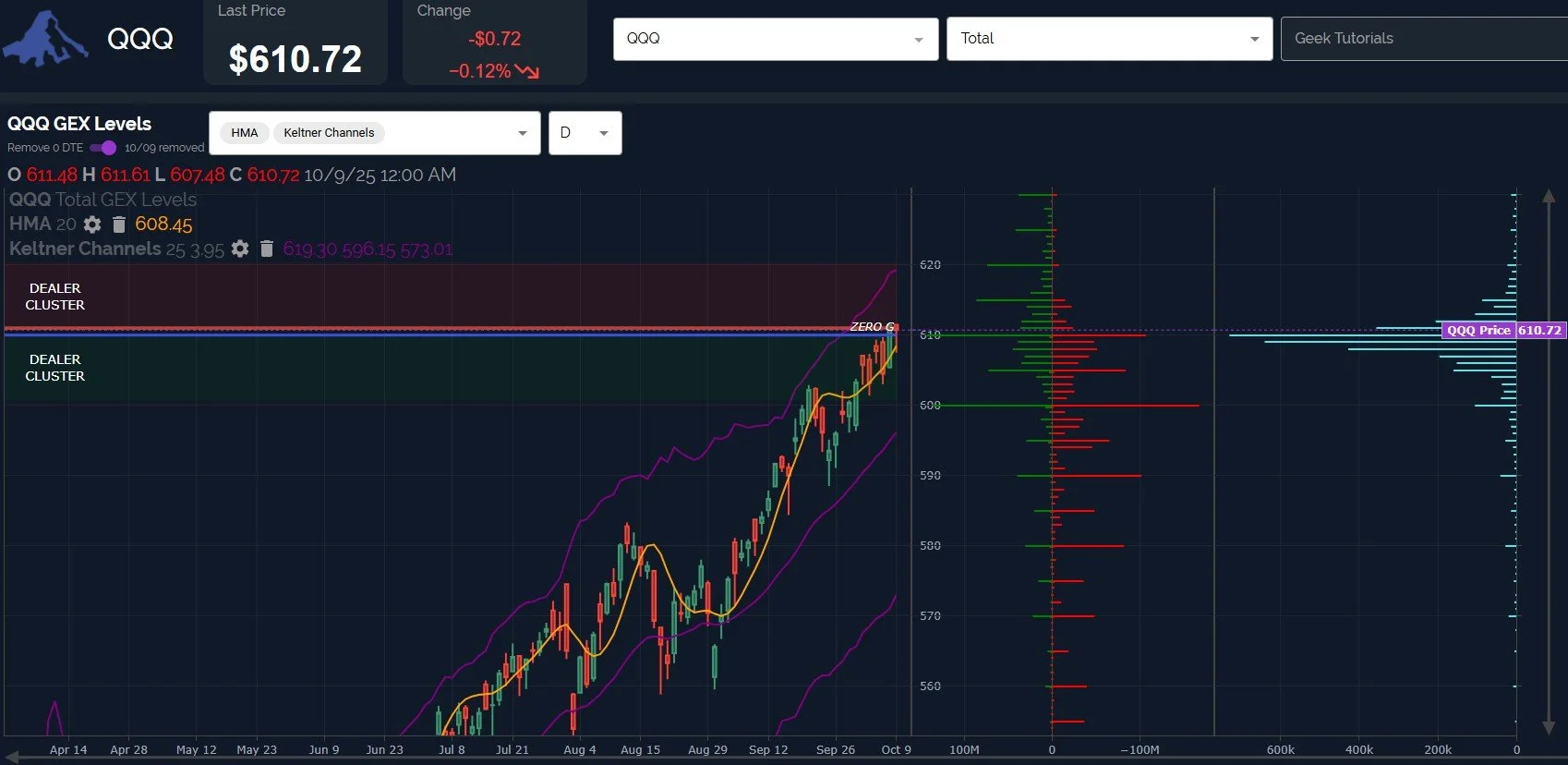

QQQ looks a little more bullish than IWM and SPX today, closing well above the daily Hull and printing a wick on the daily candle.

The rising Keltners for all indices point at the possibility of another push higher, though GEX diminishes substantially startin at the 615 strike and going higher.

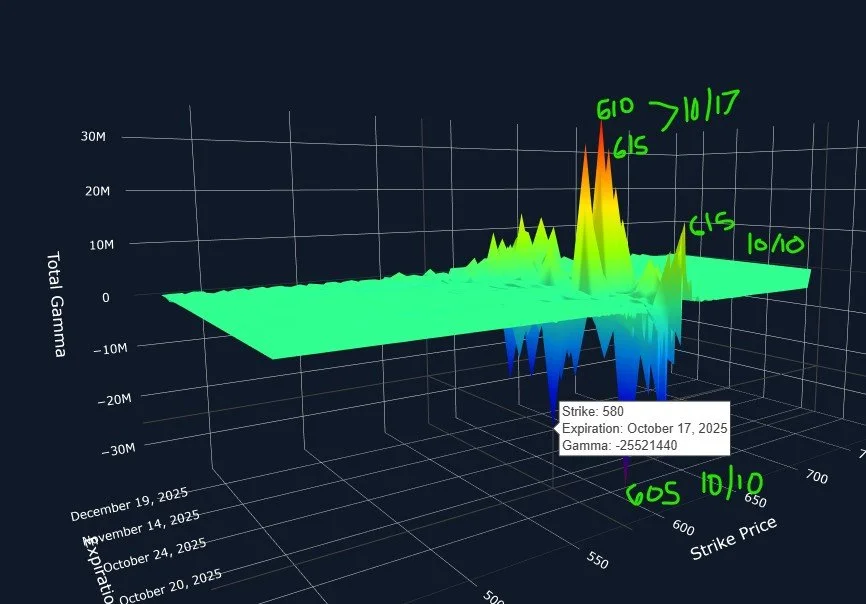

Let’s look at our 3D graph for a more granular view of the largest individual GEX clusters (not net GEX) expiring this Friday and OpEx Friday next week.

605 is the largest negative cluster expiring tomorrow, with 615 representing the largest positive cluster. 613 and 616 (not highlighted) are slightly smaller than 615. 605 is larger than any one of those clusters, but combined, 613-616 have more GEX. I consider this contrast indecisive and we could see both hit tomorrow: gap down and then a Friday close at highs, before dropping into OpEx? whoa there, let’s not get ahead of ourselves.

QQQ did close back in negative GEX territory though… As did IWM today.

SPX also closed below the daily Hull, though SPX is still well above the key 6700 area, showing major positive and negative GEX (even more than at 6000).

6800 is a big positive cluster that is fairly close to the upper Keltner channel, representing a solid target that we expect to be reached imminently.

Bears need a sustained breach (ideally a daily close below, or gap down below) 6700 to eye 6500-6600 as an initial downside target.

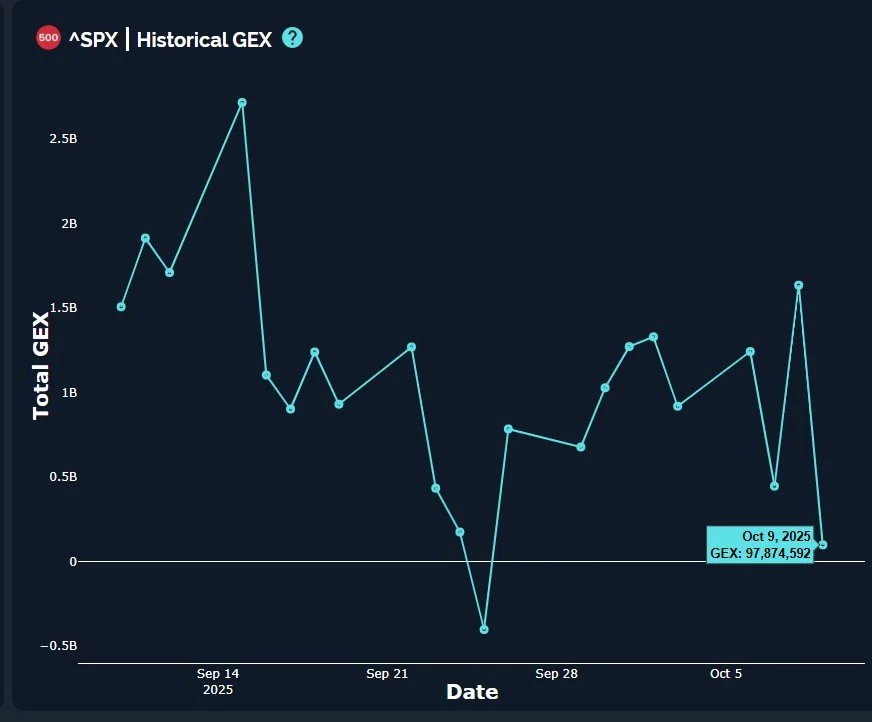

SPX saw net GEX drop precipitously today, wiping out roughly 1.5 billion in positive GEX. The last time we see a net GEX reading this low or lower was September 25, which also marked the short-term bottom for SPX. However, that was after a 3-day decline, we can’t even decline more than one day before making new highs, so this time is already different.

The question in our minds isn’t whether or not we will see another pullback soon, the question is whether it’s another run-of-the-mill 2-3% microscopic blips on the radar or if it’s a larger pullback. We will have plenty of data to assess as we turn the corner, and we’ll be sure to share our thoughts with you all. In the meantime, can we please get SPX 6800 and IWM 250 out of the way?

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.