Powell, Gov’t Shutdown, Rising VIX..Does It Matter? September 23 Stock Market Preview

September 23 Stock Market Preview: Indices are quickly approaching the next upside targets following completion of last week’s OpEx, and the VIX continues moving higher, introducing a big red flag in a week of very little economic data. With Powell speaking tomorrow at 12:35 AM ET and a potential looming government shutdown, we still have excuses ahead for possibly volatile moves during a seasonally bearish week.

2nd Half Of September: Historical Trend Or Making History? Stock Market Preview For September 22, 2025

September 22 Stock Market Preview: Indices are approaching “stretch” upside targets in the near-term, with the Keltner channels and Hull Moving Average showing strong momentum higher. When will we see a reversal?

Newton’s 3rd Law & Quad WItching: September 19 Stock Market Preview

September 19 Stock Market Preview: With OpEx and Quad Witching only hours away, I’m reminded of Newton’s Third Law Of Motion, which says “every action has an equal and opposite reaction.” Let’s dive deep into philosophy and a look at the GEX picture for Friday.

Moving On Toward OpEx: September 18 Stock Market Preview

September 18 Stock Market Preview: GEX gave us a good preview of the ranges experienced today across the board, particularly on IWM, though closing prices showed little change for the day, and the VIX lower. Odds appear to be increasing for a pullback sometime soon as the VIX is still in an area of support while IWM may have made a short-term top today. What comes next?

FOMC And Monthly VIX Expiration: September 17 Stock Market Preview

September 17 Stock Market Preview: We saw more upside for the VIX today, also overcoming the key 9-period weekly SMA. With FOMC and VIX Expiration tomorrow, we are on watch for a possible acceleration toward a short-term top or a reversal lower continuing from here, either way, setting up a possible buying opportunity for the next more sustained move higher.

Extremes & Divergences Approaching FOMC: September 16 Stock Market Preview

Indices pushed higher today, though divergences are building: IWM underperforming, the VIX staying strong, and GEX reaching Intensity Gauge extremes (one of our tools). What can we expect heading into Wednesday and then quad witching just beyond that?

Warning Signs From IWM Entering OpEx: September 15 Stock Market Preview

Many signs point to general continued strength amongst indices, though IWM and the VIX may be signaling that a period of weakness is imminent before the trend continues higher. With FOMC and VIX expiration Wednesday, and quad witching Friday, how realistic is it that we see a pullback?

%B 20,2: Revisiting A Useful Indicator As we Preview The Stock Market For September 12, 2025

September 12 Market Preview: The SPX magnet of 6600 remains, almost being tagged today. IWM saw a bullish move to the big GEX cluster at 240, though the VIX printed a higher low today, marking a divergence. With OpEx next week, where do we think we go from here?

VIX Divergences (Again): Atypical 9/11 Ahead? September 11 Stock Market Preview

September 11 Market Preview: September 11 has by and large been a positive day for markets since 2001, but with CPI being reported premarket, will we start the cash session with a gap down or gap up? Let’s take a look at where the indices closed as well as some divergent signals from the VIX today.

Divergences Creeping In? September 10 Stock Market Preview

September 10 Market Preview: Indices moved higher to close the day as the VIX dropped back to 15. VIX:VVIX divergence (VVIX was positive) and IWM showing weakness are possible warnings as we head into PPI in the morning. Will SPX and QQQ yet again reject the Hull Moving Average on the weekly charts?

Flipping Short-Term Bullish: September 9 Stock Market Preview

September 9 Market Preview: GEX shifted more positively for indices as QQQ and SPX also hold above the daily Hull Moving Average. Weekly resistance has held so far at the weekly Hull, but will it hold on another attempt higher? Today we look at the VIX, IWM, and SPX as we consider the big picture.

QQQ High A Month Ago, VIX At 15: September 8 Market Preview

September 8 Market Preview: QQQ hasn’t made a new high since August 13, and the VIX is close to 15. Is this time different, or are we in a topping process right before a correction?

Reversal or Breakout? September 5 Stock Market Preview

Indices are hanging onto short-term rebound possibilities by a thread, closing just above key support. With the VIX getting crushed quickly, are bulls already running out of runway to keep the dream alive?

Closing At Resistance: September 4 Stock Market Preview

Indices are hanging onto short-term rebound possibilities by a thread, closing just above key support. With the VIX getting crushed quickly, are bulls already running out of runway to keep the dream alive?

The Key To The Future Rests Upon…IWM? September 3 Stock Market Preview

The VIX approached 20 today, a test we’ve anticipated in the recent past as we saw key VIX technical levels conquered recently. Despite the red ink spread across indices today, let’s look at some details that paint more of a mixed picture, with QQQ appearing the most bearish and IWM appearing to be the most bullish.

Weekly Resistance Still Holding: September 2 Stock Market Preview

September 2nd Stock Market Preview: Indices have rejected from the approximate area of the weekly Hull Moving Average, with GEX also shifting more negatively. The VIX remains on a Hull Moving Average buy signal, and volume is persistent at much higher strikes. Are we at the doorstep of a market decline or will we a continued push higher?

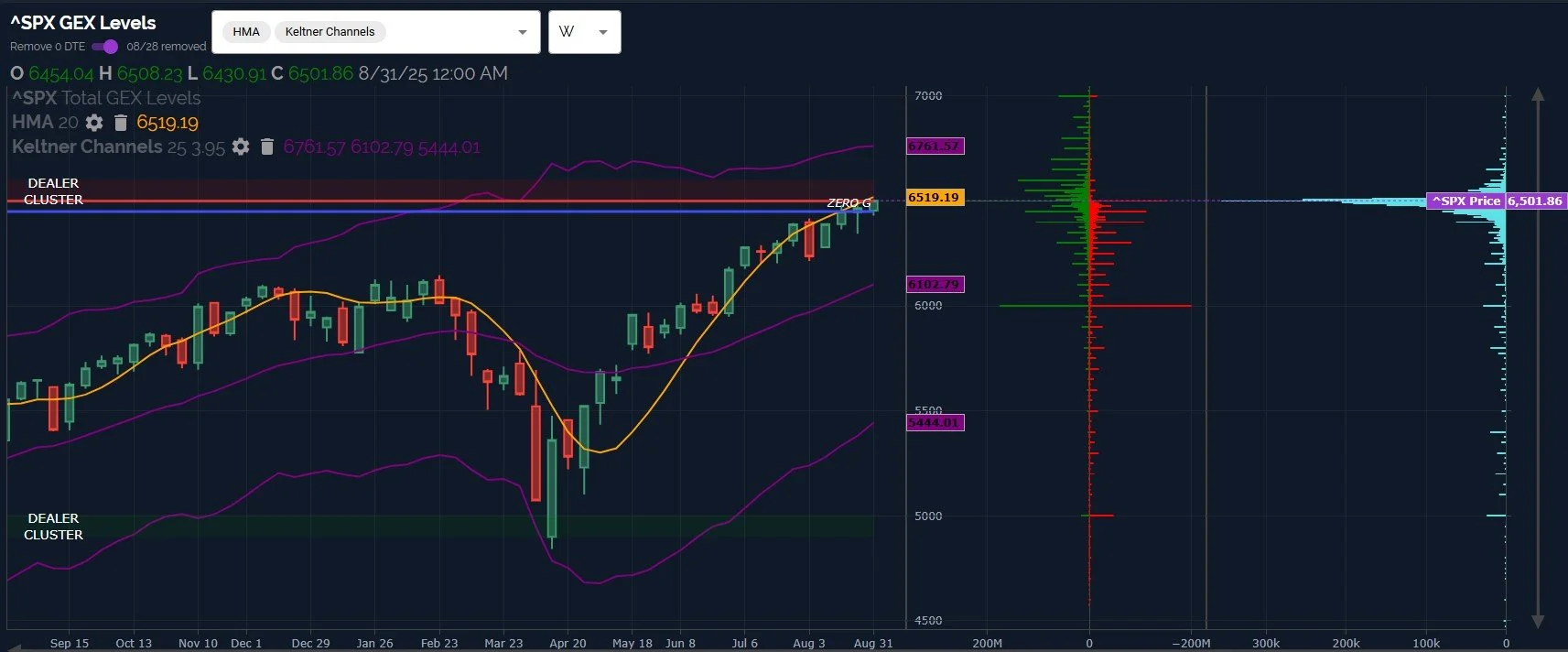

6500 Tagged! Now What? August 29 Market Preview

August 29 market preview: The last trading day of August is upon us, with indices approaching the weekly Hull Moving Average and SPX finally tagging 6500 today. With the VIX almost touching 14 today, we are nearing an inflection point where a decision will be made: The VIX will either fall into the channel established between 12-13 like May-July 2024, or we will see a rebound from this area. What is likely to happen next?

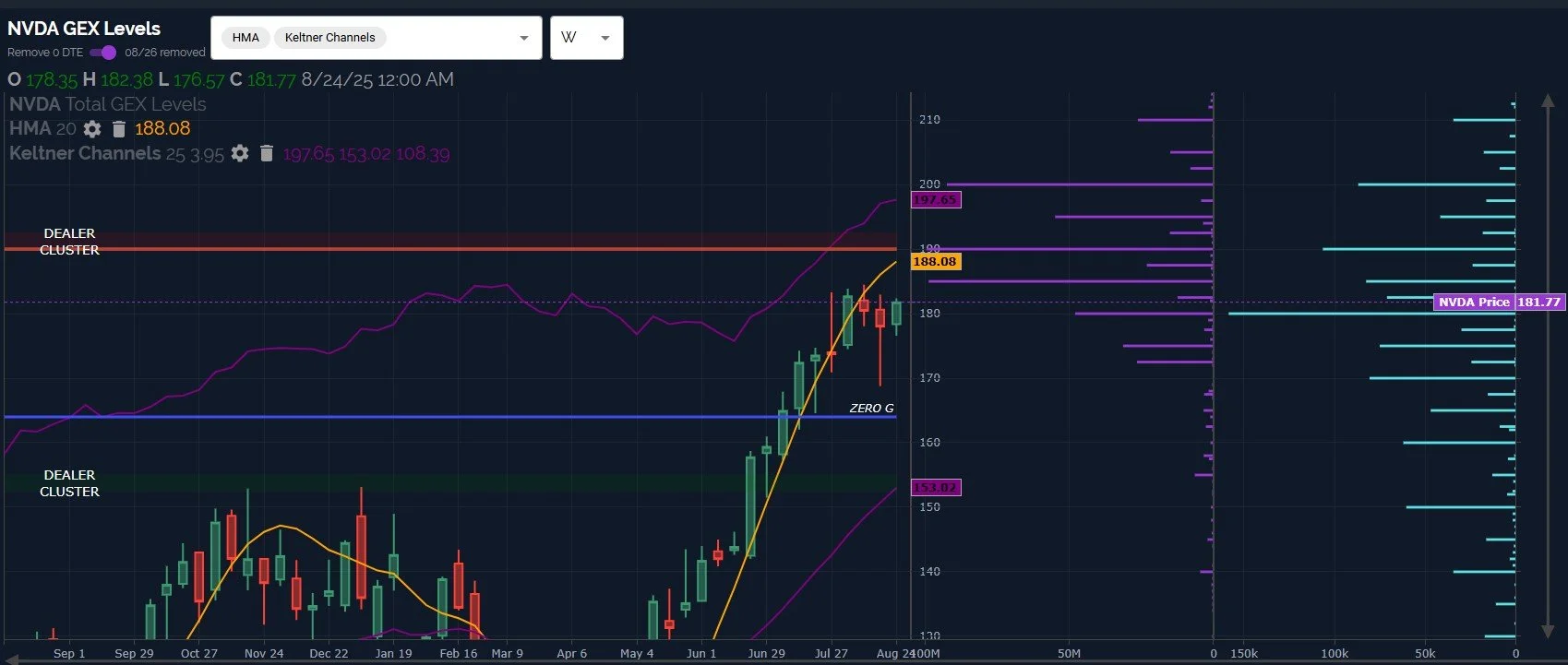

Still On A Buy Signal Despite NVDA: August 28 Market Preview

August 28 market preview: SPX and IWM have been showing relative strength to QQQ this week, and NVDA appears to have dragged QQQ down after hours as of the time of writing this edition of the newsletter. Does QQQ have hope for a rebound in the next couple of days to catch up with SPX, or will QQQ drag everything down and invalidate the buy signal mentioned yesterday? Let’s take a closer look at whether or not the much anticipated pullback is on hold or not.

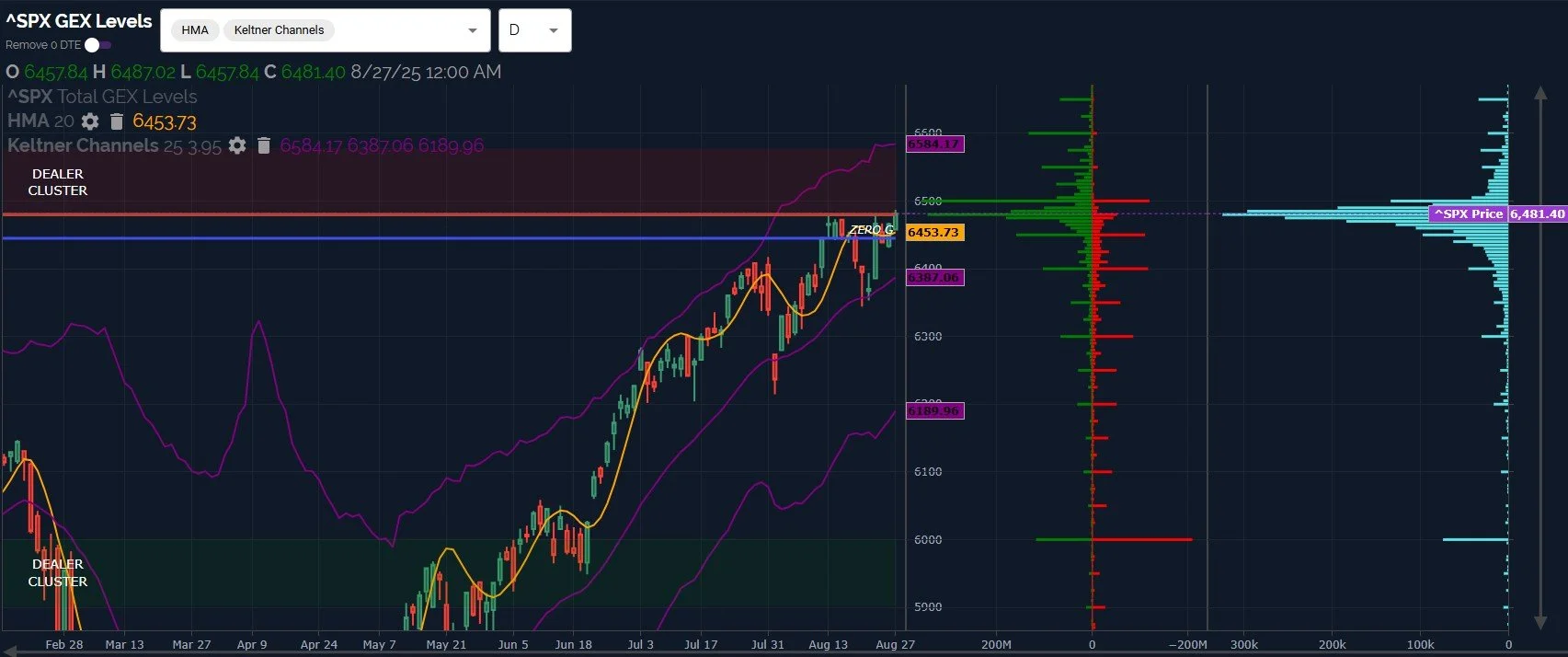

Flipping To A Buy Signal! At Least Temporarily (Market Preview- August 27)

August 27 market preview: The VIX lost its buy signal today, and we have NVDA and QQQ gaining a buy signal on the Hull Moving Average, as well as accompanying improvements in the GEX picture. While upside still appears to be limited in the near-term, we need to recognize the shorter term likelihood of at least an attempt toward higher targets already mentioned this week. A more substantial pullback still looms as a very real possibility. Let’s look closely at today’s close.

Signs Of Weakness..Leading Into NVDA Earnings? August 26 Market Preview

August 26 market preview: Indices are showing signs of weakness at the Hull Moving Average, which isn’t unexpected. IWM exceeded the Hull Friday, but now sits closer to the upper Keltner channel. How much downside is possible going into NVDA earnings? Call us skeptical, but let’s dig a little deeper and take a look.