Warning Signs From IWM Entering OpEx: September 15 Stock Market Preview

SPECIAL FIRST-TIME MONTHLY ANALYST PROMO- Exclusively for newsletter subscribers who’ve never joined us- interested in checking out our website and Discord community but you’re not sure about spending $99-$199? Enter code FIRSTTIME25 at checkout to try our monthly Analyst subscription for ONLY $25 for the first month! You can cancel anytime. ENDS SOON!

Tonight’s YouTube video takes a look at upcoming events this week, some different points than we cover here on the broader indices, and some individual stocks like NVDA, so be sure to check it out!

Indices continued a relentless push higher last week, with SPX reaching 6600 Friday and QQQ reaching identified targets, both visiting their upper Dealer Cluster zones where we expect dealer behavior to potentially include consolidation.

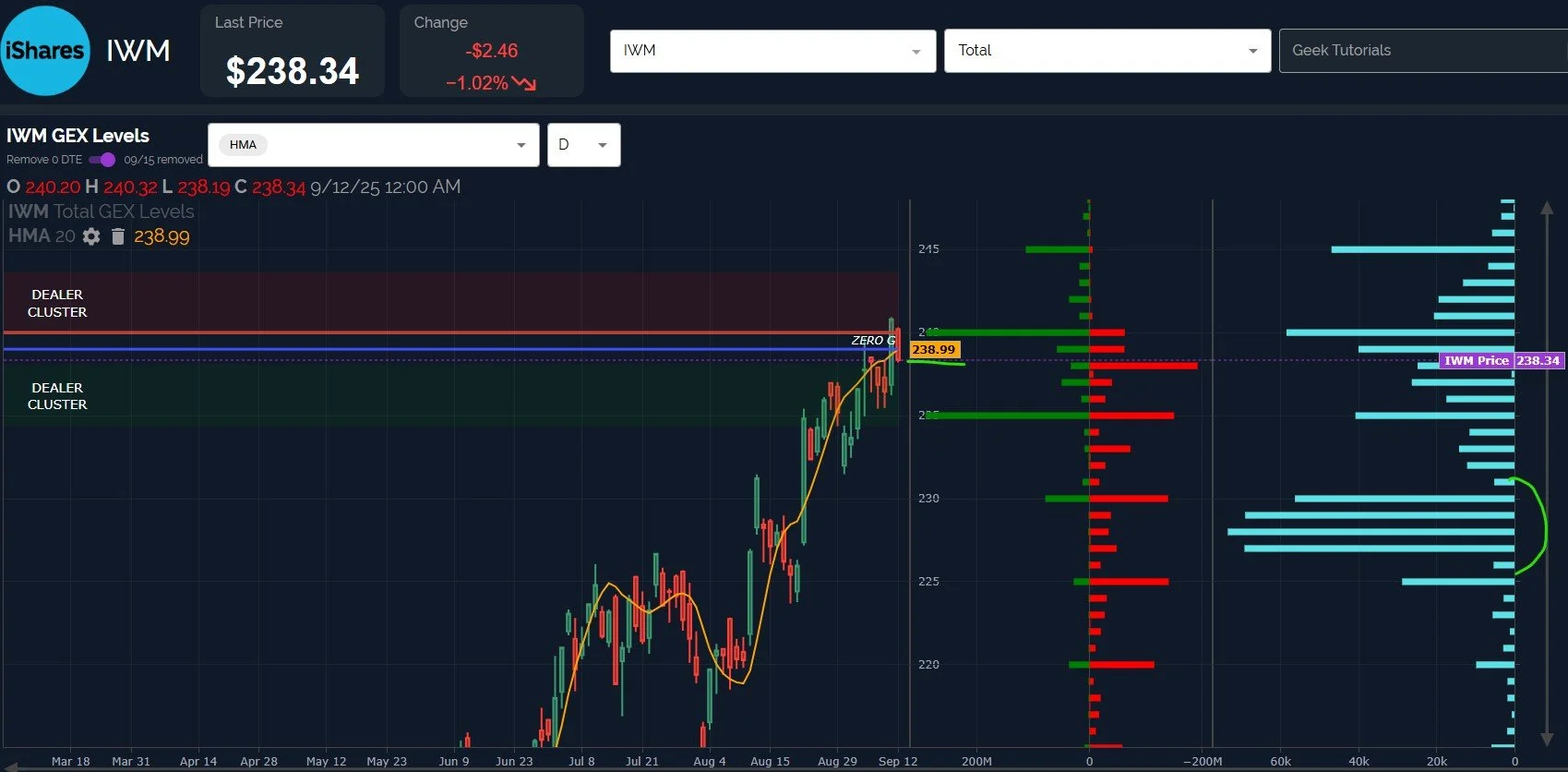

Referencing our GEX Levels chart below (which shows our chart+gross or net GEX+daily volume), IWM closed back below the daily Hull Moving Average again. Volume was heaviest between the 227-230 strikes, though 245 does get “honorable mention.”

Zooming out to the weekly chart shown below, we see an indecision candle, which has occurred several times over the last year on a weekly basis, though obviously the November 2024 top catches my attention, especially compared to today’s lower high.

Note the large GEX at 235. My expectation is that 235 is an important lie in the sand, with the daily Hull rejection possibly finding support at 235, which may support a move toward 250. At a minimum, I see the daily break of the Hull as a red flag.

Furthermore, IWM historical GEX dropped right back into negative territory.

While negative GEX can result in dealers exacerbating moves in both directions, we’re still very much in a neutral zone close to zero, so it’s hard to have solid expectations of assured downside.

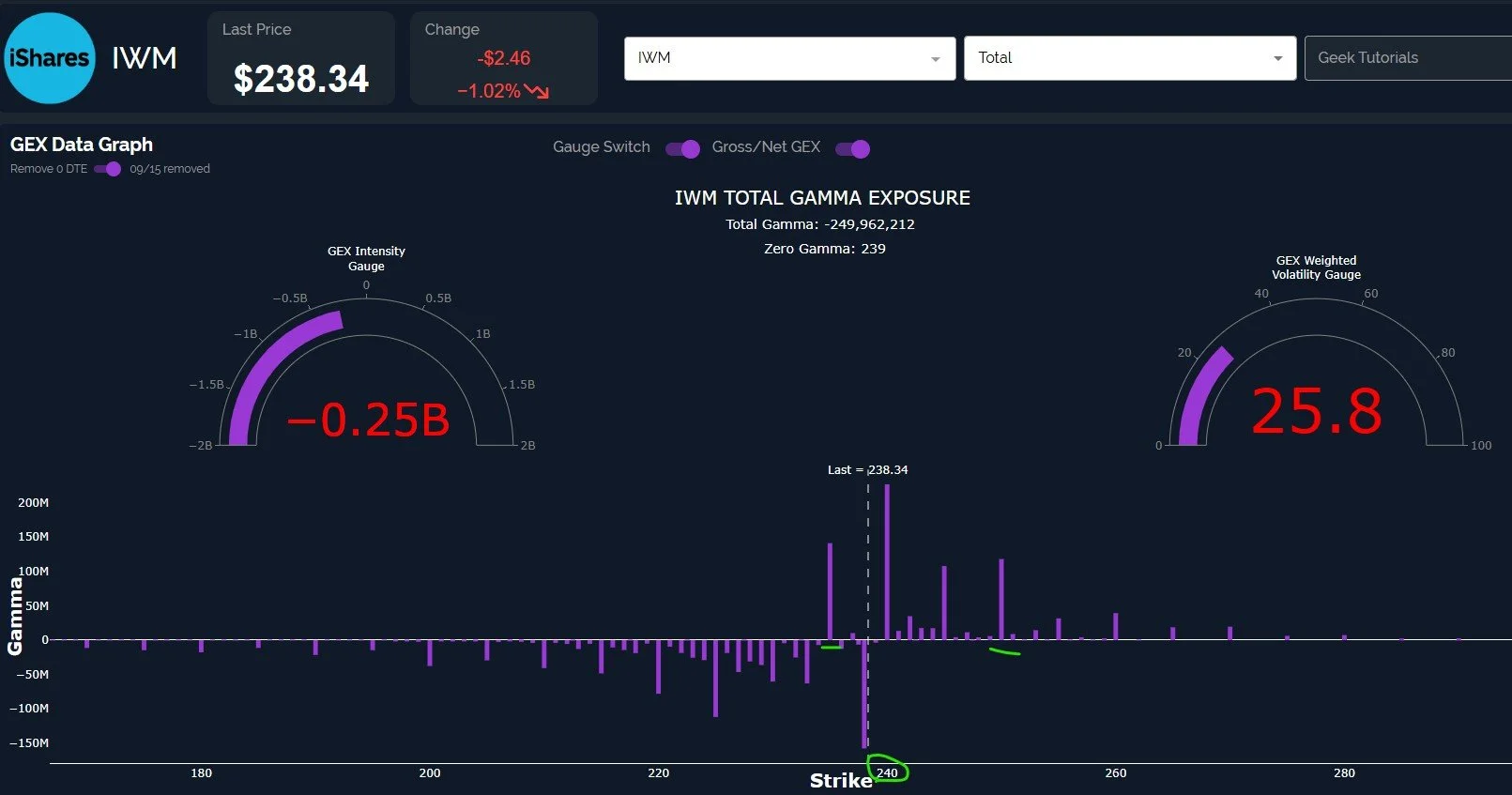

Our GEX Data Graph demonstrates the GEX position in a slightly different perspective, making clear the important barrier represented by 240, and the large number of negative strikes with some visible GEX, whereas the positive net GEX drops off fairly quickly after about 250.

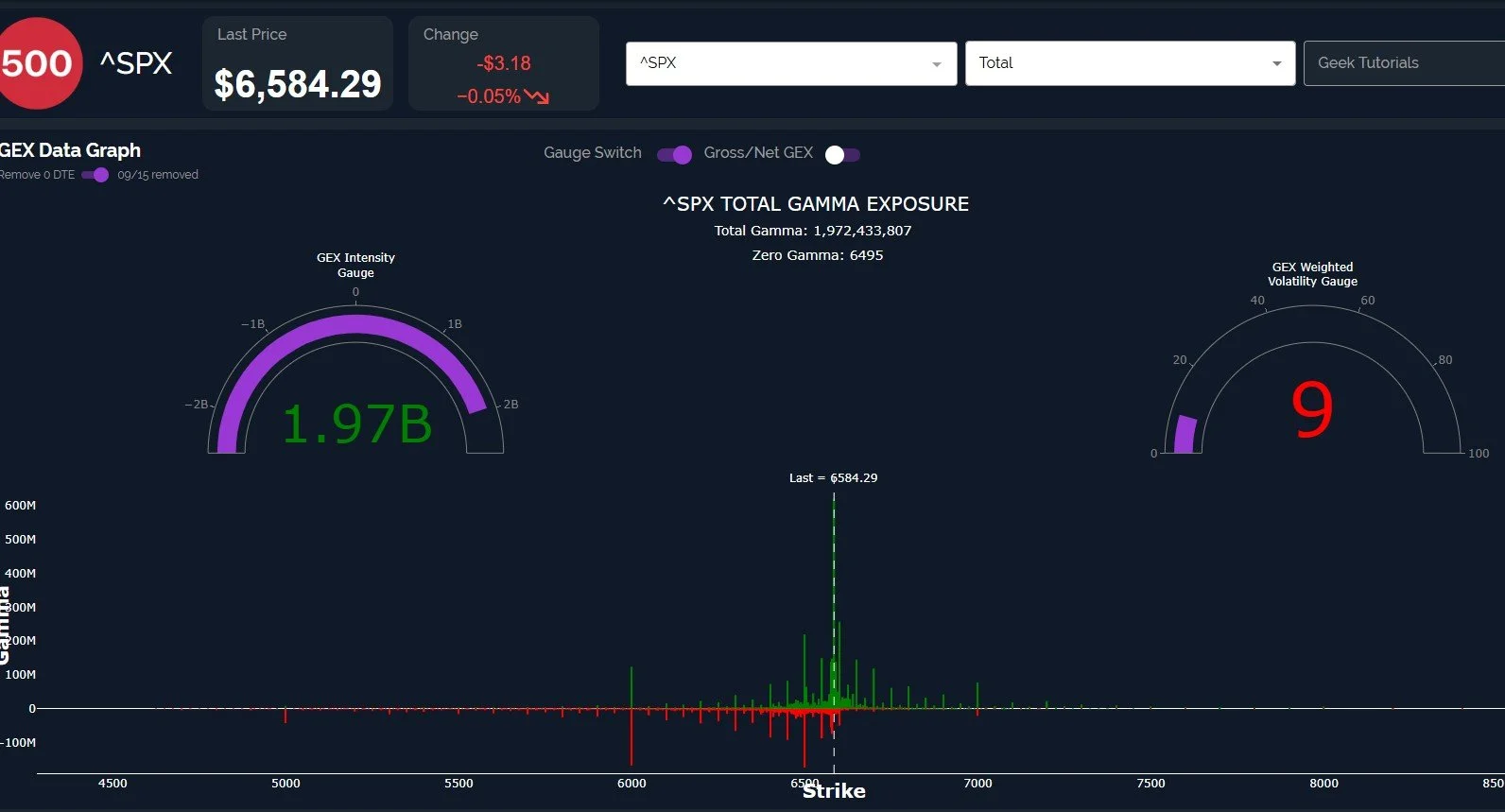

SPX might be issuing its own warning of a different nature, namely the distance between the price and the Hull, which appears stretched right now.

Most recent examples of similar situations were drops far below the daily Hull, resulting in fairly fast rebounds back toward the line. My expectation is that price will gravitate back toward the line from the stretched upside this time, though another 1% higher is certainly possible before a drop back toward 6500.

2nd highest volume was at the 6000 strike, which seems far away at this particular moment.

SPX is approaching another extreme on our GEX Intensity Gauge, meaning SPX GEX is almost higher now than any time over the past year. Reversals can happen at extremes, though exact timing can be difficult if strictly relying upon the intensity gauge as a sole source for making decisions.

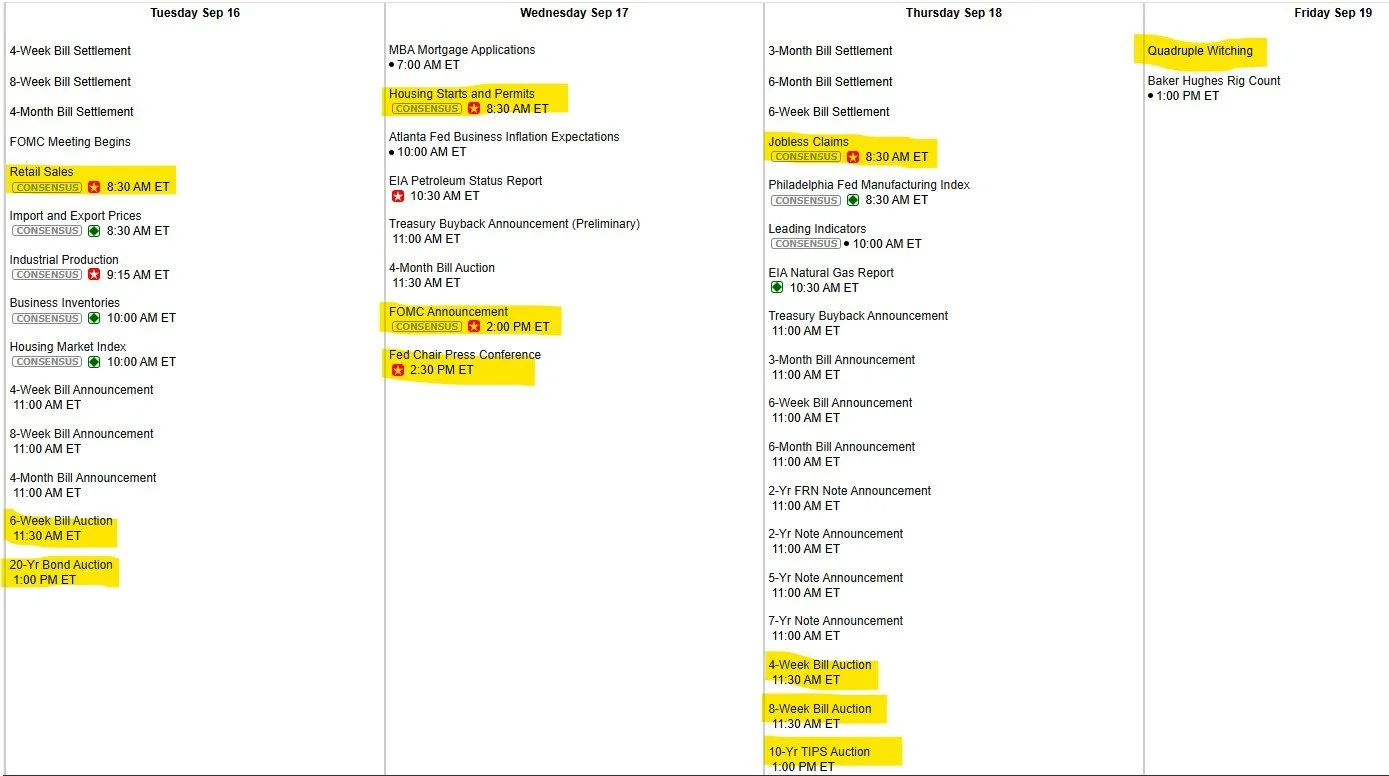

The upcoming week carries possibilities of volatility, especially FOMC and VIX expiration Wednesday, and quad witching Friday. We’ll also watch the big bond auctions in particular (20-year, etc).

We hope you’ll join us in Discord (and give our monthly Analyst subscription a try) for real-time insights as we update the 0 DTE picture and share interpretations of new GEX data.

econoday.com

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video yesterday, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.