%B 20,2: Revisiting A Useful Indicator As we Preview The Stock Market For September 12, 2025

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

We return to our regularly scheduled YouTube video tonight after taking some time off yesterday to add almost 80 new tickers to our Dashboard last night (now approaching 700 total), and you can watch the latest video by clicking here. We Take a look at an important possible inflection point for indices as well as some individual tickers.

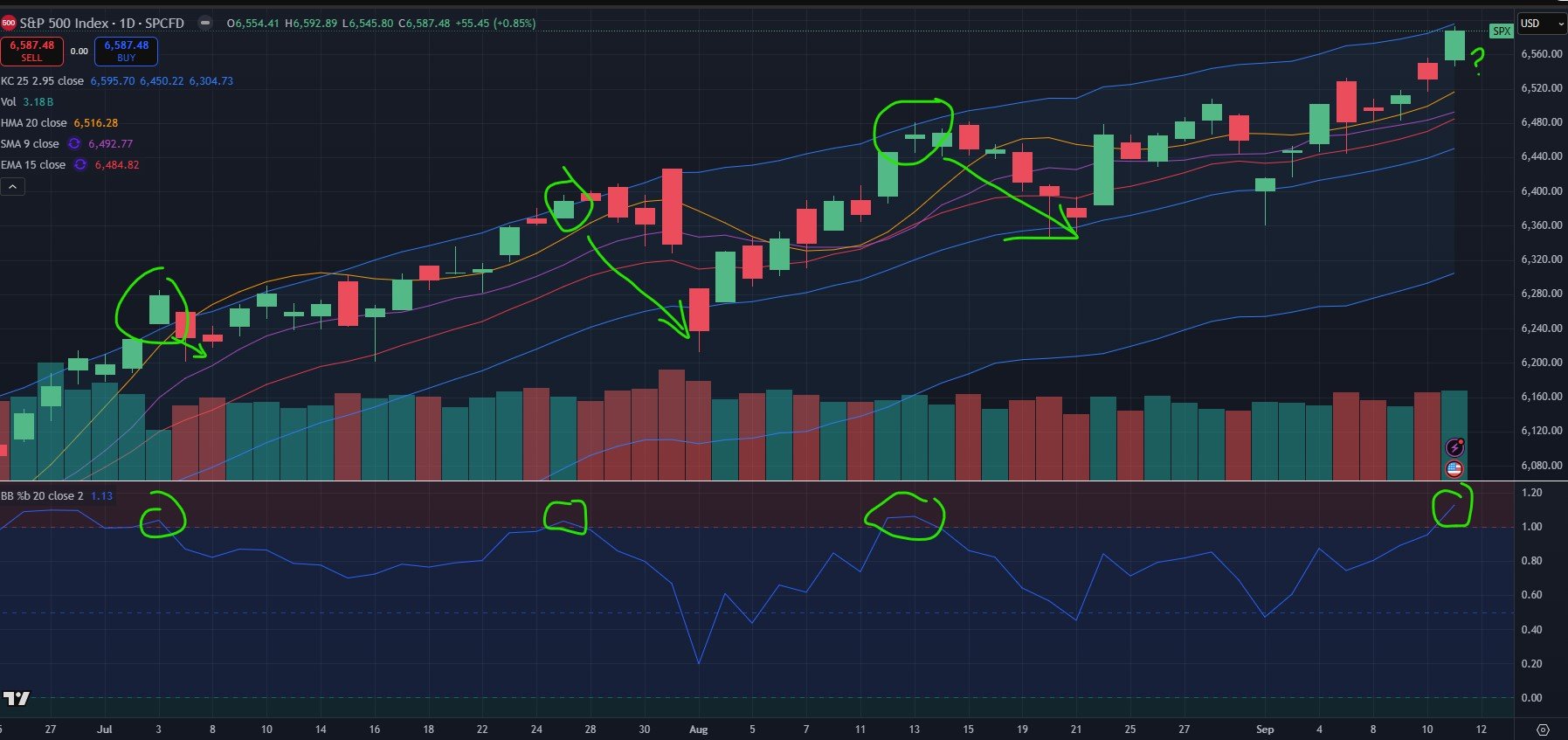

The primary scenario of breaching the weekly Hull Moving Average as the bullish daily chart is fulfilled- notably reaching the big GEX cluster at 6600- is playing out as expected, but we need to look at something that might give us some quantifiable context regarding the likelihood of a reversal from 6600 (which we approached within 8 points today).

Enter %B (20,2), one of my favorite “extreme” indicators, oftentimes giving us approximate areas of reversal.

We don’t have to go back far, let’s just look at the times we exceeded 1.0 on the %B lower study since July, we can see within 1-2 days we saw some sort of pullback.

With SPX well over 1.0 on the %B indicator while tapping the upper Keltner channel, the odds are favorable for a pullback.

Given that tomorrow is Friday, and next week is OpEx (following a bullish week), it wouldn’t surprise me to see a top Friday and a move lower next week.

tradingview.com

The weekly GEX Levels chart shows the outsized cluster at 6600, also showing the breach of the weekly Hull. Note the decreased GEX above 6600, though still larger than GEX at negative strikes at the moment. The lack of larger GEX clusters beyond 6600 may be the more important immediate data point.

QQQ shows a similar pattern of topping around the 1.0 %B reading, even if the pullback was only one day.

QQQ is currently slightly below 1.0, implying a potential move higher is possible.

tradingview.com

QQQ has underperformed SPX and QQQ, retesting the weekly Hull but unable to conquer it, and GEX diminishes quickly over 590-600 (1%-2% away).

IWM reveals a consistent pattern regardless of the index- a pullback following a breach of %B (20,2) 1.0. The exception was July 10, though the breach of the upper Keltner channel provided an actionable event on that occasion.

The current touch beyond 240 and GEX as well as the upper Keltner at roughly 245 pens the door to 242-245 before a reversal.

tradingview.com

In summary, SPX is within a zone where a reversal can be expected, though we may continue higher toward a technical touch of 6600 or slightly higher.

The VIX did not make new lows today despite SPX and IWM makinQg new highs, a negative divergence.

QQQ has been weaker, but it’s still posssible a test of 590-600 may happen before a larger pullback.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video yesterday, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.