Divergences Creeping In? September 10 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SUMMER2025 at checkout! ENDS SOON!

Tonight’s YouTube video can be viewed by clicking here. We Take a look at SPX, IWM, XHB, UNH, and more, so check it out if you have a few minutes.

As we approach PPI tomorrow morning, the VIX made a near-perfect test of the daily Hull Moving Average with today’s high of 15.82, though the VIX ended up closing slightly lower.

Caution is warranted as VVIX (the index measuring future expected volatility of the VIX) closed positive. When we see multiple divergent days in a row of VIX and VVIX moving in different directions, VIX spikes tend to follow.

If indices push higher, we’ll be watching the weekly Hull at VIX 14.60 as a possible reversal area, and any breach of 15.85 by the VIX may imply a larger VIX move is underway to higher levels.

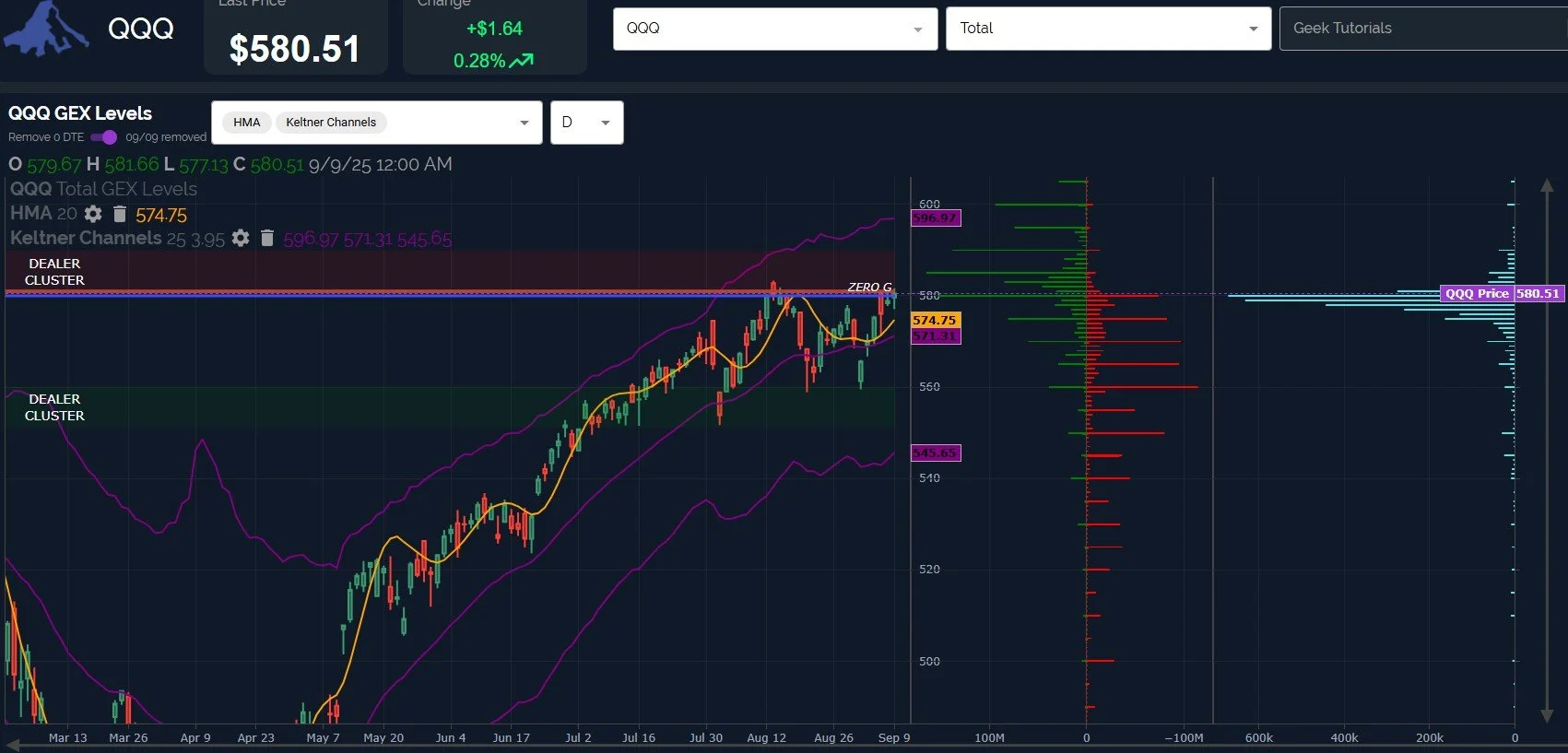

QQQ continues to maintain a positive bias above the daily Hull at 574.75, also closing above the important large positive GEX cluster at 580.

GEX is meaningful at 585 as well, though it begins to taper off quite quickly after the 600 strike.

QQQ is at the lower edge of the upper Dealer Cluster zone, so we typically exercise caution at this stage.

Let us not forget, the weekly Hull has been resistance for over 2 months, not as noticeable while the Hull was rising, but it’s flattening out here- another red flag..

The bullish daily chart suggests 585 is likely, though we should be aware that the odds are that QQQ closes under 584 this week, barring a major shift toward another leg up.

Given the move higher since April, and the lack of any major pullbacks, I remain skeptical that “this time is different” in terms of holding above the weekly Hull.

SPX has a similar daily setup to QQQ, with the next largest non-0 DTE GEX cluster at 6600.

6600 has grown in recent days, elevating the odds that we reach 6600. 6600 also coincides with the approximate upper Keltner channel at 6634.86, roughly .50% higher.

The rising Hull at 6489.69 gives us a relatively tight line-in-the-sand for a possible flip toward a bearish bias, though GEX at 6600 combined with the close above the Hull till tilts our expectations in a bullish direction.

SPX has the same problem as QQQ: The weekly Hull has served as resistance going on 7 weeks for SPX, actually a little longer than QQQ (though the Hull still looks more bullish for SPX than for QQQ).

The rising Hull at 6550.61 is close enough to 6600 to expect the same possible overshoot that we expect with QQQ.

To add a speculative element- September 11 has been a statistically bullish day, so if we are to have a down day this week, perhaps it will be Wednesday or Friday?

Regardless of what happens this week, some sobering data from market performance over the last 5 years reveals 4 out of 5 of those years showing some pretty noteworthy negative returns:

So with the VIX being near yearly support, indices approaching the 6-7 week resistance at the weekly Hull, and your recent historical September stats, who wants to bet against a pullback?

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.