Still On A Buy Signal Despite NVDA: August 28 Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SUMMER2025 at checkout! ENDS SOON!

Tonight’s YouTube video can be viewed by clicking here. We take a look at the markets following NVDAs big earnings release, so give it a look!

Yesterday we noted that the VIX had lost the Hull Moving Average while major indices had triggered buy signals, with follow through today mostly being seen in SPX.

QQQ maintains a buy signal (according to the Hull) despite underperforming SPX.

The VIX and VVIX (the index measuring future expected volatility of the VIX itself) were both positive today, a possible negative divergence for major indices.

A whopping 321k contracts traded at VIX 47.4 today (misstated as the 50 strike on our Youtube video, FYI).

The large negative GEX position at the 15 strike is currently acting as a ceiling, but this same area serves as a possible bull/bear line for volatility just above the daily Hull.

The VIX is currently below the daily Hull by a penny, basically right at the line. The VIX holds the weekly Hull by .10 as of now.

All signs point to a need to be cautious toward further volatility compression, even if we do see near-term spikes higher in the indices. Such rallies may be short-lived, pending a deeper pullback or larger shift in the VIX regime toward 12-13.

SPX made an incremental new high today, touching the upper Dealer Cluster zone that we view as a cautionary area for possible reversal/consolidation. 6500 is still a large possible target staring at us, and getting a little closer to (or exceeding) 6500 seems very likely.

The upper Keltner channel matches with the 6600 GEX cluster, which is not as significant in size relative to 6500, but it still represents a possible target, depending on what happens at 6500.

The close solidly above the Hull maintains a buy signal for SPX, and the bias remains long above the Hull at 6454.

QQQ is lower after-hours following NVDAs earnings, yet still above the Hull at 570.49. The decline of the Hull below the current price increases the odds of QQQ making yet another push higher before a larger pullback, barring a loss of the 570 area.

Such an upside move may still result in a lower high, with 580 marking the upper Dealer Cluster zone and GEX diminishing quickly above 585. A possible contrarian short opportunity may arise at the 580-585 zone.

As mentioned previously, loss of 565 would suggest increased odds of a quick move toward 550.

If NVDA remains negative, other major tickers will need to pick up the slack for QQQ in the morning, so let’s take a look at a few names to watch for possible rotation.

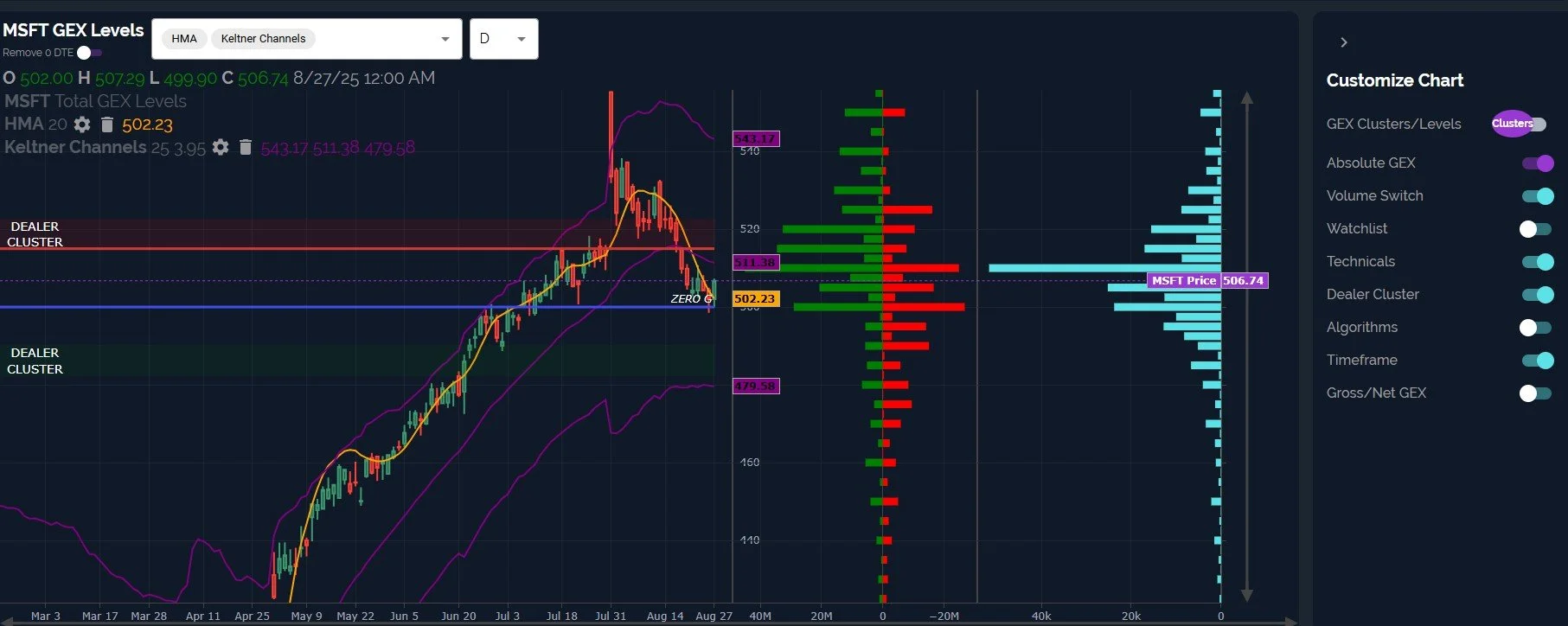

MSFT has done nothing but decline since its totally unhinged “I want to be a penny stock!” gap up post-earnings.

The last 4-5 days have seen a subtle shift sideways, with some days showing signs of life again.

MSFT has quietly regained the daily Hull, and we still see a positive GEX picture, with a lot of room overhead based on both the Keltner channels as well as positive GEX up to 520 especially.

AAPL has been consolidating in a somewhat messy sideways flag since the big move higher.

Keltners continue to point higher, with 240 appearing to be a possible target with meaningful GEX.

The comedians in the control room managed to close AAPL today at exactly the daily Hull, 230.49. I’m not sure if this means my indicator is worthless or the best ever, but there it is, right at the line.

All things considered, AAPL has a shot at leading the way higher (or softening the blow) in the event of NVDA acting temperamental tomorrow.

AMZN is very close to the middle of the Keltner channel range, but GEX remains tilted positive, and AMZN closed just above the Hull.

The upper Dealer Cluster zone at 235 or just above that area at 240 appear to be possible targets if AMZN doesn’t fail and fall back below 229.

All things considered, NVDA might not be enough of a shock to throw the jockey off of the rally horse, so we will watch other important components of the Nasdaq for clues tomorrow, and of course the total GEX picture as well. The VIX remains at a concerningly low level from a contrarian perspective, but this general concern doesn’t invalidate the likelihood of achieving higher targets. We hope you’ll join our community in Discord where we share different ideas and observations throughout the day!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we just rolled out the ability to toggle 0 DTE GEX on/off!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.