Flipping To A Buy Signal! At Least Temporarily (Market Preview- August 27)

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SUMMER2025 at checkout! ENDS SOON!

Tonight’s YouTube video can be viewed by clicking here. We discuss the big picture with major indices as well as a few individual names, so check it out!

Our previously expressed skepticism appears to have been well placed, with indices recapturing the daily Hull Moving Average (“the Hull”), the VIX flipping to a sell, and GEX generally improving across the board.

The odds of a near-term push higher are still countered by the risk of a deeper pullback, though such a pullback appears to be more likely after an upisde market spike, as of today’s close.

Let’s start with a brief analysis of the VIX, which lost several key areas of support on the 2-hour chart as the VIX appears to be heading toward 14.

tradingview.com

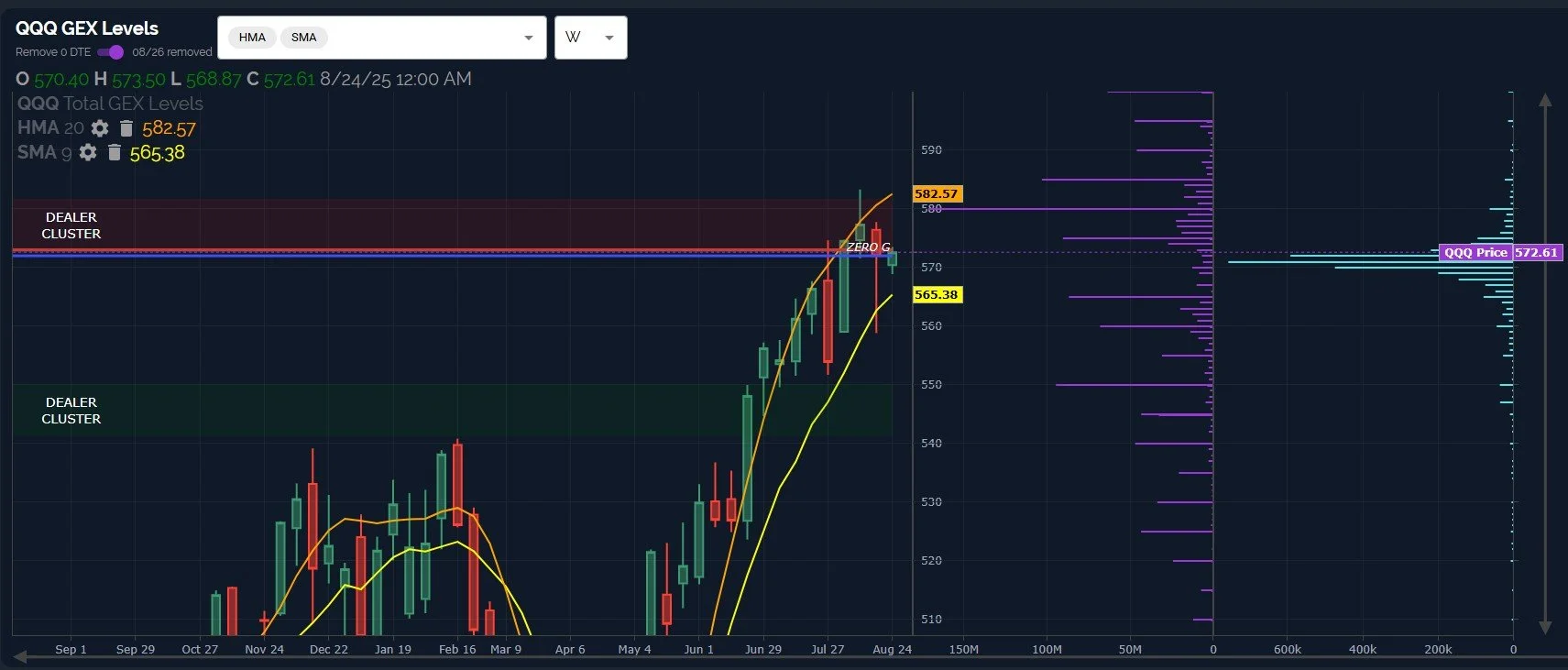

Switching over to QQQ, we see QQQ closed well above the declining Hull, creating a buy signal. GEX is back to positive today, though still within a range we view as neutral, yet 580 appears to be indicated as a likely upside target.

QQQ’s weekly chart shows 565 to be an important bull/bear line below, so until we lose 565, the daily chart indicating QQQ on a buy signal and the weekly chart not flipping to a sell until 565 cause me to be biased toward the upside above 565.

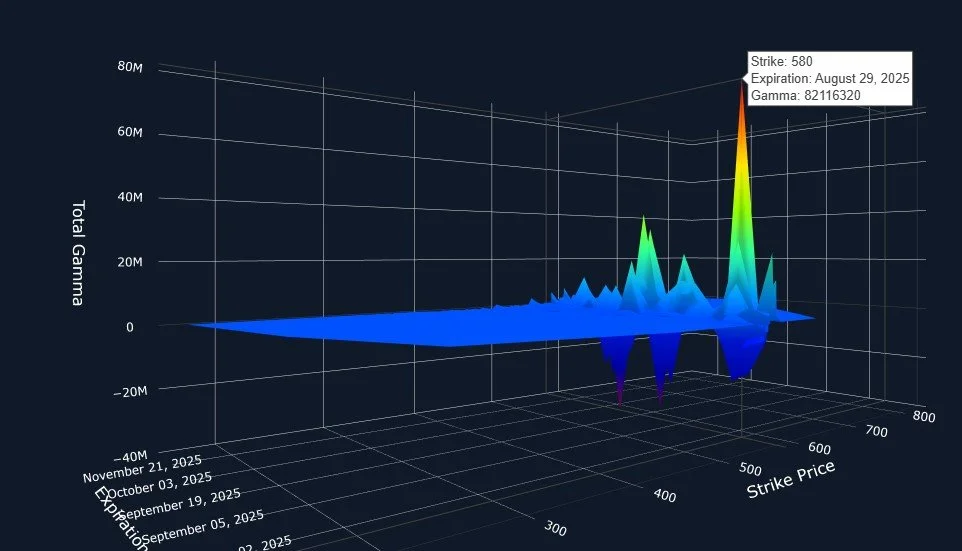

The 3D chart confirms the signficance of 580, with 580 marking the largest GEX cluster expiring this week.

IWM remains bullish, another potential confidence booster for longs in other indices. While IWM is right at the doorstep to the upper Dealer Cluster zone, we see 240 as a significant target that also matches up with the upper daily Keltner Channel. Perhaps IWM tags 240 and then embarks on a bullish pullback toward 220-230?

This will be our last newsletter entry prior to NVDA earnings after the bell tomorrow. NVDA has continued pushing higher, with the upper Keltner channel at 200, and accompanying GEX that makes an initial spike very likely, except for the pesky unknown we call “earnings.”

NVDA’s Hull on the weekly chart is around 188, also very close to the upper Dealer Cluster. Given that daily and weekly charts are in agreement, and NVDA is below the Hull, I’m guessing we touch 188-190 and maybe 200 post-earnings, but the possibility of a pullback and speed of a pullback may surprise some, with a drop toward 160.

We’ll be happy to share our thoughts in Discord tomorrow, we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we just rolled out the ability to toggle 0 DTE GEX on/off!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.