August 25 Market Preview: Approaching The Next Pivot

August 25 market preview: August 22nd played out great according to our preview from the day prior, with indices tagging upside targets and potentially setting up some interesting possibilities for the week ahead.

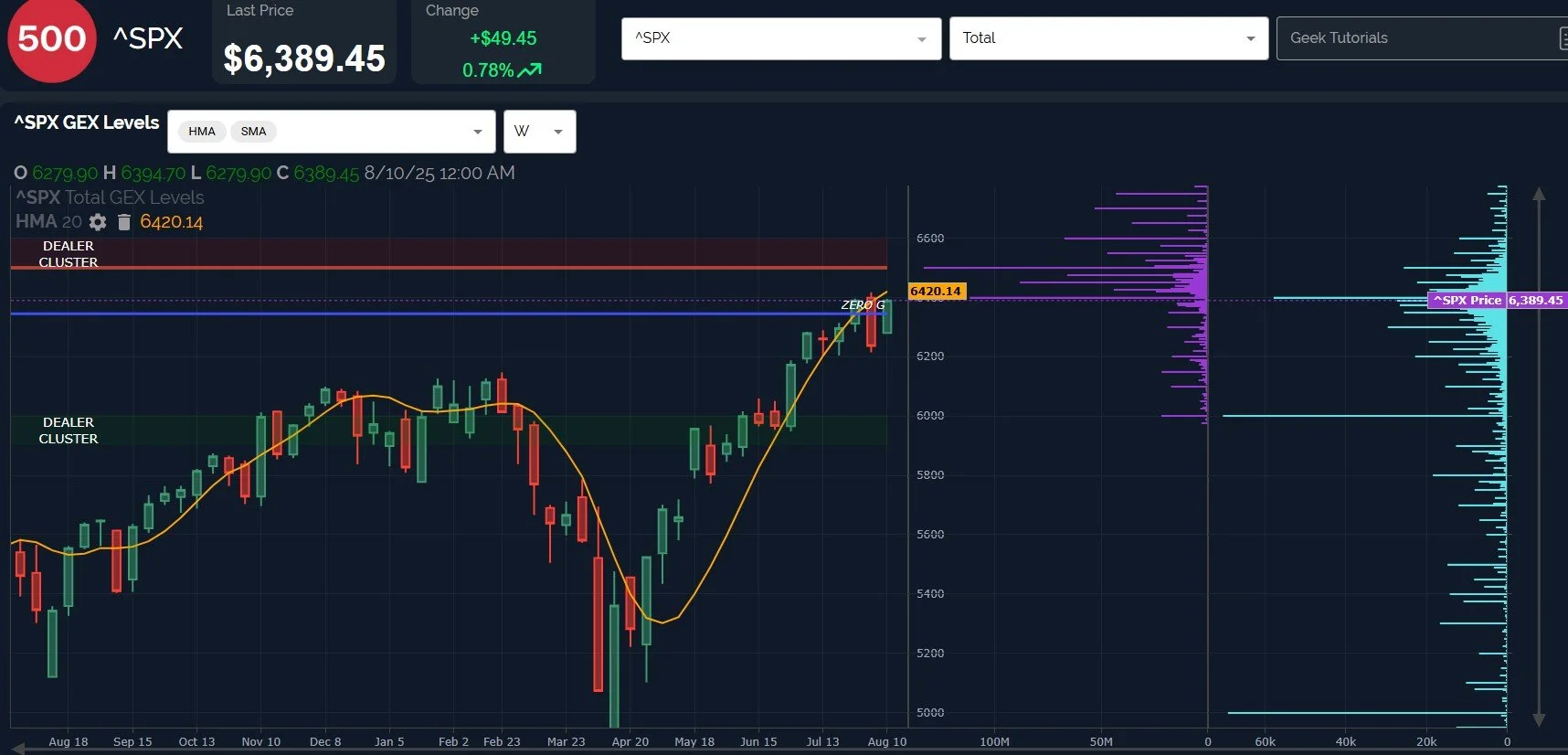

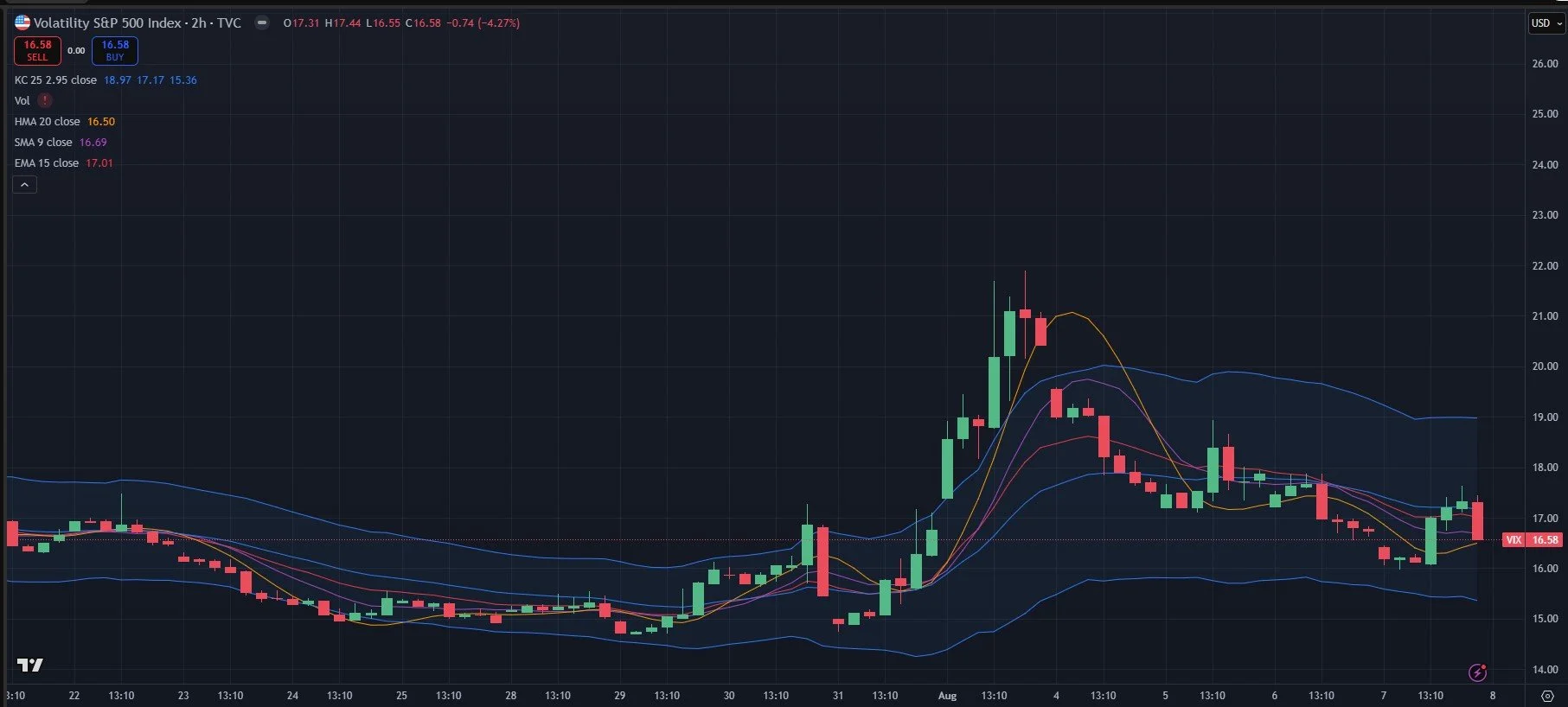

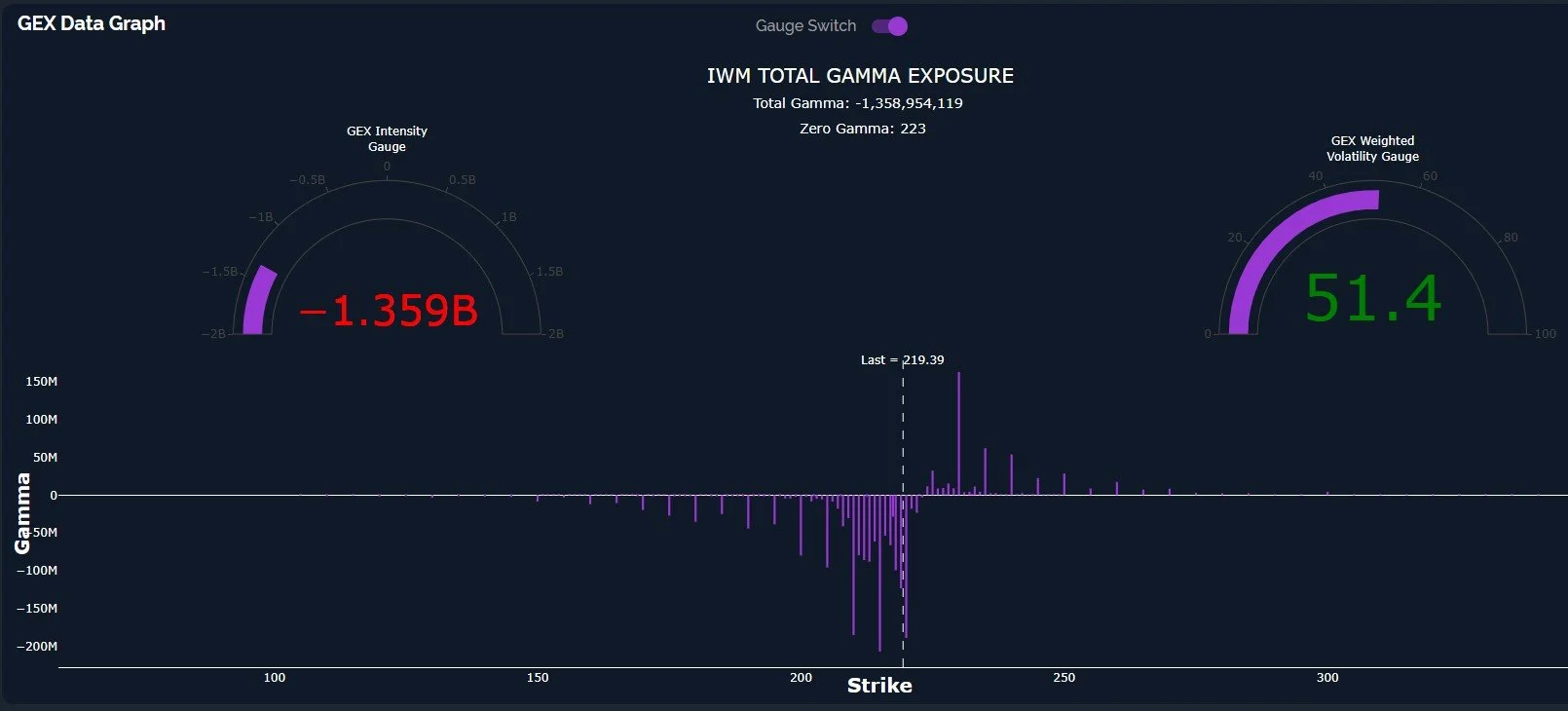

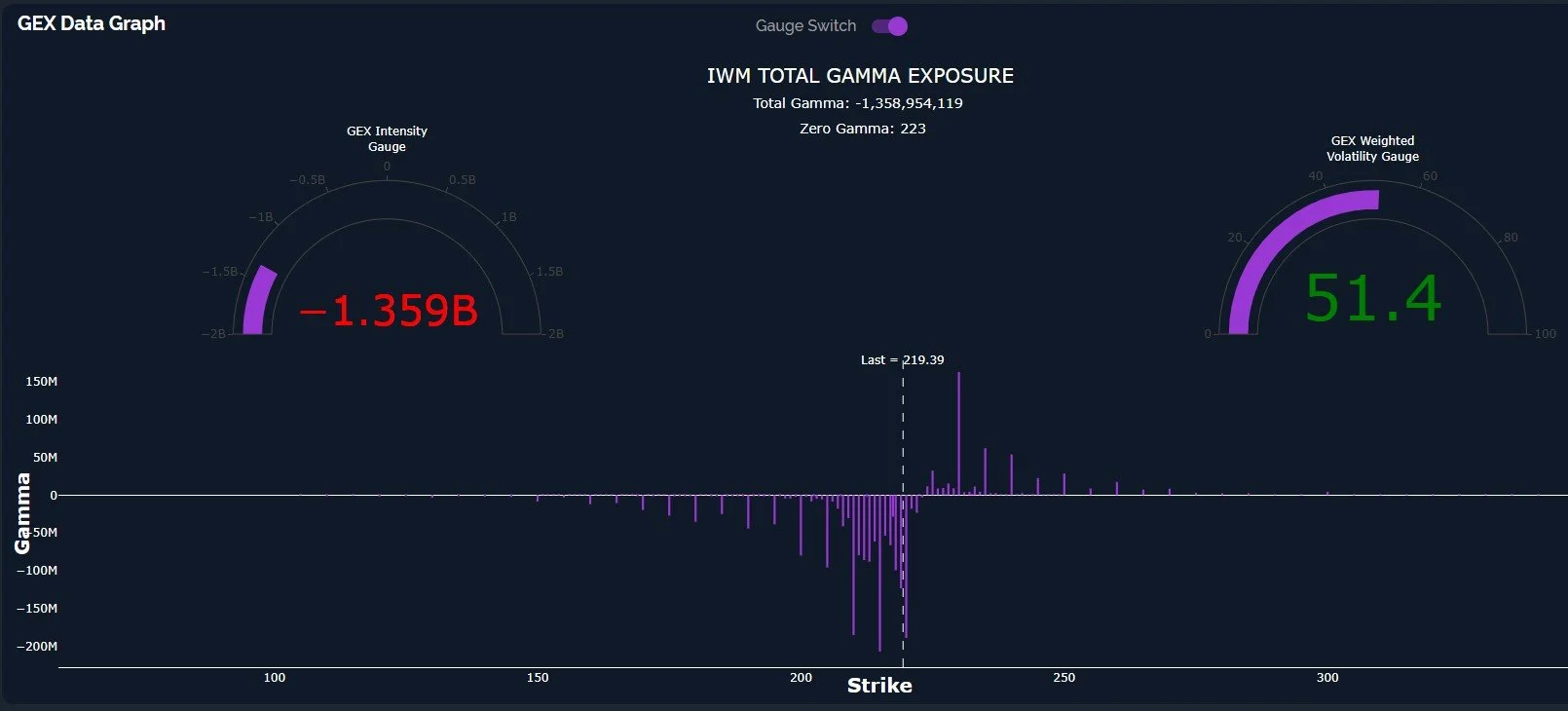

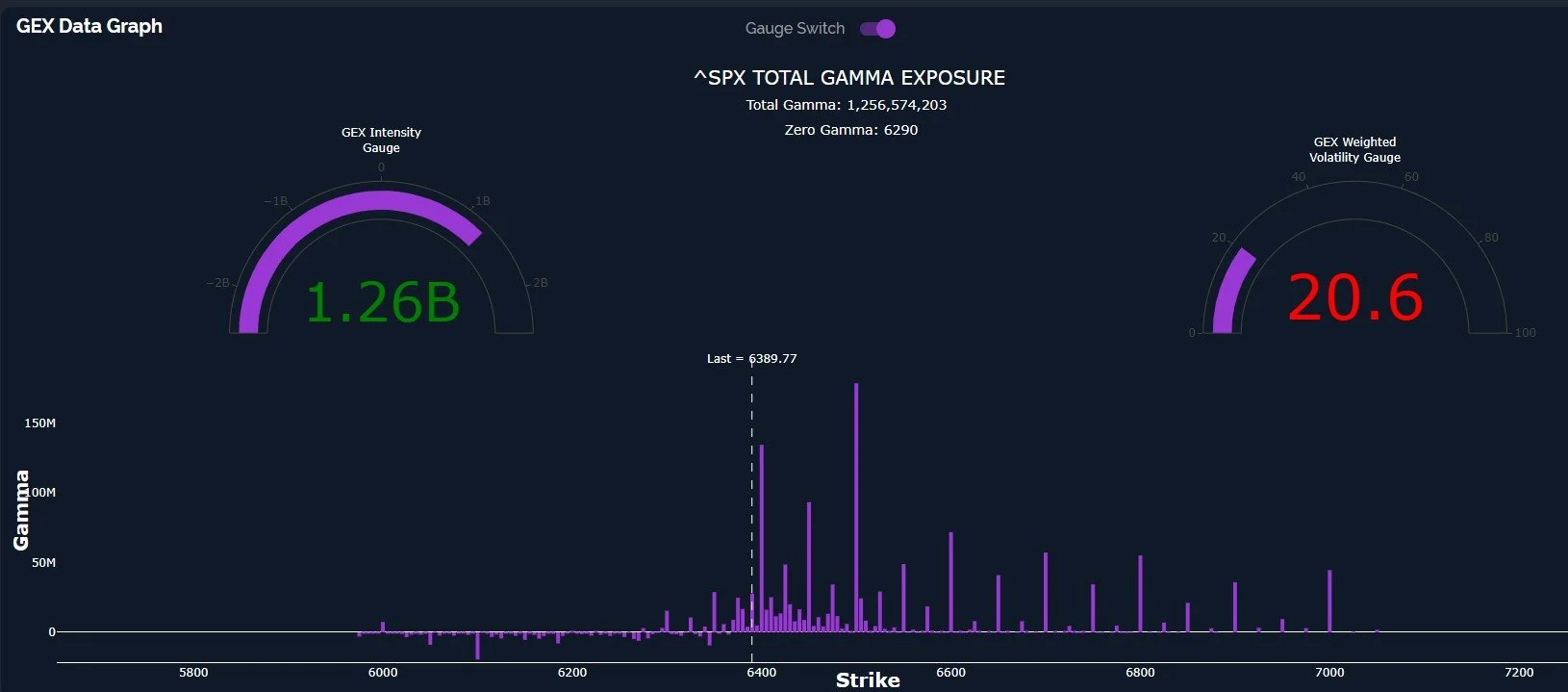

Bulls now need to be cautious of a VIX near a potential reversal signal, indices tagging GEX upper dealer cluster zones, and indices also at or approaching resistance according to specific indicators like the Hull Moving Average and the Keltner channels. With GEX still looking bullish into year-end, can we still see a pullback? Let’s discuss.

August 22 Market Preview: Anticipating A Reaction

August 22 market preview: Indices were unsurprisingly indecisive today, with Jerome Powell speaking Friday and NVDA earnings right around the corner. In today’s newsletter, we look at risks present that may justify moves in either direction, with a tactical view of reacting to whichever side is chosen first.

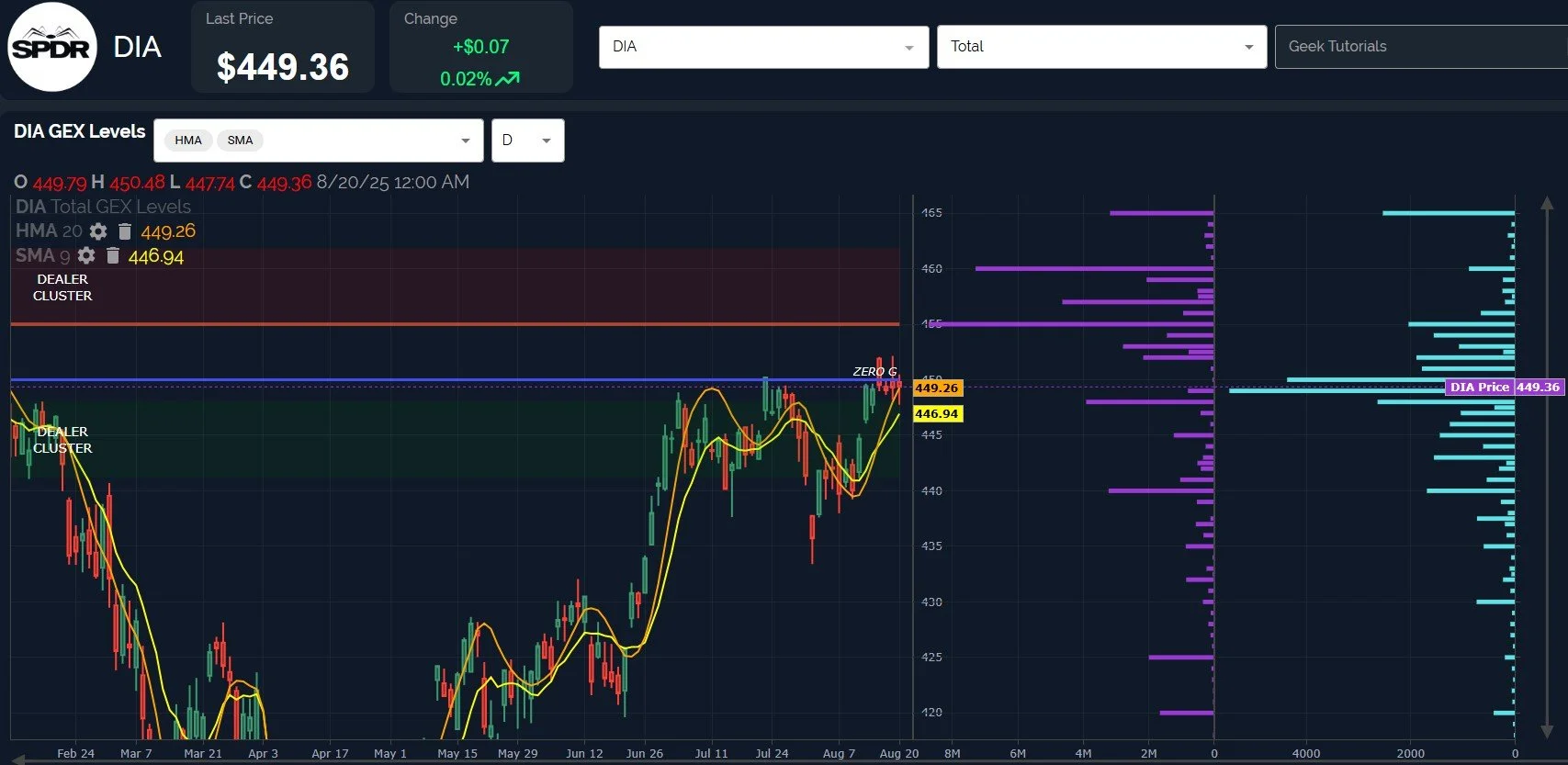

August 21 Market Preview: Can DIA Strength Last?

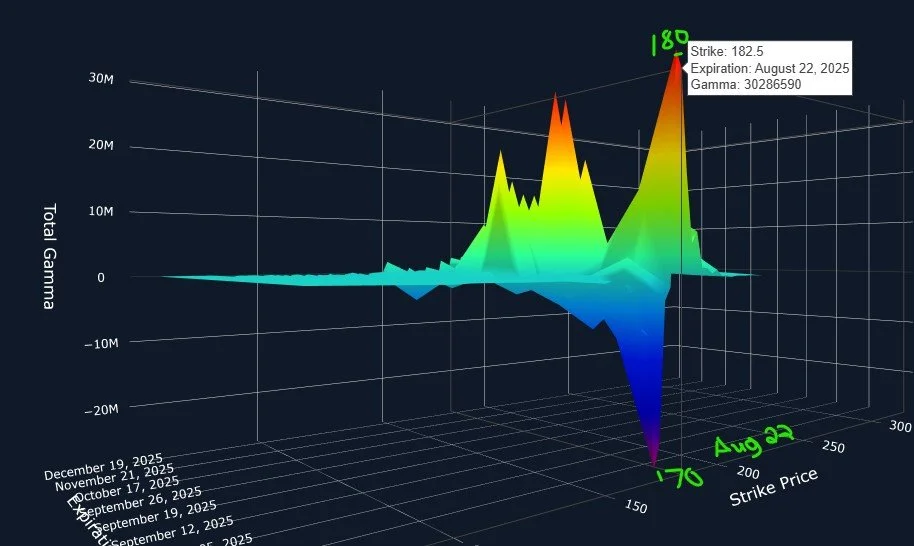

August 21 market preview: Downside warnings have been playing out as expected, but now the picture may get tricky: We have bullish divergence from DIA with WMT earnings premarket, the VIX still solidly on a buy signal, and QQQ’s big red candle has a long wick, indicating buying at the 560 area (a trade we took in Discord). Mixed signals on the surface, with GEX moving slightly more negative. Will we see a bounce and then more downside?

August 20 Market Preview: VIX Expiration & TGT Earnings

August 20 market preview: VIX monthly option expiration is at 9 am ET, and we will get Target (TGT) earnings. Several signals (including shifts in the GEX picture) signal that indices may be close to a deeper pullback, so let’s take a look as we formulate a game plan to react to opportunities this week.

More Cracks Emerge

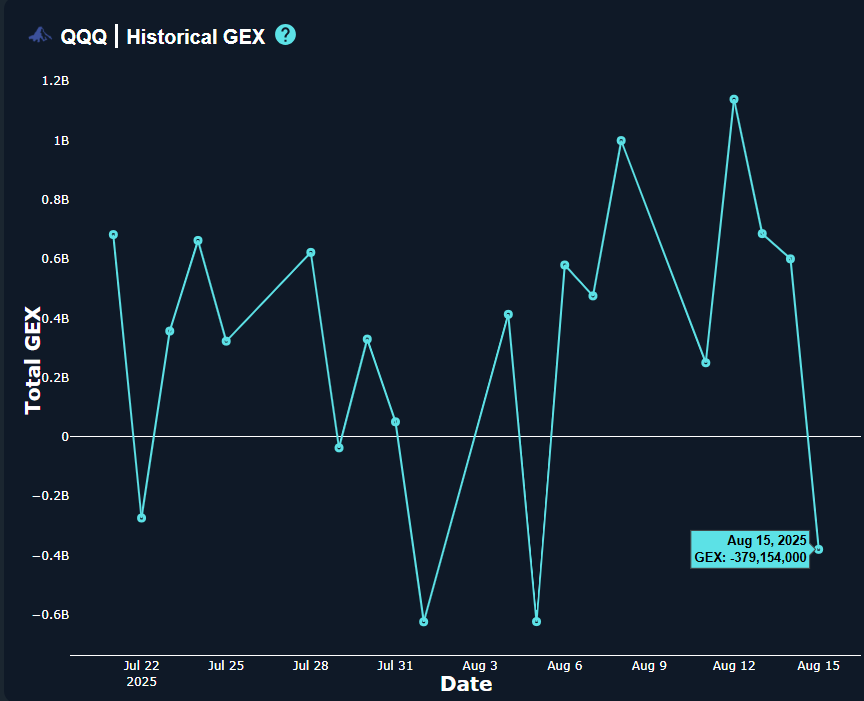

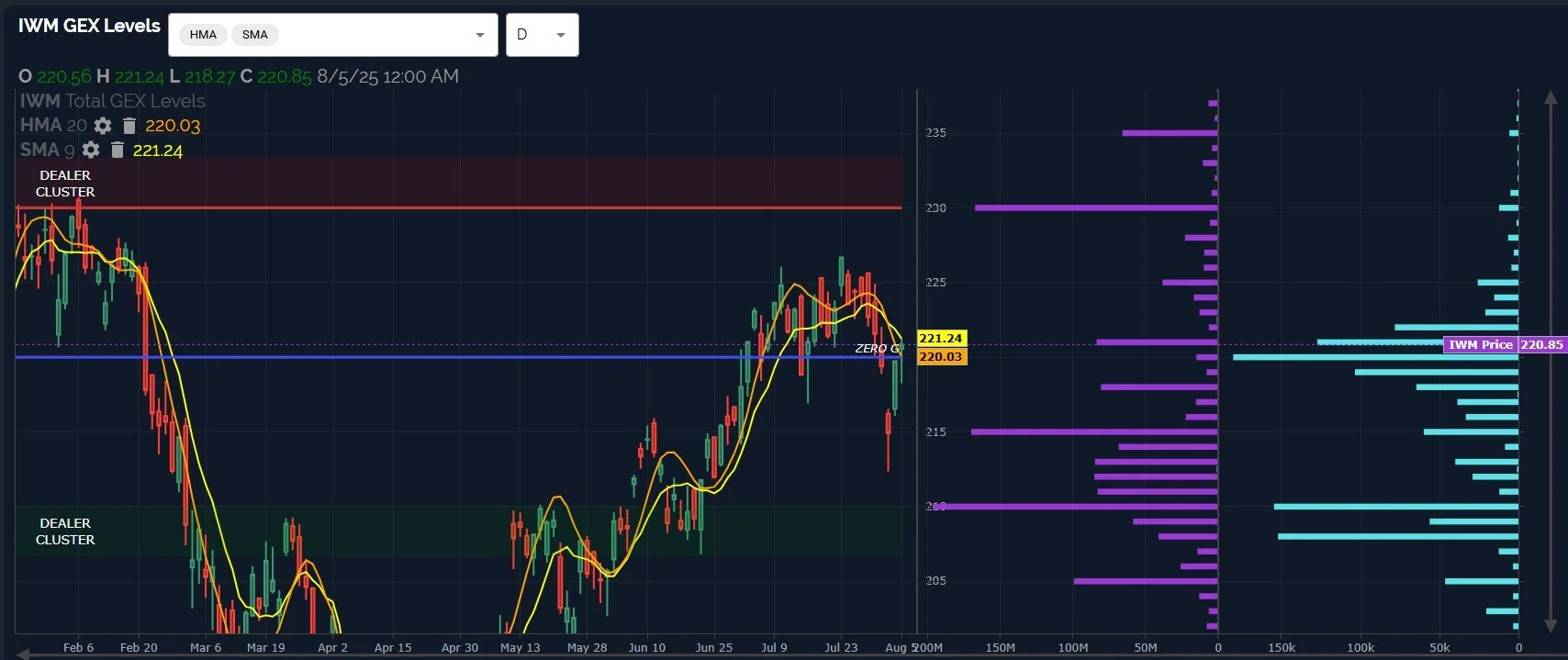

Further cracks are emerging in the major indices immediately post-OpEx, with SPX now catching up (down?) with QQQ in relation to specific indicators flipping bearish. IWM has been the lone important holdout, though RTY futures are on the brink, despite the small decline. Can markets begin a “real” pullback prior to monthly VIX expiration Wednesday? Let’s look more closely.

Weekly resistance Still Holding

As we resume our daily newsletter after a 2-brief break, indices are still holding with the weekly Hull Moving Average as resistance, the QQQ notably lost the daily Hull, and the VIX is on a buy signal. On top of that, QQQ saw GEX flip negative, and SPX saw a sharp drop as well, though still in positive territory. With OpEx behind us and VIX monthly option expiration coming Wednesday, we may see a sharper move happen in either direction either leading up to Wednesday or shortly thereafter.

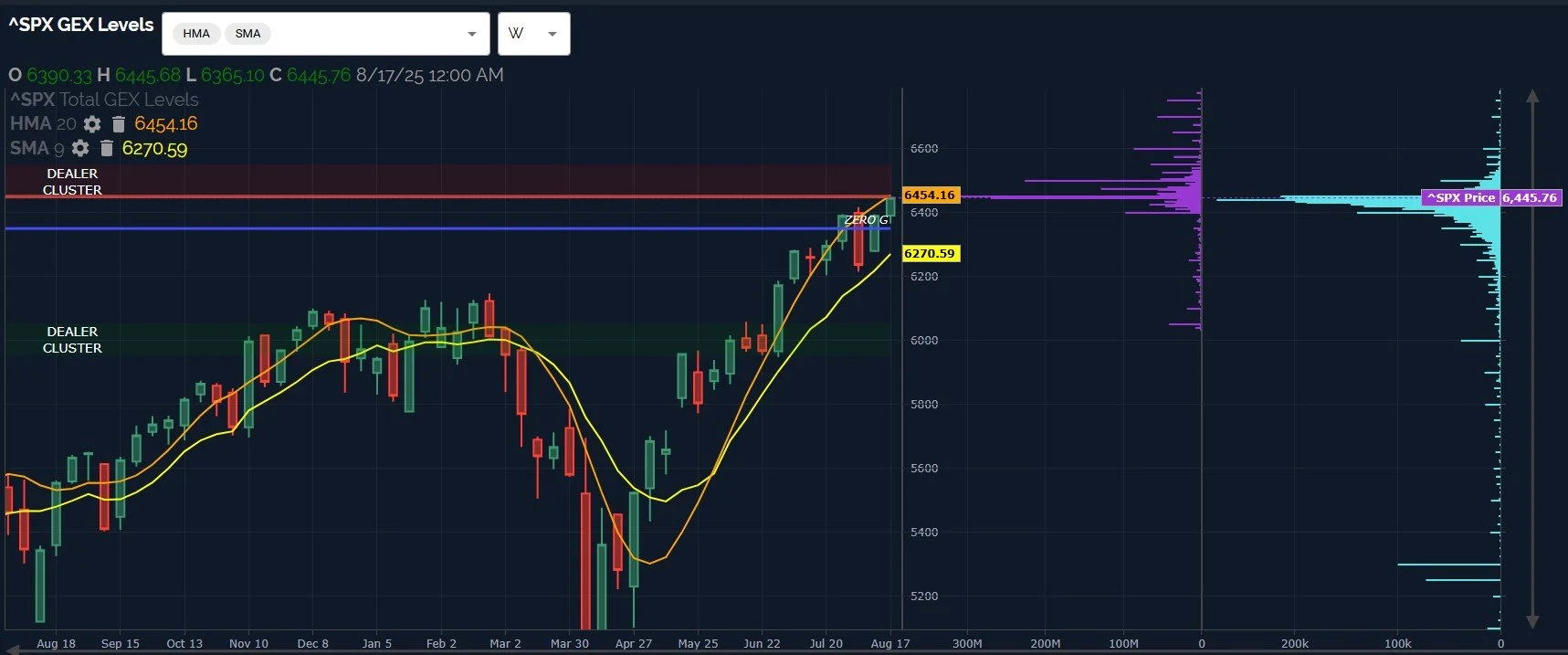

The Key Test Is Here

Indices reached the weekly Hull Moving Average (support-turned-possible-resistance) today, achieving a test I was hoping to see. Is this the beginning of a massive blow-off move, or the end of the road for bulls? With PPI Thursday and OpEx coming Friday, it’s hard to say, but let’s take a closer look at some key indicators.

Tuesday CPI: Pre-OpEx Tree Shake?

The VIX is showing positive momentum on the 2-hour timeframe, and it’s holding the Hull Moving Average on the weekly timeframe as well. With CPI approaching tomorrow, OpEx Friday coming up, and VIX monthly option expiration the following Wednesday, several opportunities exist to see the market break in one direction or another, or further chop within a wide range..What is GEX saying?

August Econ Entertainment Week

Despite daily ranges expanding, indices seem intent on preventing meaningful downside, though the VIX seems to be pressing on a string near the 15-handle. In tonight’s newsletter, we zoom out the weekly view on SPX and IWM and contrast that with the daily charts, with context tied to gamma exposure (GEX).

It “Ain’t” Over ‘Til It’s Over…

A determined effort seems to be in play toward preventing lasting downside, which can’t be ignored. We might have other timeframes in play at this point, which may imply additional upside attempts before a larger downward move, so let’s look at the weekly setup.

Here We Go Again…

Today’s rally brought indices just above the confluence of the Hull Moving Average and the 9-period SMA, flipping bullish (according to my rules). The issue now is that the VIX will likely reach a floor pretty quickly at the current rate of decline, and the S&P+IWM only barely closed above the line..Here we go again with yet another evening of uncertainty regarding which direction the market will choose next. Let’s look at targets in both directions.

Divergences & Doozies

The lone positive divergence from IWM might not be enough to save the negativity seen with QQQ, especially given the bombs dropped by AMD and SMCI after hours. What are we looking for tomorrow?

Fast Rebound! Now: Decision Time

IWM’s extreme negative condition is already largely cleared after today’s rally, and we’re approaching important resistance across the board. Let’s take a look at odds of upside versus downside from here and some key levels to watch.

Are We Bear Yet?

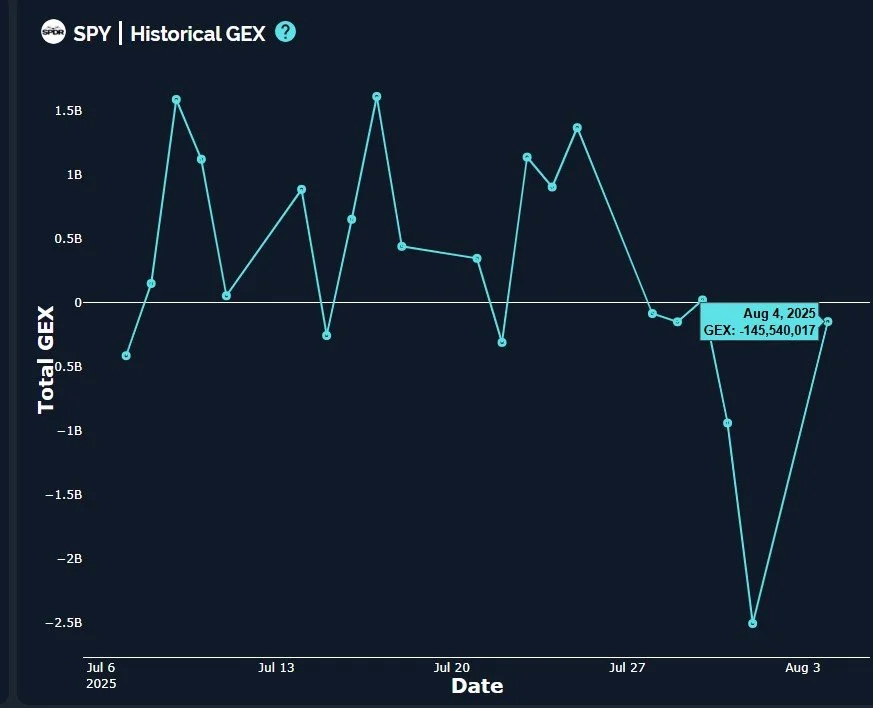

QQQ had a fantastic intraday reversal, with MSFT pulling back some 35 points after a massive gap up. Indices are now far enough below the Hull Moving Average to increase the odds of a pullback across the board, especially combined with a deeper negative move in terms of net GEX. What are some parameters we can watch on the upside and downside that might clue us in to continuation in either direction?

Pullback Into Early August?

QQQ had a fantastic intraday reversal, with MSFT pulling back some 35 points after a massive gap up. Indices are now far enough below the Hull Moving Average to increase the odds of a pullback across the board, especially combined with a deeper negative move in terms of net GEX. What are some parameters we can watch on the upside and downside that might clue us in to continuation in either direction?

Can Divergences Become Any More Extreme?

We saw the spike to VIX 17 we were waiting for, but what happens next?

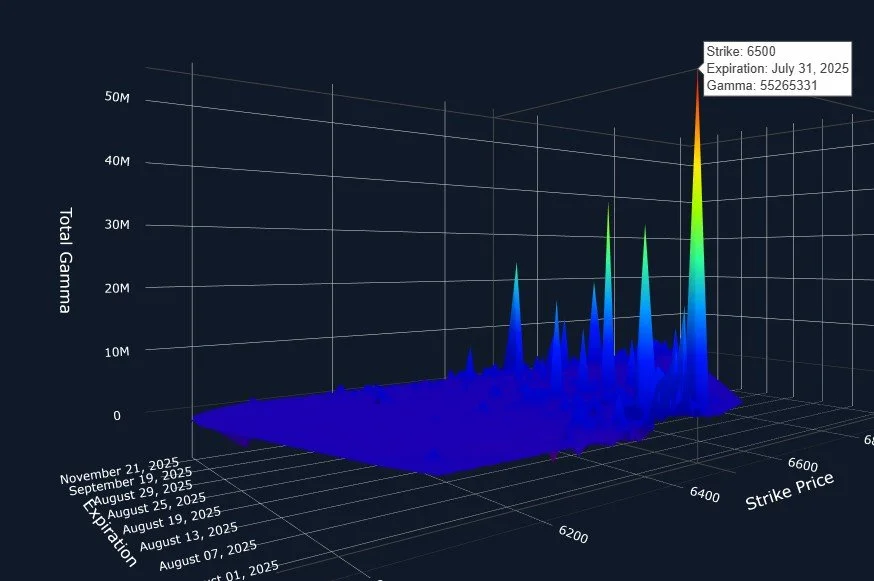

Pivotal FOMC, Earnings Ahead

The uptrend (so far) remains intact, with narrow daily candles and a 6401 high for SPX today. With earnings reports accelerating this week, and FOMC Wednesday, let’s take a look at the calendar and sprinkle a little GEX into our discussion to get a better idea of what we might look for this week.

Rising Prices, GEX “Ceiling..” Rising Risk?

While price has continued pushing toward what seem to be extremes, GEX has remained relatively flat overall for several days, and well off highs of July 3/4. With the VIX below 15 and index upside seemingly limited to 1-2%, we continue to remain cautious while recognizing the difficulty of the exact timing of a turn lower.

Early Signs Of A VIX turn?

Indices continue pressing toward higher targets in choppy fashion, though the weakness under the surface can’t be ignored. Rotation continues to enable maintaining the status quo, but with initial earnings reports seeing mixed reception, what are we seeing as we look ahead? Let’s take a look at the charts+GEX.

Melt-Up Mode Meets VIX Divergence?

The first big earnings reports are out after hours today, with TSLA and GOOG facing mixed reception. Futures are like the honey badger- they don’t care, they’re moving higher. IWM also made a decisive gap above the Hull today, appearing to be headed toward 230 imminently. Let’s take a look at possible reversal areas as QQQ enters short-term nosebleed territory.