Divergences & Doozies

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

In the time between sending out the newsletter and the earlier recording of today’s YouTube video, the night crew went to work and flipped futures from negative to positive, but we still highlight some relevant points. You can check out the short recording by clicking here.

Across the board, we saw indices test and reject the Hull Moving Average, a reaction we mentioned we expected to happen, though remaining open to other possibilities.

IWM was the lone optimist, closing slightly above the Hull, though not what I would subjectively call “decisively.”

IWM is also sandwiched between the Hull and the 9-period SMA, and a quick review of recently closes that were similar reveals a mixed bag in terms of the next move.

This is where we can add GEX (Gamma Exposure) for an additional layer of info on top of the chart:

GEX is still solidly negative, though improved off of the extreme lows we saw Friday.

If IWM’s divergence and the overnight move higher holds, the trip toward 230 could potentially happen quickly, depending on the reaction of another test at 225.

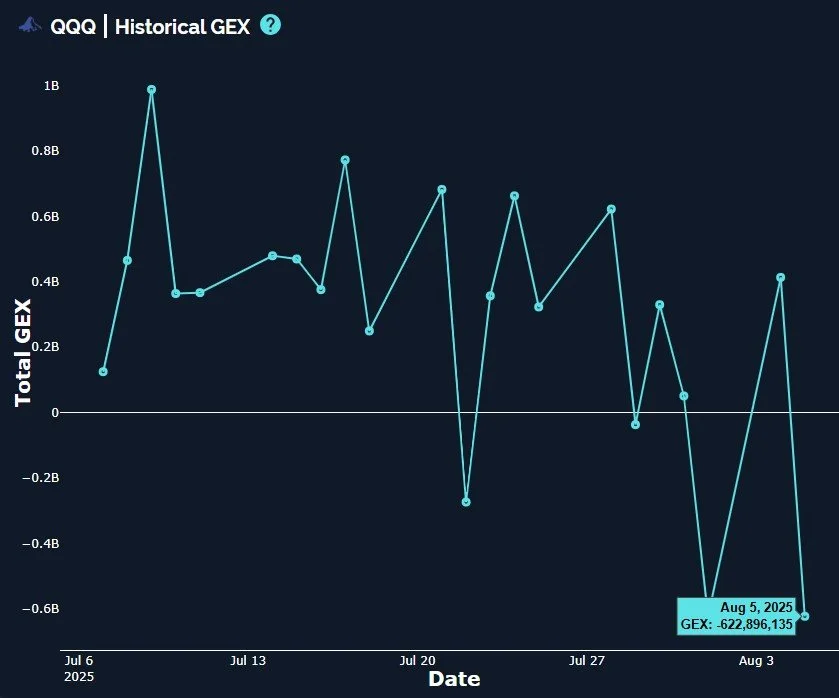

Moving on to QQQ: the most negative of the bunch today, and not helped at all by the after-hours “earnings doozy” reports by AMD (Accelerating Monthly Decline) or SMCI (Suffering Micro Computer Internals).

If IWM and SPX are positive tomorrow, QQQ will likely follow (though not necessarily), with 565 now acting as even more important resistance, with the next attempt being the 2nd attempt to overcome the line.

GEX favors a test of 550 over any strike above 560, though 570 will be the next area to watch if 565 is overcome.

QQQ reached a lower low relative to Friday as far as net GEX is concerned, deeper into negative territory.

Despite the deeper dive into negative GEX, QQQ still isn’t anywhere near an extreme reading relative to the last 52 weeks (a metric reflected by our GEX Intensity Gauge), so GEX can drop lower.

SPX and SPY look only slightly better than QQQ, also failing at the confluence of the 9-SMA and the Hull, though not dropping as low relative to yesterday’s lows as we saw from QQQ.

Given the close at roughly 628, SPY 633 needs to be overcome to shift the technical bias more positively, in my view.

A question that often arises: Why aren’t SPX and SPY GEX figures the same given that they move in the same manner and toward the same destinations on a relative basis? A thorough answer goes beyond the desired length of this newsletter, but keep in mind SPX is an index, only options trade on SPX, the reasons for trading options may be different than SPY units, and the crowd is most definitely different (fewer retail participants trading SPX options).

I prefer to use SPX GEX as a more accurate barometer of where price is headed, as SPX GEX seems to shift less dramatically compared to SPY day-to-day. I also remember key reversals where SPX was more accurate.

All praise aside, SPX shifted even lower into negative territory than it did Friday. Not the best sign for bulls looking ahead a few days.

The VIX made a lower low and lower high today, though the drop held where it needed to at just above 18.

An intraday reversal to allow a close back above 17.2 preserves the bullish picture for volatility, with VIX 25 as a potential upside target.

The problem the bulls still have is that the VIX dropping below 14.5-15 is unlikely, with the number of days below 14 being counted on one hand going back over a year, and Monday alone the VIX dropped double-digits. How many double-digit declines does it take to reach 15 from here? Two days?

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.