Here We Go Again…

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video can be viewed by clicking here. We cover some complementary data points as well as other observations that might be helpful.

Indices look bullish as of today’s close, and even after hours, as future push higher.

IWM was the sole “sourpuss (a highly scientific term)” of the bunch, leaving a red candle behind.

Even with its red candle, IWM closed well above the Hull Moving Average, triggering a long single (according to my rules).

We’ll look at the VIX later, which presents a conundrum: If indices are flipping bullish, how do we reconcile a close above a key technical indicator and the VIX being almost back to 16? We’ll dive into this deeper, but as far as IWM is concerned, I’m looking for possibly a 2% move higher, roughly back to 225 before greater risk of downside.

SPX had the most suspect close, requiring a huge green candle just to barely close above the Hull.

Coinciding with IWM at 225 and the VIX at 16, I found a resistance level looking at ES futures that points to 0.5%-1% upside for SPX, putting it within range of the noticeable GEX cluster at 6400 (maybe 6375, just to enrage the 6400 crowd, possibly).

The 2-hour SPX Keltners look bearish, though targeting the lower channel at 6190 requires losing the 6329 area first.

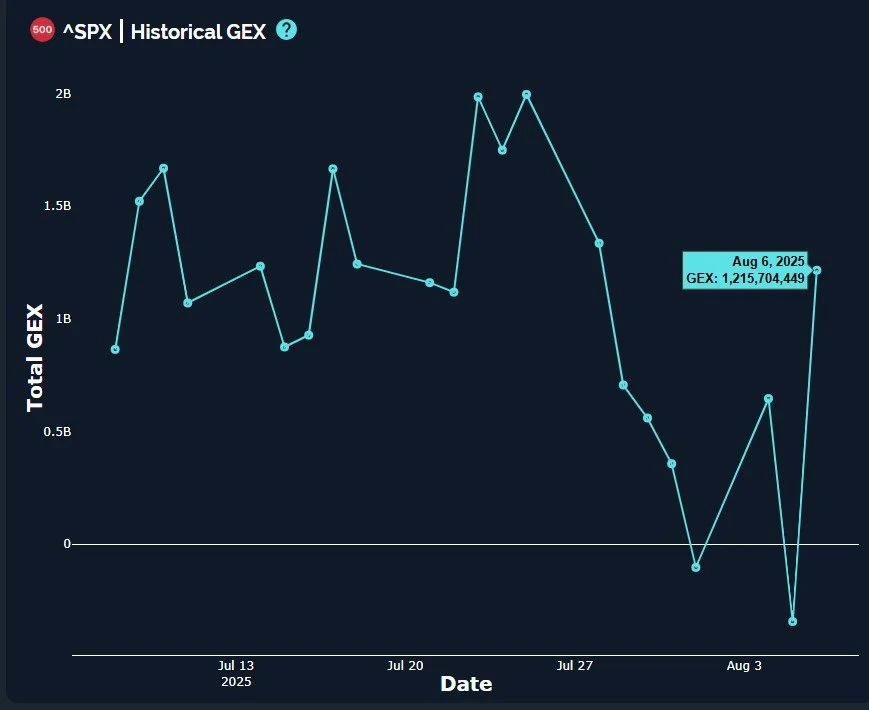

I’ve been sharing SPY data this week due to the massive 0 DTE positions skewing SPX, with today’s 1.5B swing as case in point.

The sharp drop over a weeks time and then a sharp rise in a day is a sign of a big change ahead, in my view.

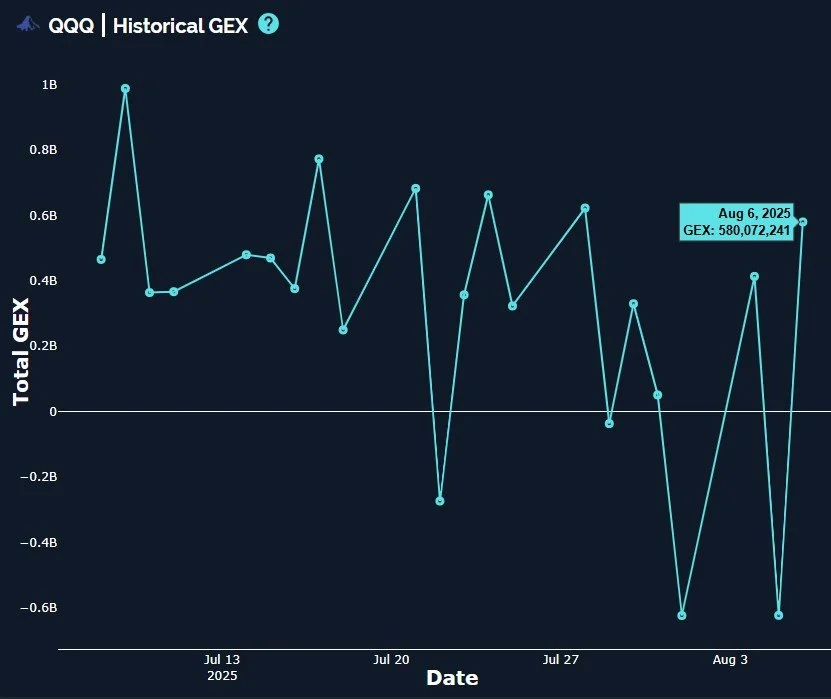

QQQ has entered manic mode, trading higher on bad semiconductor news (and climbing further on after-hours 100% semiconductor tariff news, LOL), making up a huge drop the day prior and closing well above the Hull.

Don’t fight price action, so looking at higher targets, I think we need to watch the big GEX cluster at 570. This matches what I see as resistance on the neutral 2-hour Keltner channels, though pushing higher from there would target 575.

QQQ with roughly a 1.2B GEX swing, going from -623 million GEX to positive 580 million.

I ended yesterday’s newsletter with a rhetorical question about how many days the VIX can be pushed lower by double-digits before reaching a likely floor. Alright, technically today it “only” dropped -6%, but the point remains..And GEX backs the view that 16-17 is still a possible reversal zone.

My previous targets on indices utilized indicators specific to those indices, though I also incorporated some guesstimates regarding where they might be with the VIX at 16, since the confluence of the two factors should work in tandem to mark a reversal.

The risk exists that the VIX enters a new regime for a time of declining to even lower lows, say- 10-12, but until we lose 15 and hold below it, we will supress the imagination and rely on recent history, looking for a VIX spike before our next likely round of market upside into year-end.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.