It “Ain’t” Over ‘Til It’s Over…

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video can be viewed by clicking here. We cover some complementary data points as well as other observations that might be helpful.

Intraday action appeared as if bears were winning, and we even placed a successful 0 DTE short, which was posted in Discord at the time of placement (and at our profitable closing of the trade). Nothing like an 18-point 5 min candle into the close to let everyone know who is still in charge…It isn’t the bears.

ES futures further exacerbated pain for the bears, ralling further as of the time of this newsletter.

Given the relatively unchanged close today (despite the intraday volatility), a lot of what we said last night still remains in place: Even the 2-hour chart for ES shows roughly 1% upside before reaching the upper Keltner channel.

SPX’s daily chart shows an attempt to break the daily Hull Moving Average, which narrowly failed, thanks to the closing candle.

The gap up was sold initially, but technically SPX still maintains a bullish bias above the Hull, 2 days in a row now.

I will note GEX is relatively less significant at 6500 and higher compared to prior weeks where we highlighted growing GEX at higher strikes.

SPX’s weekly chart is where our perspective might shift, and why I like to zoom out sometimes.

We see last week marking the first week since April when SPX closed below the weekly Hull (and quite far below it, I might add).

So far this week, we remain below the weekly Hull, not even testing the line as of yet.

The large GEX at 6400 and the Hull at roughly 6415 make a test of 6415 or even higher very possible if the overnight continuation higher holds into tomorrow’s cash session.

Without a definitive close above 6415, risk to the downside remains the favored outcome in light of technicals as well as weakened GEX relative to prior weeks.

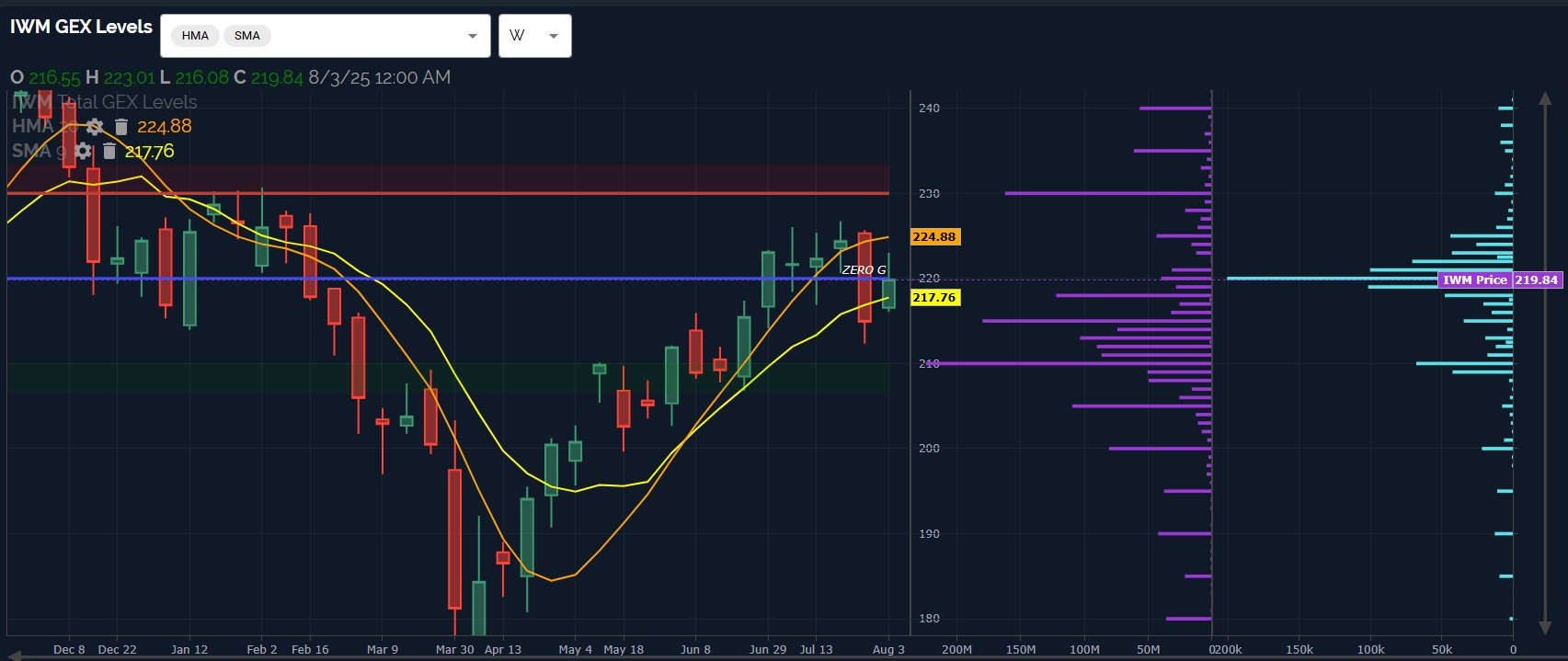

IWM started out with a gap up above both the 9-period SMA and the Hull, though it ultimately dropped so much that it was below both of those averages at one point intraday, ultimately rebounding to preserve the sandwich between both averages, now refrigerated to prevent sickness, with the edges of the bread getting a little bit crusty.

The weekly chart actually looks bullish, for now. Yesterday’s mention of 225 appears to still be valid, with a green weekly candle still targeting 225 before a larger battle may occur, and given that GEX is almost non-existent between 218 and 230, we just might see a violent overshot to 230 before a relatively large drop toward 210.

I’m entering speculative territory with the play-by-play possible pathways, but the bottom line is that we have a short-term bias toward upside, yet recent indications starting last week that justify an ultimate resolution toward the downside.

We still expect any near-term downward move to be a buying opportunity for a rally into year-end.

The VIX had an interesting day, with an early spike right into the Hull being faded back below the Hull as well as the 9-SMA. I posted in Discord that the 2-hour VIX appeared poised to pinch higher, which happened, yet the late day VIX crush brought the VIX back to only a slightly higher close from yesterday.

The issue for bulls remains that the VIX is near the lowest large GEX cluster at 16 and most daily volume has been focused on higher strikes, as high as VIX 55 today.

A drop back to 16 (again, given that today’s low was 15.98) may coincide with hitting the targets we mentioned yesterday and today, setting up a possible pullback into OpEx Friday next week.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.