August Econ Entertainment Week

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

First off, check out tonight’s YouTube video, which can be viewed by clicking here. We cover quite a bit in 9 minutes, and some of the info provides good context for the newsletter tonight.

“August Econ Entertainment Week” isn’t an officially recognized week, fortunately, because most of us can only handle so much excitement from the markets in one week.

Indices are impressively resilient so far, though OpEx week and CPI on Tuesday present opportunities for some volatility.

Volume and breadth have been a little concerning under the surface, but we will only touch on those points today.

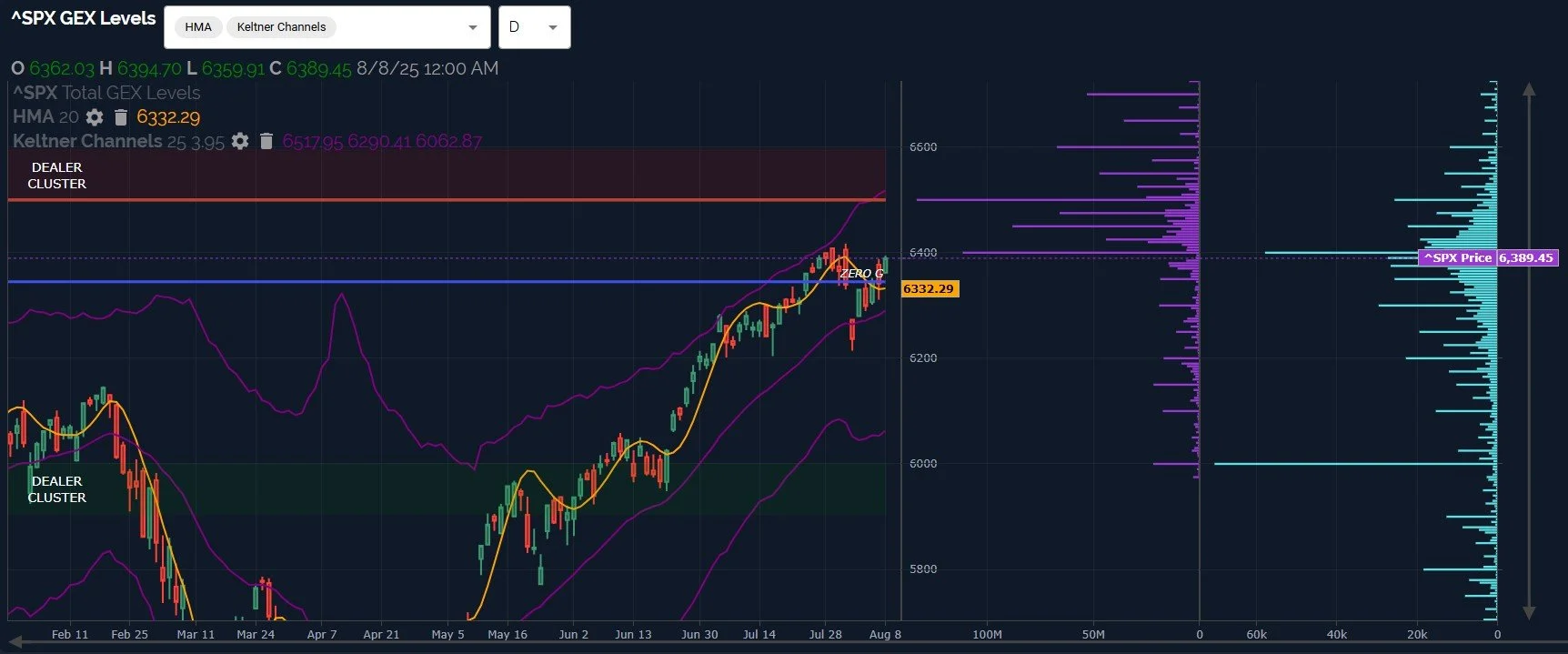

Let’s begin with a zoomed-out view of SPX, looking at the weekly chart: SPX closed below the weekly Hull Moving Average for the 2nd week in a row, a noteworthy change not seen since April.

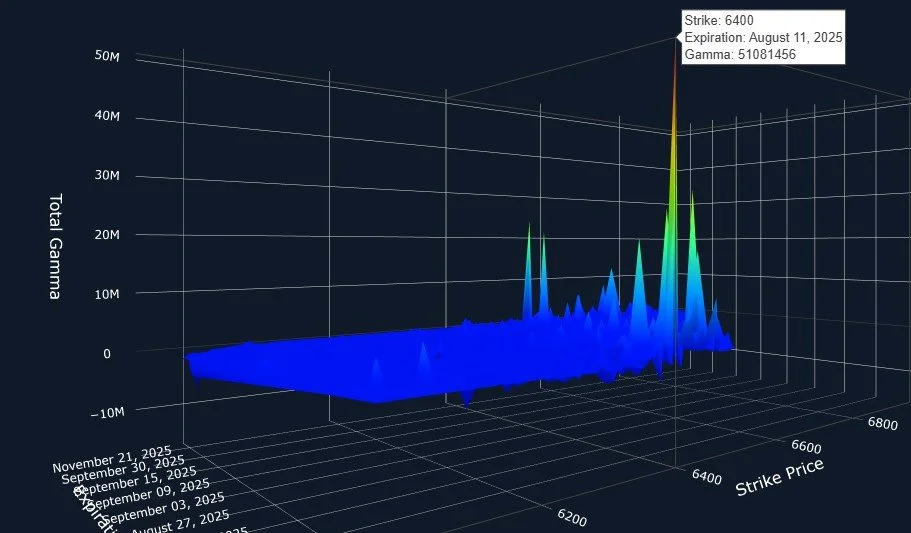

Volume spikes on Friday in particular are noteworth at the 6000 and 5000 strikes.

6500 is once again a larger GEX cluster than 6400, which is a slight positive shift into the end of the week.

We have two somewhat conflicting pictures, technically: A view of SPX holding above the daily Hull, a bullish signal, while remaining just below the weekly Hull, a bearish signal.

Various indicators combined seemingly justify a possible overshoot of the weekly Hull at 6420, closer to the upper Keltner channel+upper Dealer Cluster zone at 6500, but this move may be short-lasting.

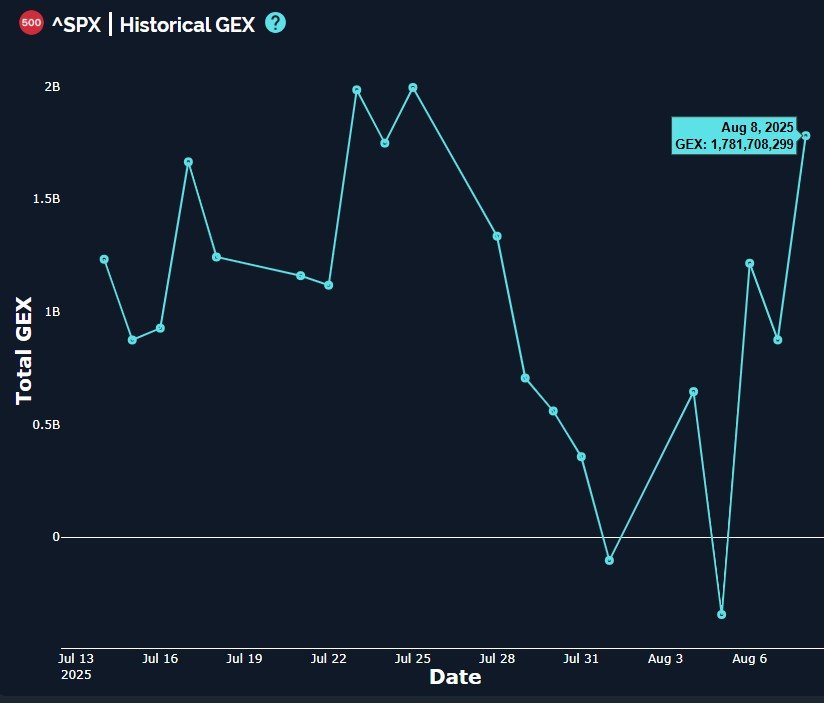

SPX GEX is rapidly approaching previous GEX highs, which becomes a more contrarian indicator, with July 25 marking the exact pivot to more selling pressure in SPX despite the high in net GEX (the old saying that too much of anything is bad, in this case, positive GEX).

Looking at the 3D graph, 6400 stands out as the largest GEX cluster expiring tomorrow, making 6400 a solid target. Futures are slightly up at the moment, indicating a move toward that general direction.

In summary, GEX is positive, but approaching previous extreme reversal areas.

SPX has conflicting daily and weekly technical pictures, thus presenting 6420 as a line-in-the-sand for further upside toward 6500 versus a reversal lower (holding below 6420 increases the odds of a trip toward 6000-6150).

IWM has a similar conflict: Daily volume Friday is still tilted lower, as well as the GEX picture, but technicals justify a move toward 225, and beyond 225, we may see 230 visited.

The daily chart shows 3 red candles in a row, yet IWM still holds above the Hull around 219, so the technical bias is for a move toward 230. The risk of visiting 210 still appears to be high, but before or after another move toward 230?

CPI on Tuesday at 8:30am ET and OpEx Friday give two more obvious potential pivots or excuses for volatility, so we’ll be watching this weeks developments in real-time, posting observed changes in Discord.

The VIX is slightly below the weekly Hull at 15.29, though close enough to not be surprised by a quick retracement back above the line and a VIX spike following. GEX and volume below VIX 15 is virtually non-existent, but glancing at prior instances demonstrates the possibility of temporarily holding below the line for 2-3 weeks.

www.geeksoffinance.com

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.