Fast Rebound! Now: Decision Time

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video covers some important context surrounding where markets appear to be headed as of Friday’s close, so check it out by clicking here.

In yesterday’s newsletter, we noted the distance between the price of major indices and the Hull Moving average, stating our view that “a rebound (and possibly a gap fill) becomes more likely,” even with the overarching negative momentum.

Today’s 0 DTE GEX gave us an accurate early indication of where SPX, QQQ, and IWM would land before the day was over, with SPX and IWM hitting the exact GEX clusters and QQQ climbing very close to target.

Starting with SPY tonight, we see the largest GEX clusters between 630-640, and price is quickly approaching the declining Hull Moving Average at 634.50.

A daily close above the Hull will tilt the odds in a bullish direction.

Based on SPX GEX, SPY may see a shift in GEX toward 600 if we resume the decline, but we will need to watch how the situation develops if we retest Friday’s low, possibly a key decision area below.

Even with today’s big short squeeze, GEX is still negative on SPY, but the more extreme reading has been negated, which actually negates a positive contrarian signal that has now played out (or perhaps is in the act of playing out).

Let’s look at my friend Smalls (Vinnie’s cousin), real initials “IWM,” which has reached the Hull and closed just below the line.

We still see 210 as the largest single net GEX cluster and the highest volume of the day was actually even lower at 206. 230 is still within the realm of possibilities if IWM can retake 221 with a decisive close above the line.

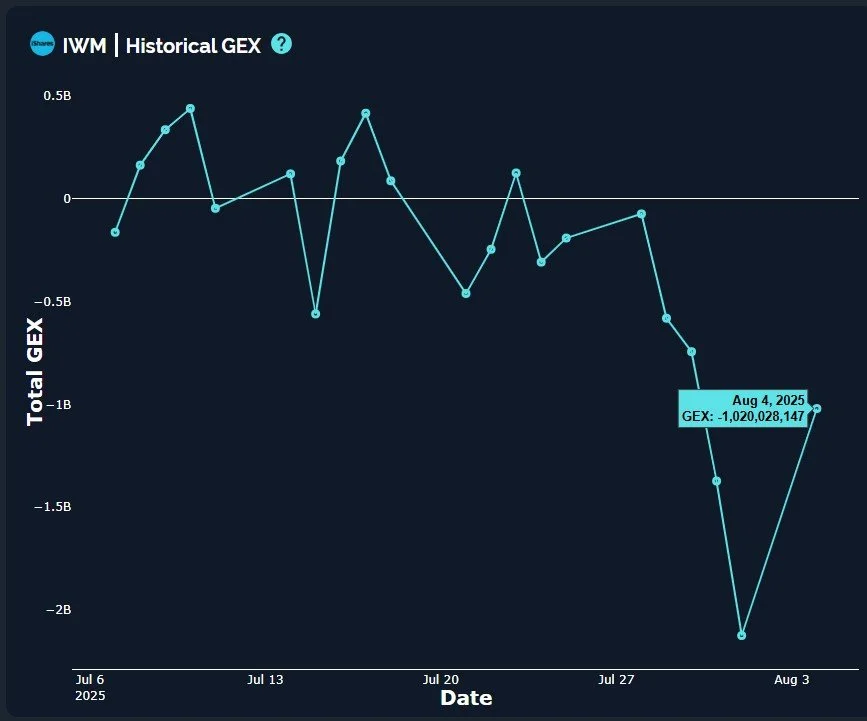

Similar to SPY, IWM saw a sharp decrease in negative GEX today, erasing the contrarian buy signal generated by Friday’s close.

IWM is still in solid negative territory, so today’s rally leaves IWM in the “Danger zone” for continuation lower.

At a -14% decline daily, it won’t take the VIX long to reach a spot where it’s not going to be smart to be short the VIX, so this is one of the more eye-opening indicators to me that this rally may not be headed for new highs any time soon. Well, unless you think the VIX is going to 12.

Volume was relatively elevated at the 24 and 25 strikes, and we’re rapidly approaching the rising Hull at 16.64, also close to the middle Keltner channel. This move also fills the gap left from last week.

We are beyond most Big Tech earnings, though PLTR reported after hours today, and AMD is tomorrow, which will likely weight on the semiconductors (SMH) Wednesday.

Most other earnings reports are significant, but perhaps more meaningful toward specific subsectors in the market (nothing a little rotation into tech can’t fix, right?).

The danger at the moment exists in the technical picture and the GEX picture we just described, and a shifting focus toward other non-earnings developments and events, so let’s take each day one day at a time and incorporate the clues we receive from the 0 DTE GEX picture as we start out tomorrow. We’ll share some of our observations in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.