Are We Bear Yet?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video covers some important context surrounding where markets appear to be headed as of Friday’s close, so check it out by clicking here.

Friday’s price action left a big gap from Thursday, and the close was less than inspiring.

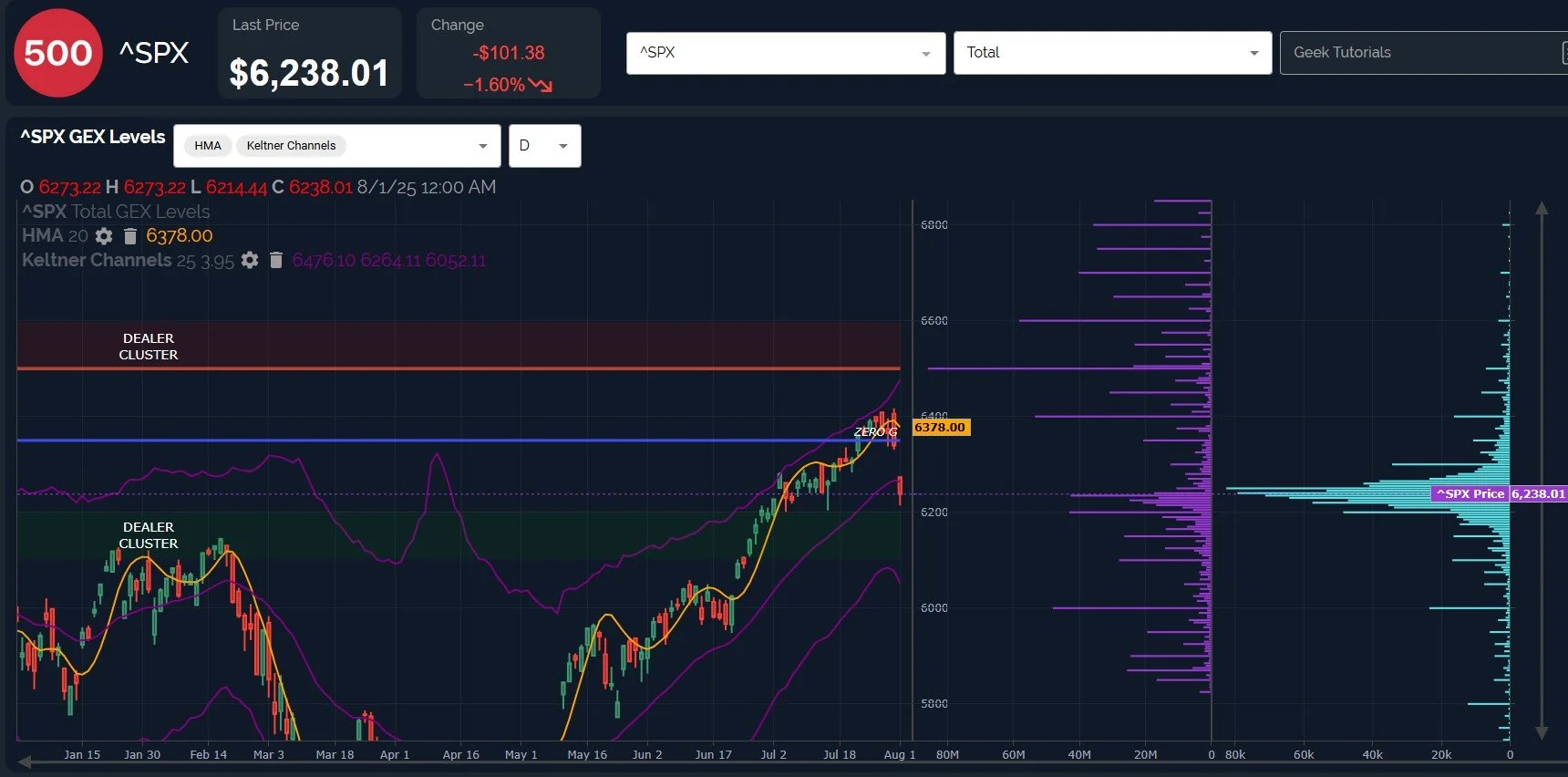

Upper and lower Keltner channels are diverging, with the upper channel still pointing higher toward 6500, but the lower channel now pointing lower.

As long as we’re below the daily Hull Moving Average, my bias is lower, though we are such a distance away from the Hull at this point that a rebound (and possibly a gap fill) becomes more likely, even if we continue making lower highs and lower lows beyond the positive days. a declining line currently at 6378 SPX may be a good line in the sand for bullish versus bearish momentum.

Volume and GEX at 6000 as grown, with GEX at 6000 now larger than any GEX cluster other than 6400, 6500, and 6600.

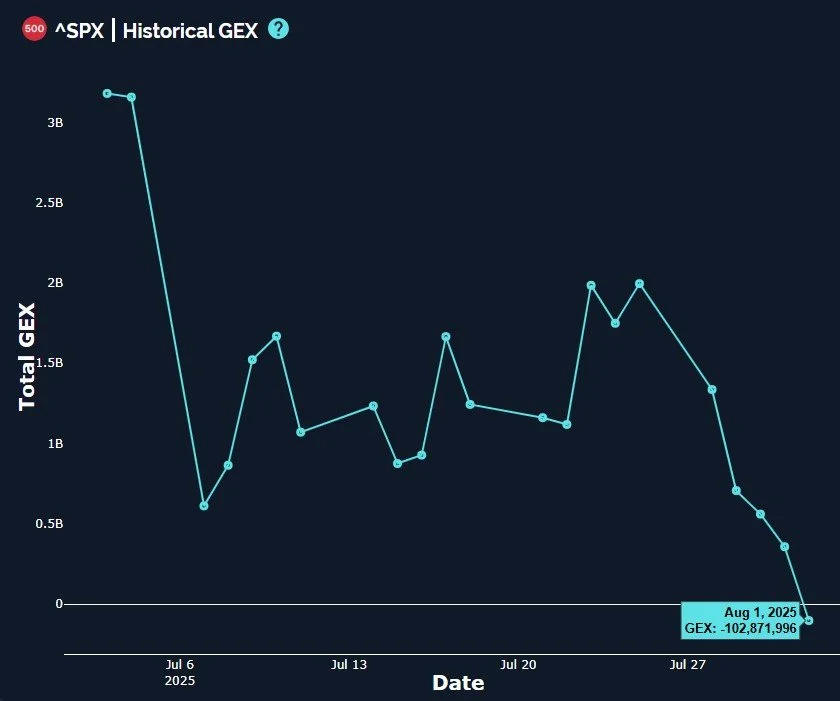

SPX net GEX has finally dropped into negative territory, though barely. As we’ve been highlighting (especially with QQQ), we have larger individual GEX clusters on the positive side, but a greater net amount of GEX spread across more strikes toward the negative side at the moment.

Taking a quick look at the SPX weekly chart, we see that 6000 matches the middle Keltner channel quite well, despite 6000 not really matching any current indicator level that I use on the daily chart.

It’s also important to note that last week was the first week closing below the weekly Hull since April, possibly implying a larger shift toward more downside in the near-term.

QQQ’s weekly chart shows confluence with the middle Keltner and QQQ GEX at 522.

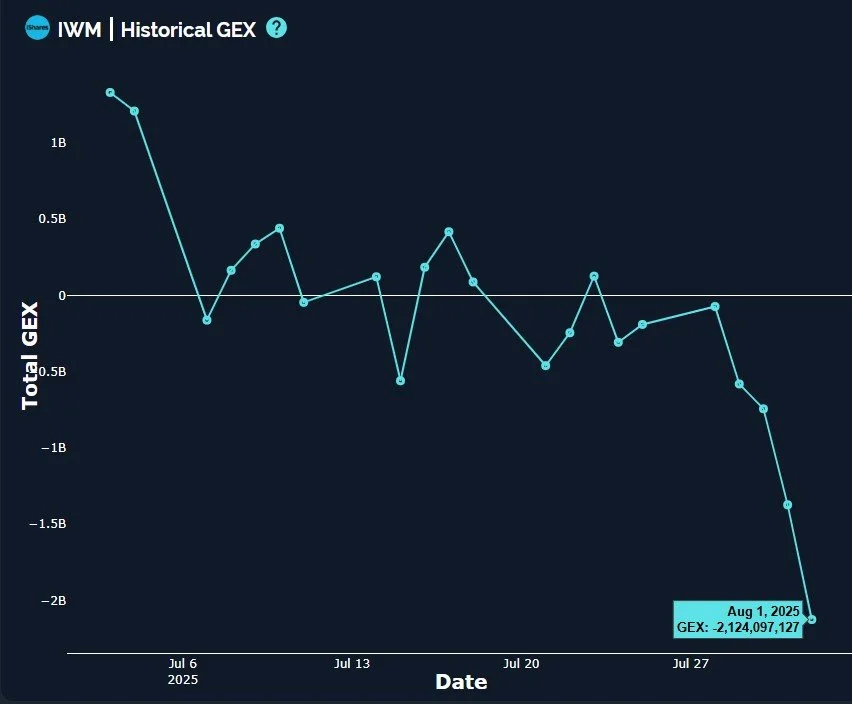

We’ve been highlighting what we felt was a possible early signal from IWM that a pullback was imminent, obviously playing out..And now IWM actually gave us a little positive divergence on Friday.

A large gap still exists with IWM similar to SPX and QQQ , as well as a significant distance between the current price and the Hull, so it’s possible an ensuing rebound may occur soon, even if temporary.

One of the problems bears currently have is that IWM is already almost at an extreme negative GEX reading, in danger of becoming a contrarian positive signal.

Ultimately, SPX and QQQ still appear to have more downside in store (now or a little later), so the current oversold appearance of IWM may prove to be temporary, with a possible bounce being met with more selling.

The future reaction to a bounce that hasn’t happened aside, a gap down or push toward 210 is likely a buyable area for a bounce, so we’ll be watching for additional signs in coming days.

The VIX also left a gap behind, though in this case, a gap below…And GEX took a blast into positive territory, with 25 now representing the largest net GEX cluster.

The upper Keltner channel is rising, and we saw volume to the tune of 367k contracts at the 35 strike, so I’ll let you draw a conclusion as to whether or not the current pullback is over.

Don’t worry, if you haven’t yet had enough coffee to draw such meaningful and consequential conclusions, we will still post updates as the day progresses, hopefully helping us in deciding how to the next zig or zag may go. Join us in Discord, we appreciate it!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.