The Key Test Is Here

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

AUTHOR’S NOTE- I’ll be traveling Wednesday and Thursday, so the next newsletter after tonight will be Sunday evening. You’ll have to keep your groans on hold until then, but I’ll make sure to have an extra dose of terrible jokes ready for Sunday so you can start off next week right.

Tonight’s YouTube video can be viewed by clicking here. The market is at a pivotal juncture, so we discuss different aspects of the major indices and the VIX, as well as some big individual stocks like AMZN.

Let’s stick with the weekly charts in tonight’s newsletter, because my weekly indicators show the only possible resistance between the current price and 100 points higher (the upper Keltner channel on the daily chart).

SPX and QQQ both reached the weekly Hull Moving Average today, QQQ closing slightly above the line while SPX closed just below the line. This line has acted as resistance for 2 weeks prior, so the burden has to be on the bulls to prove a sustained breach to the upside of the weekly Hull.

Another possible hurdle is the perfectly coinciding upper Dealer Cluster zone, which stretches from 6450 up to 6550. Given that the Dealer Cluster zones serve as formidable reversal areas oftentimes, the confluence with the Hull may mean that climbing deeper into the red box may only be a pyrrhic victory for bulls.

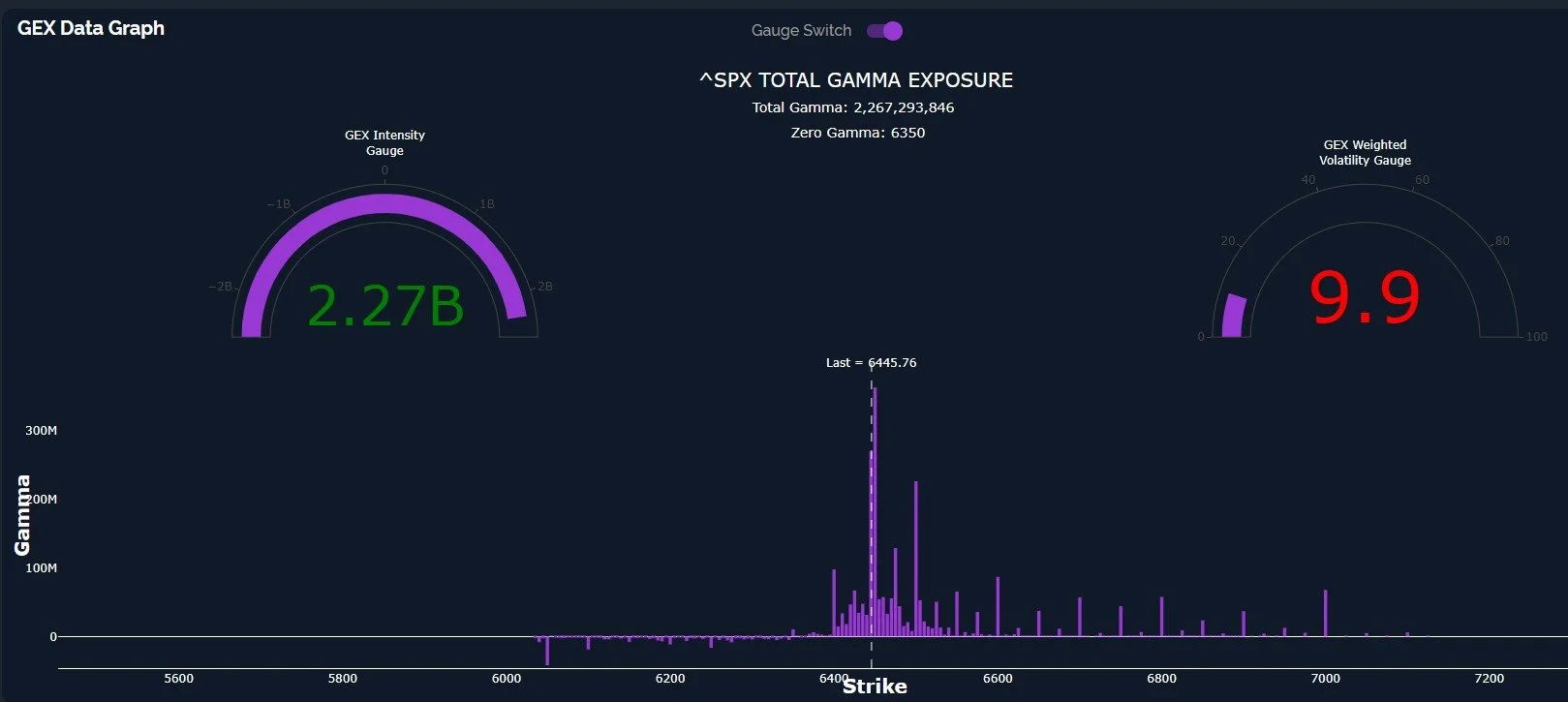

A quick note about the GEX Intensity Gauge, which compares GEX to previous readings over the last 52-weeks: SPX closed at a proper extreme level. GEX Intensity Gauge extremes (especially on SPX, which are less common than some other indices/stocks) can be contrarian signals that accompany reversals.

It’s nearly impossible to time exact tops or bottoms, so I view any contrarian signal as approximate and not exact, which has to be considered with positioning (I don’t view use of max leverage and 0 DTE options as a good way to bet on reversal of a strong uptrend, personally, for example).

The uptrend since April (and the quick snapback rally over the last week) has led me to dust off one of my favorite extreme indicators: the percentage bollinger (%B 20,2) that has served me well over the years. The usefulness of GEX has overshadowed my reliance upon most indicators, but when something “feels” extreme, I often consult with %B (the lower study on the tradingview chart below).

The main idea is that a reading over 1.0 is in overbought territory, and barring a couple of exceptions where price continued sideways or higher for a period of time, it has generally marked tops. The January and mid-February tags of the line were great examples.

The current reading of 1.05 as of Tuesday is definitely an extreme, so will we see reversal here, or will this time be one of the exceptions to the general rule with a continued climb higher?

tradingview.com

IWM had a big bounce, covering the entire distance between the 9-period SMA and the Hull, closing just above the Hull. The upper Dealer Cluster zone at 230 and the large GEX cluster at that level may be a magnet as IWM continues the late stage catch-up we’ve expected in the case of continued upside.

As mentioned, we wanted to see a test of 225, and we got it. Do we quickly reverse lower from here, or perhaps from 230?

The daily chart was one reason I said I wanted to see 225. Despite the red candles, IWM was holding above the Hull and 9-SMA, and today’s spike was the fulfillment of that setup. At this point, we’re quite far away from the daily Hull, which has not followed this fast move higher. A retracement back to 220 and another decision at that point by IWM to either aim for lower targets (like 210) or possibly chop sideways even longer would not be surprising.

IWM saw net GEX shoot into positive territory considerably, reflecting capitulating shorts and bullish positioning.

The bad news for the bulls (potentially, though not guaranteed) is that the last few times we crossed into positive territory marked exact tops or a few days before a top.

IWM shows a 100% success rate in 2025 with %B approaching 1.00 marking topping zones. I guess the optimist can hope the current reading is different this time?

The VIX has continued to get pummeled, losing the weekly Hull at 15.22 and straying quite far from the daily Hull at 16.92. This sort of distance usually results in some mean reversion with the VIX rising to get closer to the Hull, and we certainly don’t see market participants betting on lower VIX levels according to GEX or option volume today.

Volume at higher strikes (especially 30) remains elevated, presumably due to hedging activities while the VIX rests at an area that has marked a low point all year.

With PPI reported Thursday and OpEx Friday, it’s hard to know exactly what happens, but we see indices in their upper Dealer Cluster zones with certain indicators at extreme levels.

We’ll continue to post updates in Discord throughout the week and we hope you’ll join in the conversation!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.