August 25 Market Preview: Approaching The Next Pivot

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Tonight’s YouTube video can be viewed by clicking here. We discuss the big picture with major indices as well as a few individual names, so check it out!

Friday gave us a fast reaction to Thursday’s warnings of an imminent upside move, with several factors being mentioned as to why the bears might (again) be at risk of a population culling. IWM’s 235 GEX target was hit, and other indices saw major GEX clusters tagged and/or the weekly Hull Moving Average tested, all of which we were hoping to see with an upside move.

A number of conflicting factors point to risk in the near-term for bulls, while the bigger picture targets (including SPX 7000) remain valid into year-end as possible destinations.

One concerning factor for bulls is that the VIX is hugging the lower Keltner channel on the 2-hour timeframe after a monstrous VIX crush Friday. A quick look at the beautiful green digital ink shows that the VIX doesn’t spend a lot of time stuck at the bottom of the 2-hour Keltner channel. The usual disclaimer: Maybe this time is different (good luck!)

Let’s zoom out to the daily chart from Friday: The VIX is just above the zero gamma line at 14, just below the daily Hull at 14.86, and we saw high volume at exclusively higher strikes, especially VIX 55.

In the event of a “bulls curled up in the fetal position” VIX spike, 55 is certainly a possibility, though I would prefer to see what happens around VIX 20 before busting out the vintage WWII helmet and preparing the MREs.

Despite all of the drama, SPX is still hugging the weekly Hull, which is still on a higher trajectory, albeit at a slighter angle than the May-July trajectory. Notable volume occurred Friday at the 5000 and 6000 strikes, which I guess goes along with the VIX 55 volume, though it’s hard to draw any conclusions outside of someone being smart enough to hedge while hedging appears cheap (maybe they’re leveraged long overall, for all we know).

As long as SPX remains below the weekly Hull, we can consider that area to be important resistance, with a daily close above 6487 possibly opening the door to a trip to the 6600 GEX cluster, and maybe toward the upper Keltner channel at 6757.

SPX is also at the doorstep of the upper Dealer Cluster zone at 6500 again. The presence of the zone at 6500 may indicate a possible reversal from this area, or some consolidation.

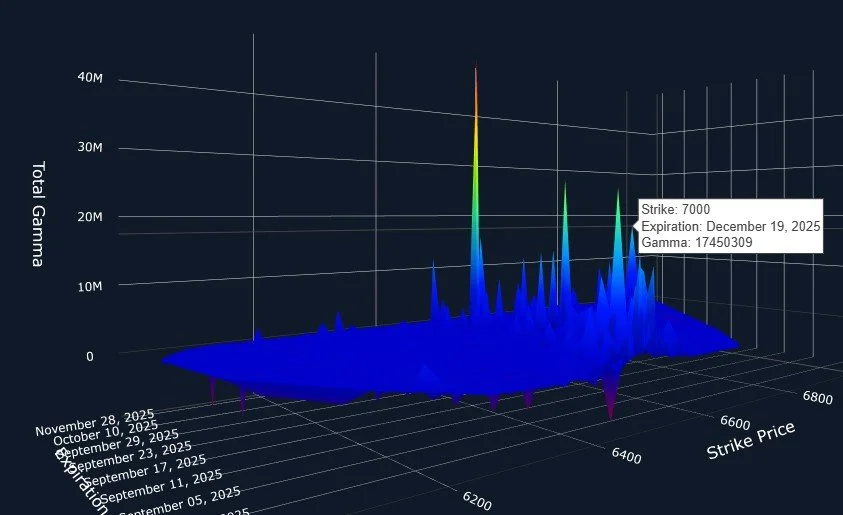

GEX structure is interesting in that we see GEX drop off quite a bit after 6600, and it’s very minimal below 6500, though a look above shows 7000 to have some interest.

Let’s add context to the big positive GEX at SPX 7000: Most of that GEX is way out in December, December 19 to be exact. Other GEX clusters at the 7000 strike are scattered across a variety of other dates.

The implication is that participants are not assigning high odds to 7000 being reached anytime soon, but confidence exists that 7000 is likely to be reached by the end of the year. Shorter term GEX clusters are focused mostly closer to the current price.

With NVDA earnings approaching August 27, let’s revisit one of the more important components of QQQ.

We previously noted that it was hard to imagine NVDA continuing lower (especially below 160) without some sort of bounce into or around earnings, especially with GEX mostly positioned at higher strikes.

The rebound since Wednesday has brought NVDA right into resistance at the daily Hull, though the Hull is declining fairly rapidly, likely creating a situation soon where NVDA’s price will be above the Hull (barring an even more intense selloff for NVDA ahead of the Hull’s decline).

The close right at the Hull resistance, and Friday’s top 4 strikes in terms of volume occurring below the current price (down to 160) brings up the possibility of a move lower soon.

Earnings reactions (not earnings themselves, which are likely to be within a tight range predicted by every analyst on the planet) are inherently unpredictable, so we will choose to react instead of anticipate as far as trading goes.

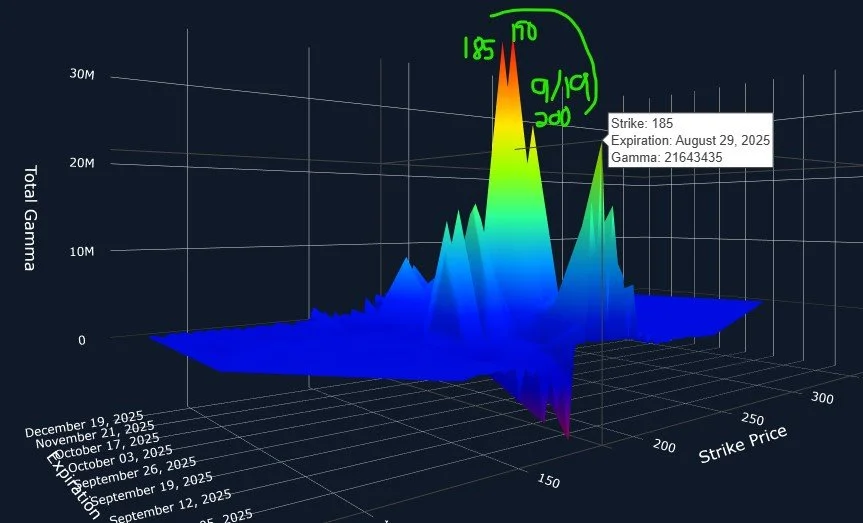

Most GEX is positioned higher, up to the 200 strike, which is also very close to the upper daily Keltner channel.

Buying NVDA below 170 was an easier decision than buying now, but a good possibility still exists for a spike in coming days, even if the eventual resolution is lower.

The 3D picture show 185 as the largest GEX cluster expiring Friday, with higher strikes mostly concentrated out to September 19.

185 isn’t that far away, so participants overall may be cautious toward Wednesday’s reaction.

Overall, Friday’s momentum higher across the board is positive, despite landing right at key resistance for all indices as well as NVDA.

Odds seem to favor some sort of pullback and then continuation higher.

0 DTE GEX data continues to lead us in the right direction on most days, so we’ll be updating our view in Discord Monday. We hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, some of which will be rolled out this week!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.