August 22 Market Preview: Anticipating A Reaction

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Tonight’s YouTube video can be viewed by clicking here.

IWM is nearly perfectly respecting the daily middle Keltner channel.

The low (so far) has been about halfway back to the big green candle from August 8.

IWM GEX has not moved substantially more negative, and we still have large GEX clusters at 230 and 235, increasing the risk to bears that a potentially imminent rebound may retest at least 229 and maybe 230.

The GEX at 235 is close to the upper daily Keltner channel, also representing a new rebound high, if IWM stretches higher in the near future. 230 still appears to be the more likely initial destination on the positive side.

While being this far away from the Hull Moving Average at 228.63 increases the odds of a bounce (in my opinion), we still need to pay attention to the meaningful negative GEX at 220, which is greater in size than the positive GEX at 235. This discrepancy appears to tilt the odds toward 220 and 230 as the likely directional destinations, with my preference being to react to whichever target is reached first, either a long trade at 220 or a possible short at 230, depending on evaluating the complete landscape when either event happens (reviewing the charts and GEX picture for the VIX and other major indices).

If IWM continues the move higher, the immediate resistance at the 9-period SMA needs to be overcome, so my bias is lower until 226.6 is recaptured. Holding above that line opens the door to 229-230, which may spread to other indices, if SPX and QQQ haven’t already shown signs of reversal higher.

With NVDA reporting August 27, let’s look more closely at QQQ entering Friday, given the significant impact NVDA will have on tech.

So far, QQQ has stopped its decline on a closing basis right at the weekly 9-period SMA.

GEX diminishes below 540, so at the current moment, further downside may target the 540-550 area.

Switching over to a daily chart: QQQ is quite extended below the Hull, similar to the late July/early August extension that saw a quick rebound back to the line.

Mean reversion is a very real risk with QQQ this far extended below the daily Hull, implying at least a temporary bounce back toward the 9-SMA around 574 or as high as the Hull at 576, at which point we want to see if QQQ rejects that line or shows a daily close above the line.

Powell Friday or NVDA the 27th could spur such a retest (acknowledging values will shift somewhat lower by the 27th, if the current trajectory continues).

Concerningly for bulls, QQQ GEX didn’t improve a bit, in fact both QQQ and SPX saw GEX move ever so slightly more negative today.

In summary, we see conflicting signals that could resolve in a number of ways.

NVDA may already be gearing up for a move higher, outperforming QQQ today and climbing some 6 points off of the low yesterday.

In similar fashion to QQQ, NVDA tested and held the 9 SMA so far.

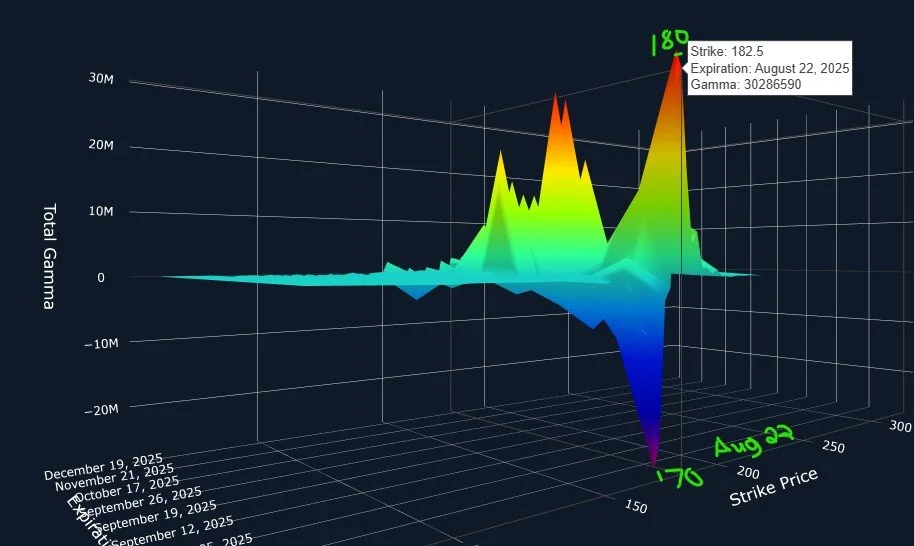

NVDA GEX is obviously concentrated at higher strikes, ranging from 180 to 200.

Friday’s largest GEX clusters expiring for NVDA are at 170 on the negative side, and 180 on the positive side, with 182.5 almost as large as the 180 cluster.

Interestingly, we see a lack of large GEX clusters for next Friday, perhaps indicating a shying away of major bets by participants between Friday and September’s OpEx.

My plan is to review where NVDA closes Friday, then reassess how participants shift positioning Monday, given the expiration of those large GEX clusters Friday.

Earnings inherently introduces the risk of a move that can’t be predicted, but a contrarian view would be that NVDA somehow dropping further toward 160 is more likely a buying opportunity than a selling opportunity heading into earnings (and a rally into earnings may be a selling opportunity, depending on how high it goes).

We will be looking for 0 DTE intraday opportunities Friday, and we’ll look for opportunities heading into next week as well, so join us in Discord where we’ll share what we’re seeing as Jerome speaks.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, some of which will be rolled out this week!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.