August 21 Market Preview: Can DIA Strength Last?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Tonight’s YouTube video can be viewed by clicking here. We cover some additional tickers, including GLD, PLTR, and ADBE, so check it out if you have a few minutes!

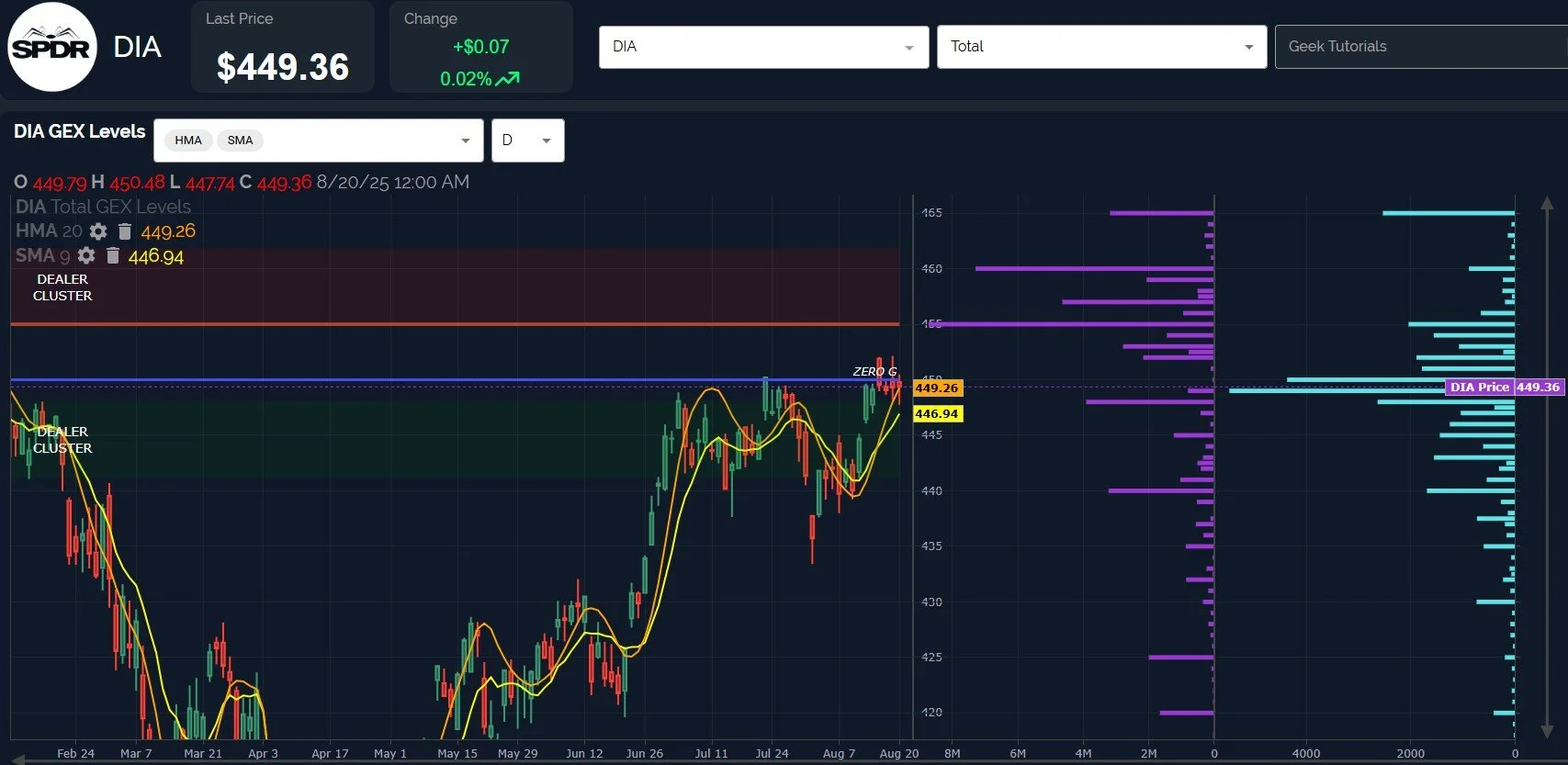

We haven’t touched on DIA for quite some time, but DIA has shown remarkable strength in the face of other indices declining.

DIA still holds above both the Hull Moving Average and the 9-period SMA, and the positive GEX picture includes noteworthy targets at 450 and possibly 460.

DIA’s more defensive focus may be helping this outperformance.

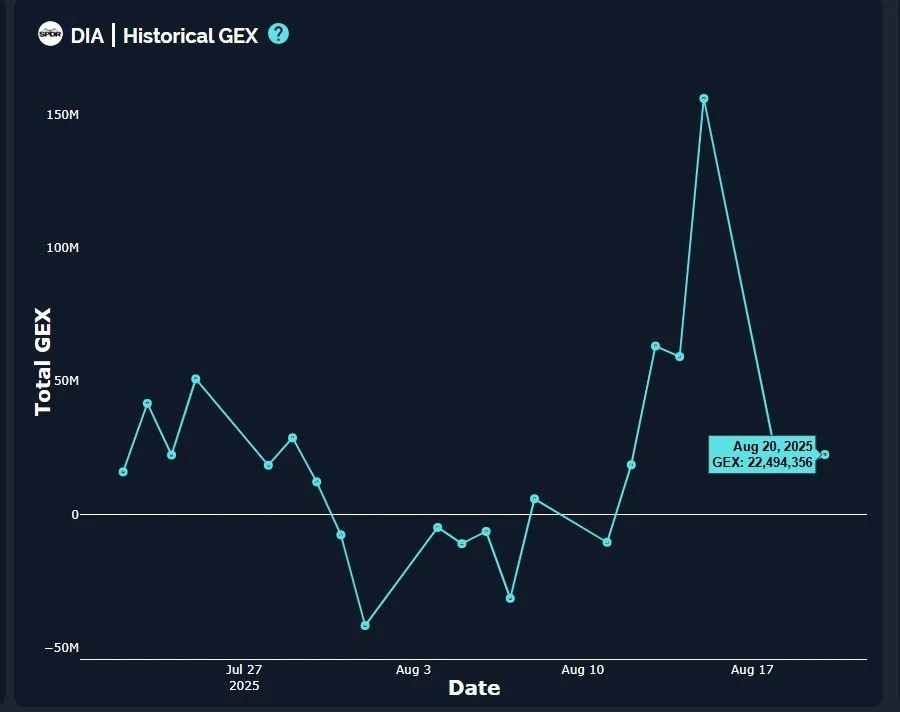

While net total GEX has decreased, it’s still positive, a feat that other indices haven’t been able to maintain in recent days.

Odds seem to favor DIA stretching for the upside targets, but we need to watch for DIA to not lose the 449.26 Hull to keep the technical picture aligned with the higher GEX targets.

The VIX presents a challenging picture for market bulls.

Volume (the light blue bars) today was elevated at 45, 55, and even at the 80 strike.

We’re starting a new VIX OpEx cycle with this morning’s expiration of the front month VX futures contract, and the VIX has only yesterday regained important resistance-turned-support that may imply more volatility ahead in the near-term.

The VIX spike this morning was faded, but the VIX still closed above both the Hull and the 9-day SMA.

A spike to the zero gamma level at 18 seems like a good initial target in the event of continued market downside, though it’s unclear whether or not we will see a reactive market bounce into Friday.

QQQ touched 560 this morning, and we took a long trade at that area that became nicely profitable. This was based on the extreme negative GEX reading on a 0 DTE basis, a large 0 DTE GEX cluster at 560 that had potential to serve as support, and a lack of meaningful negative GEX below 560.

QQQ actually looks fairly bullish to me with the long candle wick, possibly indicating eager buyers at the lows.

The intraday lows also represent a retest of the last pullback zone, though we haven’t yet seen a retest of the exact lows.

The distance from the Hull and the 9 SMA is considerable, so mean reversion back towards the line (575 area at least) wouldn’t be surprising.

With Powell and NVDA around the corner, we may have upcoming excuses for either a solid low or a rebound high, it’s too early to say which, obviously.

Concerningly for bulls, QQQ GEX didn’t improve a bit, in fact both QQQ and SPX saw GEX move ever so slightly more negative today.

In summary, we see conflicting signals that could resolve in a number of ways.

My personal view is that A) we have good odds for a bounce higher, but B) the VIX is too low to see the market begin a new sustained leg higher, so C) we will probably get an interim bounce soon (either Powell or NVDA?) as DIA also reaches it’s 1-2% higher targets, but D) the market will then resume its decline to set the stage for a solid year-end rally.

The challenge to this view is that we may decline straight into NVDA, potentially marking an important low, but I think QQQ has already strayed too far from the Hull to not see a bounce soon..Either way, we will watch developments and update our members in Discord as we evaluate new evidence of what is coming next.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, some of which will be rolled out this week!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.