August 20 Market Preview: VIX Expiration & TGT Earnings

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Tonight’s YouTube video can be viewed by clicking here. It’s short and sweet (or sour, depending on whether or not you’re triggered by potentially negative ramifications for some securities), so give it a quick look!

We’ve been sharing general reasons for caution in recent weeks, but the VIX triggering a volatility buy signal and QQQ as well as SPX losing key levels (based on indicators we use) has proven to be a fairly prescient warning, in hindsight.

Since we’re approaching the anticipated monthly VIX options expiration date Wednesday at 9am ET, let’s look at the VIX:

VIX gamma exposure (GEX) remains close to extremes, with a lot of negative GEX at 16. The negative GEX has shifted higher from the 15 strike in recent days, which is interesting.

GEX-weighted volatility is close to an extreme low, which compares current GEX to readings from the prior 12 months. Such a low reading may imply more mean reversion in the near-term, which in this case may involve a trip to higher VIX levels.

A quick look at the daily chart backs this possibility, with the VIX overtaking both the daily Hull Moving Average as well as the 9 period SMA, an accomplishment not seen since August 5th.

A quick glance at the chart since February shows the VIX moving higher for at least a day or two following an initial close above both averages. Of course, past is no guarantee of the future, though.

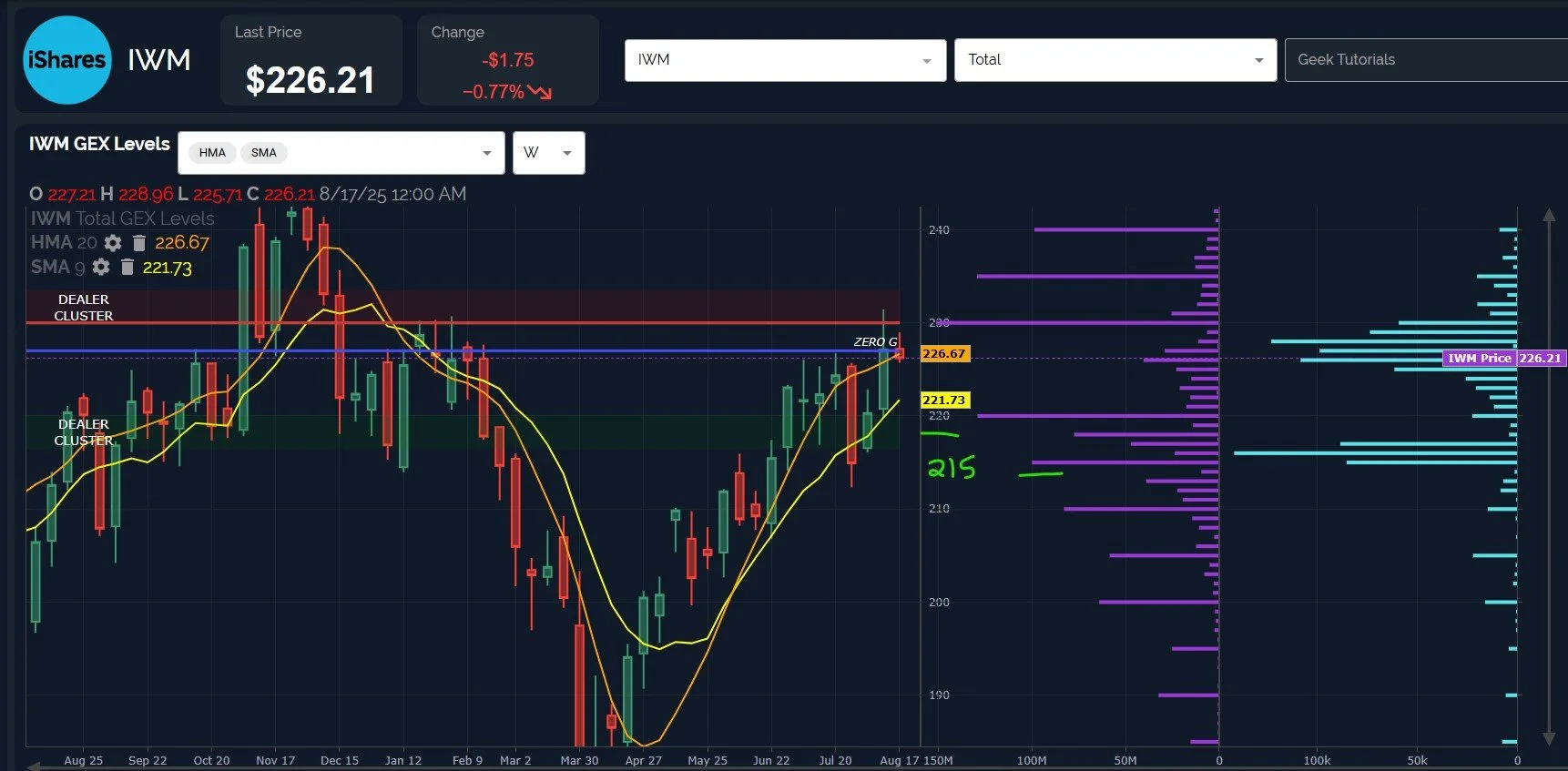

I mentioned a focus on IWM given its divergence from other indices, with attention toward a possible “fakeout” by SPX and QQQ.

IWM broke below both the daily and weekly Hulls today, joining the others with a more bearish short-term potential setup.

IWM has generally moved more positive though, with GEX shifting more positively, including the largest negative strikes moving higher, currently at 215 and 220 (we were previously looking at 200-210).

IWM’s historical GEX shows a drop back into negative territory, though you can see IWM has generally been trending higher in terms of net GEX since late July.

We remain open to a more bearish shift, but we won’t be surprised if the upward trend continues both in terms of higher lows and higher highs with price as well as GEX.

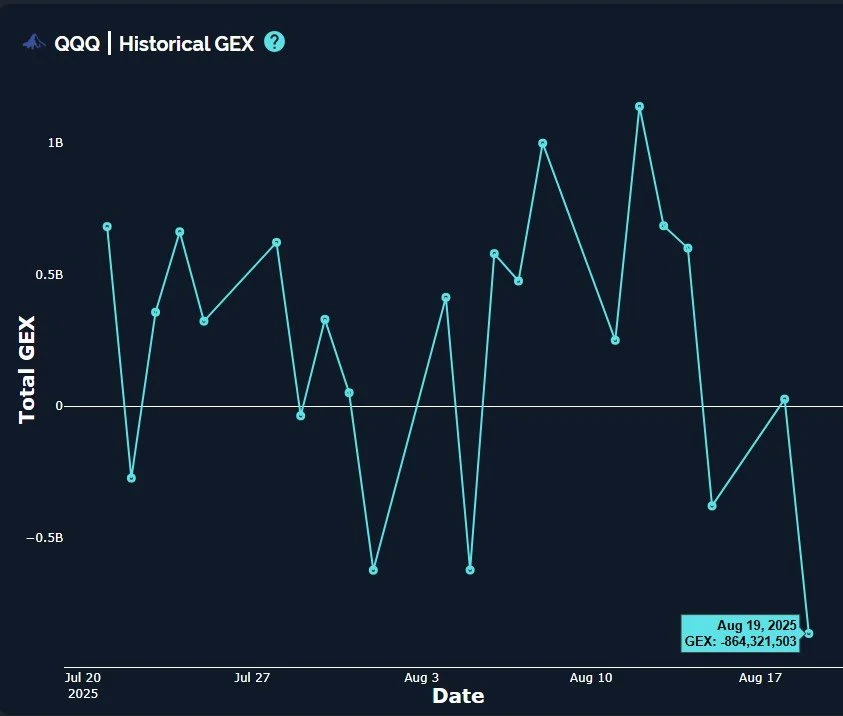

QQQ has been the weakest link, especially since Friday, and now QQQ is closer than other indices in approaching the weekly 9-period SMA after losing both the daily and weekly Hulls.

Note the candle wick last week, reflecting eager sellers in the upper Dealer Cluster zone and a close below the “magical” orange-tinted line (the weekly Hull).

562 is the 9-period SMA, a line that has held since April, to give context regarding its significance.

QQQ plunged deep into negative GEX territory than we’ve seen over the last month, yet we aren’Ont near an extreme, reflecting a more negative shift amongst market participants without triggering a contrarian buy signal.

One last important (in my opinion) note on QQQ- a lot of the initial negativity has been in the semiconductor sector. We still have earnings for NVDA next week. I don’t know if their CEO will be wearing a highly polished, slick black leather jacket next week, or if he’ll be signing customary chest autographs, but I have an un-scientific feeling that a continued decline in QQQ into the end of the week may mark a good buying opportunity prior to NVDA earnings.

In contrast, a sharp rebound/rally into NVDA earnings may be a selling opportunity. The bottom line (in my view) is that we have large positive GEX at 185-190 for NVDA (a lot of the 182+ GEX expires this Friday) so the odds may favor a test of those levels, be it before or immediately after earnings.

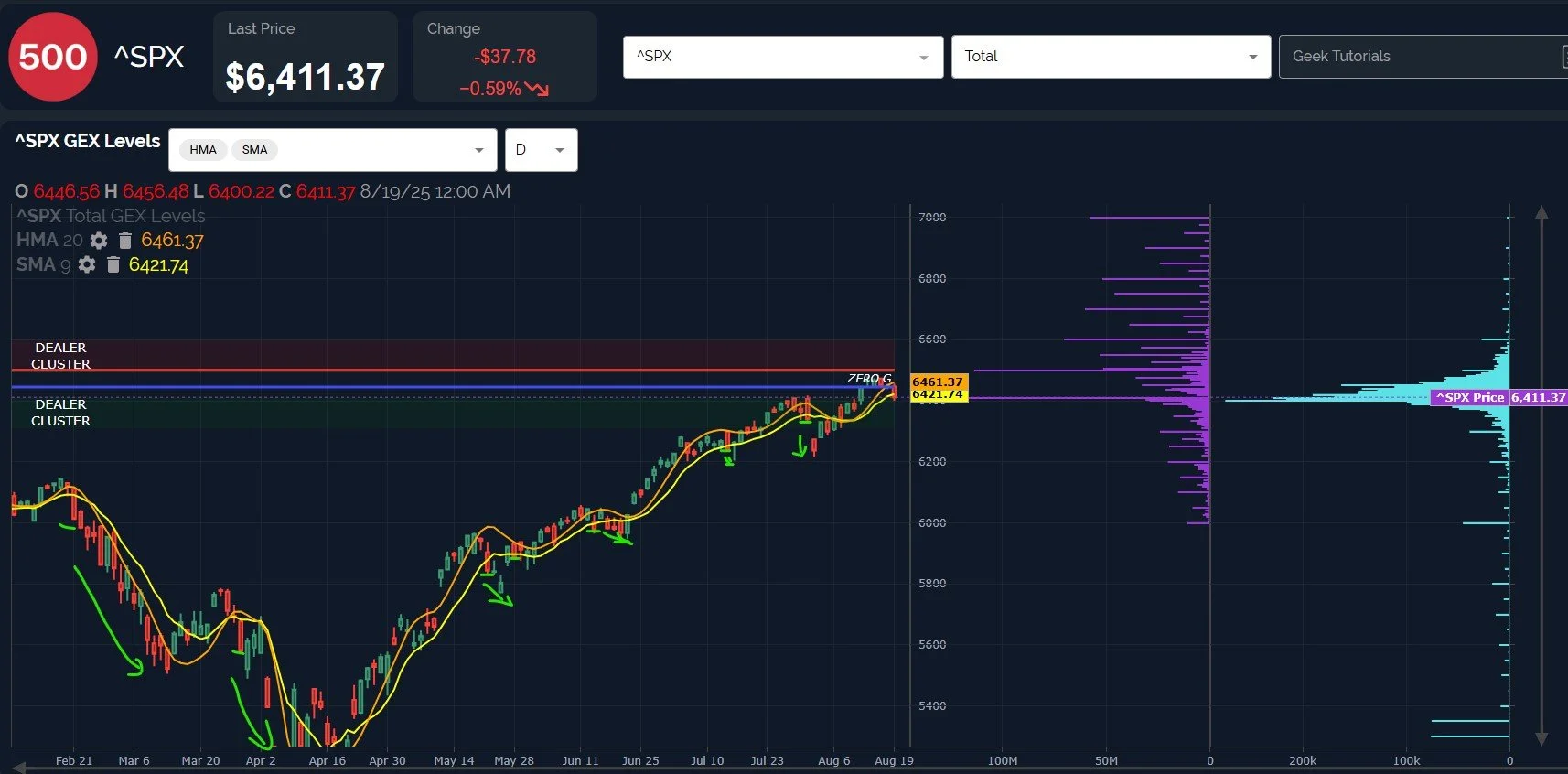

Lastly, a feather in the bears cap is the loss of the daily 9-period SMA by SPX, which is now below both the Hull and the 9 SMA.

The light blue denotes daily volume, showing a few particularly negative sadists buying options at the 5300 and 5350 strikes. 6000 also saw some action, whereas we saw very little option volume above 6600. Last time I checked, 5300 is farther away than 6600, but I’m certainly not a mathematician (or a market psychologist).

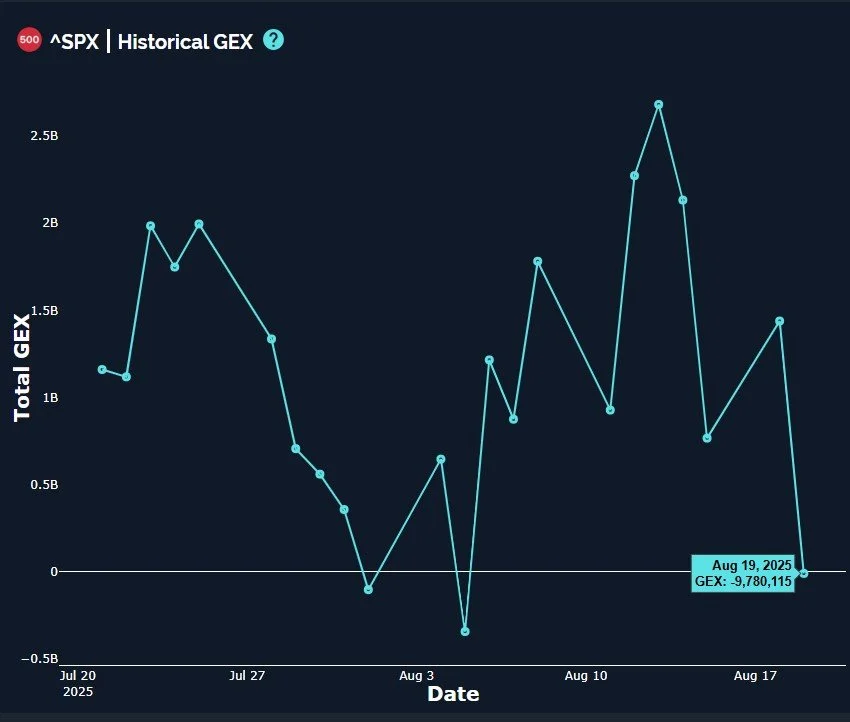

SPX dropped back into negative GEX territory, though barely, but the magnitude of the decrease from over 1B positive GEX was noteworthy.

In summary: GEX has shifted more negative as we approach VIX expiration premarket Wednesday.

IWM joined SPX and QQQ in losing key levels, potentially signifying a broader pullback.

With NVDA earnings August 27, and NVDA showing GEX at 185-190, we are cautious regarding sustained downside, with good potential to see either an immediate rebound and a high into NVDA earnings or potentially a low prior to earnings, implying a contrarian scenario in the short run.

We’ll continue to consult our intraday 0 DTE targets for intraday trades and indications of where we are heading in real-time, so we hope you’ll join us in Discord for our intraday posts.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.