More Cracks Emerge

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We decided to extend our offering of $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Tonight’s YouTube video can be viewed by clicking here.

Speaking of cracks emerging, we aren’t talking about eggs or sidewalks, but rather the major holdouts to QQQ’s early failure, SPX and IWM (RTY futures tonight, to be more specific regarding IWM).

Let’s make a quick note about the VIX, particularly with monthly VIX options expiration approaching Wednesday morning at 9 AM ET. Despite the red candle, the VIX closed above the daily Hull Moving Average for the first time since August 5, leaving us with a bullish volatility signal entering Tuesday.

The lower Keltner channel and the upper Keltner channel are at odds, both pointing slightly toward each other, which (if extrapolated into the future) could create another “pinch” scenario, similar to when we saw the last VIX spike in July.

Volume continues to be primarily at higher strikes and GEX as well as volume is virtually nonexistent below VIX 14.

Before we get too far into the week, let’s emphasize a few known potential volatility catalysts, though it’s worth noting it’s the unknowns that are impossible to predict, yet accompany the largest moves at times.

We mostly have economic data, with my own emphasis being placed on the longer dated bond auctions (20-year and 30-year TIPS) and PMI data, as well as some housing data. My emphasis on the bond auctions pertains largely to potential impacts on market liquidity, given that the Fed certainly allocates resources to ensure the US can buy its own debt (I know it sounds comical to lend yourself money, or maybe I just find that humorous).

Powell speaks Friday, which may prove to be more eventful than the FOMC Minutes, so we have some potential entertainment this week.

Econoday.com

Let’s shift to SPX’s weekly chart, which shows SPX price now below the weekly Hull Moving Average.

The next indicator below that I’ll be watching is the rising 9-period SMA at 6324.58.

Given that both averages are rising in bullish fashion, and we see positive GEX all the way up to 7000 on SPX, the environment is still buy-the-dip until proven otherwise.

A retest of the Hull at approximately 6485 gets us almost to the big upper Dealer Cluster at 6500, which I believe makes the target very likely this week, even with a larger view shift toward a deeper pullback soon.

We see GEX quite sparse on the negative side until you get close to 6000, which I find interesting. A lack of meaningful GEX in between two larger GEX clusters may imply a faster move toward the next large GEX cluster, which in this case would be 6050. I am not expecting 6050 tomorrow, per se, but we need to be mindful of risks that are present even during a strong uptrend.

What changed today is SPX also losing the Hull Moving Average, closing at 6449 while the daily Hull is at 6450.54. Yet another “coincidence” of the close being very close to my favorite moving average indicator.

In conclusion, with the daily and weekly Hulls now aligned with the negative picture on QQQ, I lean toward selling rallies until those Hulls are conquered again, the weekly in particular.

A negative tactical bias brings focus toward the 6350-6414 range for an initial test of support.

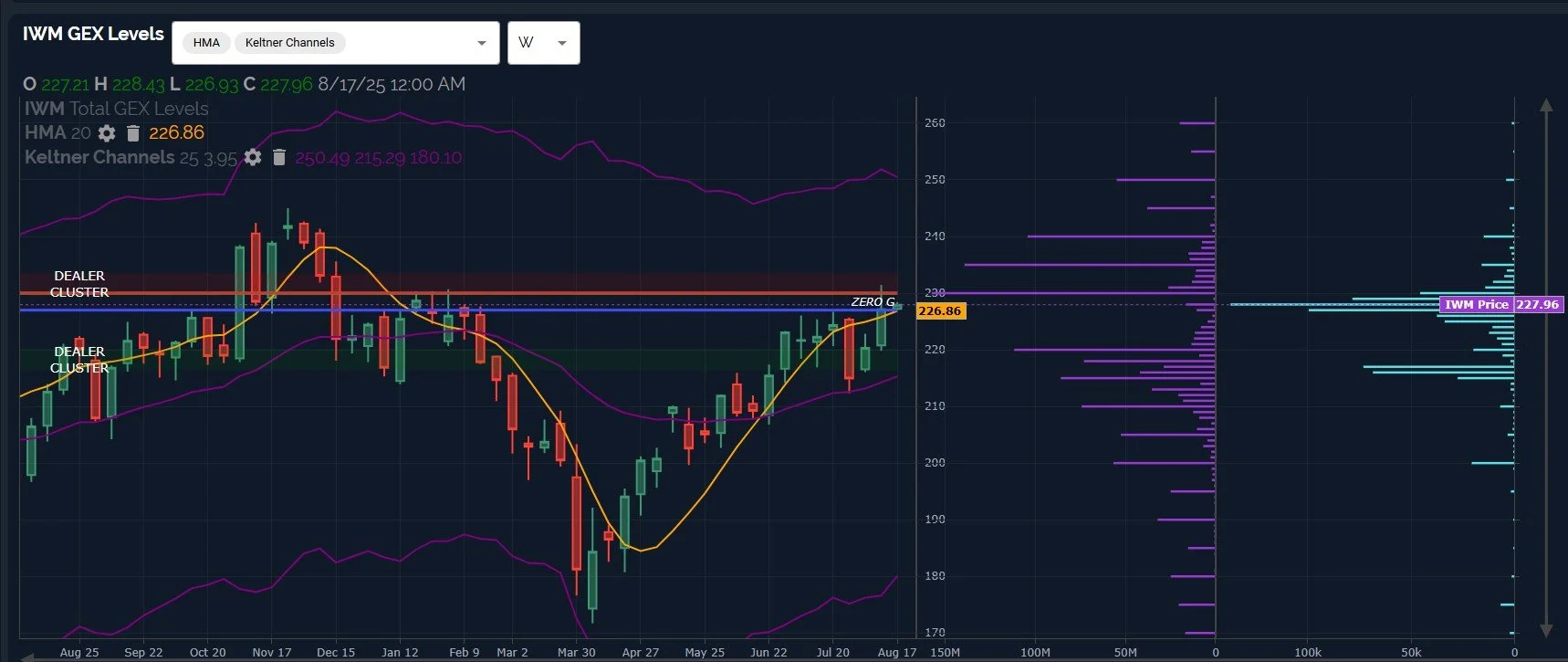

IWM has been the best argument bulls have for markets continuing higher.

If IWM is still holding the weekly and daily Hulls, and GEX has shifted noticeably more positive, does this imply SPX and QQQ resolve higher as well, perhaps even before a meaningful pullback? I believe it’s possible, and IWM does have a record of leading us into and out of pullbacks in recent history.

The weekly upper Keltner is aligned with the last larger GEX cluster visible on IWM at 250.

Also including a look at the daily chart, 235-240 are more likely, and possibly soon, unless IWM can join SPX and QQQ with further signs of weakness.

One last note on IWM- RTY futures show a loss of the Hull, though barely. If this holds, IWM’s possible bull flag may end up failing and adding further confidence to the idea that major indices are ready for a pullback.

We’ll share our 0 DTE and other observations as soon as we process new information, so join us in Discord where we’ll be active tomorrow!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.