Rising Prices, GEX “Ceiling..” Rising Risk?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our top subscription!

Today’s YouTube video can be viewed by clicking here. Check it out if you have a few minutes! In tonight’s newsletter, we look at the subtle reversal of the VIX and where it might be headed, IWM, and SPX.

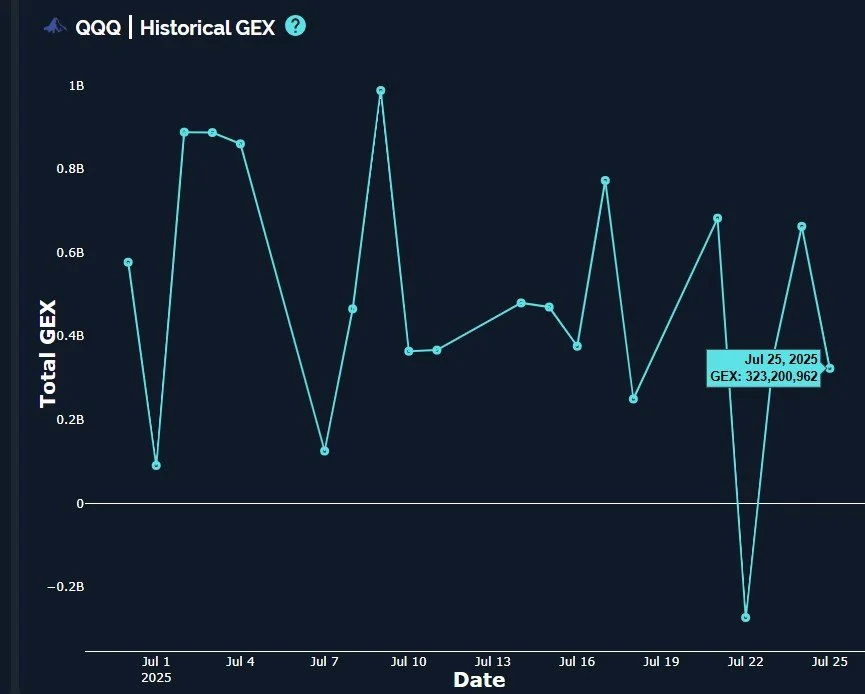

QQQ: 575-580 Max?

Every day since the mid-July failed breakdown has been a struggle session of alternating candles with fairly narrow range, incrementally squeezing out new highs at the end of the week.

Keltner channels remain bullish and on a mission for higher highs.

GEX drops off sharply after 580, and questions remain whether we will even surpass 575, given the confluence of the upper Keltner with 575.

QQQ has been hugging the Hull Moving Average, though the bullish ascent of the Hull leaves little hope for bears without a break of 565. Perhaps the proximity to 565 for QQQ’s price reveals some vulnerability, since losing the Hull would be a bearish break on a daily close.

QQQ has been making mostly lower highs and lower lows on total net GEX since July 9. While not a future predictor of exact turns, it appears participants are not growing more bullish as price rises, a negative GEX divergence.

The lack of GEX growth above 580 combined with the net GEX observation leads to a general conclusion that risk may be tilted more toward the downside at this point, with limited upside above barring a pullback.

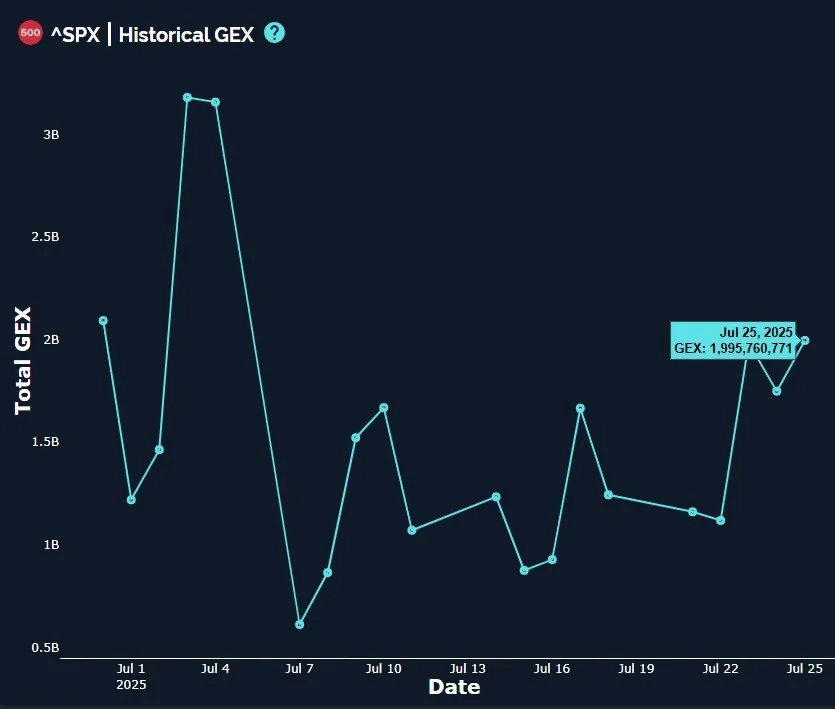

SPX: Still Looks Bullish

SPX is once again pressing against the upper Keltner channel with a rapidly rising Hull and GEX overhead at 6400.

The early July period was similar, and once the Hull crossed over price, we saw a slightly downward bias until mid-July (perhaps the most bullish outcome while below the Hull).

With 6345 SPX in mind as a technical line-in-the-sand, we look for a tag of at least 6400 and possibly a 1.5% overshoot to nearly 6500 this week as we approach the end of July on Thursday.

Volume was elevated at the 6000 strike Friday, and with GEX so singularly biased toward upside, any pullback lacks meaningful targets to pinpoint below, so technically, 6000 looks possible (I’ll watch 6200 first).

Keltner channels do not yet reflect good odds of reaching prices beyond 6400-6500 without more time passing, though the trajectory is clearly higher as long as the current trend holds.

While QQQ net GEX decreased and SPX increased, both largely remain lower than early July highs. SPX reached over 2B intraday Friday afternoon before closing with net GEX just below 2B. This reading reflects a relative extreme compared to most times over the last year, which is potentially a warning of a contrarian reversal being near.

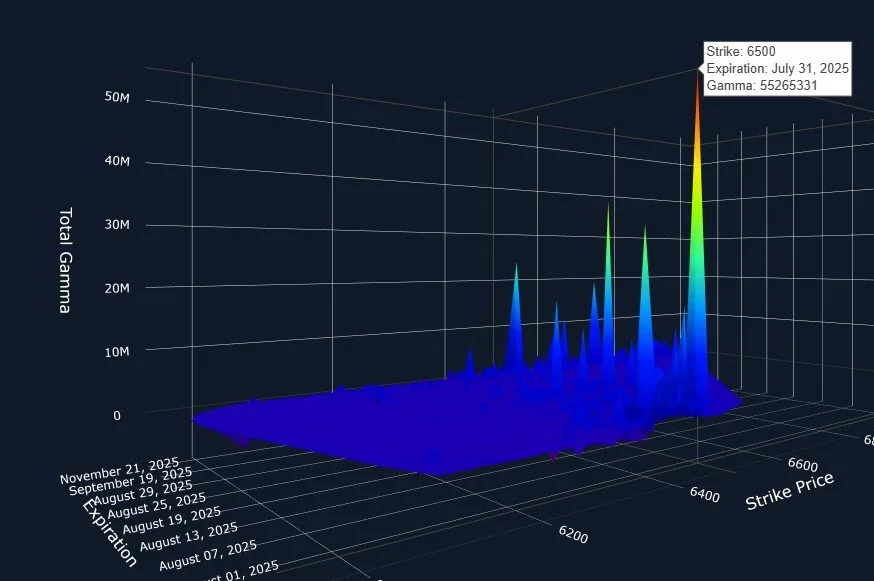

SPX’s 3D graph reflects good odds of SPX reaching 6500 by Thursday, though not necessarily on Thursday exactly.

Previous analysis of the 3D graph revealed a bias toward the end of September into possibly October before seeing 6500, but the latest shift requires attention toward a possible earlier high and reversal lower, with an unknown resolution beyond such a pullback.

Growth of GEX at even higher strikes is required to shift a more uncertain view with possible bearish implications toward continuation of a bullish trend.

While the VIX once again reflects negative net GEX, we still hear crickets below VIX 15 in terms of participant interest (or belief?) in lower VIX prices. Volume on Friday was heaviest at the 17 strike, and almost exclusively at strikes above 15. We saw the VIX drop below 10 in 2017, so sure, anything is possible, but the odds are against betting that the VIX breaches anything below 14 at this point, especially for a daily close.

All signs seem to point toward the potential for a brief spike higher for the indices, and possibly a drop for the VIX, but such an acceleration is likely temporary.

We’ll begin each day with an open mind and we’ll share our 0 DTE observations in Discord in real time. we hope you’ll join us there to participate in the discussion!

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.