Pivotal FOMC, Earnings Ahead

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video can be viewed by clicking here. Check it out if you have a few minutes!

Before we dive into the indices, note the dearth of important earnings reports this week, also layered atop the FOMC announcement and press conference on Wednesday. Tuesday (tomorrow) appears to be the day of the most meaningful reports possibly impacting multiple sectors outside of tech, while Wendesday after the bell (and after FOMC) will see META and MSFT reporting. Thursday’s after hours reports from AAPL and AMZN will set the tone for the first trading day of August on Friday. This week definitely carries potential for more volatility and/or important shifts than any week in July, at a minimum.

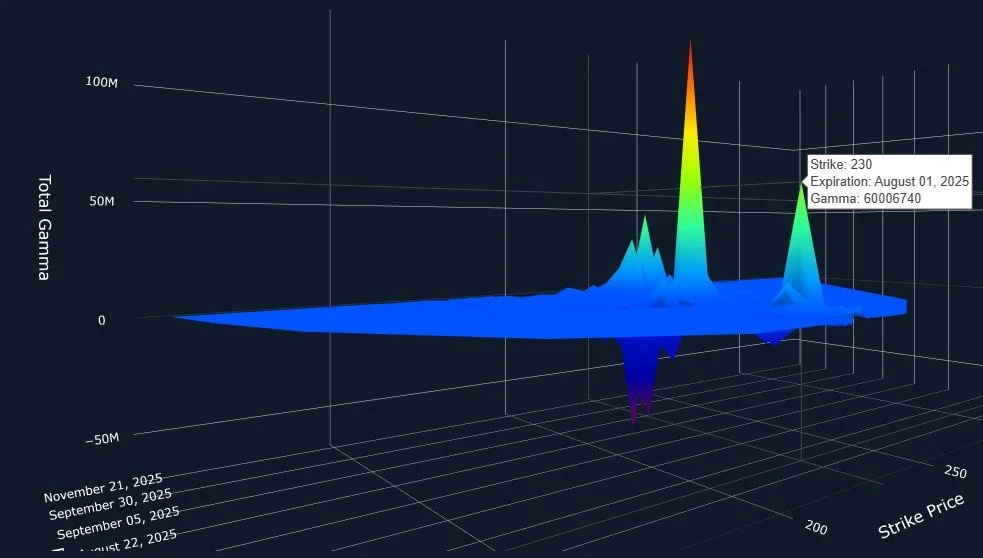

IWM still appears to carry the greatest bullish potential based strictly on GEX and indicators like the Keltner channels, which are rising in bullish fashion, with a range of 230-233 likely on the upside.

Today’s close below the Hull Moving Average opens the door to potentially starting a more significant downward move, though the closing price was too close to the line to draw any definitive conclusions.

A meaningful gap lower tomorrow may open the door toward 210 within a few days, otherwise, 230-233 remain solid upside targets.

A lack of meaningful GEX above 230 raises doubt as to how quickly we will surpass and hold a rally beyond 230.

The odds of a spike toward 230 are still good despite several days of consolidation. A spike toward 230 might mark an important reversal before looking at higher targets again, if IWM rejects a test of the 230 GEX cluster (we see more GEX at 210 than at any price above 230).

230 has shifted to reflect a meaningful cluster this Friday, 8/1, and the largest cluster at 8/15.

Participants appear to suggest IWM has a good shot at 230 sometime in the next two weeks.

SPX is within a tight technical “sandwich” between the upper Keltner at 6412 and the Hull at 6364.

A break below 6364 may signal the beginning of a pullback, otherwise momentum continues to favor the less than 2% overshoot toward 6500.

Our GEX Data Graph shows the positive SPX GEX cluster at 6400 (today’s high was 6401) as key toward hitting 6500 or beginning the pullback immediately, given SPX closing slightly below the 6400 cluster.

Lastly, the 4-hour VIX chart shows the important 14.98 Hull holding, though conflicting with the Keltner channels in terms of which direction is the most likely immediately break.

As long as the VIX is above the 4-hour Hull, I maintain a bias toward higher VIX levels, though a break of the VIX toward the downside may reach 14.50 or less.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.