Melt-Up Mode Meets VIX Divergence?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our top subscription!

Today’s YouTube video can be viewed by clicking here. We mention different perspectives than shared in the newsletter tonight, and we also cover TSLA (which reported earnings after the bell), so check it out!

Current State of QQQ:

Rising Keltners are close to the 570 GEX cluster, deep within the upper Dealer Cluster zone

Today saw an incremental high over the high 2 days ago, though after hours action saw a boost following TSLA and GOOG earnings

GEX is more heavily weighted toward the positive side, though declining positive GEX as we look up the chain raises uncertainties about the next area for possible reversal lower

If after hours strength continues, we may reach and slightly exceed 570 tomorrow

Upside still appears to be limited to 1%-1.5% higher than today’s close with risk to the downside still present

IWM had a decisive breakout over the Hull Moving Average following yesterday’s close barely above the Hull.

We’ve been highlighting IWM as the index with the greatest upside potential in the near-term given the bullish rising Keltners and the proximity of upper Keltner resistance to the largest upper Dealer Cluster zone at 230, which appears likely to be hit following today’s close

We must note that option market volume is still skewed more toward lower strikes than toward strikes higher than today’s close

A tag of 230 might be a good reversal area given the late covering of shorts and reduction of negative GEX recently for IWM (a contrarian signal) as well as a lack of substantial positive GEX above 230

Volume and GEX seem to support the notion of a buyable dip in the 210-215 range

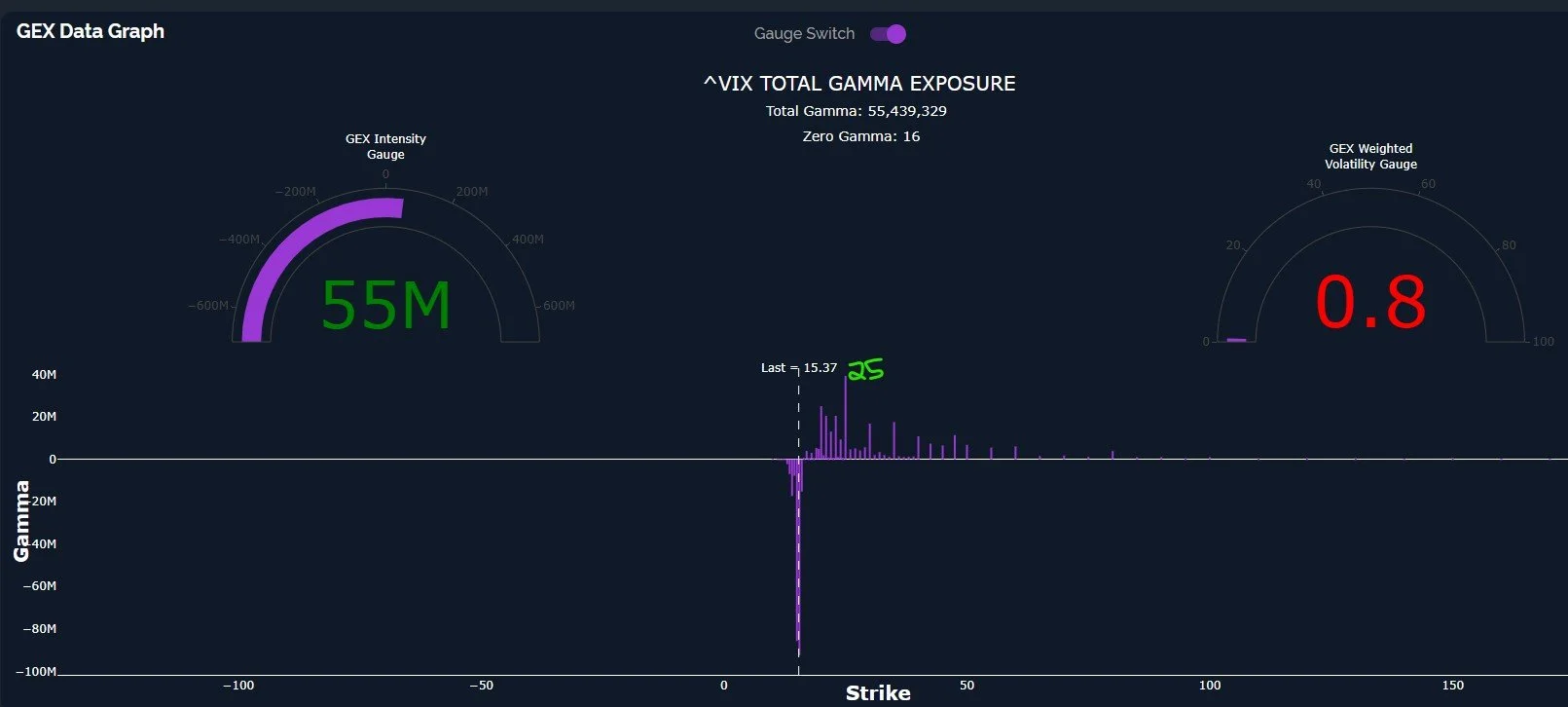

The VIX shows nothing short of capitulation by volatility bulls- they’re more afraid of having to pay for protection than they are of a market decline (alright, I’m kind of joking here)

The VIX 4-hour chart shows the VIX almost to the 15.11 lower Keltner channel, which has been a good guide for VIX reversals in the past, with some exceptions

Zooming out to the weekly chart- the proximity to the Hull at 14.85 introduces an important support and/or pivot point- the VIX losing 14.85 may introduce a multi-week downward move in the VIX, though odds likely favor a reversal between 14.85-15.11 given indices proximity to their own upper resistance levels

Another interesting factor related to today- the VIX swung from -132.7mm negative GEX to positive 58.6mm, a big swing in volatility bulls favor just as the VIX is sinking to new recent lows. Quite the divergence!

VIX 25 currently shows the greatest positive GEX cluster, and the largest negative GEX resides at the 15 and 15.5 strikes, with very little below

Our skepticism expressed yesterday regarding meaningful downside was correct, though the steep and rapid ascent toward the upper Dealer Cluster zones as the VIX plunges to recent lows raises concerns of a potentially sharp pullback sometime between now and the end of July. We still view any such pullback as a buying opportunity for another rally into the Fall or year end, and we’ll continue updating our members and community with what we’re seeing.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.