QQQ: On The Edge?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our top subscription!

Today’s YouTube video can be viewed by clicking here. We’re going to experiment with a slightly different format today as we attempt to condense our observations into shorter bullet points. This may mean fewer jokes (and we know those are really good jokes), so hopefully you’ll survive! Regardless, we appreciate feedback when you share it with us, and we’ll be attentive to listening to your comments in all aspects of our offerings and Discord community.

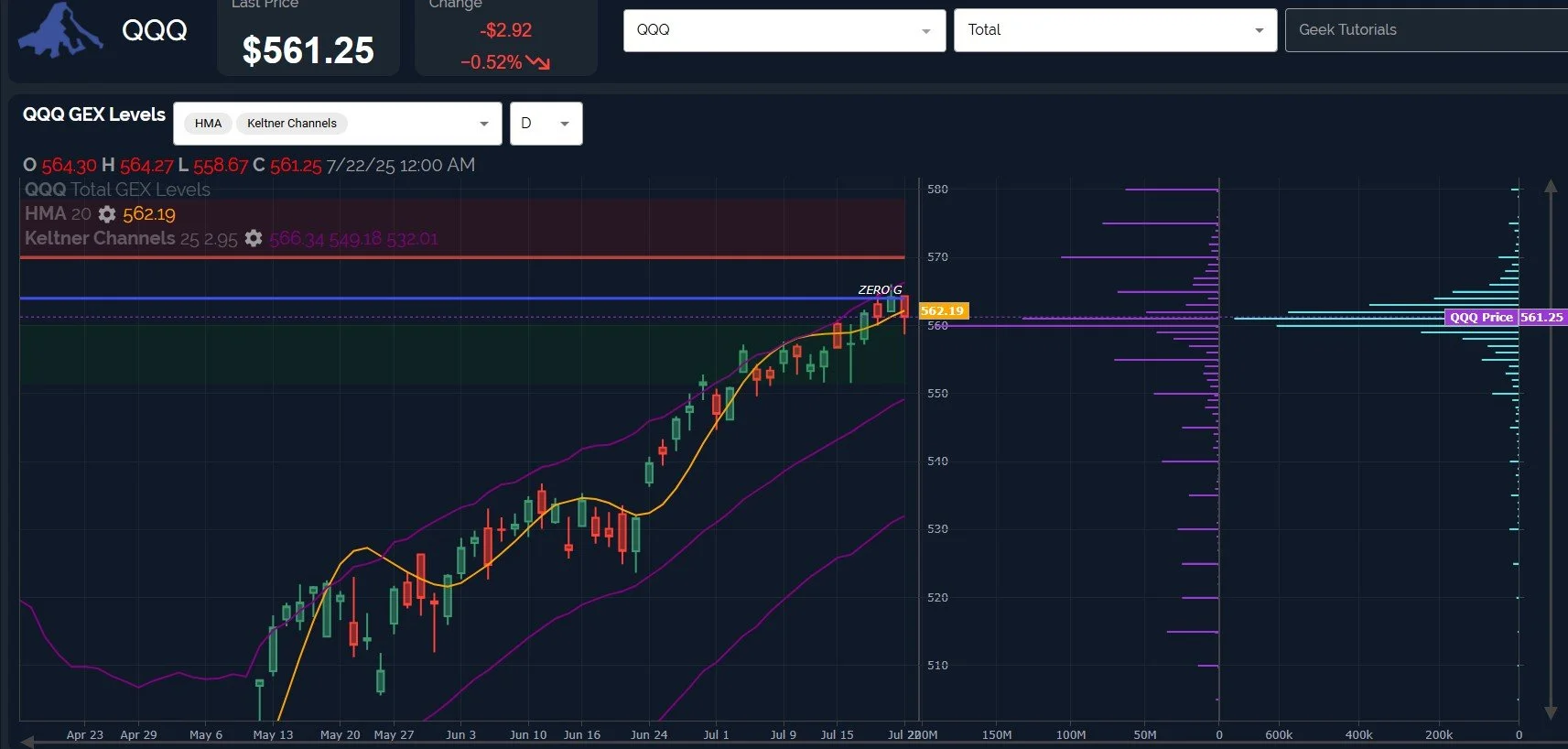

Current State of QQQ:

Keltner channels are still in a solid bullish uptrend since mid-May

GEX (gamma exposure) is still larger at 570 and 575 than at any negative strike, though note the fairly even distribution of GEX across every 5-point increment between 500 and 555, whereas positive GEX is almost nonexistent above 585

Today’s close below the yellow Hull Moving Average is potentially bearish, though the close wasn’t very convincing, as we’re still close to the line

QQQ plunged into negative GEX territory for the first time in quite awhile, though most of this is concentrated at the 0 DTE strike.

It’s still worth noting that the median negative GEX strike between 500-555 has more GEX than strikes above 580.

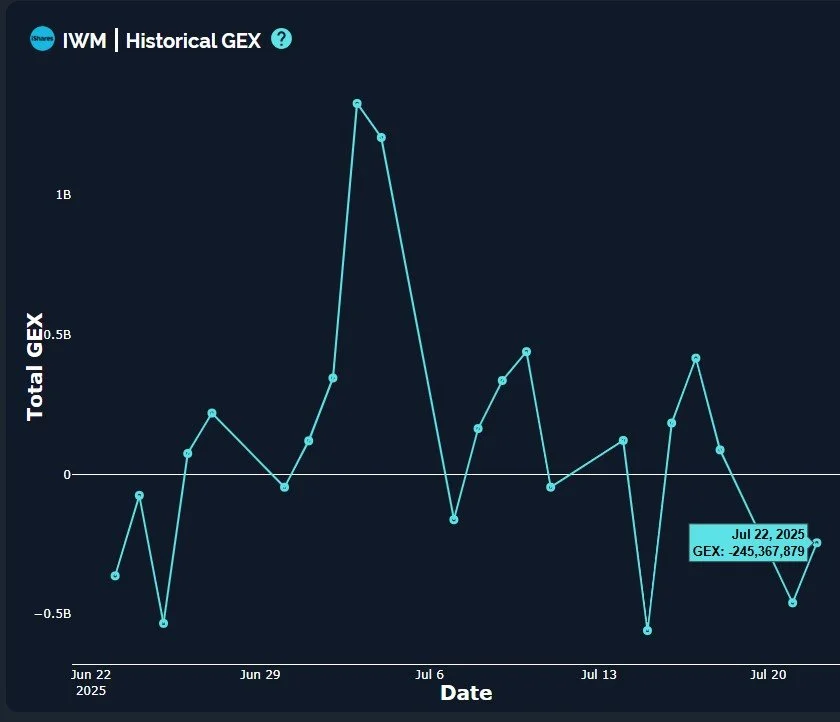

IWM staged an impressive rebound, closing just above the Hull, though barely.

Both QQQ and IWM printed lower lows and lower highs today.

IWM continues to show the most bullish near-term scenario with the Keltner channels aiming for 230 by Friday at the latest.

IWM GEX remains mired in negative territory, though not deeply negative.

IWM’s GEX picture still shows most of the 230 GEX to be clustered around August 15.

We’ll continue watching IWM for possible advanced signals regarding the next directional move that may end up applying to other indices as well.

The VIX is still hugging the Hull, also coinciding with the big GEX at 16-17.

Options market activity has been elevated at almost exclusively higher strikes.

The VIX continues presenting a potentially contrarian bullish setup for volatility and a bearish setup for indices.

We may be hard-pressed to see substantial downside right before major earnings reports, starting with GOOG and TSLA tomorrow and a large number of others in coming days. July 31-early August appears to be the timeframe with the heaviest concentration of earnings reports, so any shallow pullback may end up being an opportunity between now and then.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.