Cracks Emerging In The Never-Ending Rally?

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re currently offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Take advantage now, deal with the summer heat on your own, but let our tools remove some heat from your portfolio! Enter code SUMMER2025 at checkout to lock in a great annualized cost for access to our top subscription!

Today’s YouTube video can be viewed by clicking here. We cover some of the major indices, the VIX, and several major tech names, so give it a look if you have a few minutes!

The last couple of weeks haven’t been nearly as easy as one might assume if they simply read the latest “Market Hits New All-Time High!” headline. The S&P is 0.30% higher since July 4, QQQ is 1.5% higher (the winner, I guess), DIA is flat, and IWM is actually lower. Not exactly an easy upward trending market for the better part of 2.5 weeks, with very few exceptions.

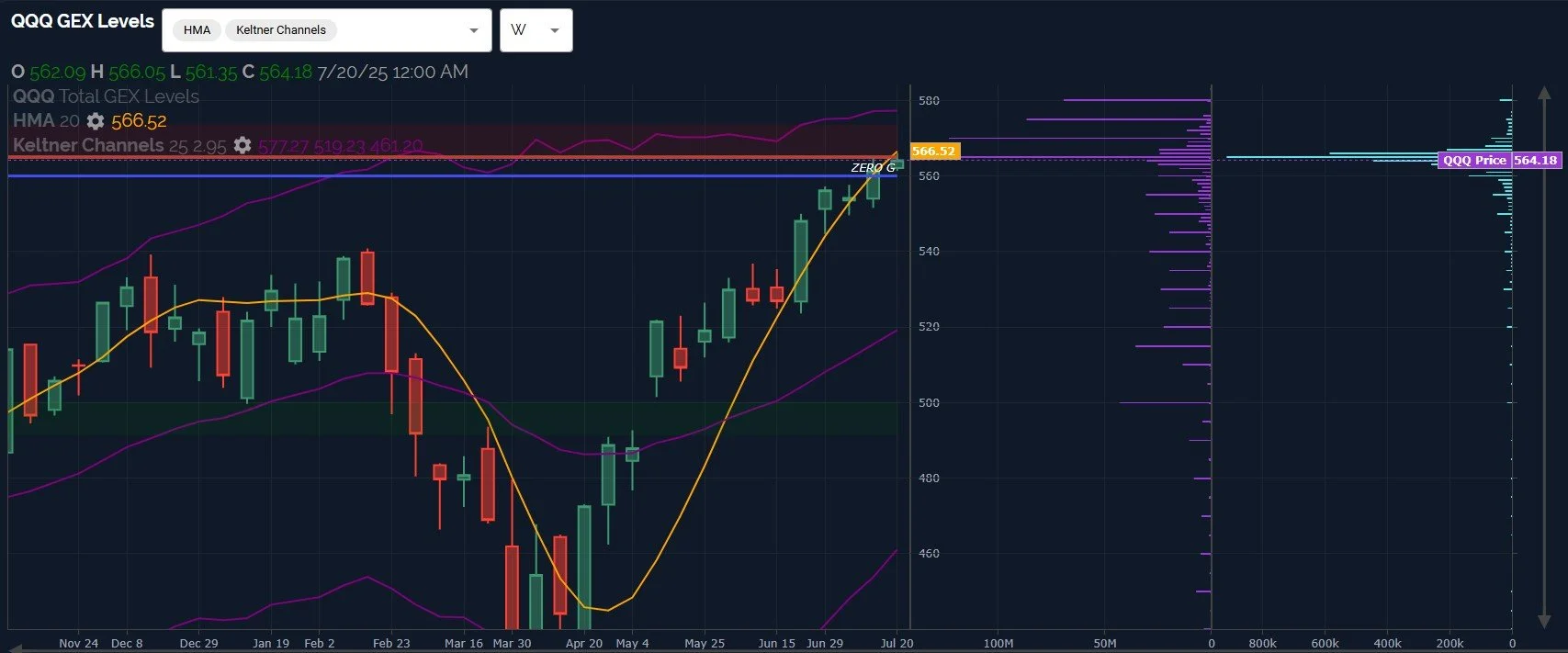

Glancing at QQQ’s daily chart, nothing overly concerning, and QQQ has performed better than other indices. One warning sign I see is a rejection of the upper Keltner channel and the upper Dealer Cluster zone at 565. GEX drops off sharply toward 570, possibly signaling uncertainty regarding the odds of reaching 570 in the near term. 570 is still a big positive cluster relative to everything below 565, but for now, 565 should be treated as important resistance, in my view.

QQQ’s weekly chart is where I think things get interesting. We spent a lot of last week below the weekly Hull Moving Average (the yellow line), yet we closed above it, negating the short signal generated by a close below the weekly Hull. Yet today, we’re back below it again. The Hull is rising, and you can see an example in early December 2024 where we closed below a rising Hull, challenging the short signal with a rise back above it before dropping further. 520-525 would be the next ultimate target if we can stay below the line, and GEX supports that idea on a speculative basis. With earnings for most major companies coming up at the end of July/early August, we might not see much follow through to the downside (barring an unforeseen or unappreciated development, like Powell resigning or something similar), so the merits of repositioning net short may have some serious challenges at the moment.

Let’s add SMH into the warning pile for QQQ, which closed below the daily Hull last week and closed again below the Hull today, failing its attempt to retake the line. We were fairly close to the 295 upper Dealer Cluster zone, close enough to be cautious of a pullback from this area. Look at the volume at 280 today (the light blue horizontal line). If semis still lead QQQ, we might see downside before earnings season, then a “final” rally thereafter (alright, I’m speculating again, I’ll stop).

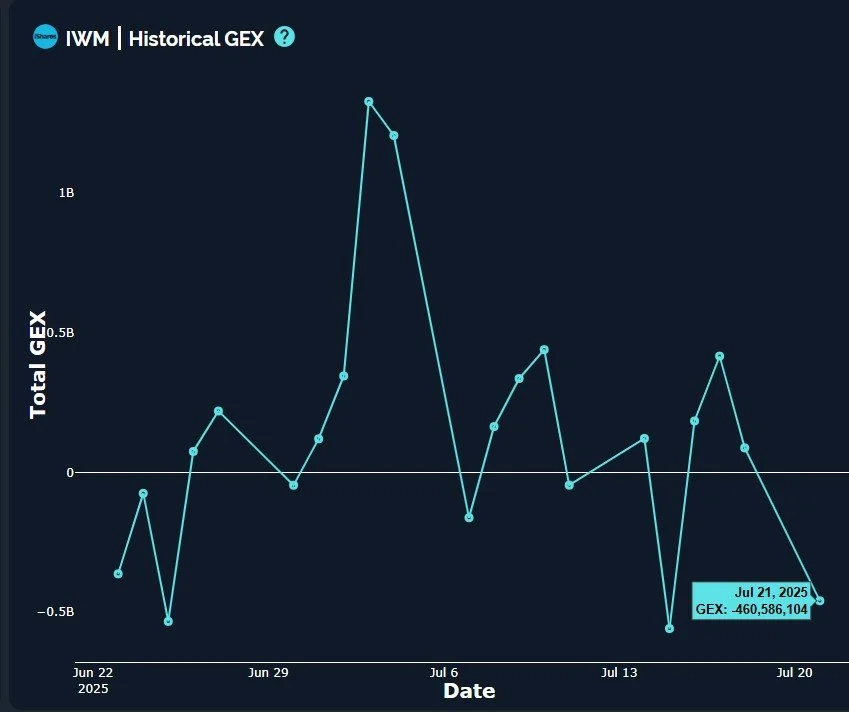

Can’t I find some rainbow & roses data point to highlight? Nope, not tonight, sorry…Let’s appreciate our gains to this point and look at the negative opportunistically, but you won’t receive any dose of Cramer in this edition. IWM daily volume is bifurcated, with a large amount of volume at 211-213 as well as the few strikes surrounding today’s range. IWM tried to retake the Hull that it lost Friday but without success, rejecting the Hull this afternoon and closing below Friday’s low. I love sales, so I wouldn’t mind buying a quick drop to 210, but it’s still too early to say. Early signs are encouraging for bears and may have bearing (sorry for the bad pun) on other indices as well, including SPX and QQQ.

IWM had a sharp drop back into negative GEX territory, divergent from QQQ’s sharp increase in GEX. SMH also saw a sharp decrease in net GEX, similar to IWM in terms of magnitude, so which one is telling the truth- QQQ or SMH? Anyway, to maintain focus on IWM, IWM has signaled weakness ever since losing the July 3 high, vacillating between positive and negative GEX with the negative spikes larger than the positive spikes.

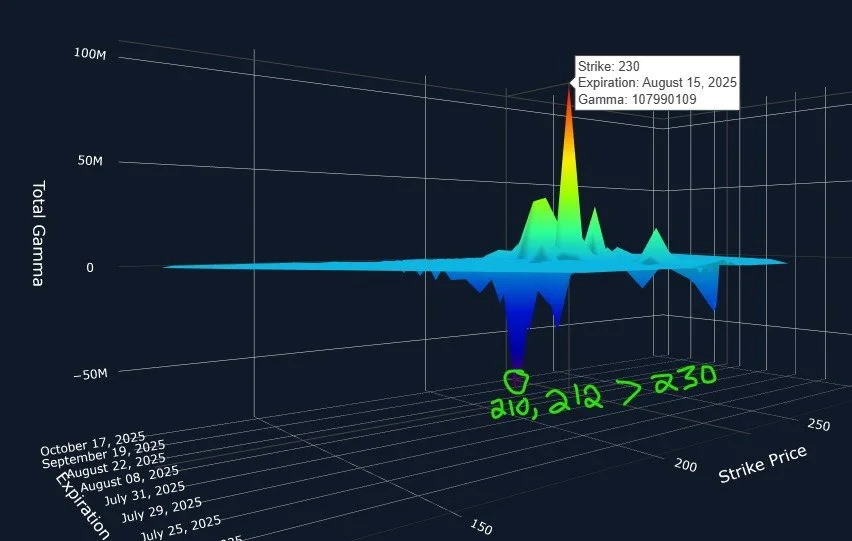

I also notice the negative GEX for August 15 at the 210 and 215 strikes for IWM are larger combined than the positive GEX at 230 for the same date (or even when you add August 1 to the positive total). Seems like participants are shifting back toward expectations of a pullback for IWM. We’ll continue monitoring and sharing intraday developments in Discord, we hope you’ll join us there using the link below.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.