Newton’s 3rd Law & Quad WItching: September 19 Stock Market Preview

SPECIAL FIRST-TIME MONTHLY ANALYST PROMO- Exclusively for newsletter subscribers who’ve never joined us- interested in checking out our website and Discord community but you’re not sure about spending $99-$199? Enter code FIRSTTIME25 at checkout to try our monthly Analyst subscription for ONLY $25 for the first month! You can cancel anytime. ENDS SOON!

Tonight’s YouTube video addresses key aspects of what we observed today across major indices that is complementary to what we discuss in tonight’s newsletter, so check it out if you get a chance!

Newton’s third law states that “for every action, there is an equal and opposite reaction.” Are we going to discuss this in the newsletter? Not at all. We’re not philosophers and nor do we want to compete with Howard Marks and his periodic notes.

Alright, for those not entirely disappointed (yet), let’s dive into GEX and some key possibilities going into tomorrow.

The VIX retested the weekly Hull Moving Average premarket Thursday, rebounding over a point as the day went on, closing near highs.

A bit strange, isn’t it? With indices positive? The VIX high of the day correlated with a retest of the declining Hull Moving Average on the 4-hour chart, leaving some indecision in play, though the 2-hour, daily, and weekly charts for the VIX remain on a buy signal for volatility.

While Wednesday’s VIX spike almost reached 17 before rejecting and closing below the 9-period SMA, today saw the VIX rise again to bump back up against the 9-SMA from below, so we can’t be certain whether or not the bullish VIX close right below resistance will lead to a down day for markets Friday or another push higher to close above the 9-SMA for the first time in 7 weeks.

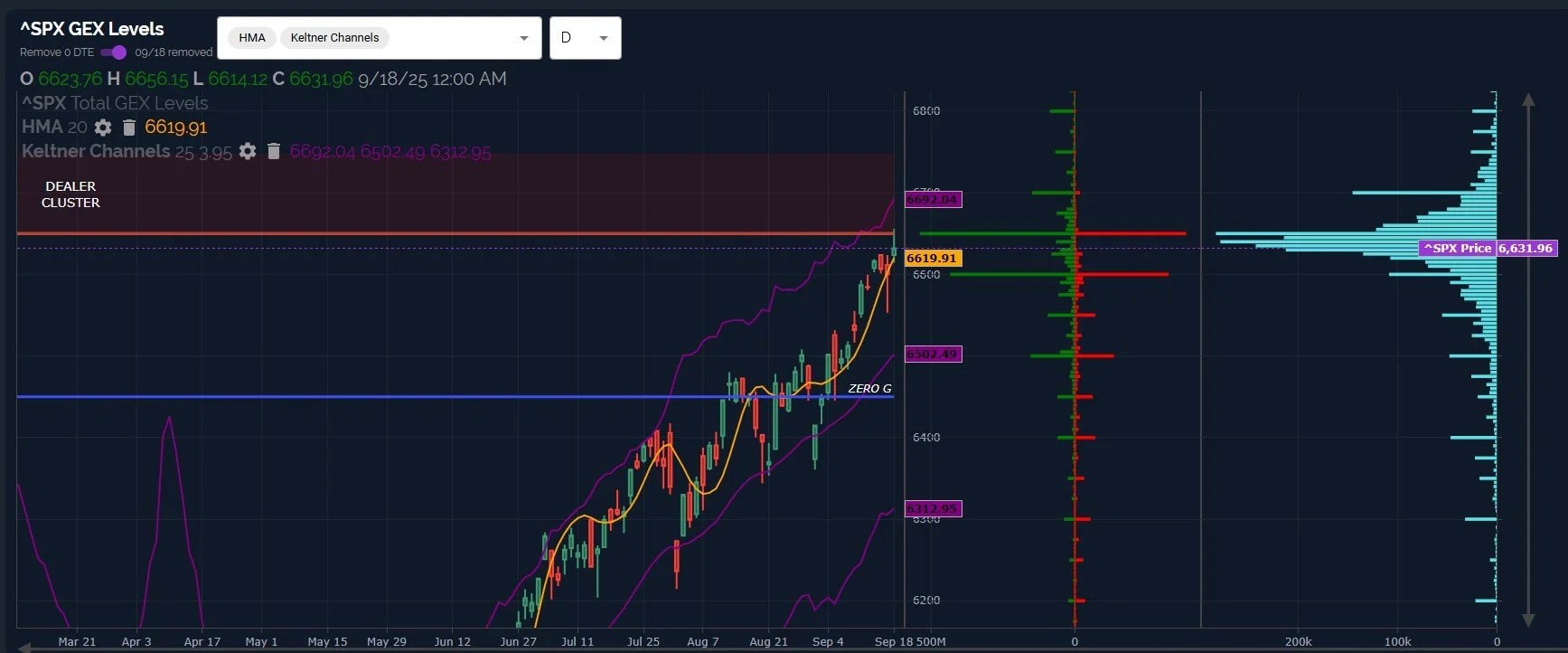

SPX tested the big positive GEX cluster at 6650 before fading, still closing above the sharply rising Hull on the daily chart.

Volume at 6700 is worth noting for Friday, though GEX drops off rapidly after 6650, leaving a question mark as to whether or not we can test 6700 tomorrow.

The upper Keltner channel is at 6692, matching quite well with the GEX at 6700, and momentum has been to the upside, so the odds favor an attempt higher even with the uncertainties of the VIX and the smaller relative size of 6700 compared to 6600-6650.

A gap down Friday would likely place SPX below the Hull, diminishing the odds of conquering the Hull and tackling higher targets in the same day, though the pattern is clearly bullish with possible targets approaching 7000 into December.

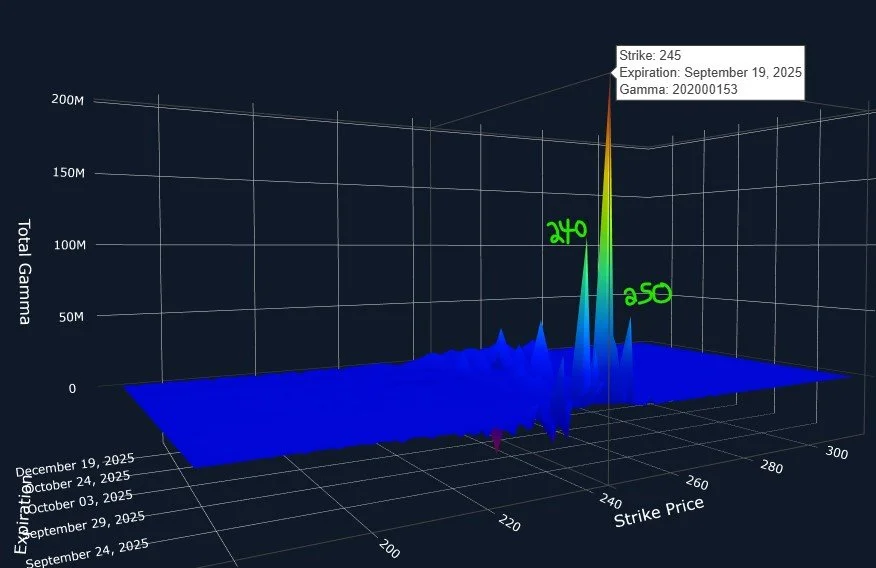

IWM didn’t give bears a chance today, gapping back above the Hull and the positive GEX at 240, paving a pathway to 245, with IWM closing at highs.

GEX has grown at 250 and the upper Keltner is at 249.67, good confluence heading into OpEx Friday.

From a contrarian perspective, the massive surge in IWM GEX is a bit of a red flag, at least I can’t remember seeing this big of a number over the last 2-3 years. Even if IWM is preparing to lead the way higher for a final stage of the bull market, this is a bit extreme, reflected as such on our GEX Intensity Gauge as well.

While the Geeks are long IWM, we’d prefer to see some sort of pullback before entering new longs, personally.

Our 3D graph shows IWM 245 to be the largest expiry for tomorrow, interestingly. Not 240, not 250..In fact, 250 is the smallest of the three strikes.

I give GEX clusters on the 3D graph high value in terms of identifying where we may close by certain dates, but the picture shown doesn’t necessarily mean we won’t test 250, only that the current picture assigns higher odds to a close around the 245 area. So be open to various patterns of volatility Friday that may or may not result in one or more of those targets being hit.

We often get a more clear picture as the cash session unfolds, and we’ll be sharing our obervations in Discord in real-time.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video yesterday, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.