Moving On Toward OpEx: September 18 Stock Market Preview

SPECIAL FIRST-TIME MONTHLY ANALYST PROMO- Exclusively for newsletter subscribers who’ve never joined us- interested in checking out our website and Discord community but you’re not sure about spending $99-$199? Enter code FIRSTTIME25 at checkout to try our monthly Analyst subscription for ONLY $25 for the first month! You can cancel anytime. ENDS SOON!

Tonight’s YouTube video looks at the aftermath of today’s choppy FOMC announcement, also taking a look at some long and short ideas with BIDU, ASML, and more.

SPX and QQQ appeared to be breaking down at one point today, eventually recouping a lot of the downside to close barely red, though still below the 6602.74 daily Hull Moving Average.

Volume was heavy at 6650, and with the upper Keltner channel at 6677 and GEX at 6650 and 6700, a pathway exists to see higher prices into the end of the week.

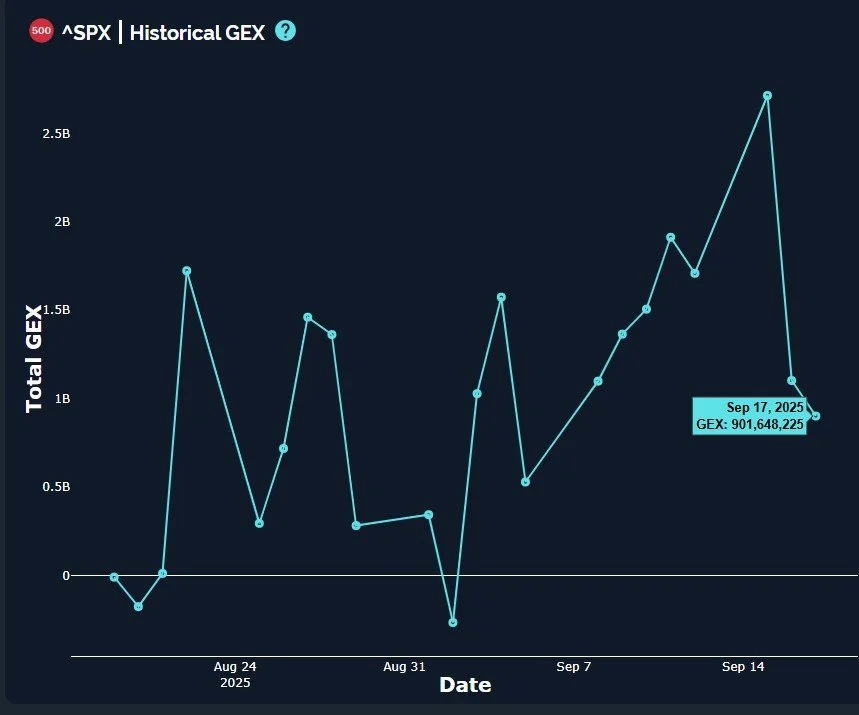

Despite the possible pathway higher, GEX ticked lower for the 2nd day in a row. We haven’t seen two days of movement in the negative direction since August 28-29.

In summary for SPX, we may see another push toward 6700, but a pullback appears imminent, even if it begins from a slightly higher level (6700 is barely 1.5% away).

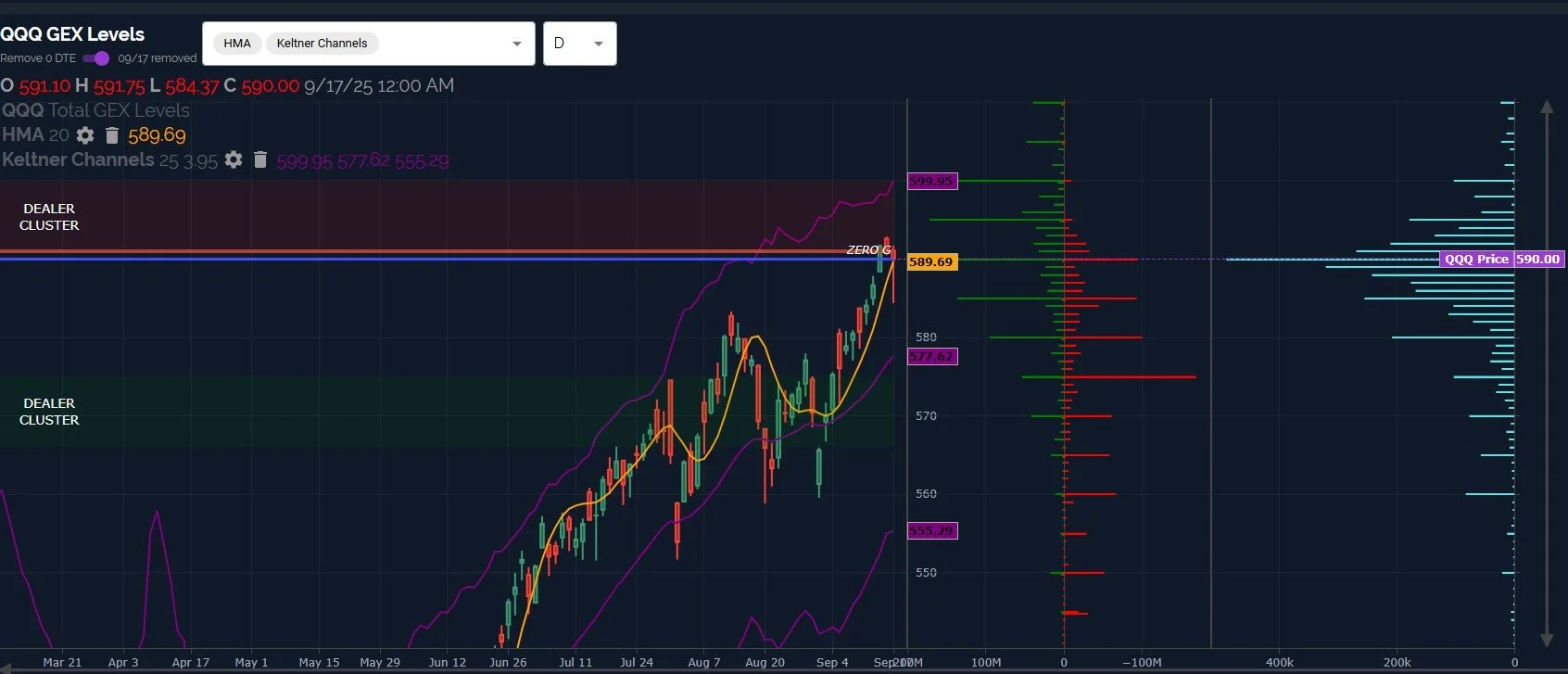

QQQ saw very similar performance toda, with one distinction: QQQ closed ever so slightly above the sharply rising Hull.

Both SPX and QQQ are close enough to the Hull that we can view price in relation to the indicator as indecisive.

QQQ still has meaningful GEX at 595 and 600, and today’s low matched quite well with what GEX was telling us earlier in the morning.

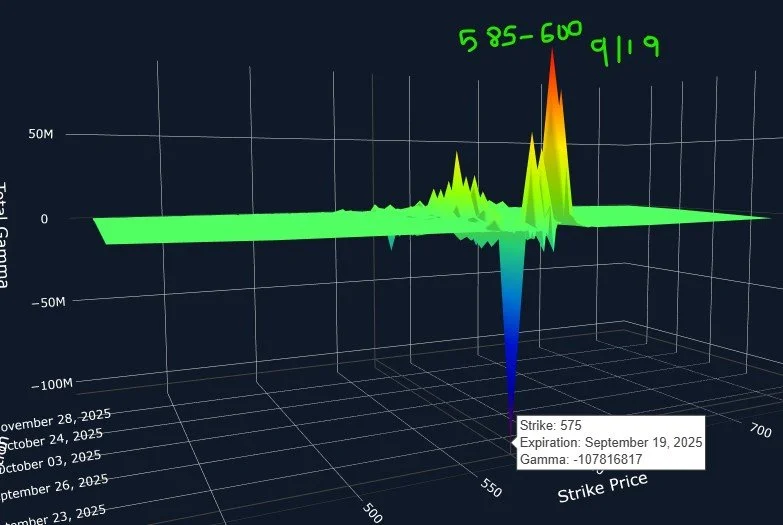

Our 3D graph, which shows individual GEX clusters at each strike and expiration, reveals 575 to be the single largest GEX cluster expiring Friday, though it’s worth noting that the positive GEX at 585-600 combined is larger.

While the 3D graph certainly raises some questions about which direction will win into Friday, we can narrow down a likely range of 575-600 based on today’s GEX structure.

IWM saw a spectacular move today, and the move was advertised very early on, with a huge GEX cluster at 244 sticking out like the Eiffel Tower compared to everything else on our GEX data graph. We also had this preview early enough to discuss it in Discord and our live stream comfortably before the move actually happened.

After briefly exceeding the 244 target, we saw a rather impressive and surprising retracement of nearly the entire move up, which I have to admit does not look bullish. We also fail to see meaningful increases in positive GEX anywhere on the map, potentially raising the odds of a pullback beginning imminently.

IWM also closed below the Hull, though I do think it’s worth noting that IWM didn’t make a new low today compared to yesterday. Volume (the blue bars) at 233 and 236 were elevated, possibly indicating downside targets in the near future.

Join us tomorrow and we’ll continue sharing insights with the latest real-time GEX data from our dashboard!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video yesterday, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.