Powell, Gov’t Shutdown, Rising VIX..Does It Matter? September 23 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

Tonight’s YouTube video covers several individual stocks as well as a different view of SPX (though incorporating the same GEX data), so check it out if you have a few minutes!

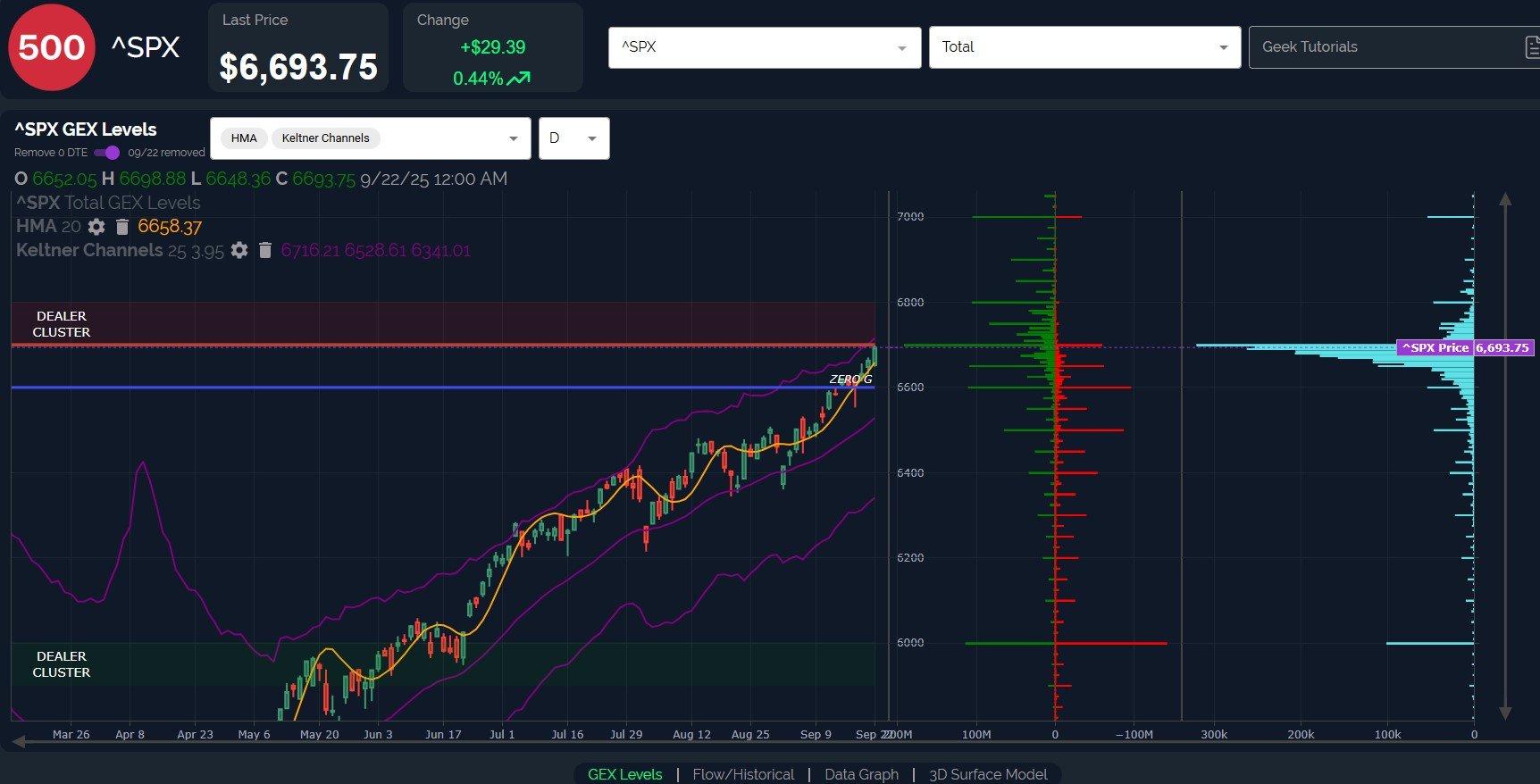

Indices are quickly approaching the next large GEX clusters we observed after OpEx Friday, with SPX approaching 6700, QQQ conquering 600, and IWM approaching 245 again on its way to 250.

SPX in particular (with 0 DTE toggled off, to show what awaits us beyond today) shows the outsized GEX at 6700, and a large cluster at 7000, though everything else between 6600-6800 is equal in size, about half of what we see at 6700.

Conclusion? SPX GEX is reflecting a bias to the upside by participants, though we need to watch what happens around the current 6700 area to determine how quickly we’ll reach 7000.

The presence of the rising upper Keltner channel right at the 6700 upper Dealer Cluster zone certainly increases the odds of another modest pullback (or more) before continuation higher. Let’s look at some other important factors.

IWM has been remarkably strong, converting many religious bears to bulls as of late, and the trend remains higher. GEX has shifted toward a pronounced positive cluster at 250, also matching the upper Keltner channel.

IWM has been a good “truth teller” in the past for us, often giving clues as to what lies ahead. We can’t ignore the many days on end of seeing repeatedly high daily option volume (the light blue lines) in the 225-235 area.

We can’t say for sure if option volume will translate to a selloff, and GEX at 240 needs to be overcome to open the door to more downside, but the confluence with the lower Dealer Cluster zone and the seasonally bearish timing this week certainly raises the risk that such observations might mean something.

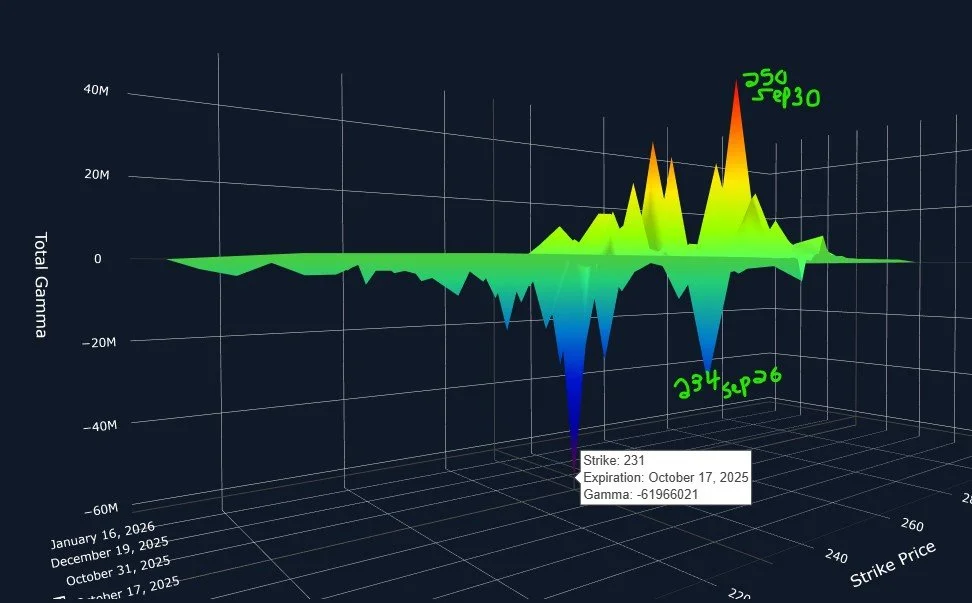

A more granular look at our 3D graph, which shows GEX clusters at each expiration going out for some time, reveals the largest GEX cluster expiring Friday to be a negative cluster at 234. The big positive GEX at 250 doesn’t expire until Tuesday, September 30. Additional lower targets exist toward October OpEx.

Could this be a tidy little “gift” demonstrating a likely drop this week, rally into the last day of September, then more downside? GEX deserves a little humble brag if see it play out this way (if not, this was never written and you saw nothing).

The VIX has risen 3 days in a row, making higher lows and holding above the daily Hull Moving Average, not the look bulls want to see. Of course we’ve been repeating the fact that 14-15 has been a bottom all year for the VIX, and the VIX can rise alongside the market for a period of time, no doubt.

Elevated volume today at 25, 30, and 50 strikes stands out, and it’s also notable that virtually no volume exists below VIX 15.

The 4-hour chart shows the VIX closing the gap from Friday and rebounding, holding a number of key indicators and opening a possible pathway to VIX 17-20.

In summary, indices still look bullish, and we’ve discussed a number of targets that are higher. With negative divergences from the VIX and upper Keltner channels+upper Dealer Cluster zones converging for IWM and SPX, we may be close to yet another pullback before continuation higher. The size and duration of such a pullback is yet to be seen, but for now, it appears that any dip this week may be a short-term buying opportunity for a positive last day or two of the month. We’ll continue updating our Discord participants with our thoughts intraday along the way!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.