A Hint Of Red? September 24 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

Tonight’s YouTube video covers several individual stocks like NFLX, APP, and NVDA as well as a different view of SPX, QQQ and more, so check it out if you have a few minutes!

We saw at least a little red on the screen today, possibly the beginning of a somewhat larger move based on the seasonality, VIX divergence, and resistance on the indices we’ve been noting recently.

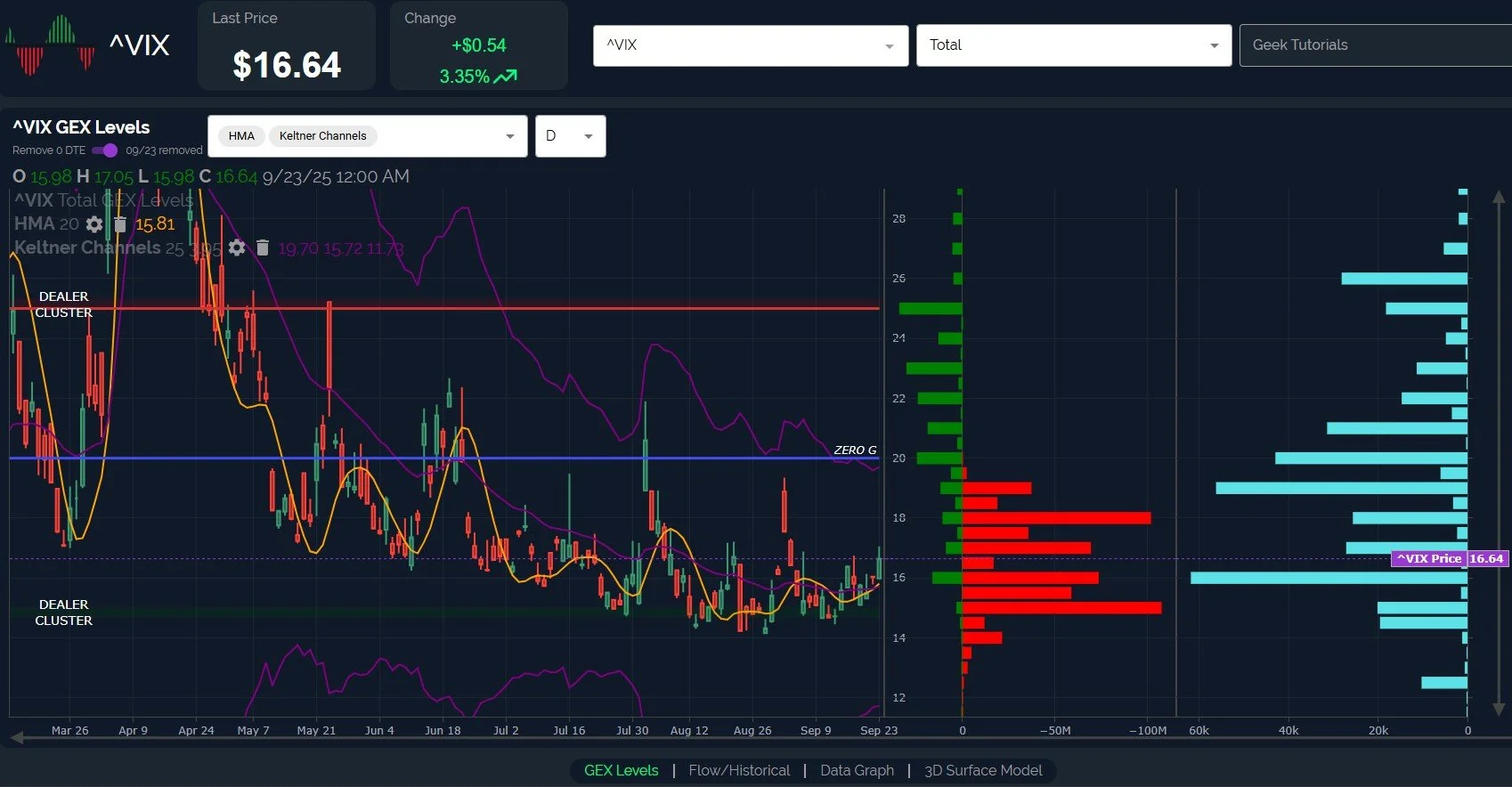

The VIX maintains the bullish (for volatility) outlook with a rising pattern since mid-September.

A large negative GEX cluster at the 18 strike (noted by the red, since I have gross GEX toggled on our chart) may serve as an initial target, also matching the approximate area of the 4-hour upper Keltner channel.

A continued spike to 20+ is very possible if we see indices continue lower.

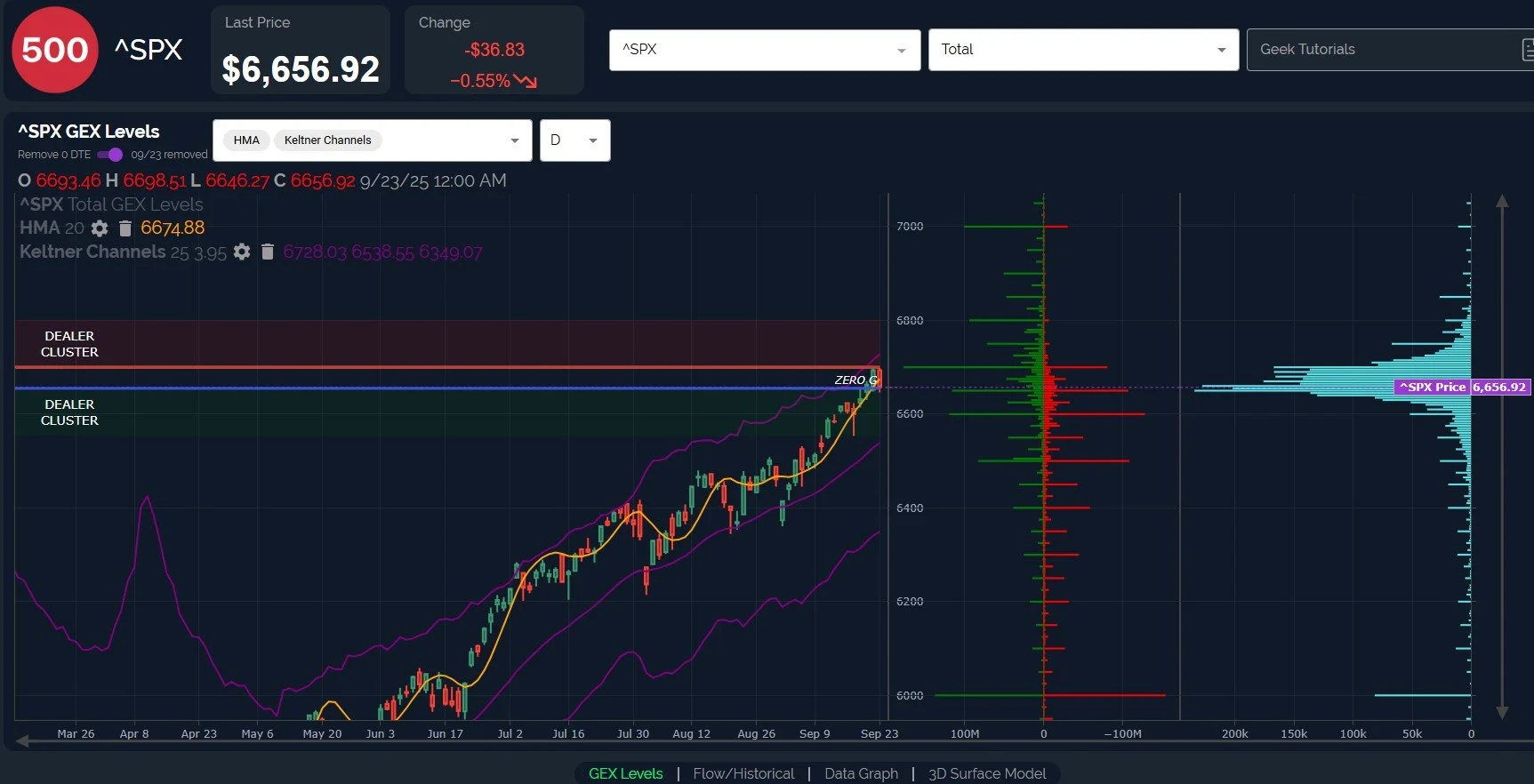

While the odds favor lower on a micro basis, the big picture is still very bullish for indices, with SPX showing meaningful GEX at 6800 as well as 7000.

Most of the GEX at 7000 is clustered around the December OpEx timeframe.

SPX closed about 18 points below the Hull Moving Average, which is not necessarily definitive, though the Hull approaching the upper Keltner in close proximity has often been accompanied by consolidation periods or pullbacks.

At this time, we need to watch 6500 as a possible target for a pullback, fairly modest and potentially a good buying opportunity.

Prior to taking action if and when we reach 6500, we will reassess the current GEX picture, the VIX, and our charts at that time.

A more granular look at our 3D graph, which shows GEX clusters at each expiration going out for some time, reveals the largest GEX cluster expiring Friday to be a negative cluster at 234. The big positive GEX at 250 doesn’t expire until Tuesday, September 30. Additional lower targets exist toward October OpEx.

Could this be a tidy little “gift” demonstrating a likely drop this week, rally into the last day of September, then more downside? GEX deserves a little humble brag if see it play out this way (if not, this was never written and you saw nothing).

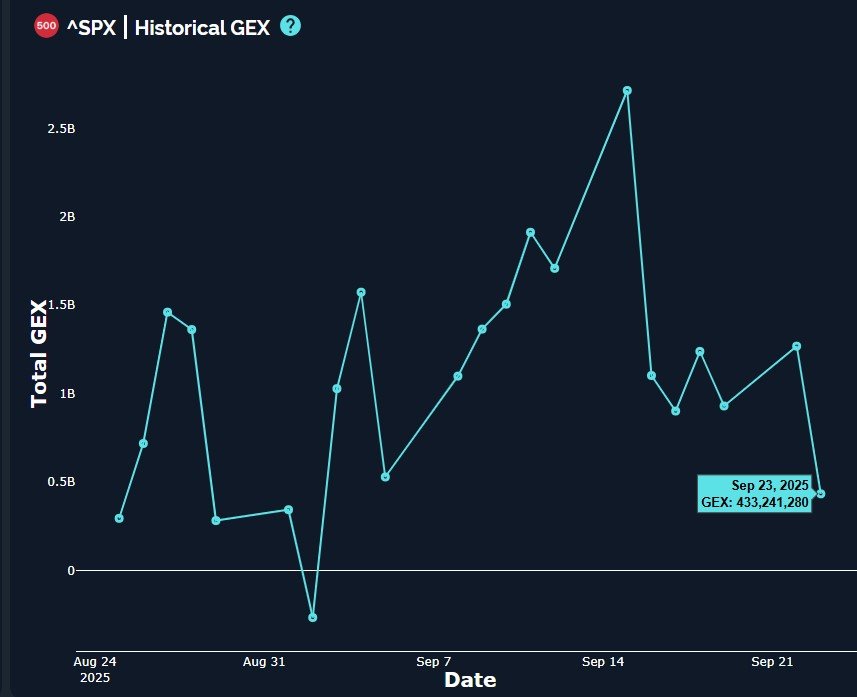

SPX GEX dropped to the lowest level since the negative reading on September 2nd, though we’re currently still in a positive/neutral range that doesn’t rise to the level of being really worried.

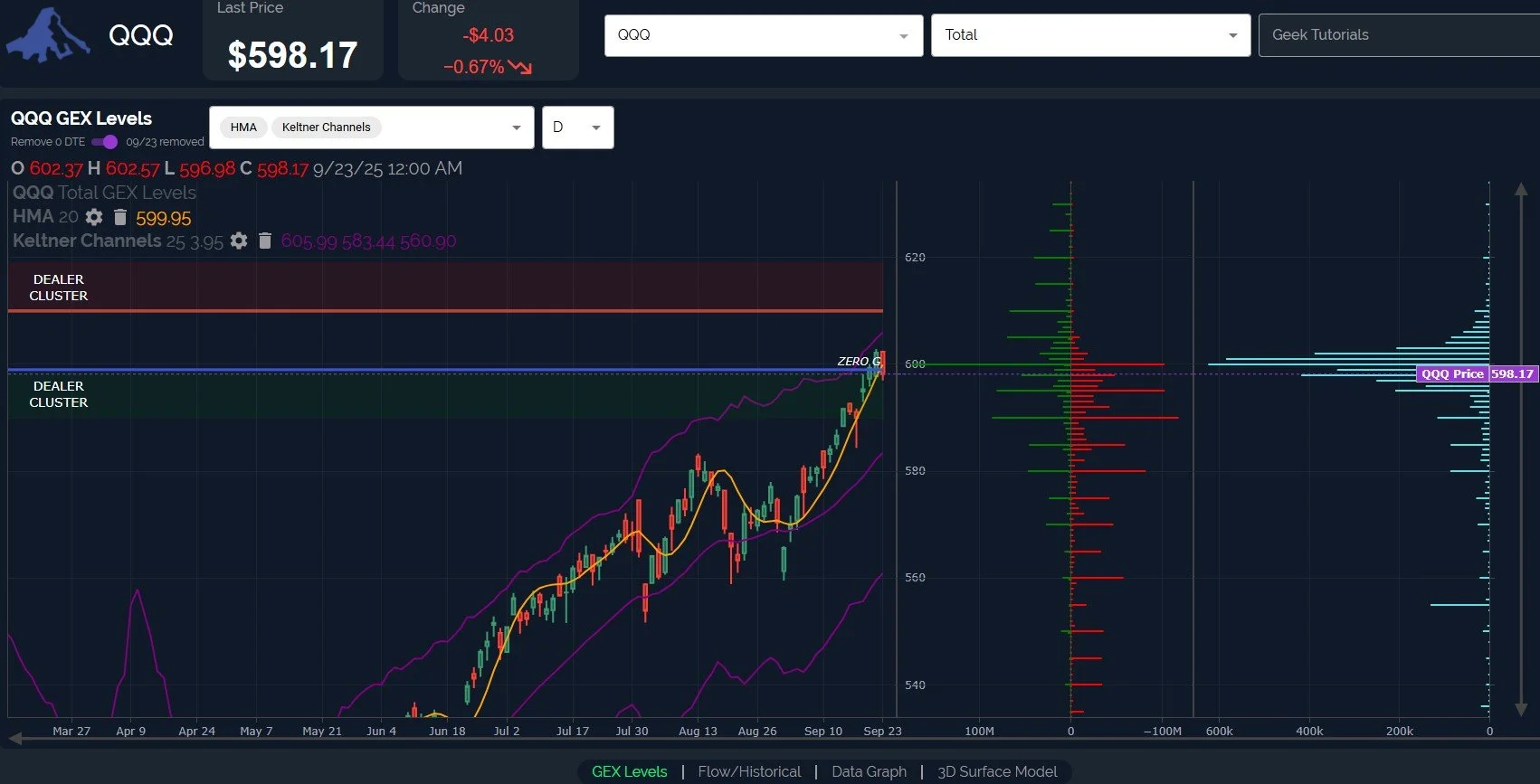

QQQ shows very little above the 600 strike in terms of GEX targets, and we have the same challenge of the rising Hull rapidly approaching the upper Keltner channel, marking a possible short-term pivot lower similar to what we saw around July 10 and July 30.

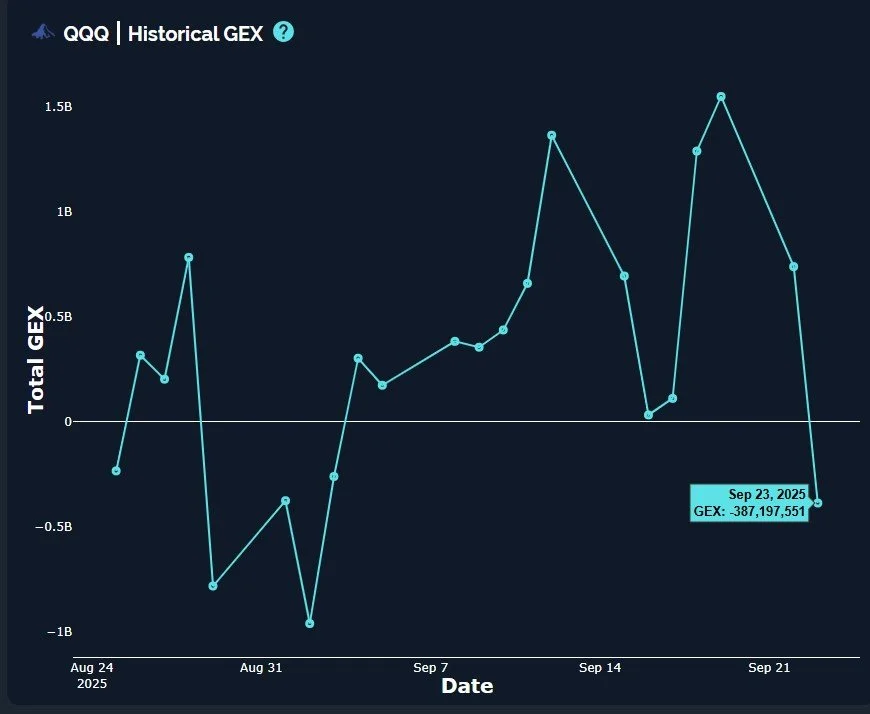

QQQ shows a more dramatic shift in net GEX, dropping into negative territory again, in contrast to SPX’s neutral read. I tend to give more signal “credit” to SPX when net GEX readings disagree, so I don’t read too heavily into this one-day change for QQQ.

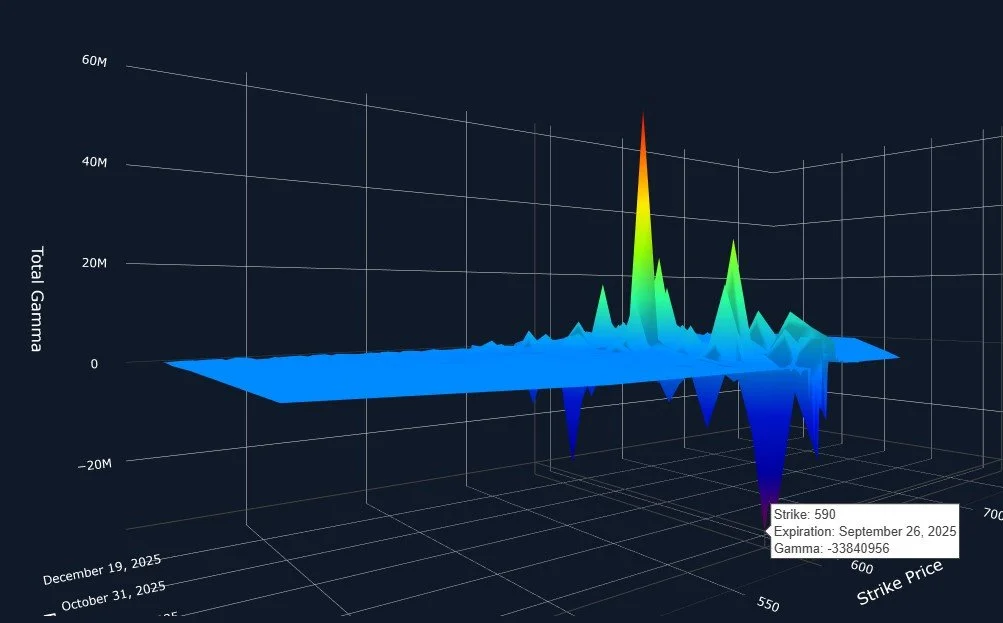

What are some downside targets for QQQ? We can get more granular by looking at our GEX 3D graph, which shows individual positive and negative GEX clusters at each expiration, allowing us to see how GEX is distributed across various timeframes of interest as opposed to a holistic view of total GEX.

Looking at this Friday in particular, we see the largest GEX expiring for QQQ at the 590 strike, closely followed by the negative GEX at the 595 strike.

A GEX cluster appearing prominent on a set date doesn’t necessarily mean the target hits right on that date, but we find our odds are improved by viewing such expirations as possible maximum timeframes to see a target reached. Sometimes we observe target clusters reached a few days after expiration too, so it’s good to realize that improved odds doesn’t necessarily equal a fail-proof crystal ball.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.