JPM 6505 Short Call In Play? September 25 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

Tonight’s YouTube video takes a look at SPX, IWM, HOOD, PLTR, and MSTR, so check it out if you have a few minutes!

Indices continued lower today after triggering a sell signal with yesterday’s close below the daily Hull Moving Average. IWM has now joined the pity party with a close below its daily Hull as well.

Strangely, the VIX actually closed down almost 3% today, strange given the bearish closes for the indices.

It’s important to note that the VIX is still tightly maintaining above the rising daily Hull, keeping the possibility of a VIX spike toward 18-20 alive.

Volume at 18 was especially elevated today, though we saw notable VIX options volume at various strikes all the way up to 50.

Was today’s drop a desperate attempt by VIX shorts to push the VIX down, or a gift freely given to the long volatility charity fund, set to benefit destitute VIX call buyers since April with one last chance to buy before a spike to 20? Just kidding…But the line at 16 remains important as a line-in-the-sand for upcoming days.

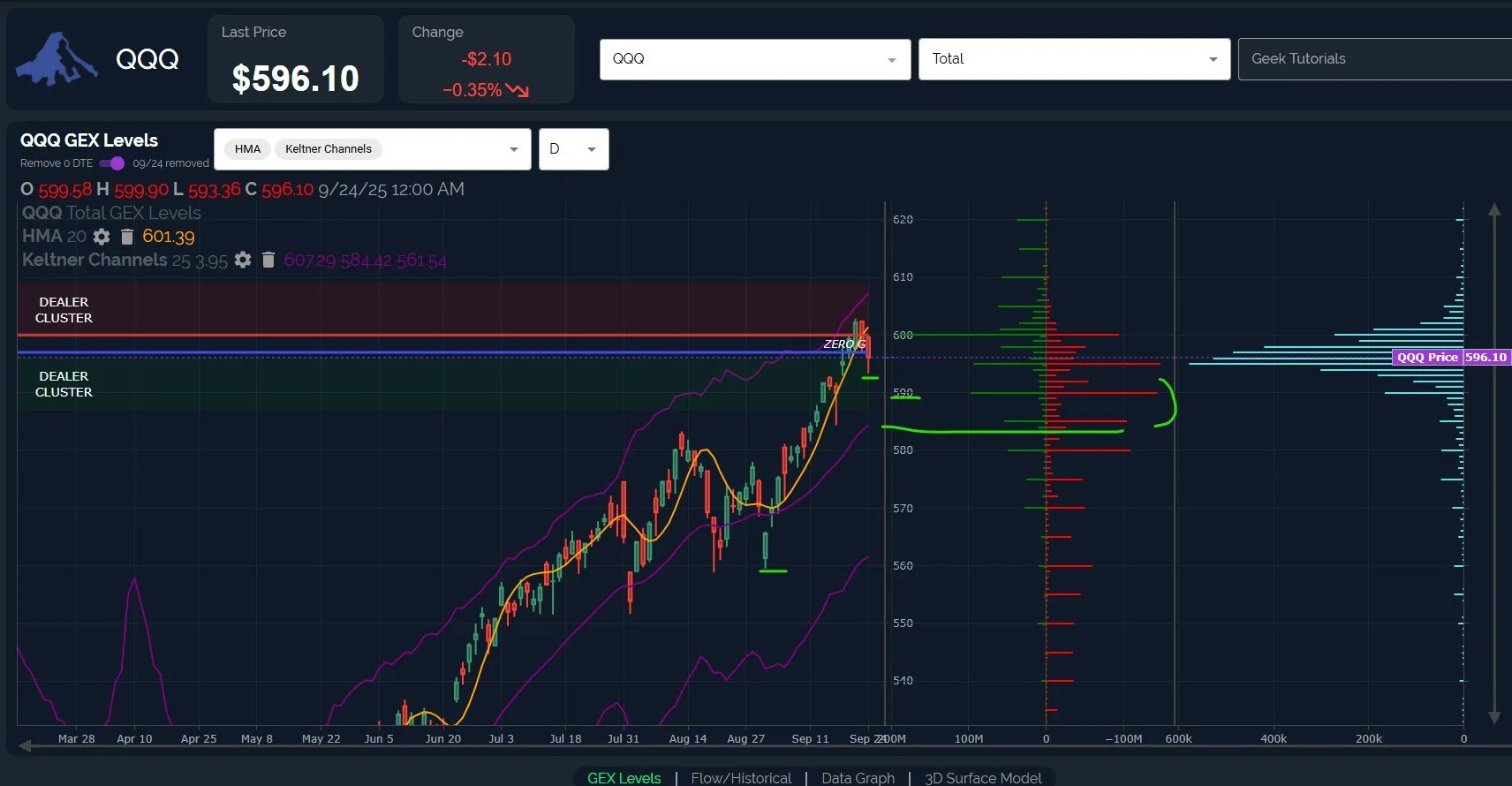

The early week warning we issued about QQQ 590 and 595 GEX appearing to be likely targets is coming to fruition, with 600 now appearing to be a big wall of resistance.

QQQ closed at the lowest level below the Hull since September 2nd, so we do see a meaningful bearish close. While September 2nd marked a low, that low followed a lengthy downward consolidation period, whereas today’s drop is barely 2 days away from all-time highs.

585-590 appear to be good targets to watch in coming days, if downside continues. A tag of this zone likely represents a buying opportunity given the GEX structure at higher levels, especially for SPX and IWM.

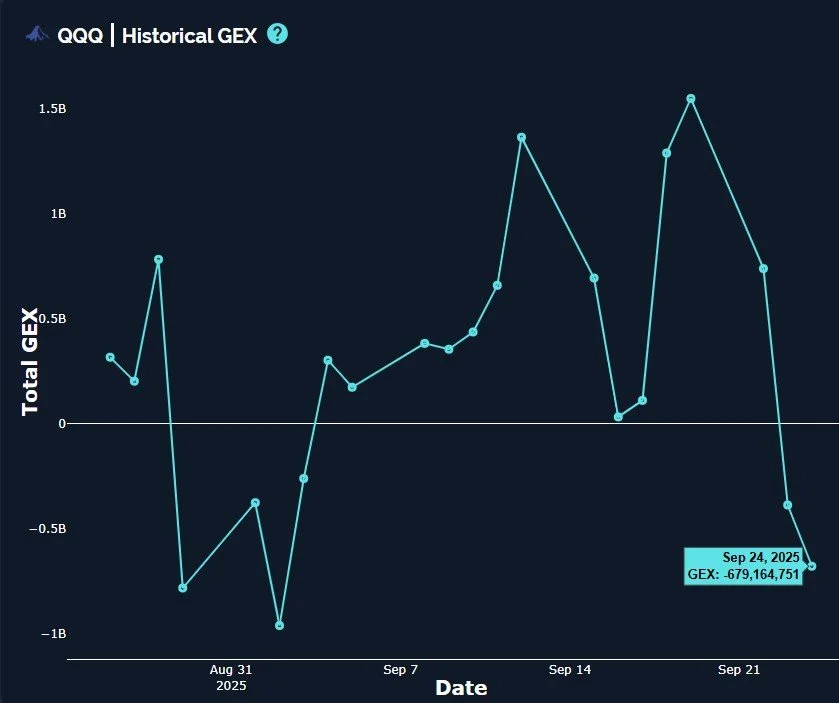

QQQ net GEX continues dipping deeper into negative territory, though QQQ net GEX wouldn’t reach a potential contrarian extreme until we see -3B (not that an extreme is a prerequisite for a rebound now, it just wouldn’t be because of an extreme being reached).

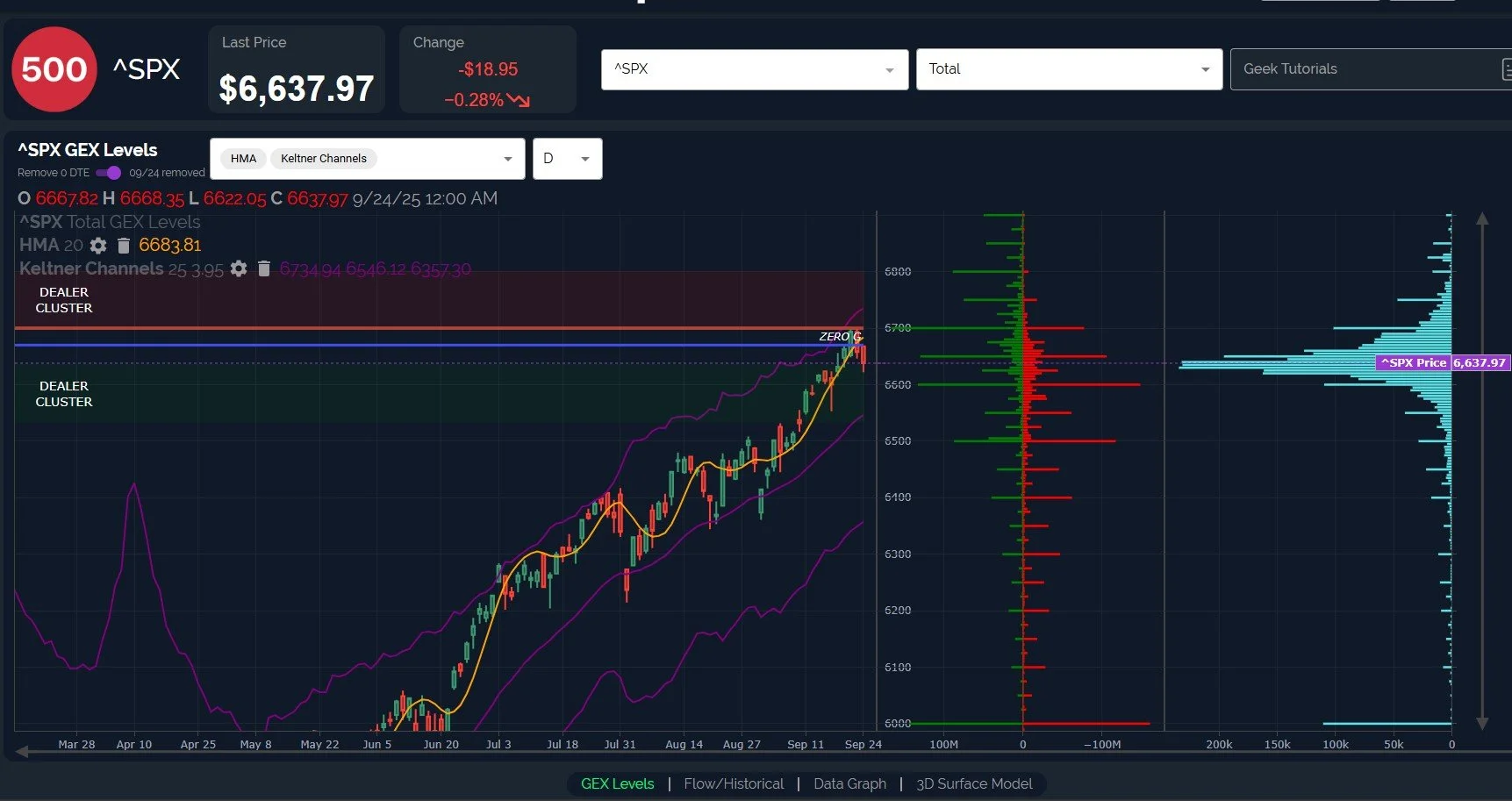

SPX also had the deepest close below the Hull since September 2, so it’s possible we see further downside.

The counterpoint to the close below the Hull is the fact that the trend remains higher, and even a drop toward 6500 is likely a buying opportunity at the first touch of the zone.

GEX backs this view, with substantial positive and negative GEX present at 6500.

If the drop doesn’t get that far, 6600 is also a possibility, barely .50% away at this point. The prudent move would be to wait and see what the price action looks like at 6600 to assess the likelihood of continuation toward 6500.

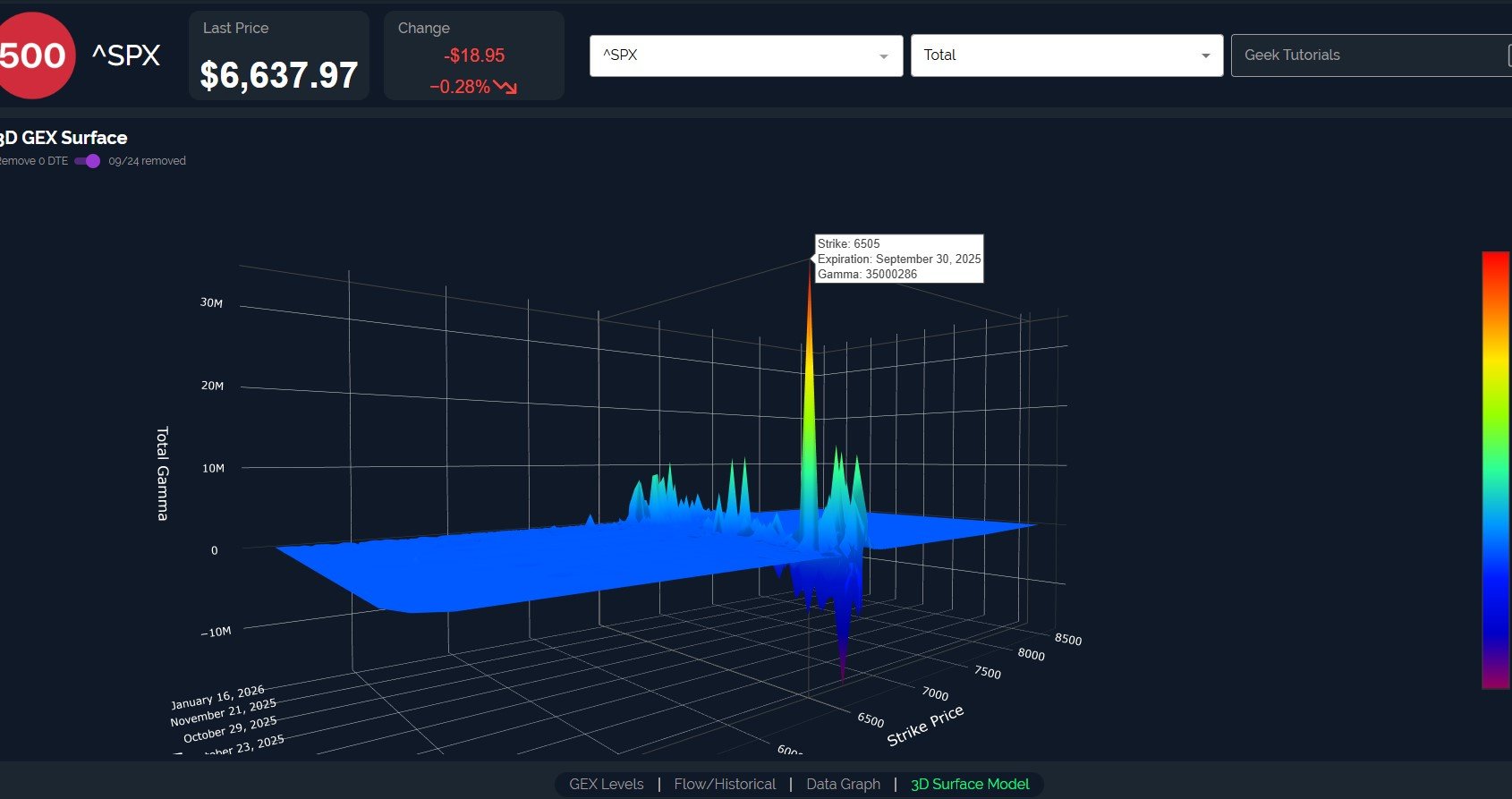

A more granular look toward month-end, which is Tuesday: The top of JPM’s collar trade is a short call position at 6505 (last I checked?), represented by a single large GEX cluster at 6505. Not visible as obviously is a large total GEX cluster at 6500 as well, a negative cluster spread across a variety of dates (hence the lack of major spikes visible on the 3D graph).

My conclusion from the large positive and negative GEX between 6500-6505 is that we may approach that area in coming days, but absent a major shock, we’re also likely to hold that area, possibly creating a nice buying opportunity.

We’ll continue to monitor and update our Discord community and readers with the latest GEX changes as we see them happening.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.