Initial Downside Targets Reached: September 26 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

Tonight’s YouTube video takes a look at SPX, IWM, HOOD, PLTR, and MSTR, so check it out if you have a few minutes!

Today saw nice fulfillment of some initial targets that we identified (and shared) using our GEX data, including QQQ reaching 590, SPX reaching 6569, and IWM reaching 237.55, within 3 points of the 234 GEX cluster we noted heading into Tuesday.

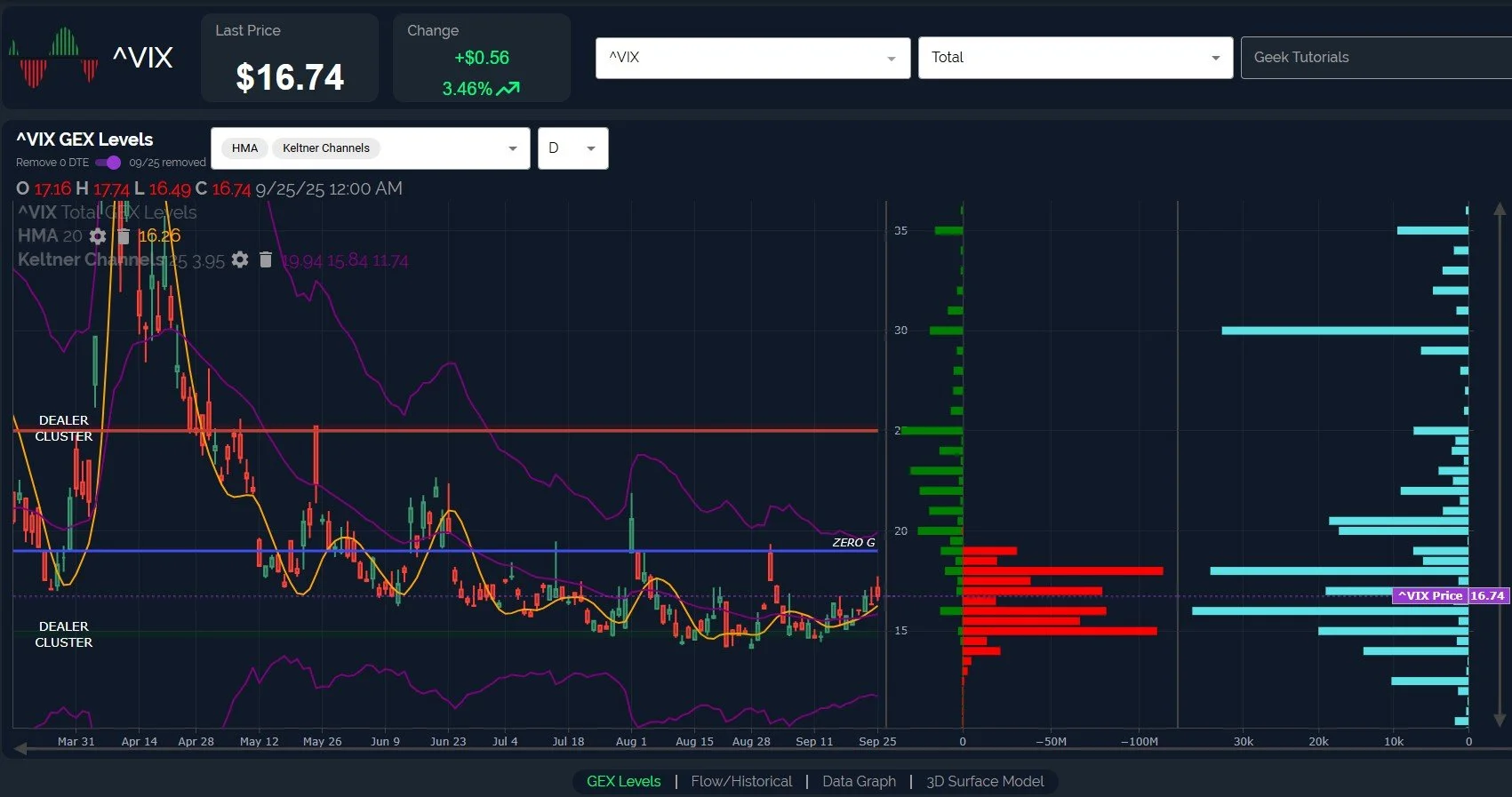

The VIX also nearly reached 18, printing higher lows and higher highs as it climbs the positively trending Hull Moving Average.

Volume (light blue), GEX, and a review of prior VIX patterns casts doubt on a sustainable low being formed today for indices, even if we bounce tomorrow. Early December 2024 was the last time we saw 8+ days of a rising trend with the VIX, and that period culminated in a spike from roughly 15-24.

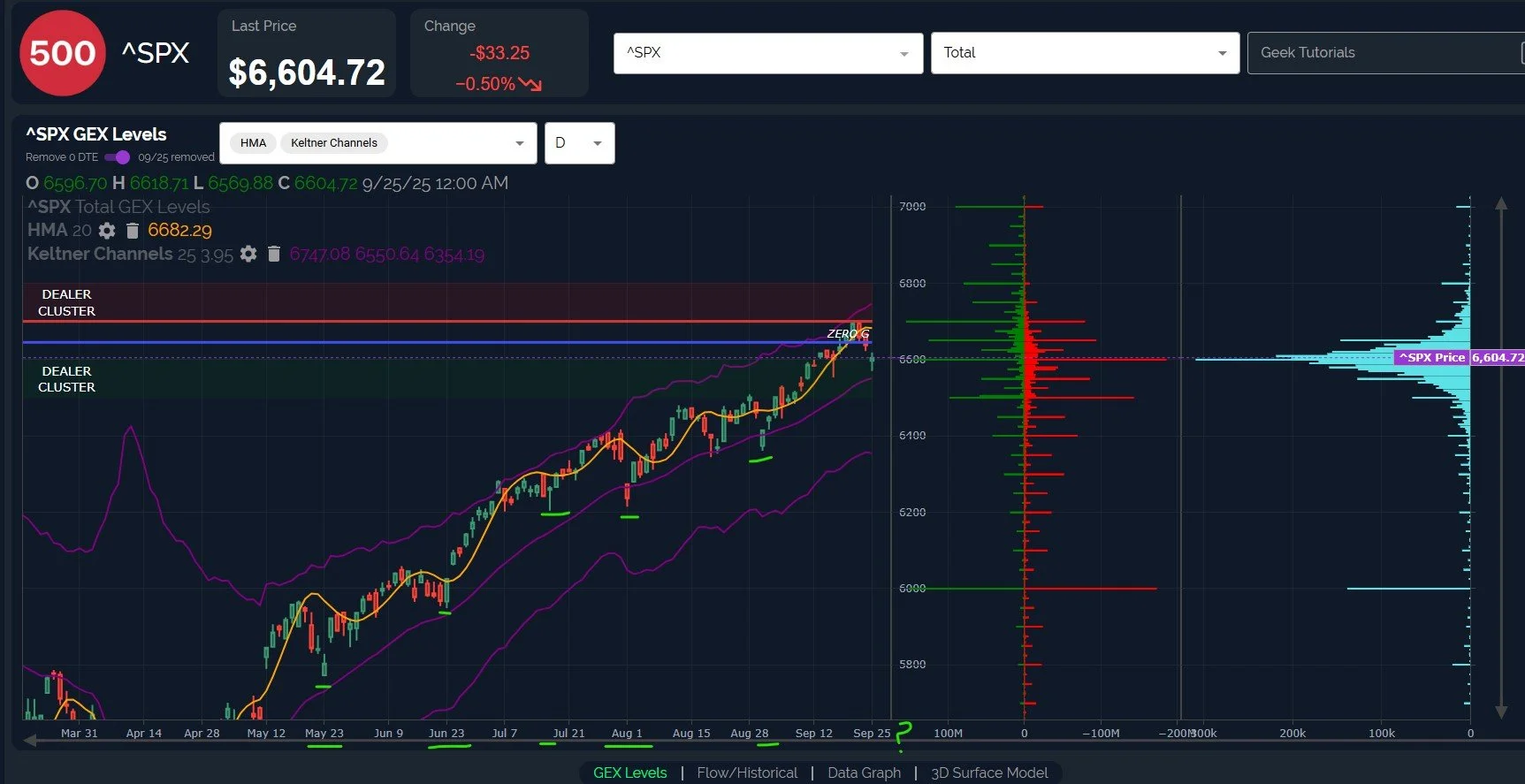

SPX stopped its decline just above the rising middle Keltner channel, just below 6570, bouncing to close near the important 6600 GEX cluster.

We are a bit extended below the flattening daily Hull at 6682, with the September 2nd low marking the last time we were this far below the line, suggesting a bounce may be due.

That said, let’s look at the recent pattern of highs/lows for SPX: May and June set important lows quite exactly at May 23 and June 23, but July switched the pattern, creating a mid-month low closer to the 15th, then August and September have made lows at the beginning of the month. Will October be similar, with an October 1-2 low?

We managed to highlight the JPM collar with the short call position at 6505 last night, so perhaps we get a little closer to 6500 by October 1st. This target would allow an interim bounce tomorrow (as an example) before resuming downside Monday/Tuesday. We’re only talking 1.5-2% lower, so don’t convince yourself 100 points is what it used to be!

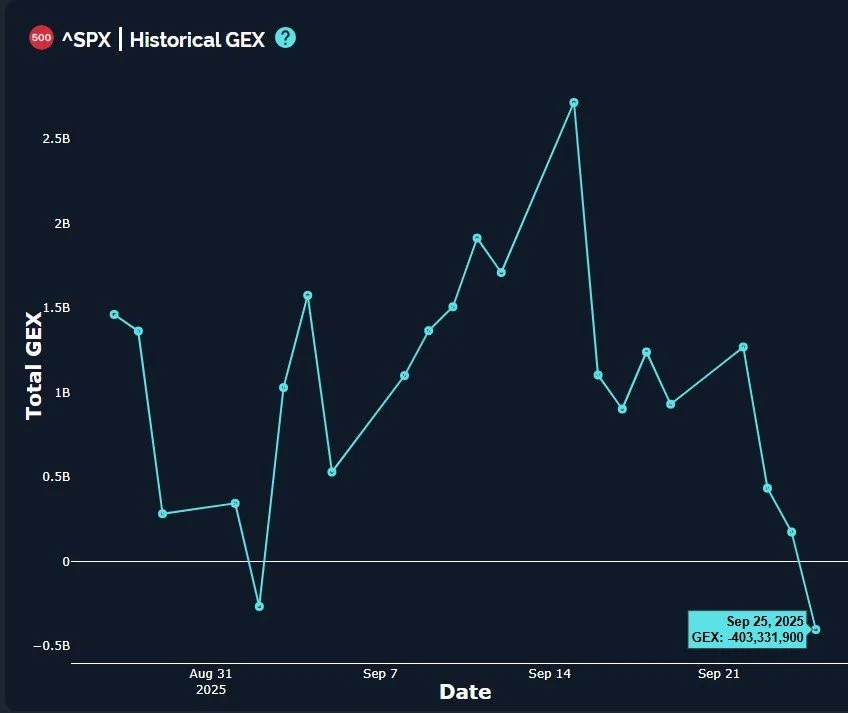

SPX GEX also moved even more negatively, reaching net negative GEX for the first time since the beginning of the month, exceeding the low from that time.

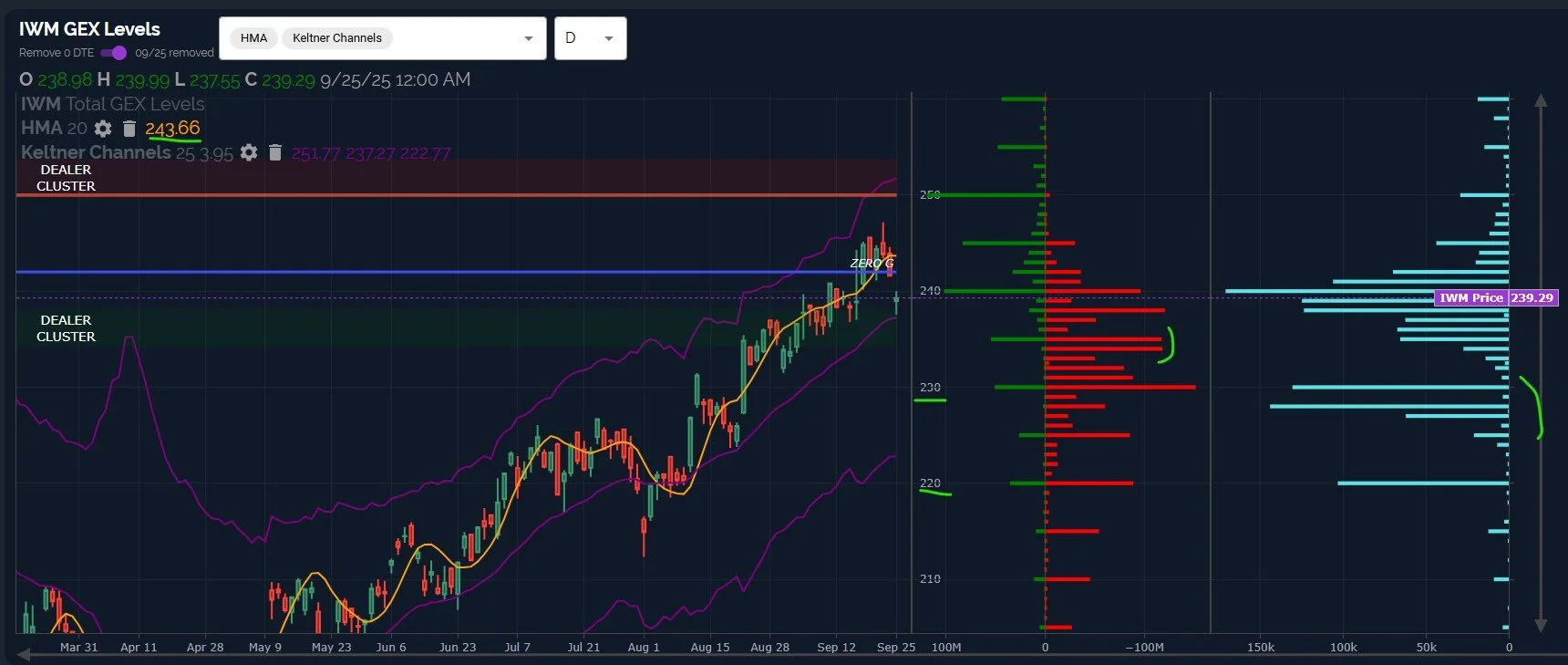

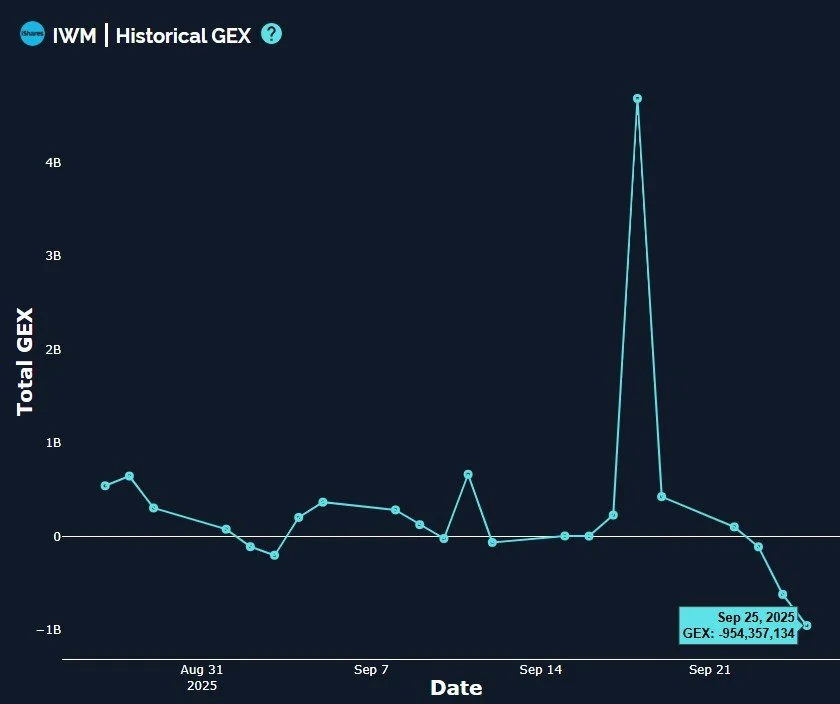

IWM’s volume we repeatedly referenced at the 225-235 area makes a lot more sense now, with IWM reaching 237.55 before bouncing back to 240. This move was advertised early on with our 0 DTE GEX graph.

Uncertainty exists regarding an immediate move lower toward the large negative GEX clusters at 230-235, but if we do approach that area tomorrow, it’s likely a buying opportunity. Any initial rebound will likely meet resistance (again) at 243-245 with a good chance of rejecting initially on the retest.

IWM also saw GEX move more negatively, a curious fact given that IWM’s price rebounded off of the lows. While not a guarantee of more downside, a move lower in net GEX like we saw is what bears want to see to maintain favorable odds of a continued move lower in price.

We’ll continue to monitor and update our Discord community and readers with the latest GEX changes as we see them happening. In summary, short-term oversold conditions lend toward a bounce, and we still see any continuing dip as a good buying opportunity for a year-end rally. But this dip may require more time and more downside to complete, so we need to take these signals day-to-day with an open mind. Especially after the very large (yet ignored?) percentage gain in indices just since August!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.