Attempting To Turn The Trend Back Up: September 29 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS SOON!

Tonight’s YouTube video takes a big picture look at SPX, our income strategy on GLD, AAPL, and more, so be sure to check it out!

Last week saw fulfillment of the seasonal bearish performance we discussed before the week began, and true to form (given the bullish performance leading up to last week), the dip was disappointing for bears by the time Friday’s session concluded.

The VIX, for example, rallied into Thursday before collapsing almost -9% into Friday’s close, nearly reaching 15 again.

The GEX picture still shows most activity above 15-16 as far as daily option volume is concerned, and we have large negative GEX at 15-15.5, raising doubts as to the VIX’s ability to sustain any move below 15.

One noteworthy observation is that Friday’s option volume saw at least some activity at the 12 strike, though there’s little GEX to show at this time. Perhaps someone feeling really good on a Friday, YOLO’ing into some VIX 12 puts? Someone who knows something you and I don’t? I guess we’ll see as we approach Q4 in a few days. I’ll note that a lot of the GEX at the 12-12.5 strike (relatively speaking, since the GEX at those strikes is so small) is focused on January 2026, so we’re talking low odds of VIX 12 in 2025 currently.

The VIX 2-hour chart shows a continued decline in the VIX is definitely possible until we see 14.5-14.8, pretty consistent with a retest of the weekly Hull Moving Average at VIX 14.51, though we are likely to see another VIX bounce from that point or close to it, as shown given the limited history below (and previously too).

tradingview

In Discord Friday morning, we mentioned SPX 6643 being an important line-in-the-sand based on confluence of several timeframes indicating resistance at the level, and sure enough, we closed at 6643 (almost 6644).

Given the nice bounce in futures so far, we can probably look toward the next level of resistance, actually mentioned in Thursday’s newsletter as a possible bounce target, 6682 at that time (now 6677.88 given the turn lower in the yellow Hull).

The GEX at 6700 is considerable compared to all other strikes nearby, so the odds of exceeding and holding above 6700 are somewhat lower in probability in the near-term, though a close above 6700 would certainly be significant in terms of the potential ramifications for heading toward 6800 (and likely 7000 at that point).

The upper daily Keltner is at 6751, and we see almost as much GEX at 6750 as we do at 6800, so any sustained breach of 6700 on a daily basis may aim for the 6750 area.

Let’s take our IWM overview back to an earlier observation regarding IWM’s November 2024 high of 244.98: We exceeded that high last week, reaching 247.18, yet we closed below the November high at 241.34.

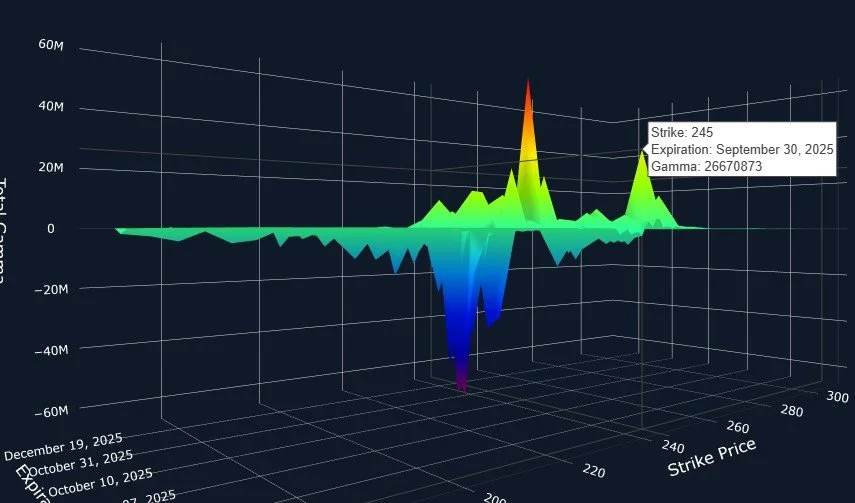

The Keltners are still generally rising, with the upper Keltner now at 251.58, and large net GEX is still prominent at 250.

We continue to see the conflicting signal of repeated multi-day option volume at the strikes surrounding 230. IWM net GEX has also been in slightly negative territory for 4 days straight, I might add.

The late-week selloff might have given some short-term fuel to bulls for a rebound, but we need to watch the Hull at 243.42 and the previous November high of 244.98 (let’s call it 245 to match the big GEX cluster) for important signals as to whether or not IWM is ready to tackle 250, or if we need to shake the tree and give the frustrated “bargain hunters” a chance to enter closer to 230.

Our 3D graph, which shows individual GEX clusters, reveals a shifting of the previously observed 250 GEX expiring 9/30 toward 10/17, and 245 is now the largest cluster expiring 9/30.

We’ve identified some potentially significant levels to watch as we approach the end of Q3 and the beginning of Q4, with the last two months in mind (lows marking the beginning of each month), and we may want to watch for the VIX reaching 14.51-14.80 while simultaneously noting where the indices are at that point to then decide where the next short-term pullback happens. We have higher targets into year-end, and any dip toward the targets identified will be opportunistically bought on our end, barring a big shift in GEX toward even lower targets. We’ll provide intraday updates within Discord!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.