Surprises Await The Final Day Of Q3: September 30 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS TOMORROW!

We take a look at SPX, QQQ, the VIX, and some individual stocks like NXPI, IONQ, and NVDA in tonight’s YouTube video, so be sure to check it out!

According to @AlmanacTrader on X.com, the S&P500 is only positive 38.7% of the time on the last trading day of Q3, with an average loss of -0.07%. Will tomorrow buck that trend as a potential government shutdown looms? Anything is possible, but not necessarily probable.

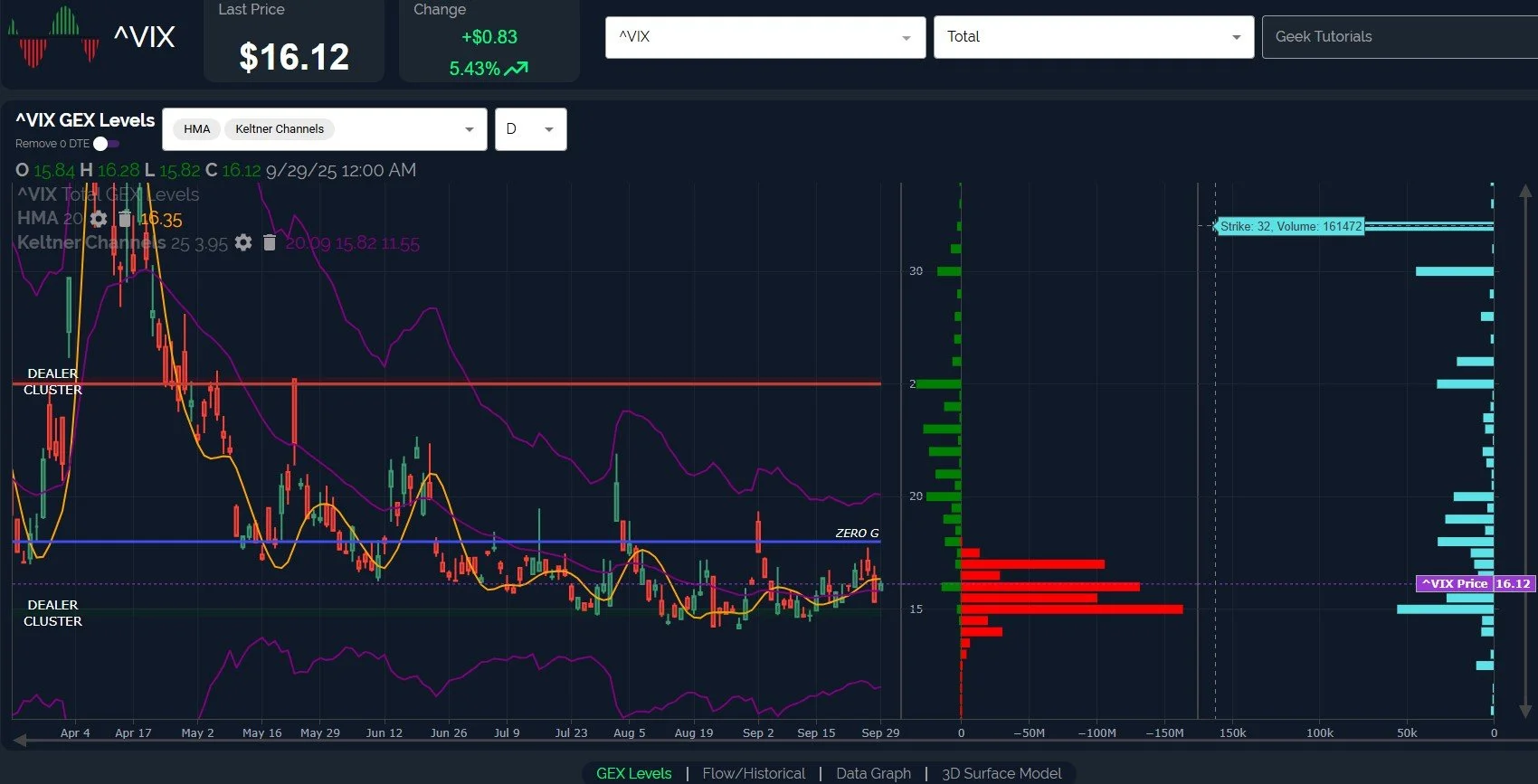

We see a mixed picture from the VIX: While rebounding 5.43% from Friday’s close, the VIX is still below the Hull Moving Average at 16.35, an important bull/bear line that can catalyze a move toward 20 or down to the 14s if we stay below.

Volume was unusual at the 32 strike, and the thick wall of negative GEX between 15 and 17 probably means the odds are low of a sustained dip below 15 (for now).

The VIX 2-hour chart crossed above the Hull, also regaining the 9-SMA and the 15-EMA by a penny.

This shift and the rising Hull do increase the odds that the VIX overcomes the 16.35 daily Hull and perhaps gives us another VIX spike, this time possibly toward the 18-20 range.

tradingview

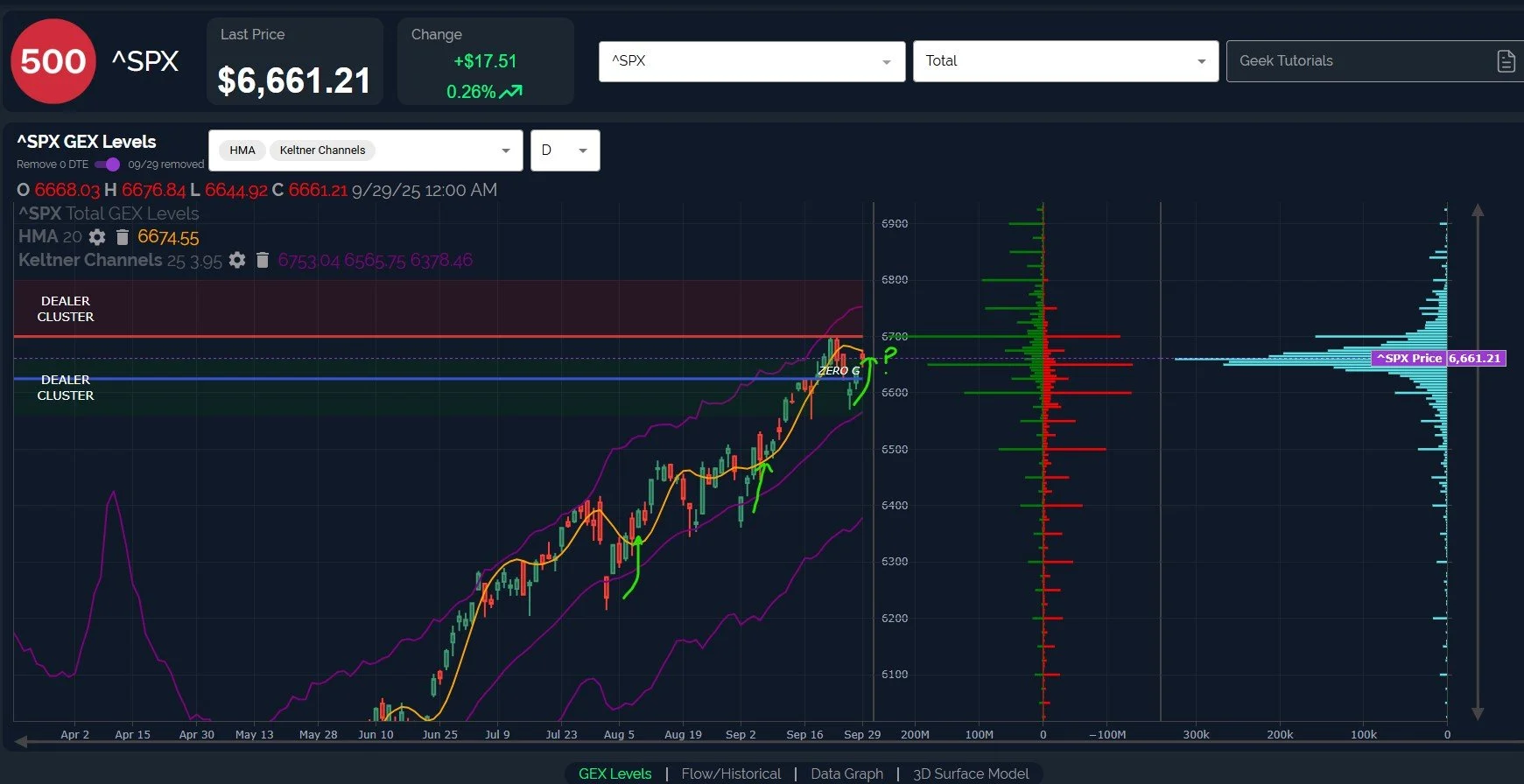

I drew green arrows to show what happened the last 2 times SPX saw relatively large gap downs, with indices rebounding quickly to retest the line from below. These recent instances saw price continue moving higher beyond the Hull, maintaining the steep uptrend. Will this time be similar?

We have meaningful GEX at 6700, yet more positive and negative GEX at 6600 than we see at 6750 and 6800.

The upper Keltner channel matches with 6750, but SPX needs to see a daily close above the Hull at 6674 to open the door toward tackling those higher targets.

SPX’s current GEX picture points to eventual continued upside toward 7000 by the end of the year, but we may see an intervening pullback to 6500 before beginning the next move higher. We will watch tactical developments and we’ll update subscribers and guests accordingly in Discord intraday.

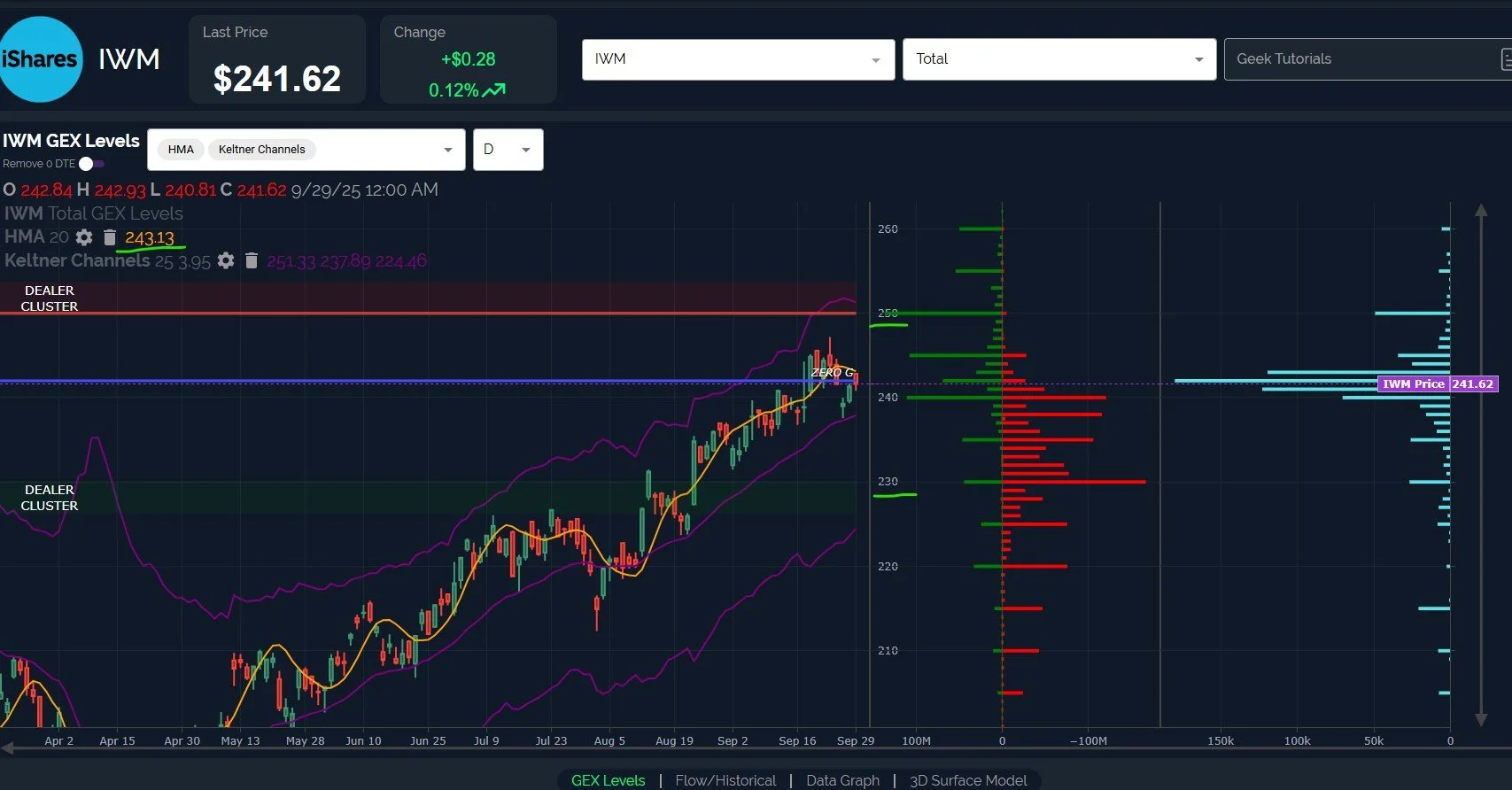

IWM retested the Hull and rejected as well today, closing at 241.62.

The upper Keltner channel has recently flattened, though the lower channel is still pointing higher, so we see conflct with the Keltners.

The positive GEX at 250 is still relatively large and matches well with the upper Keltner.

We still need to keep an eye on 230, which has seen GEX grow in recent days. You may remember our daily documentation of the elevated option volume at 230.

While IWM continues to look bullish into year-end, we must note that GEX saw a large net negative shift since mid-September, certainly suggestive that we might see some volatility between now and year end.

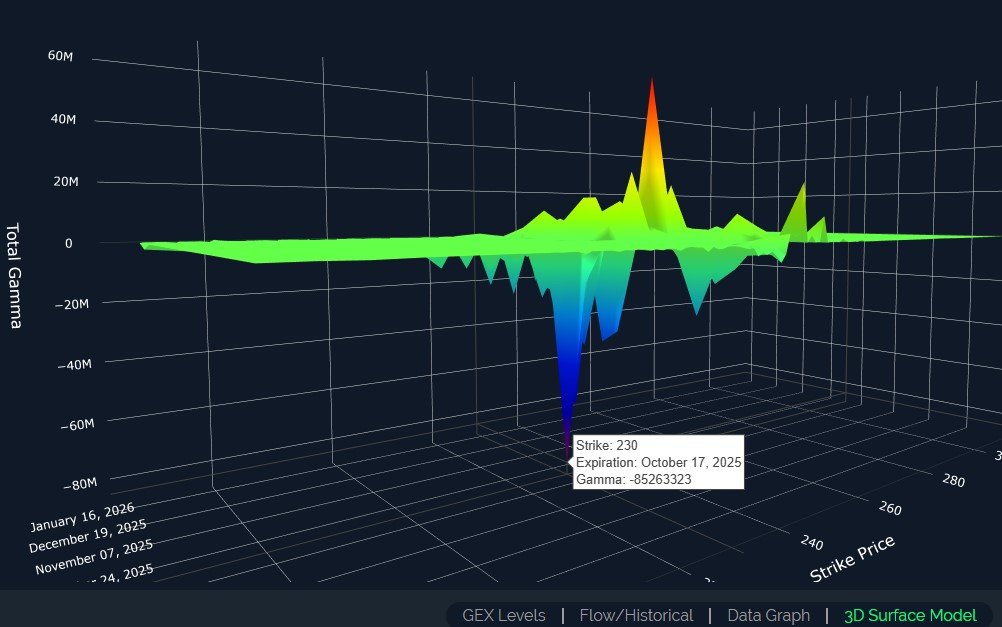

The largest single GEX cluster visible on our 3D graph right now is a big negative GEX cluster at IWM 230 expiring October 17. The 250 GEX mostly expires October 17 as well, though the 230 GEX cluster is larger.

Last week, we saw 250 GEX concentrated at tomorrow’s expiration, so obviously that shifted several weeks out and the 230 GEX has also grown relative to 250, both seemingly more negative omens in the short run.

If we do see indices pullback in coming days, and the VIX spike, we will be calmly buying that dip as long as the GEX picture continues looking constructive, and we’ll be sharing what we see in our live stream (now available on our homepage for everyone!) as well as in Discord. We hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.