Starting Q4 With A Government SHutdown: October 1 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS TOMORROW!

Tonight’s YouTube video covers SPX, the VIX, GLD, SLV, and more, so be sure to check it out!

In yesterday’s newsletter, we pointed out stats on 9/30 performance shared by @AlmanacTrader on x.com, showing that the last day of September is historically up only 38.7% of the time. Whelp, today was within the lower probability outcome, with SPX rallying late in the day to print a lower high relative to last week.

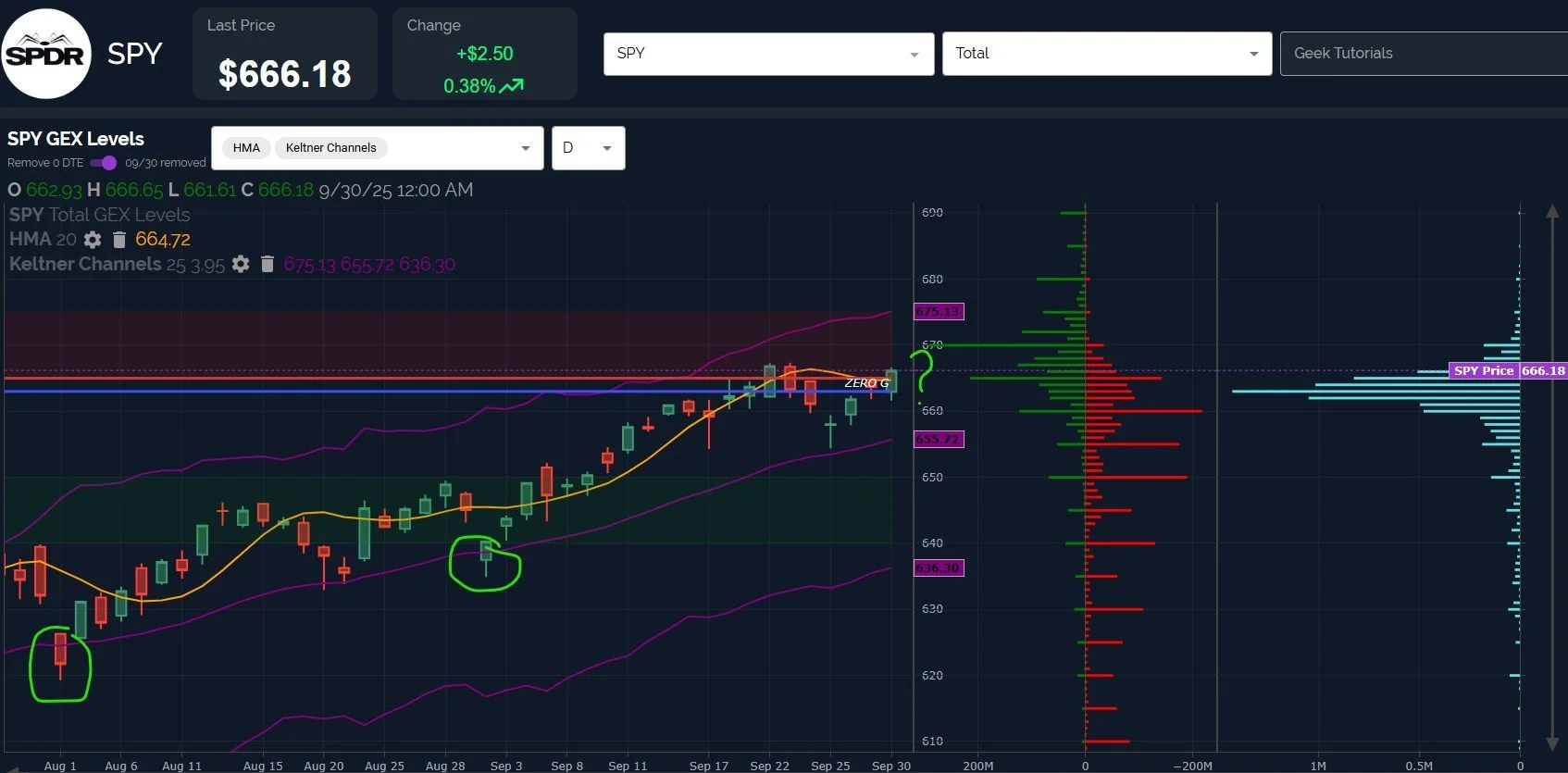

While the upper Keltner channel is continuing to barrel toward 6800, the large GEX cluster at 6700 (and the dropping off of GEX clusters at higher strikes) represents a formidable barrier to an immediate continuation higher, especially beyond the 6750-6800 area, possibly capping upside to 1-1.5% higher from here before another pullback.

SPX did close above the Hull Moving Average, though the move took SPX right into the upper Dealer Cluster zone as well, where we expect price to have higher odds of moving sideways or dropping as dealer selling pressure is expecting to increase.

Let’s also remember the prior two months (with a low on the first trading day of the month), with similar lead-ins to the gap down: several days higher preceding the larger drop. I will note one difference being that the previous gap downs that are visible on the chart followed red candles the prior day, so I am allowing some variability here to possibly allow for a Friday high and gap down Monday, though let’s wait to consider that until we see if the 1st holds weight tomorrow.

Let’s also reflect on SPY closing at 666 as we enter a government shutdown, interesting parallels as SPX saw its intraday low at 666 in March 2009, a time of unprecedented governmental intervention in the USA (the merits of which are certainly arguable, but that’s for a different newsletter).

QQQ painted a less bullish picture, stopping shy of the slightly declining daily Hull, with the Keltner channels still aiming for bullish new highs.

GEX is actually negative for QQQ while positive for SPY and SPX, so we have a divergence amongst the largest US indices today.

QQQ lacks significant GEX clusters beyond 610, with negative GEX clusters at 580 and 590 appearing to be far more significant.

Which will prove to be more accurate in the short run? SPX or QQQ?

The VIX maintains a buy signal on the 4-hour chart, attempting to decline below the various technical supports on my chart while closing above all of them (by a penny!). Let’s look at the daily/weekly charts to see if they agree with the likelihood of a VIX spike.

tradingview

The VIX daily chart technically closed below the Hull, though barely, and we have a general pattern of higher lows and higher highs. The thick wall of negative GEX down to 15 likely represents support, implying that downside for the VIX is limited from here, with upside potential to 20-25 based on GEX and option volume.

An interesting development that we see this week is the VIX holding above the 9-period SMA so far, something that hasn’t happened in 9 weeks.

The Hull (orange) is curling higher while the 9-SMA (yellow) is turning lower, creating a pinching effect and implying a big break from this zone is possible soon. Will the breakout be higher or lower? GEX+charts imply higher, but we will be open to quickly shifting focus if we see the VIX hold below 14.5.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.