Unstoppable Upside: October 2 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS TOMORROW!

Here’s the link to tonight’s YouTube video. We cover the major indices as well as some individual tickers like PLTR and MSFT, so check it out if you have a few minutes.

The “shutdown gap down” was bought this morning, with indices rallying to new highs in most cases.

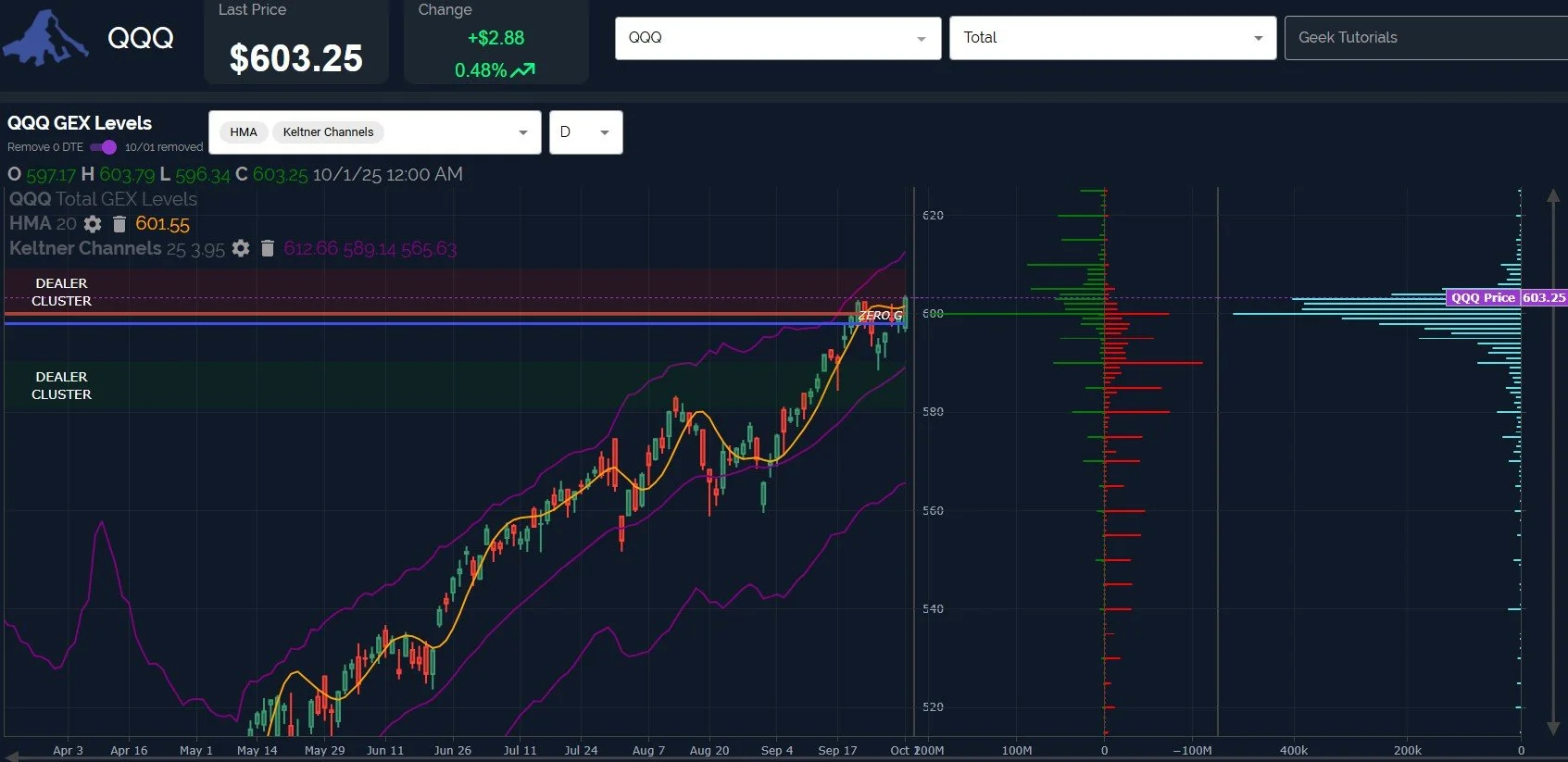

This rally also gave QQQ and SPX a more solid close above the daily Hull Moving Average, increasing the odds of tagging higher GEX levels deeper within the upper Dealer Cluster zone.

SPX’s upper Keltner channel at 6777.90 is a stone’s throw (or shall I say a put options throw?) away from 6800, the last larger GEX cluster before 7000. The distance between the upper Keltner and 7000 is still quite wide, implying more time is needed before reaching 7000, also consistent with the 3D GEX graph showing most 7000 GEX toward the end of the year.

A quick loss of 6700 likely puts the ball back in the bear’s court, and 6800 is barely 1.5% away, so be aware of the risk/reward at current levels.

Very similar picture for QQQ: The upper Keltner is just beyond the big 610 GEX cluster at 612.66, giving us a likely maximum upper limit where we might see a larger reversal occur.

An immediate loss of 600 may imply the upside move is over for now, though any push lower will be viewed as a buying opportunity in our minds as long as SPX shows a bias toward higher GEX levels.

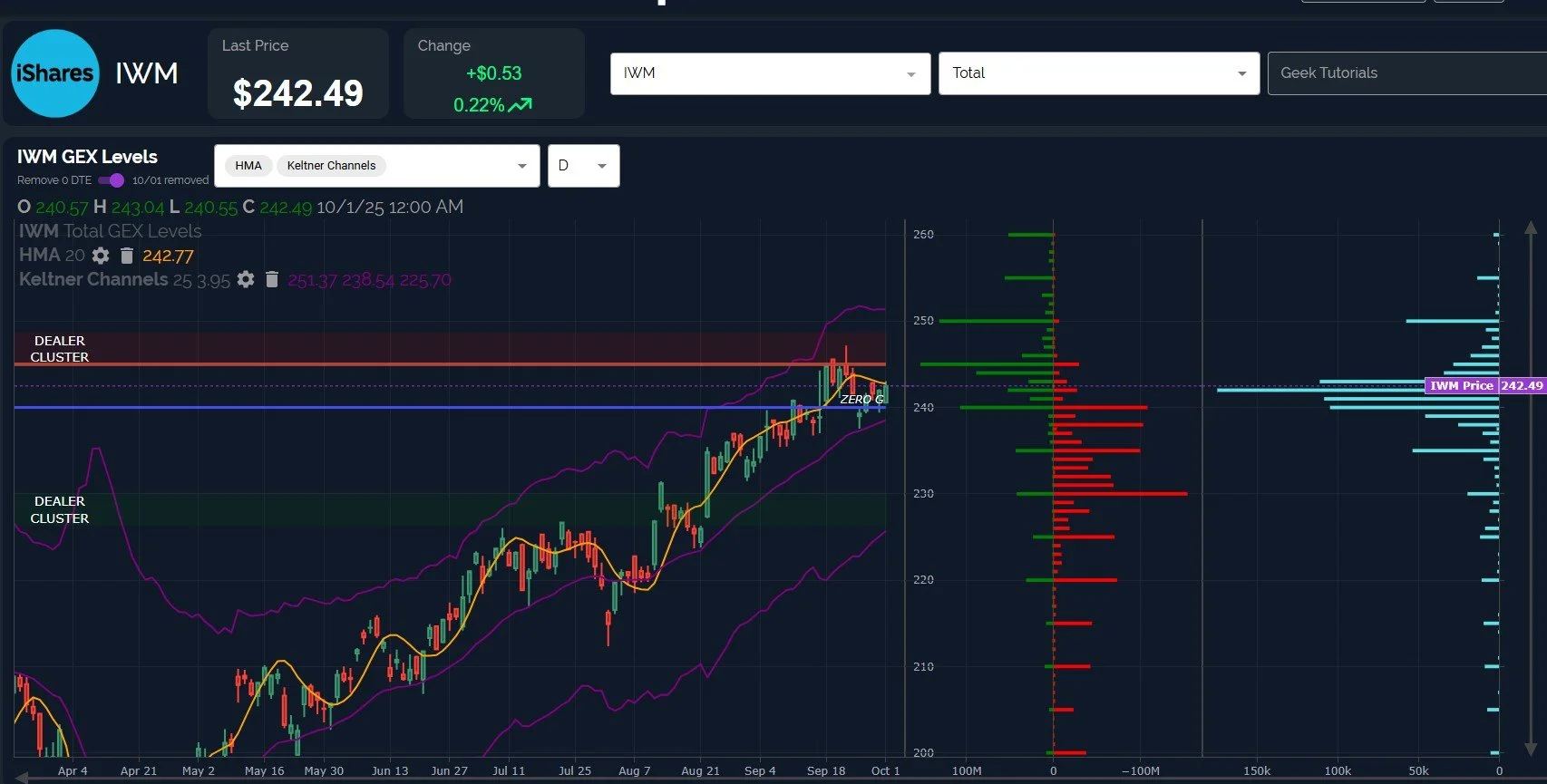

IWM remains the negatively divergent black sheep of the bunch, not even cracking the Hull, making lower highs since September 23.

IWM’s net GEX increased slightly today, though it’s still negative, as it has been going on several days.

The upper Keltner has turned sideways for IWM, just above the big net positive GEX cluster at 250, a likely destination for IWM, whether now or after a pullback from this level. We see 230 as the largest negative GEX cluster below, an area where we’ll likely look at adding to our long position, if we do see 230 tagged.

As the VIX 9-period SMA and the Hull are in the process of pinching together, we see the VIX above the weekly Hull+9SMA for the first time in 9 weeks. The question remains- will we see this shift maintained into next week, with a larger VIX spike in the works? The daily chart certainly suggests it’s possible, with a series of higher lows as the VIX slowly creeps higher, maintaining the 16s.

We also see volume elevated at the 30 strike as well as several other strikes between 18-25.

The VIX 2-hour chart (not shown) does look more bearish in the very short term, with a visit to 15.5 possible. Does this imply further upside for indices toward the SPX 6800 and QQQ 610 levels as the VIX reaches a key reversal area at the 2-hour lower Keltner channel? This view would fit together nicely, but it remains theoretical. We will start out each day as we always do- seeing what the GEX picture is signaling on a 0 DTE basis and adjusting accordingly. We discuss these shifts in Discord, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us as we navigate the remaining week ahead!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.