IWM And The VIX Both Giving A Buy SIgnal? October 3 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS TOMORROW!

Here’s the link to tonight’s YouTube video. We cover the major indices as well as AMD, SMH, and more, so check it out if you have a few minutes!

I present to you a hypothetical alternate choice scenario between two investments: Assuming a purchase 3 Friday’s ago (September 12), you can choose investment XYZ (not the actual ticker), which is currently 2% higher than the initial purchase price. Your alternative is investment PDQ, which is 15.4% higher than your entry on the same day.

Seems like an easy decision, right? It’s not a trick question, and actually it’s not even hypothetical. This is the actual performance for two indices-the VIX and SPX- since September 12.

Alright, what’s the catch? Well…What if I told you the index up 15.4% was the VIX, while the index up 2% is SPX? I bet you had a slightly involuntary revulsion, maybe a twitch- or even a little heart burn- when I pointed out that the index smoking SPX is indeed the VIX. Wouldn’t touch it? No one would blame you, but we need to look into whether or not this glaring divergence is a warning for what lies ahead, and for whom.

The VIX has closed above the daily Hull Moving Average for the first time in 5 days, and volume was elevated at the VIX 18 strike. The continued pattern of higher lows is a clear change of the trend since late August, even as indices make new highs.

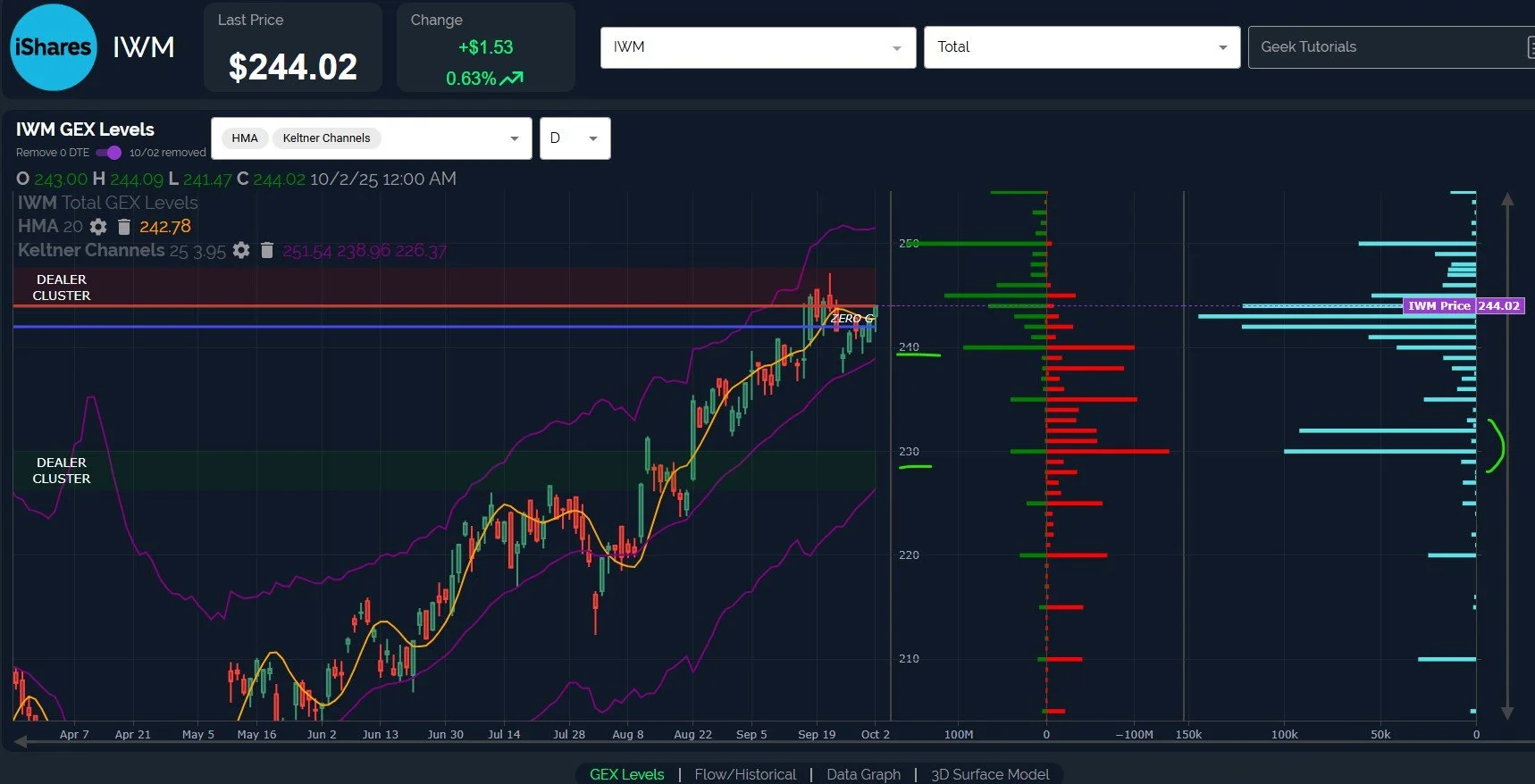

IWM made a bullish move today, breaking back above the daily Hull as well, seemingly in conflict with the VIX, as they both seem to be moving higher. IWM net GEX also moved into positive territory again, increasing the odds that we see a move toward the big positive GEX at 250.

IWM continues to show noticeably higher daily option volume at the 230-235 strikes, a repeated theme going on for at least a couple of weeks now. A large negative GEX cluster at 230 may be a potential target if IWM can close below 240.

With current momentum being higher, and given the history of the VIX to sometimes climb along with indices toward the final reversal area, shorts may be wise to await a break below 240 or re-evaluating a move to 250 (also near the upper Keltner channel) for better odds of a pullback.

SPX is holding slightly above the large 6700 GEX cluster, within the upper Dealer Cluster zone. Holding above 6700 may imply a move closer to 6750 or 6800, perhaps even slightly higher, if the weekly Keltner channel is in play near 6820.

SPX GEX continues to reflect a solid bullish picture, and 7000 seems to be a good target for year-end, so we’re in “buy the dip” mode when pullbacks materialize. A drop below 6691 may open the door to 6600 or lower.

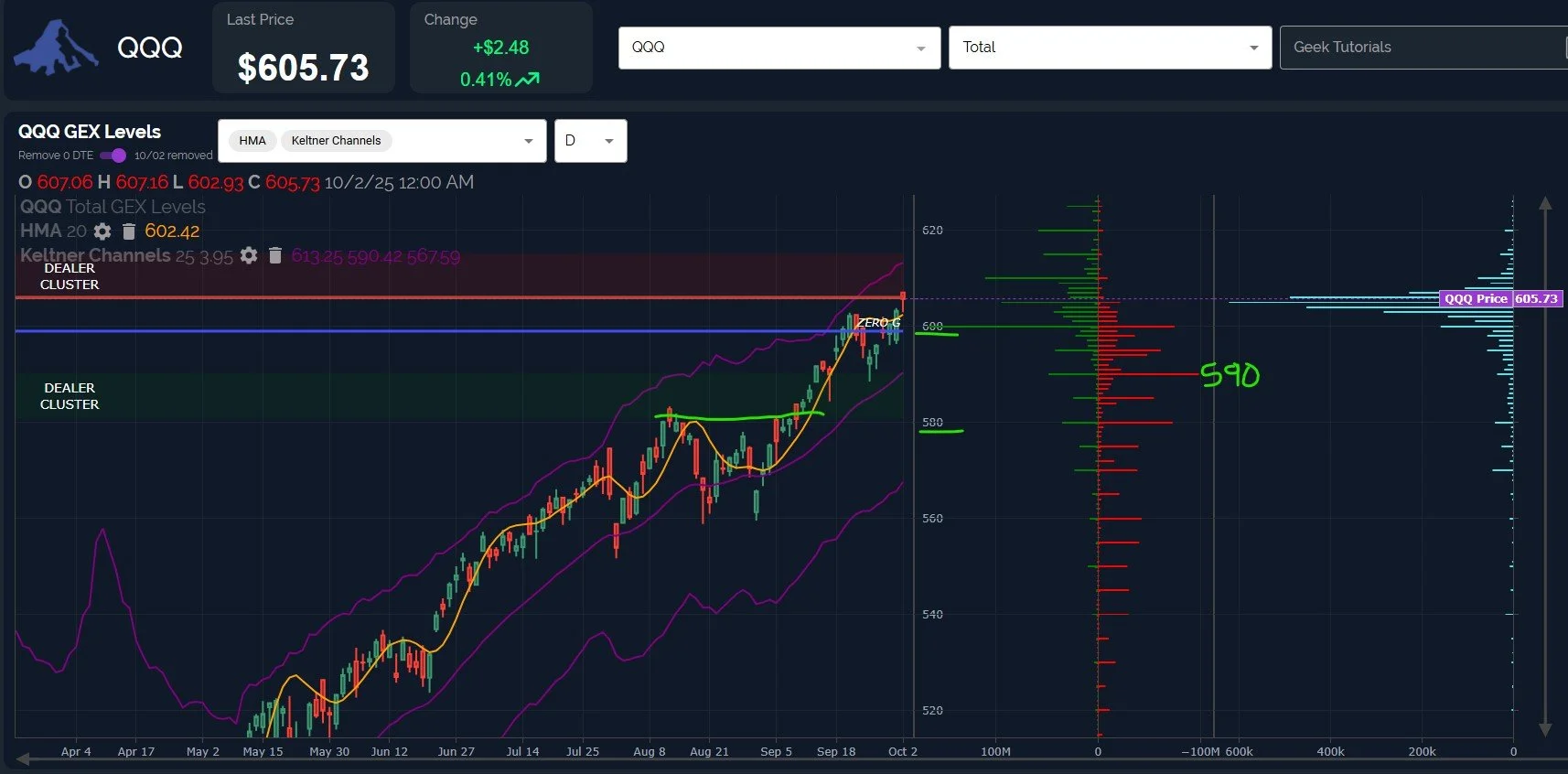

QQQ seems to be destined for 610 or higher, with GEX having grown at the 610 level, and the Keltners pointing higher.

In the event of a pullback, I like the idea of the reasonably large GEX at 580 serving as a magnet. Within a few days, 580 will mark the lower daily Keltner channel, and 580 also marks the approximate area of prior resistance-turned-support for the breakout that occurred in early September.

QQQ needs to lose 600 for a potential momentum move lower, though adventurous contrarians may want to watch a tag of the upper Keltner channel near 613.

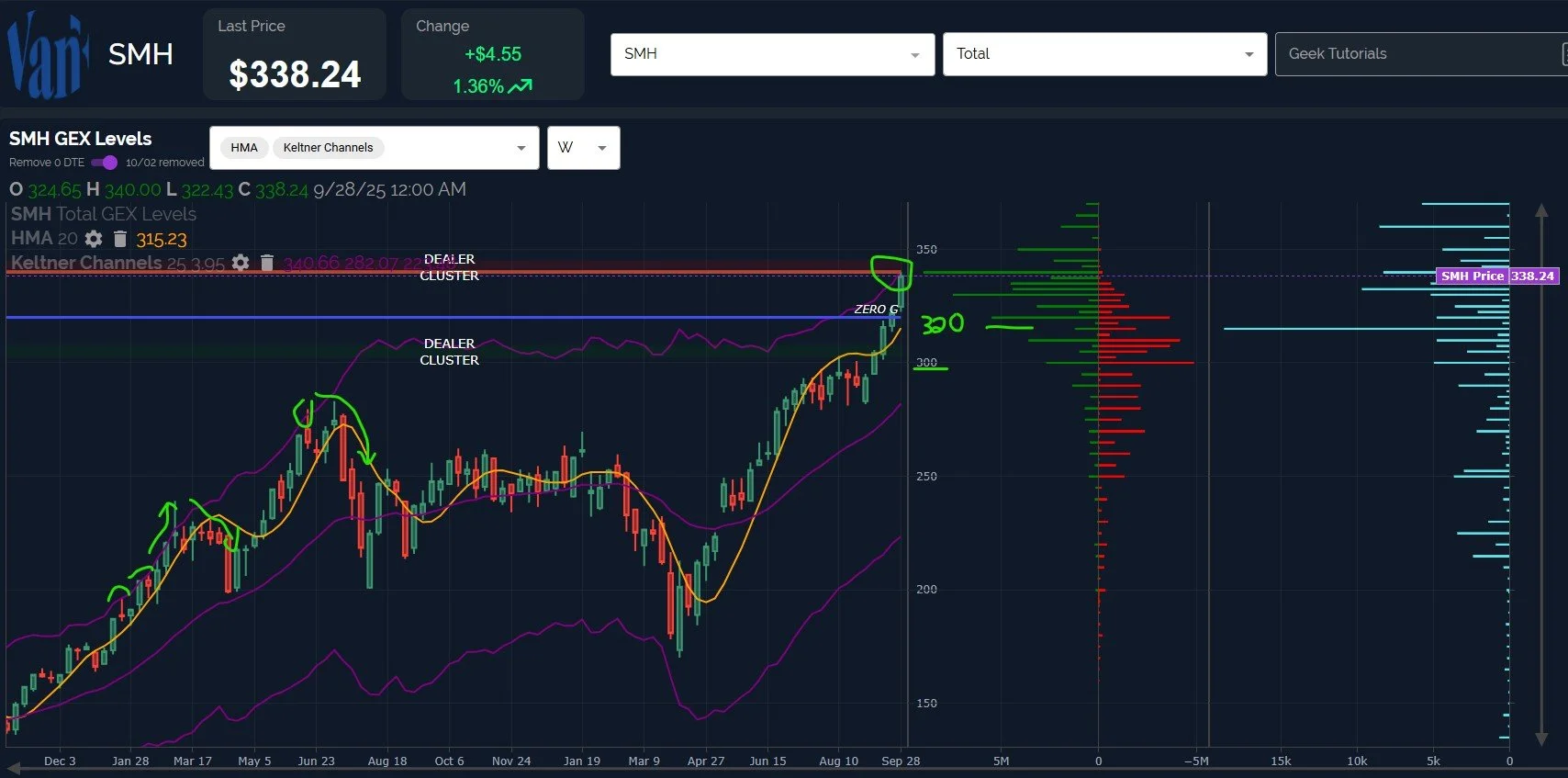

SMH is reaching an interesting possible resistance area, the upper Keltner channel (and upper Dealer Cluster zone) on the weekly chart. The last two times we touched the upper weekly Keltner, SMH saw decent pullbacks/consolidation, even during the December-March steep uptrend. Big positive weeks where SMH touched the line were met with at least some sort of pullback the following week. The May-June highs were met with even more aggressive selling. Not even the two letters “A” and “I” can save SMH from what the chart is saying (famous last words?).

Volume was elevated at the 295 strike, though 307.5 is the big negative GEX that stands out for the 10/10 expiration.

The strong positive momentum across the board is difficult to fight, but with the VIX performing so well, we are prepared with our reversal areas in mind and a plan of action to manage our hedges and buy any upcoming dips.

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading. We hope you’ll join us!

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.