The VIX: Building Up For A Spike, Or preparing To Be Crushed? October 6 Stock Market Preview

PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- $300 off of the annual Portfolio Manager subscription Enter code SEPTEMBER2025 at checkout! ENDS OCT 7!

Here’s the link to tonight’s YouTube video. We go over SPX as well as the VIX, plus some individual stocks, so check it out if you have a few minutes!

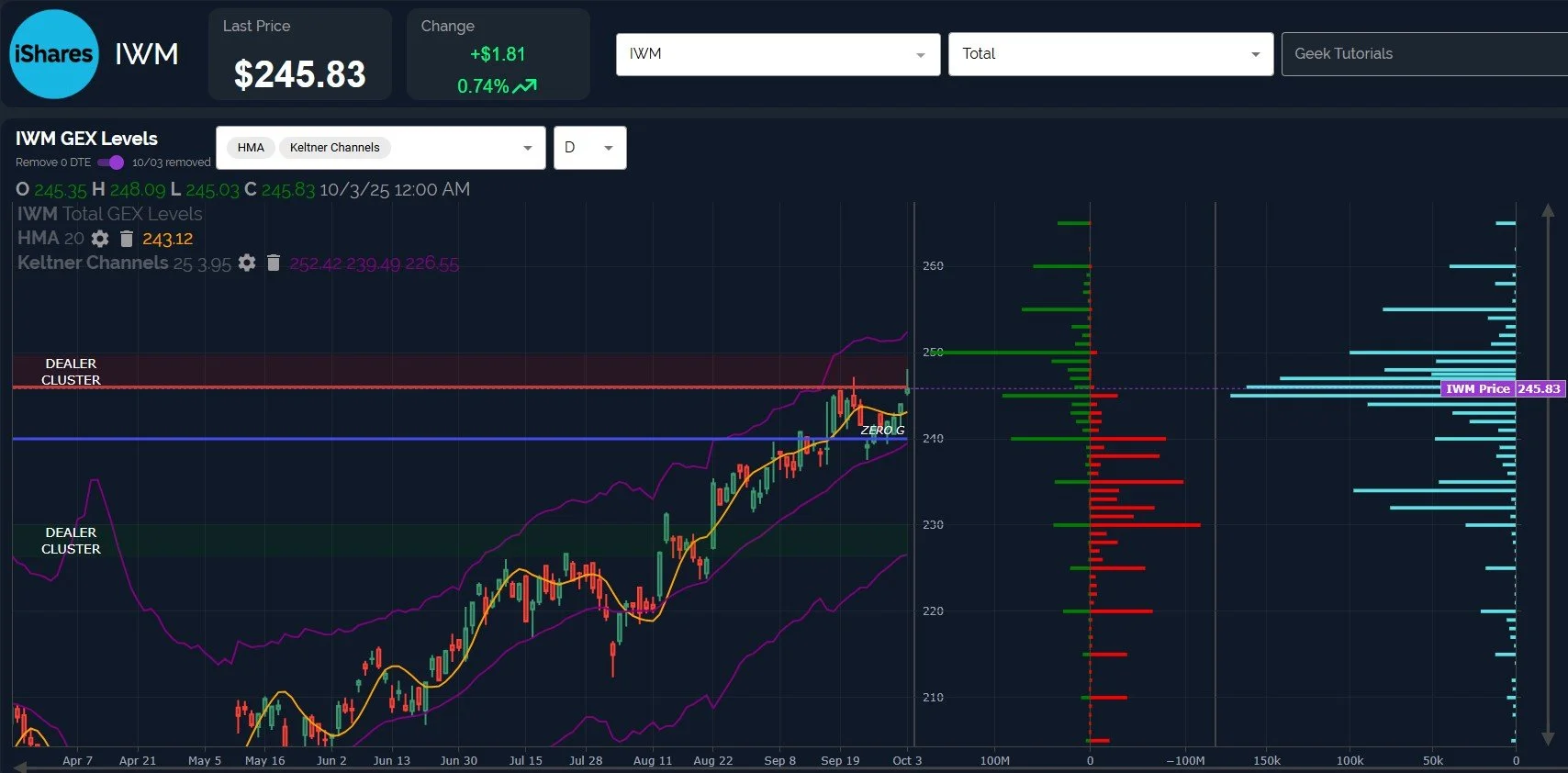

IWM made a solid attempt toward 250 Friday, a nice affirmation of the setup we mentioned in Thursday night’s newsletter. IWM reached 248, marking a slightly higher high than the high made in mid-September.

IWM remains in slightly positive net GEX, a reading we consider neutral.

The 230 and 232 strikes still show meaningful GEX specifically at the October 17 expiry, as shown on our 3D graph (not featured in the newsletter tonight), and 250-255 are also represented on October 17. 230 has shown very consistent option volume on a daily basis as well.

The Keltner channels are still climbing in bullish fashion, though the top channel has leveled off, adding to the uncertainty of what happens at the big 250 GEX cluster. Will GEX grow more substantially above 250?

If IWM can’t surpass and close above 250 on a daily basis, we may still see a drop back to 230 before a rally into the end of the year, so we’ll be watching to see what happens at that level.

SPX closed red on Friday, and 6700 is clearly an important area, not just based on the Hull Moving Average, but also based on the large positive and negative GEX seen at that strike. A close below the Hull may imply a trip toward 6500-6600.

The current picture reflects strong momentum upward overall, with the bullish Keltner channels aiming for the big GEX cluster at 6800 currently. 6800 is also the upper Dealer Cluster, representing the largest net positive GEX cluster above, so we might see a reversal at 6800 if we don’t see one upon losing the 6700 mark.

QQQ actually closed at the exact Hull, 603.18. QQQ looks quite bullish overall like SPX, but Friday’s close right on the line is a little closer to a possible pullback trigger than SPX, which closed 15 points above the Hull.

Losing 600 on a daily close would be the next big benchmark after the Hull to seeing whether or not more downside is in store. With SMH being as overbought as it is, we could see rotation, or we could begin a short drop down to 580 to set the stage for a likely rally into year-end.

The VIX is the elephant in the room for now, given the steady uptrend for weeks, and Friday saw the 4-hour chart maintaining a VIX buy signal with a close above several key indicator support levels. The 4-hour chart suggests 18 is a possible upside target.

The daily chart also remains on a buy signal above the Hull, and we lack meaningful GEX below 15, indicating participants lack of belief that the VIX is destined to spend much time below 15, at least in the near future.

Note the elevated volume at the 60 strike, and also at the 20 strike. If we’re to see a strong rally to new highs into the end of the year, a short-term spike to 18-20 (maybe 25 at the most?) should see reveral back down for the VIX, but we’ll have to monitor the complete picture at that time to see if the overall picture is still constructive toward the bullish view. We’ll be sure to share our observations in the newsletter as well as in Discord during the day, so we hope you’ll join us!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.