Weekly Resistance Still Holding: September 2 Stock Market Preview

Tonight’s YouTube video can be viewed by clicking here. Check it out, we discuss indices as well as a few individual tickers.

In Thursday’s newsletter, we said “In the event of a mini-spike, VIX 16 may prove to be initial resistance, matching both the weekly 9 SMA and the 2-hour upper Keltner channel..” and we missed it…The VIX only reached 15.97 on Friday, fading back to 15.36 at the close. Sorry for the 0.03 miss, we’ll strive for improvement.

Friday saw elevated volume at the 31 and 47.5 strikes (again), and the VIX closed above both the Hull and the 9-period daily SMA, last seen on 8/21.

Both GEX and volume continue to reflect a participant bias toward the VIX maintaining current levels or higher, with GEX dropping off sharply below 14, and virtually nonexistent below 13. VIX 20 and 25 strikes show the greatest amounts of positive GEX.

The daily Hull at 14.82 is a line-in-the-sand, and as long as the VIX holds above the level, the bias is toward volatility expansion, in my view.

SPX technically closed below the Daily Hull after failing resistance at the weekly Hull, which was expected, or at least viewed as the highest probability given the trend. The close below the Hull on the daily chart is not very convincing but given the 5-week trend of the weekly Hull holding as resistance, caution may be warranted.

While net GEX at 6000 isn’t relatively significant, our new gross GEX feature shows why volume may have been elevated at 6000, with a lot of positive and negative GEX at that strike.

The daily Keltner channels show 6200 to be a more important immediate target, if downside continues below the daily Hull.

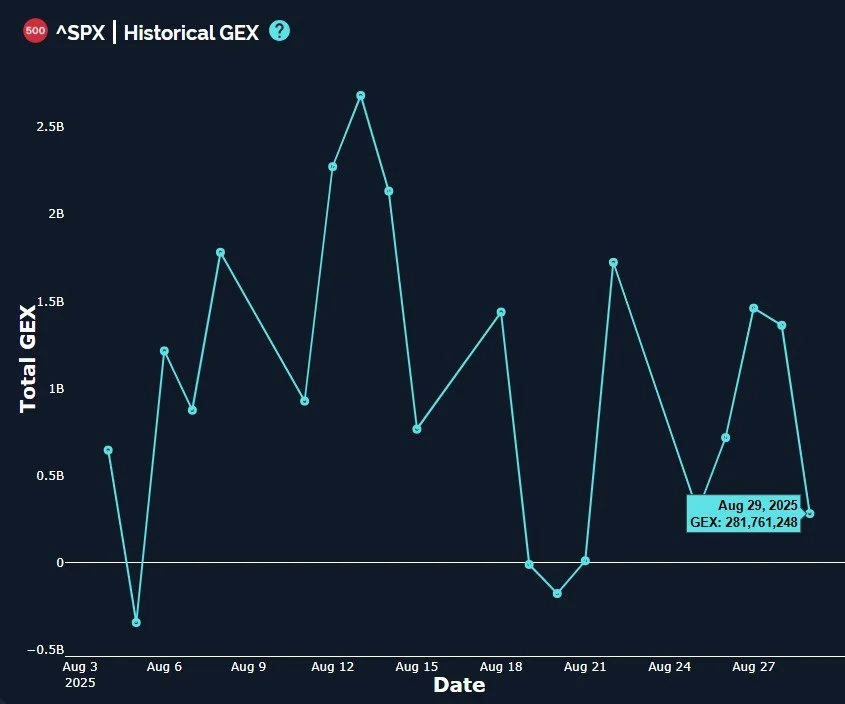

SPX GEX has been generally biased lower since the GEX high in mid-August, though we consider the current net positive reading to be neutral.

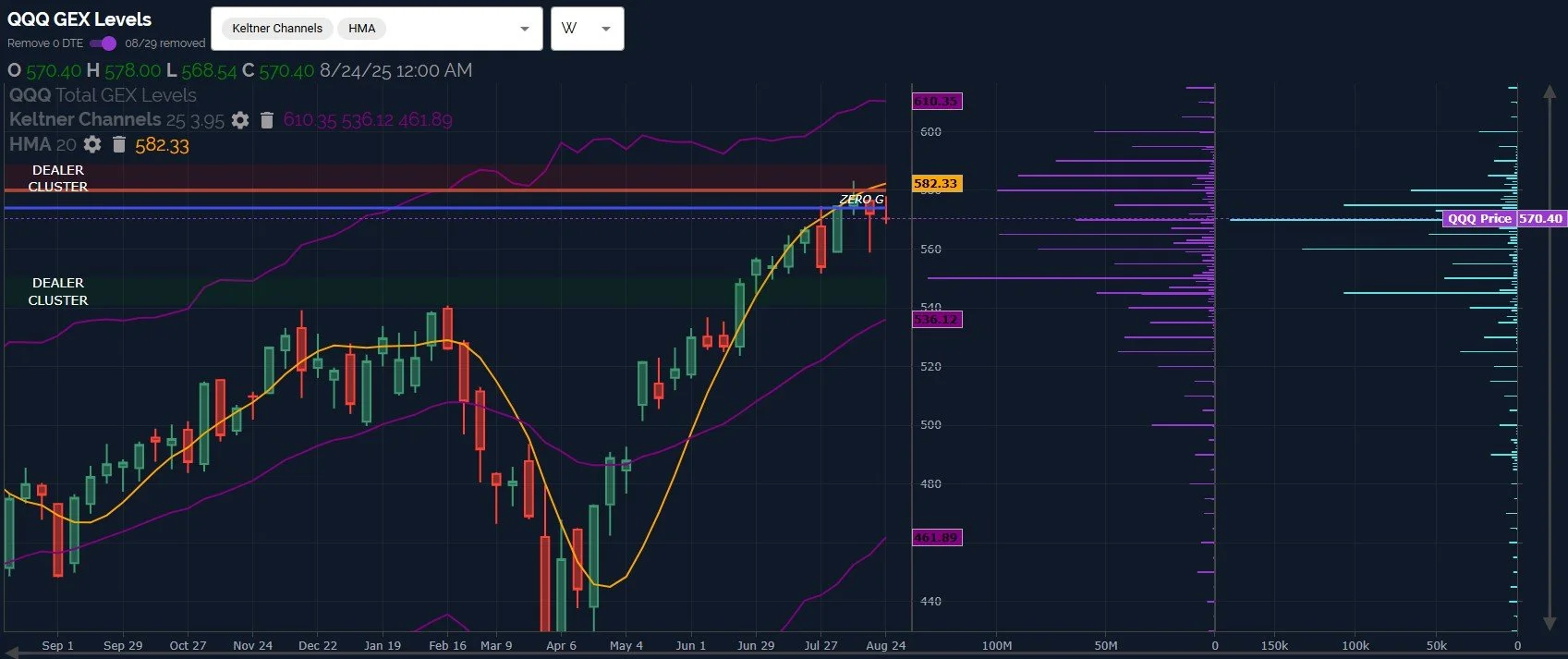

Let’s close out with a review of QQQ: Very similar to SPX, QQQ finished Friday with a close just below the daily Hull, a technically negative, though less than 1/10th of 1% below the Hull.

580 remains as the largest positive GEX cluster overhead, with the sideways consolidation leaving room for another attempt toward the line (578 was the high last week, fairly close).

Volume was elevated at 560, but 550 continues to catch our attention given the amount of negative GEX at that strike.

While SPX net GEX declined to a lower positive number, QQQ net GEX dropped yet again precipitously into negative territory.

We typically consider SPX to be an overall better barometer for where markets may be headed than SPY or QQQ, given the lack of retail participation in SPX to the same extent, but QQQ is not at a GEX Intensity Gauge extreme yet (GEX compared to the last 12 months), so it’s unclear whether the drop in GEX is a contrarian signal or if QQQ GEX will drop further prior to a reversal.

For a different perspective, let’s zoom out to the weekly chart, noting the failure just below the weekly Hull at 582.33 and the large GEX cluster at 550.

The failure just below the weekly Hull does leave open the possibility to retest the line at 580-582 (instead of the just shy 578 from last week), but we need to watch what happens at the 570 area, given the close but technical failure at the daily Hull Friday.

It’s interesting that 550 is the largest net GEX cluster on the map, a negative GEX cluster..This is compared to every other cluster on the map, which clearly flashes a negative warning.

Given the less negative view of SPX, we have negative GEX divergence with QQQ, and both SPX and QQQ closing below key technical markers, so we are still on watch for possible failure as QQQ is lower that it was 4 weeks ago on the weekly close.

Check in with us Tuesday in Discord (markets and the Geek’s live stream are offline tomorrow for Labor Day) and we’ll provide some updates based on the newest shifts in positioning post-Friday, especially during the cash session.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of additional improvements in the works!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.