The Key To The Future Rests Upon…IWM? September 3 Stock Market Preview

In tonight’s YouTube video (which can be viewed by clicking here), we take a look at today’s circus in the cash session as well as some recent moves in our profitable GLD wheel strategy, as well as some other individual tickers.

The bias toward volatility expansion mentioned in last night’s newsletter proved correct, with the VIX approaching the 20-strike that we’ve mentioned as being an important zone, rejecting a breach of 20 so far.

Despite vol sellers crushing the VIX back toward 17, the VIX remains above both the Hull Moving Average and the 9-period SMA, so the bias toward volatility expansion remains unless we see a close below VIX 16.22.

Let’s start out with the most bearish of the indices: QQQ has rejected the weekly Hull Moving Average for weeks, and now we see QQQ also rejecting attempts to exceed the 9-SMA.

QQQ hasn’t closed out the week below the 9-SMA since the big drop culminating in April, so the loss of this level is important.

We noted Friday’s close reflecting GEX at 550 as the largest net GEX cluster, which was fortuitous in hindsight. We see the overall net GEX picture for QQQ shifting more negatively, with positive GEX at 580 and above diminishing relative to the negative clusters at 550 and below.

Since other indices don’t look as bearish, and QQQ is being driven by “story stocks,” do we write off QQQ’s failure as the emotional reactions of children after a bedtime story? If the child is abnormally large and tends to break things during a fit, this question becomes important.

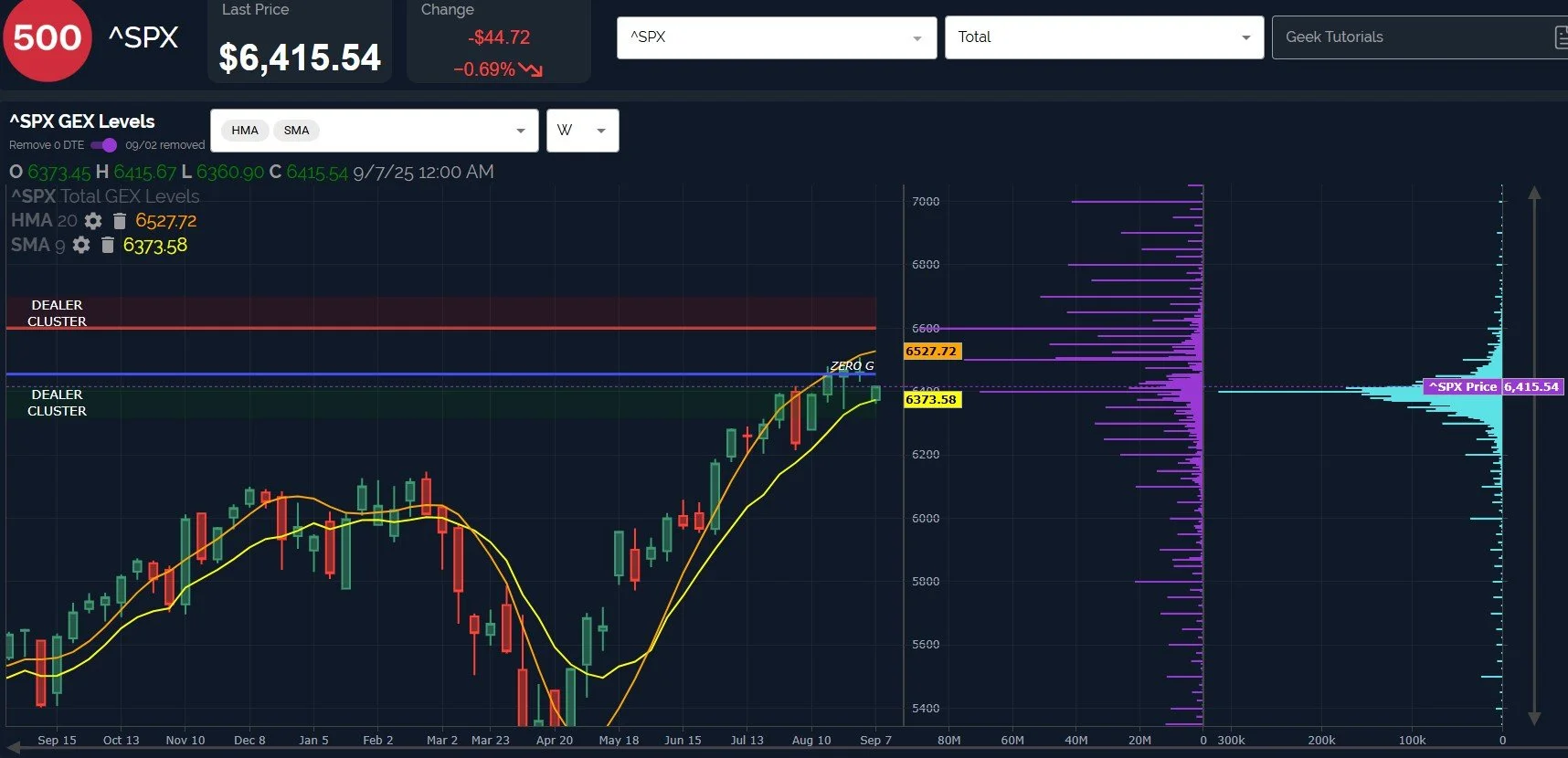

SPX is still holding above the weekly 9-SMA, a notable difference, and the positive GEX at 6600 up to 7000 hasn’t diminished, in fact, they still appear as solid targets.

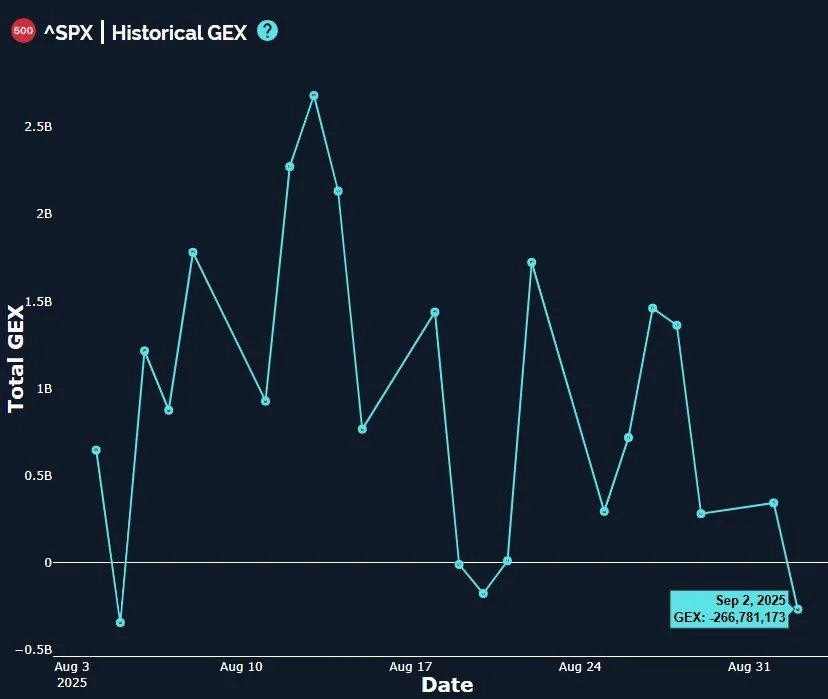

While SPX net GEX decreased today, GEX is still only modestly negative, well within the -1B to +1B neutral zone. This contrasts with QQQ approaching -1B negative.

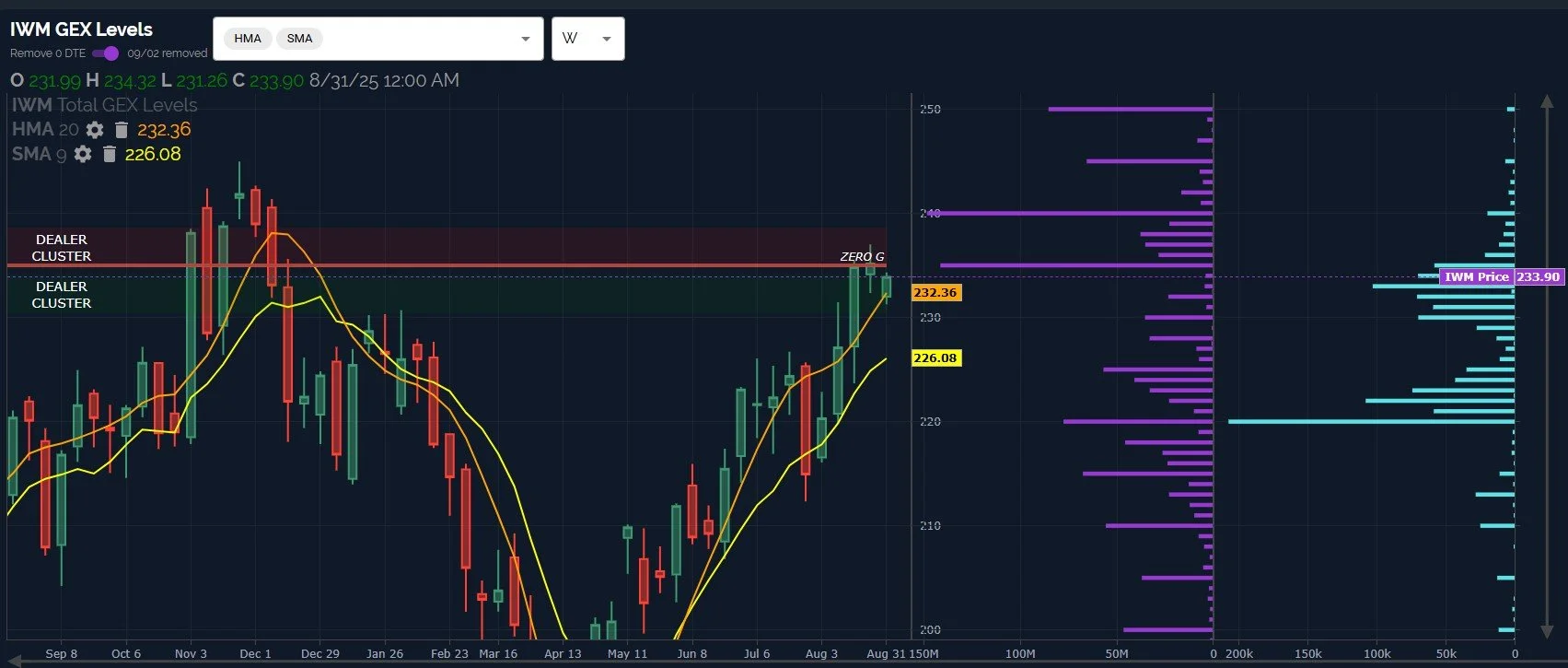

Lastly, IWM is the most positive index lately, a possibility we’ve noted on multiple occasions on account of IWM having lagged for quite some time during the rally (there’s also a de-globalization aspect as well, given the lesser impact of international trade for smaller companies in the USA).

IWM still holds the weekly Hull, not even coming close to the 9-SMA. My general rule is to use the Hull as a line-in-the-sand for bullish versus bearish positioning, in general.

That said, we continue seeing repeated high volume at lower strikes, especially 220.

In summary, it’s hard to become completely bearish on indices when IWM is still looking bullish and SPX is holding key technical support. These signs scream “buy the dip!”

QQQ is more negative, though with QQQ having led the way higher since 2009, we do need to be wary that the index of “story stocks” may also have relevance to the broader market.

IWM gives us a clear level at 232.36 to use as a bull/bear line on a weekly close.

In the interim, we’ll be watching the 0 DTE picture across the board to assist us in navigating the uncertainties of the next few days, and we hope you’ll join us in Discord, where we share throughout the day.

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, currently available to all subscribing members!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of additional improvements in the works!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.