Possible Catalysts For Volatility Ahead

GEX and several indicators show no sign of the current rally letting up, yet this week has several possible volatility catalysts that might end up coinciding with important upside targets being reached. Let’s take a closer look (whoa, hey, not THAT close!).

Don’t Discount The Bulls Just Yet

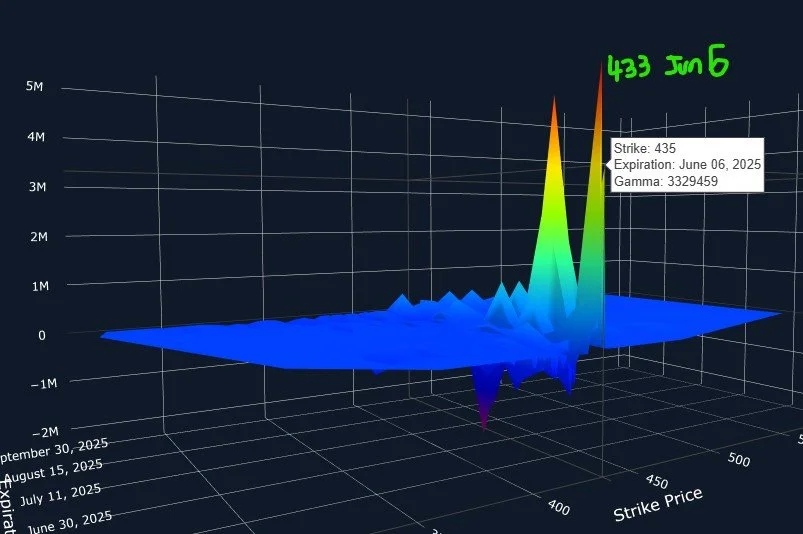

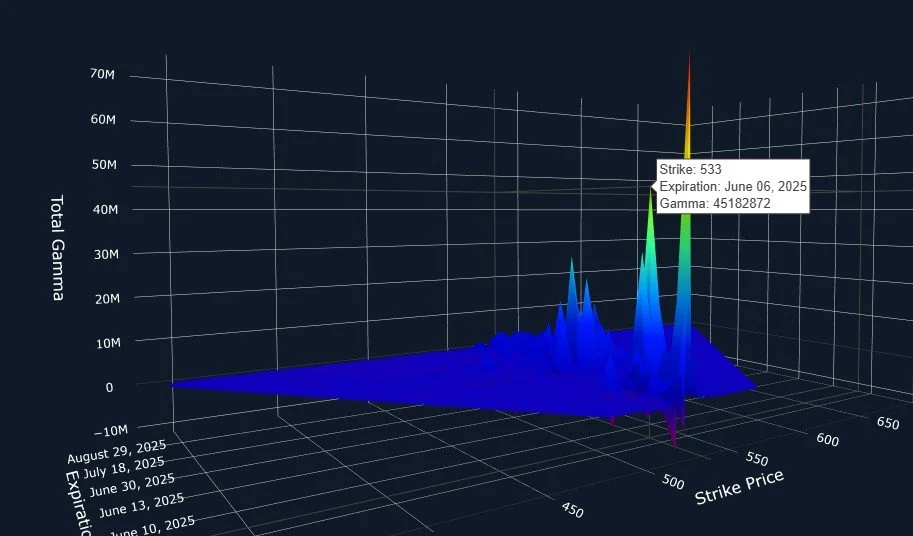

The GEX picture remains surprisingly bullish despite the “wall of worry” indices have appeared to have climbed, though we do see signs of an upcoming pause. Let’s take a look at a possible sequence of events and some of the questions yet to be answered, so we know what to look for as we enter the new week.

All Of The Boxes Are Checked

SPX had a nice intraday reversal higher at first, tagging the upper Dealer Cluster zone finally (well, 5999.44 is close enough!), then another reversal lower, closing pennies below the daily Hull moving average. Does this mean we are done with the upside for now? Not so fast, let’s take a full look across the board to best assess what comes next.

Sloth Speed To The Target

As long as we’re above 5928 SPX, my bias is for more upside, also factoring in what we’re seeing on the GEX screen. The rally has seemed pretty sluggish since 5/27, yet we continue pushing toward the target. Slowness can equate difficulty for a lot of traders who lose confidence when a move to a target isn’t fast “enough.” What changes can we comment on today? Read further.

Anticipating The Turn

Nice follow through to the upside for indices today, with most indices reaching the upper Dealer Cluster zones. Picking a top is extremely difficult, and we don’t know the future. But let’s take a look at some possible targets that may be relevant in the hours and days ahead in today’s newsletter.

6000 Tag Finally Imminent?

We’re above the Hull at today’s close, triggering a long signal that potentially will take us to the upper Dealer Cluster zones. Let’s take a closer look in today’s newsletter.

End of Q2: Performance Chase?

We’re beginning the last month of Q2, and with performance for the indices being very positive since April, we may see the institutional incentive of chasing positive performance take hold. While a speculative possibility, and fraught with the risk of intramonth volatility between points A and B, GEX seems to be backing an eventual positive resolution at this time. Let’s take a closer look.

Sell In May & Go Away?

Indices started out higher today on the back of NVDA, though SPX faded significantly premarket from the overnight highs. We are still experiencing the chop of the gauntlet near the upper Dealer Cluster zones, though IWM actually tagged the zone today, to the penny at 210. Let’s take a look at what might transpire next as we conclude the month of May.

Tagging The Upper Dealer Cluster

Indices didn’t move much today, though we did see quite the fade from the premarket highs, essentially touching the Hull moving average from below and rejecting. No surprise at the lack of movement beyond the early morning, given NVDA’s earnings after hours. Initial action post-close is very positive, prompting us to look at what comes next after the tag of SPX 6000, assuming the after hours gains hold.

Turning On A Dime

GEX is moving in a positive direction as indices followed through on their bullish reversal Friday, led by IWM. In one fail swoop, SPX and QQQ made up all of the decline from last week, and 6000 SPX seems to be a foregone conclusion. While GEX is growing at higher strikes as well, we may see a tricky pathway to get there.

Initial Rebound Imminent?

The IWM played perfectly to the 200 area we’ve been awaiting, actually overshooting it premarket before recovering. IWM led the way down, and now it looks slightly stronger as of Friday’s close. Will IWM now lead the way back up? Let’s take a look at GEX across the board and how prices are lining up with a few simple indicators we like to use.

Is That It?!

Participants bought the gap down this morning, at least enough to get indices back to virtually unchanged for the day. What does GEX say about the durability of a rebound from here?

The Pullback Is Here

Today started out according to my desired script: Gap down after VIX expiration, weakness turning into a sizable recovery, and then we saw the bond auction coincide with a stronger drop to the mid 5850s SPX. IWM almost reached 200 in one day. Let’s take a look at what might be ahead based on the charts and GEX.

Negative Divergences Building

We’re starting to see more obvious negative divergences, just as indices closed below the daily Hull moving average for the first time since May 9 (in the case of SPX). With VIX expiration tomorrow morning, we can’t rule out another push higher, especially with a retest of the Hull now coming very close to the upside targets we’ve been watching for quite some time.

At The Doorstep Of A Spike & Reversal

GEX has settled down a bit post-OpEx, with IWM posting the largest drop, back into negative territory. From all appearances, indices are very close to a more meaningful pullback, and an overnight futures high and reversal would not be surprising, if not around the open tomorrow. Despite the near-term concerns, we believe higher prices are likely beyond this upcoming drop.

GEX Shifting Higher…At Resistance

Markets stayed elevated for OpEx week, only spilling off after hours Friday on news of a US debt downgrade. With VIX monthly expiration Wednesday, let’s take a look at what GEX is saying about some of the possibilities this week.

Approaching A Likely Market Turn

Divergences are starting to emerge as indices attempted to push even higher today. SPX still has 6000 to contend with overhead, while IWM and even QQQ appear to be closer to a top. Do we still see a downside move ahead?

Canaries In The Cobalt Mine?

IWM has already shown early signs of weakness, closing lower than any day since the big gap up three days ago, and showing a fairly sharp drop in total net GEX over the last two days. SPX and QQQ are hanging on for now, but with the upper Keltner channels nearby and a lack of GEX increasing at higher strikes, we could see a pullback at any moment, with a quick tag 1-2% higher still being possible.

Time To Exercise Caution?

The bull train shows no signs of slowing down as we make a straight shot toward the upper Dealer Cluster zones across the board. We do see some warning signs in paradise, including a VIX/VVIX divergence, and we’re near or at the upper Keltner channels. What likely happens next?

New Mobile Improvements!

A brief update on the latest bug fixes and upcoming improvements…